Tag Archive: $AUD

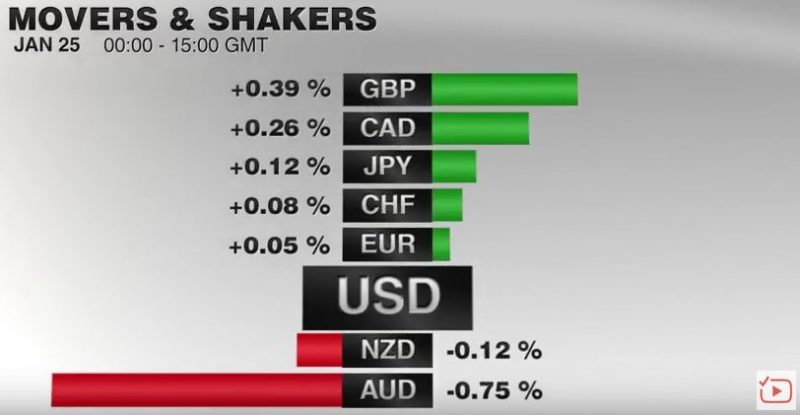

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration's economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European morning, but broader risk appetites were not rekindled, and the Dow Jones Stoxx 600, led by financials, was sold to its lowest level this month.

Read More »

Read More »

FX Weekly Preview: The Challenging Week Ahead

Investors will finally be able to focus on what the new US President does rather than what he says. The UK Supreme Court decision is expected, but it may not be the driver than it may have previously seemed likely. The dollar-yen rate does not appear to be driven by domestic variable as much as US yields and equities. Prices not real sector data may be the key for the euro.

Read More »

Read More »

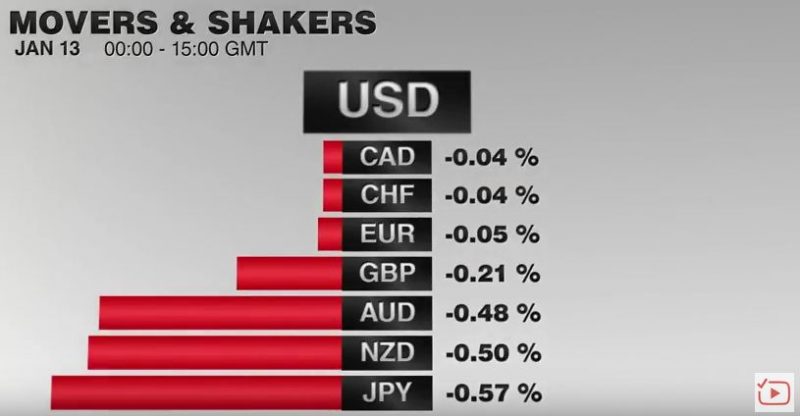

FX Daily, January 13: Corrective Forces Persist

The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote.

Read More »

Read More »

FX Daily, January 12: Dollar and Yields Ease Further, but Look for Recovery

After a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso.

Read More »

Read More »

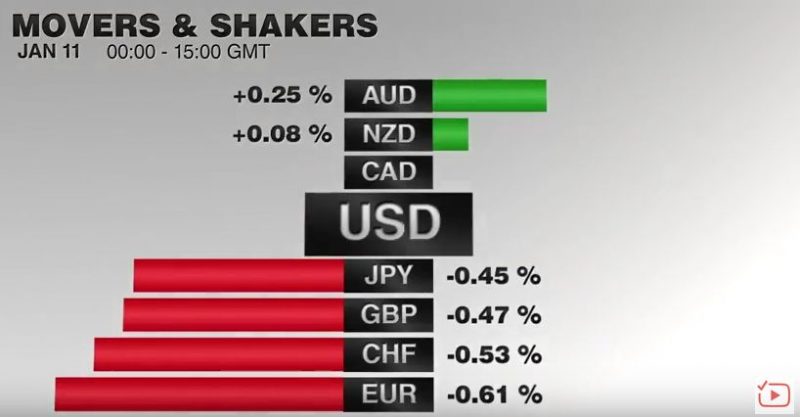

FX Daily, January 11: Dollar Comes Back Bid

The pound has seen a sharp fall following the interview that Theresa May gave with Sky news on Sunday although there has been a small rebound this afternoon. GBP CHF exchange rates are hovering around 1.2350 for this pair.

Read More »

Read More »

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »

FX Daily, January 04: Consolidation in Capital Markets

GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has ultimately benefited as a result, gaining a cent on the CHF.

