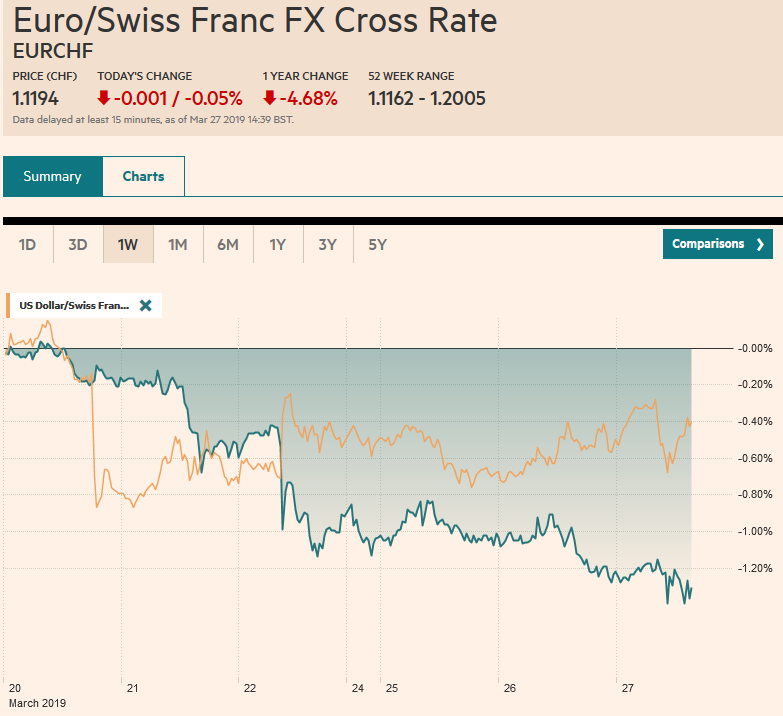

Swiss FrancThe Euro has fallen by 0.05% at 1.1194 |

EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US 10-year yield is trading below the Fed funds target. The two-year yield is trading below the lower end of the Fed funds target range. A warning by New Zealand that the next rate move could be a cut sent New Zealand and Australian yields to new record lows. In Japan, the 10-year yield slipped below the overnight unsecured call rate. Benchmark yields in Europe are mostly lower, with the yield on the 10-year German Bund is slumping to new three-year lows below minus four basis points. Stocks are mixed. Roughly 2/3 of Topix shares went ex-dividend, weighing on shares, while China’s Shanghai Composite snapped a two-day 3.5% decline. European equities are largely steady at the upper end of yesterday’s range, while US shares are building on yesterday’s gains. The dollar is steady to firm against most of the major and emerging market currencies today. The RNBZ’s dovish signal sent the Kiwi sharply lower. Its 1.5% loss leads the majors and has taken the wind from the Aussie’s sales and sent it back to $0.7100. |

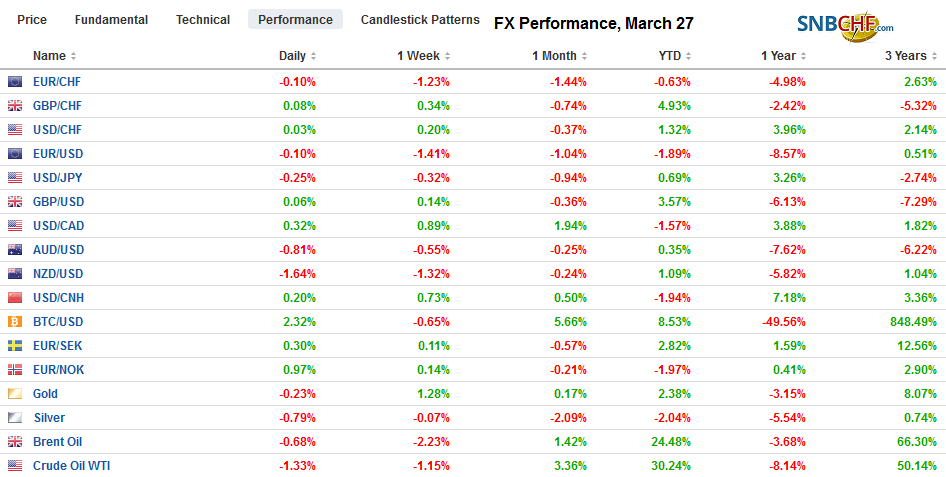

FX Performance, March 27 |

Asia Pacific

The decline in industrial profits in China will likely spur action from the central bank. Profits in January-February fell 14% year-over-year. The PBOC may respond by cutting reserve requirements. At the same time, there are preliminary signs that the economy is stabilizing and tax cuts are to go into effect next week. China’s official PMI will be reported over the weekend. The Caixin’s manufacturing PMI will also be reported then. While the official manufacturing PMI is expected to have ticked up, most forecast it to remain below the 50 boom/bust level. The non-manufacturing PMI may have eased to 54.0 from 54.3.

The Reserve Bank of New Zealand was more dovish than investors expected. Governor Orr was explicit. The next move in rates is likely lower. The central bank had previously taken a neutral stance. The currency fell from a little above $0.6900, around where it had topped out several times in the past few months, to briefly below $0.6800. The 100-day moving average is near $0.6810 and has generally provided support (on a closing basis) since early January. It also corresponds to a (38.2%) retracement objective of the rally since the flash crash (January 3). We suspect that Australia (and Canada) are not too far behind New Zealand.

