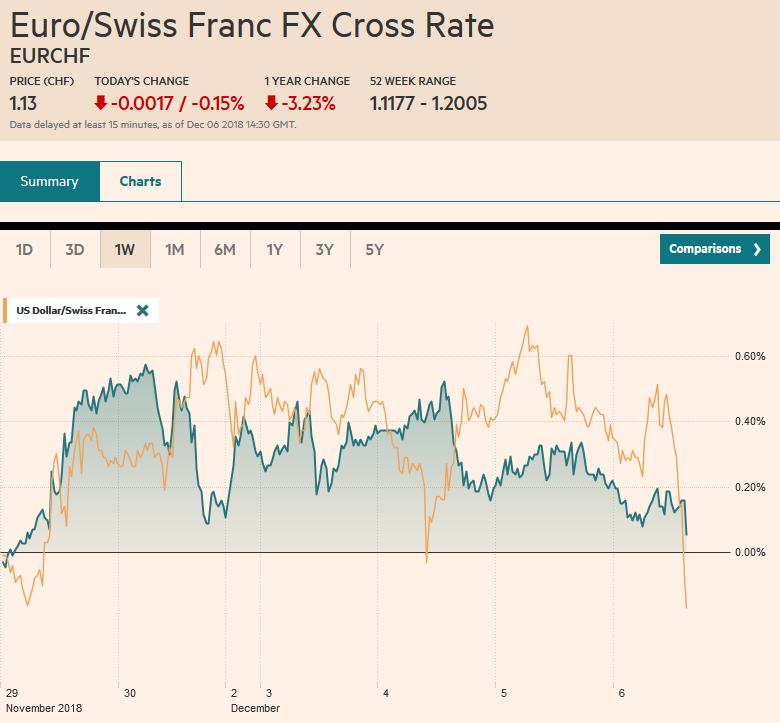

Swiss FrancThe Euro has fallen by 0.15% at 1.13 |

EUR/CHF and USD/CHF, December 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The global capital markets were fragile amid trade uncertainty and economic slowdown fears. News that Canada arrested the CFO of Huawei on behalf of the US, ostensibly for violating the embargo against Iran triggered an almost immediate risk-off wave that has extended the equity markets losses, sending core bond yields lower, with the US 10-year slipping below 2.9%, and underpinning the dollar against most currencies, with the notable exception of the Japanese yen and Swiss franc. Oil prices are unwinding the gains scored earlier in the week amid some skepticism that OPEC+ will agree on the magnitude of cuts that will impress the market. |

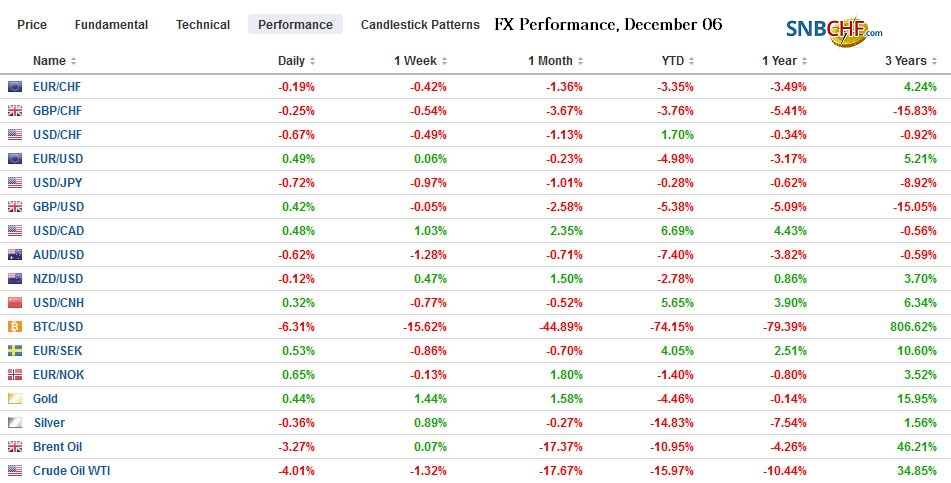

FX Performance, December 06 |

Asia Pacific

The US and China were not in sync about what was agreed at the G20 meeting. There were contradictions and miscues among the Americans themselves. The US President penchant for overselling and then retreating is being played out again with China, but also North Korea, which reports suggest is developing a new weapon and perhaps a new secret test location may have been discovered. With reports that China was already making good on its promise to buy more US agriculture goods and energy, the arrest of the CFO from Huawei in Canada has earned the ire of Chinese officials and kept global investors on the defensive. Although it is not related to US-China trade dispute, it does play into ideas that 1) trade is only one of several issues US and Chinese interests clash and 2) there is much distrust between the two largest economies and military powers.

Despite better macro news today, the Australian dollar has not been able to shrug off yesterday’s disappointment over the Q3 growth which was half of what was anticipated (0.3% vs. 0.6%). Australia’s 10-year bond yield is falling through 2.5% to its lowest level since the middle of last year. Today’s data includes a smaller than expected October trade deficit and slightly better retail sales. The trade shortfall narrowed to A$2.2 bln from a revised A$2.94 bln, while retail sales rose 0.3% after a 0.2% gain in September was revised to 0.1%. The Australian dollar is the weakest of the majors today, losing about 0.75%. It had started the week knocking on $0.7400 and today is testing $0.7200. This area corresponds to a 50% retracement of the Aussie’s gains since the low for the year was recorded in late October (~$0.7020). The next retracement level is found near $0.7165, which is also the mid-November low. The New Zealand dollar is holding up better, but it is still paring its recent gains. With today’s slippage, the Kiwi filled the gap created by Monday’s sharply higher opening. The next support is seen near $0.6850, where an option for about NZ$ 200 mln will expire today.