Read More »

Read More »

A Few Takeaways from the Latest IMF Reserve Figures

Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling's share of new reserves warns it may be losing some allure.

Read More »

Read More »

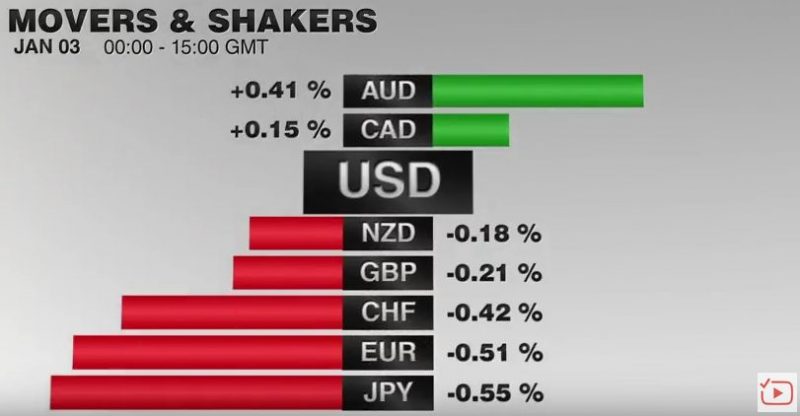

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »

FX Daily, December 28: Short Note for Holiday Markets

Economic data: Japan stands out with industrial production in Nov rising 1.5%, the most in five months. It was a little less than expected, but the expectations for Dec (2%) and Jan (2.2%) are constructive.

Read More »

Read More »

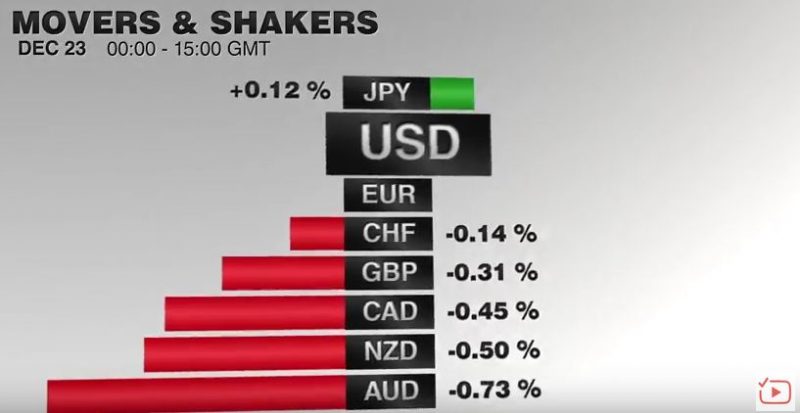

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

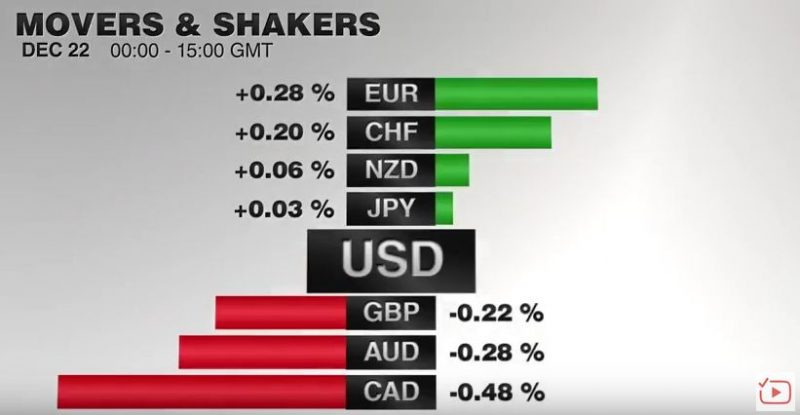

FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF.