The US dollar has been confined to about a 15-tick range on either side of JPY110.55 as it consolidates yesterday’s recovery. It is the first time in four sessions it has not traded below JPY110.00. In fact, it has not traded below JPY110.40 since before the US equity market opened yesterday. Expiring options may again denote the range. There is an option at JPY110.0 for about $835 mln that will be cut today and around $470 mln at JPY110.50. There are $1.4 bln in options at JPY110.70-JPY110.75 that also roll-off today. The Australian dollar has been turned back after approaching $0.7150 yesterday. With the Reserve Bank of Australia meeting next week, we expect the Aussie to push through the rising trendline since earlier this month, found near $0.7075 today. This is close to the 20-day moving average and the (50%) retracement of the rally (~$0.7085) since March 8 low (~$0.7000). Look for resistance now in the $0.7110-$0.7120 area.

Europe

The British House of Commons has not really wrestled control of Brexit away from the Prime Minister. At most, they have a time out for the day, but May might still try to influence today’s non-binding indicative votes. Remember the new timetable. The UK has until the end of the week to pass the Withdrawal Bill. If not, it must ask for a longer extension or leave without an agreement on April 12. April 12 was not an arbitrary date. It is the deadline to compete in the late-May EU Parliament elections. How can the Withdrawal Bill, which has been twice overwhelmingly defeated pass? The stark reality of the alternatives, including participating in the next EU Parliament elections, appears too much for many of the hard Brexit camp to accept. After having been unable to defeat May in a vote of confidence, some Tories are offering support for the With drawl Bill if the Prime Minister resigns.

The ECB’s Draghi’s comment that the officials may look to mitigate the impact of negative rates on the interest rate margin of banks. European bank shares, like those in the US, has faltered as the prospect so low rates and flat curve weighs on the interest-earning activity of banks. The euro appeared to slip lower in response as it further confirms that negative rates are here for some time. Draghi also reiterated that the economic risks remain on the downside. The poor flash PMI readings seem to leave him little choice, though the German IFO report makes us reluctant to jettison our hypothesis that the worst is passed.

Turkey’s central bank has engineered a powerful short squeeze, and without fresh liquidity injections, the implied overnight interest rate jumped to 360% yesterday, and the dollar fell to almost TRY5.30. Recall that at the end of last week, the dollar had traded a little above TRY5.85. The disruption and volatility will likely to deter speculators ahead of the local elections Sunday. The lira’s 1.1% loss today leads the emerging market currencies today.

Hungary surprised investors yesterday. The central bank hiked rates but also announced a corporate bond-buying program. It lifted the overnight deposit rate from minus 15 bp to minus five. Officials neutralized whatever positive impact it would have on the forint by noting that it was a one-off move. At the same time, it announced plans to buy HUF300 bln of corporate bonds. The euro surged 0.75% yesterday against the forint and is extended those gains today by another 0.35%. Through March 19, the forint had been a strong performer, gaining nearly 3% against the euro since the start of the year. However, even before yesterday’s decision, the euro had begun recovering. With today’s gains, the euro has extended its late March rally to almost 2.4%.

Today is the first day that the euro has not traded above $1.13 since March 11. It still may, though there is an option struck there for almost 690 mln euros that expires today and the intraday technicals warn that the euro’s recovery in the European morning from a little below $1.1250 to $1.1285 may falter as US dealers return. The uncertainty over Brexit and today’s House of Commons votes are leaving sterling uninspired and trading in relatively narrow ranges, straddling $1.32. The five and 20-day averages converge just below $1.32.

America

The inversion of part of the US yield curve continues to cause consternation among investors. As the implications are being mulled over, we make the following suggestions: First, surveys suggested that nearly 2/3 of economists expected a recession in 2020 or 2021, which is within the lag between the inversion and economic impact. The point is that the inversion of part of the curve reinforces what many had already anticipated. Second, the inversion of the curve is partial and shallow. Consider, for example, that the five to 30-year curve is the steepest since 2017. Third, the average fed funds rate in past inversions has been more than twice the prevailing level. Fourth, the decline in the US 10-year yield is not just a function of US economic prospects, but also the fact that there is more than $10 trillion of negative yielding bonds.

The US and Canada report on January trade figures today. Economists expect both countries to report narrower trade deficits. Canada’s merchandise deficit is expected to be reduced to C$3.55 bln from C$4.59 bln last December, which was a record. The US trade deficit swelled to its widest in nearly a decade at the end of 2018. The December shortfall was almost $60 bln, and that is despite the incredible improvement in the energy trade balance. The Trump Administration appears to focus on two numbers more than others. The first is the stock market and the other is the trade balance. The criticism faced over the swelling deficit may make the Administration even tougher on trade going forward. Mexico reports its February trade balance today. It is expected to have swung into surplus from a large deficit in January.

The US dollar is trading quietly against the Canadian dollar and continues to straddle the CAD1.3400 area. We like it higher and look for a test in the coming days on CAD1.3440-CAD1.3465. The dollar is testing its 20-day moving average against the Mexican peso, seen near MXN19.21. It has not closed above this average for two weeks. Above there, the next target is near MXN19.30. The Dollar Index appears to have met a wall of sellers by 97.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,MXN,newsletter,NZD,USD/CHF