The decline in yields and equities is helping lift the Japanese yen to marginal new highs for the week. Yesterday’s dollar gains above JPY113 were rejected and the greenback slipped slightly below JPY112.60. A trend line connecting the year’s low from March (~JPY104.55) and October low (~JPY111.40) has been tested in recent days. It is found near JPY112.55 today. There are some large options expirations today: ~ $1.57 bln at JPY112.75-80 and ~$2.0 bln at JPY113.00-10. That said, the intraday technicals suggest the greenback is overextended to the downside in the European morning and a recovery, at least in early North American is likely.

Europe

Brexit continues to hog much of the oxygen. The two expert opinions this week, the first suggesting that the UK can unilaterally rescind the invocation of Article 50 and the second, the UK legal opinion, published yesterday, warns that the backstop for the Irish border could indeed be indefinite has shaken up the debate. Until now, it looked like it was going to be the negotiated plan or an exit with no agreement. However, while there had been some murmurings along the way, the possibility that the UK does not leave the EU is beginning to be taken more seriously. One large US bank increased their subjective odds of the UK not leaving to 40%.

In addition to Brexit, another important concern for investors is the economic strength ahead of next week’s ECB meeting. Earlier today, Germany reported its third consecutive increase in factory orders and this reinforces the sense that the eurozone’s largest economy is emerging from the soft patch that saw the economy contract in Q3. However, the economic momentum is weak. Factory orders rose 0.3% in October, but September gain was cut to 0.1% from 0.3%, and on a year-over-year basis the contraction actually deepened to -2.7% from a revised -2.6% (initially -2.2%).

Italian and Greek bonds are treated like risk assets and are under pressure today like other risk assets. However, there are other challenges in Europe. Although the French government reversed itself, at least temporarily on the petrol tax, the “yellow vest” protest appears to have grown well beyond its origin and widespread demonstrations are expected this weekend. Without much fanfare, the French premium over German Bunds is at its widest for the year today. The results of last week’s election in Andalusia, a traditional Socialist stronghold, raises questions over the minority government’s ability to pass the 2019 budget next month. It needs to make a deal with nationalist forces in Catalonia and Basque. An election early next year cannot be ruled out. Tomorrow, Germany’s CDU meets and will pick a Merkel’s replacement.

The euro is in less than a third of a cent range. It appears trapped between two expiring options strikes today: There are 1.2 bln euros at $1.13 and roughly 2 bln euros at $1.1350-60. Just in case this is not sufficient, there are 1.4 bln euros at $1.1380 as well. Sterling is in about a half a cent range above $1.2700. It is inside yesterday’s range, which is inside Tuesday’s range. The intraday technicals appear to favor the downside.

North America

The Bank of Canada concluded its policy meeting yesterday with dovish hold. It still says that it will remove all the accommodation (return to neutral), but its economic assessment was significantly less confident than previously. The downward revisions to back data, pointing to weaker growth and recent negative developments make the central bank question whether the economy is really bumping against capacity constraints. The implied yield of the March 2019 BA futures contract had fallen from 2.57% in early November to 2.39% before the Bank of Canada meeting. It shed another seven basis points to reach its lowest level in four months (2.32%). Bloomberg calculates from the OIS that the odds of a January hike have fallen from 80% at the start of last month to 55% before the meeting and a little below 25% now. The US dollar had weakened to about CAD1.3165 to start the week after the G20 meeting and the favorable spin put on the US-China talks and Russia and Saudi Arabia’s pledge to renew their cooperation. The US dollar reached CAD1.3400 yesterday, a marginal new high for the year, in response to the Bank of Canada’s dovish statement and has extended its gains to almost CAD1.3450 today. Governor Poloz speaks (text will be available around 8:30 ET and the presentation to Toronto’s CFA will be followed by Q&A. The market will be sensitive to his comments ahead of the November employment report and the October merchandise trade balance tomorrow.

There is a full slate of US economic reports today and the EIA oil inventory data will be reported as well (a day later than usual due to yesterday’s government closure). Perhaps the ADP private sector jobs estimate, which steals some of the thunder from tomorrow’s official report, is the most important. It is to show around 195k increase after 227k in October. Although the weekly jobless claims report is not going to shed light on tomorrow’s report, a drop in claims today will lend credence to ideas that the recent rise may be a bit of a quirk and related to holidays and disasters (cf. California fires and lingering effects of the hurricanes. US trade figures and factory orders (with revised durable goods orders) may be helpful for economists to forecast Q4 GDP, but may be overshadowed by the other data and ahead of tomorrow’s national jobs figures.

The S&P 500 is poised to gap lower at the open after finishing Tuesday on its lows near 2700. There is some chart-based support that in the 2647-2650 area. Last month’s low was set next 2630 and the October low was closer to 2600. With the US 10-year yield slipping below 2.90%, the next important area is 2.80%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,FX Daily,newsletter,SPX,USD/CHF