Read More »

Read More »

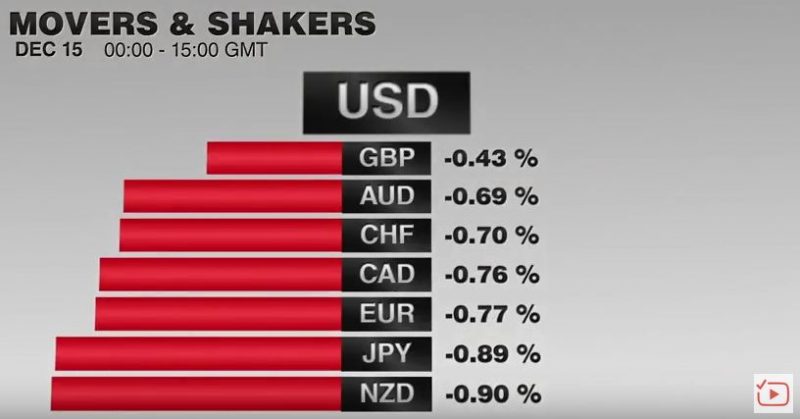

FX Daily, December 15: Greenback Extends Gains on Back of Fed

Sterling has made steady gains against the CHF over the past month and although the spike has levelled this week, the Pound has certainly gained a foothold. Yesterday’s decision by the US Federal Reserve to raise their base rate from 0.25% to 0.5% did little to shift the value of GBP/CHF but with investors still digesting the outcome, we may yet find it still has an effect.

Read More »

Read More »

FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers' currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso.

Read More »

Read More »

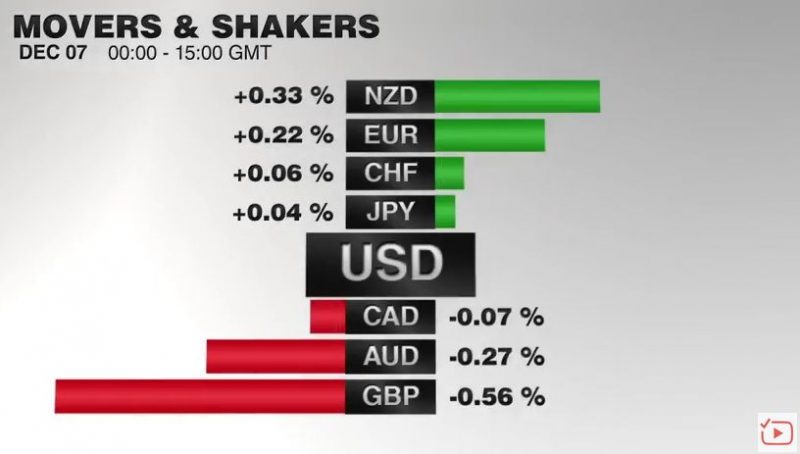

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

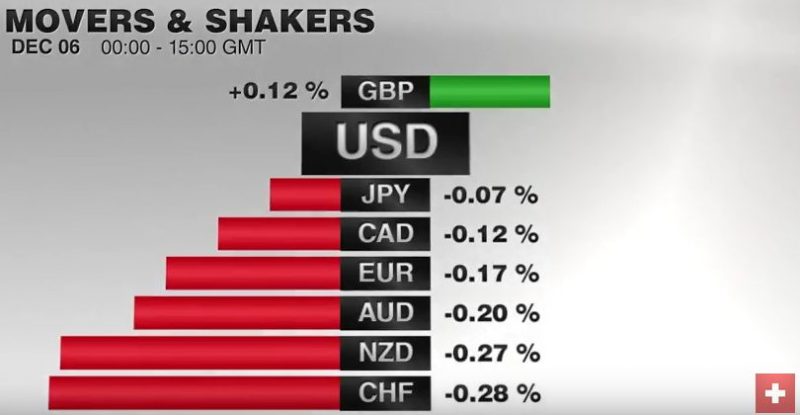

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

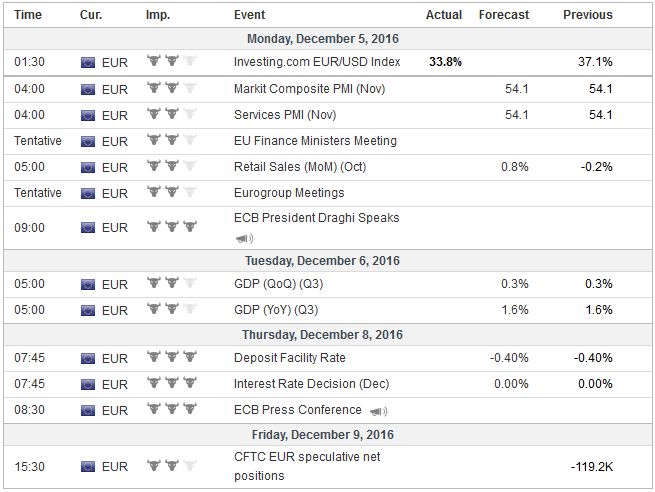

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »