Tag Archive: MXN

Thumbnail Sketch of the Peso Ahead of Banxico’s Decision

The central bank of Mexico is

expected to deliver a 25 bp rate hike later today that would lift the overnight

cash target to 11.25%. The swaps market says this will be the last hike in the

cycle. However, with a further hike by the Fed possible, it seems unlikely that

Banxico will declare mission accomplished. Still, Mexico’s overnight rate is

above current inflation. CPI in February

was about 7.6% and the core rate (excluding food and energy)...

Read More »

Read More »

FX Daily, January 20: The Dollar Slips to New Lows against Sterling and the Mexican Peso

Global equities are moving higher today. Led by continued strong buying of Hong Kong shares, the MSCI Asia Pacific Index rose to new highs. The Hang Seng is up 6% this year and is approaching the 2019 record high. Australia's shares set a new record today. Japan and Taiwan bucked the trend.

Read More »

Read More »

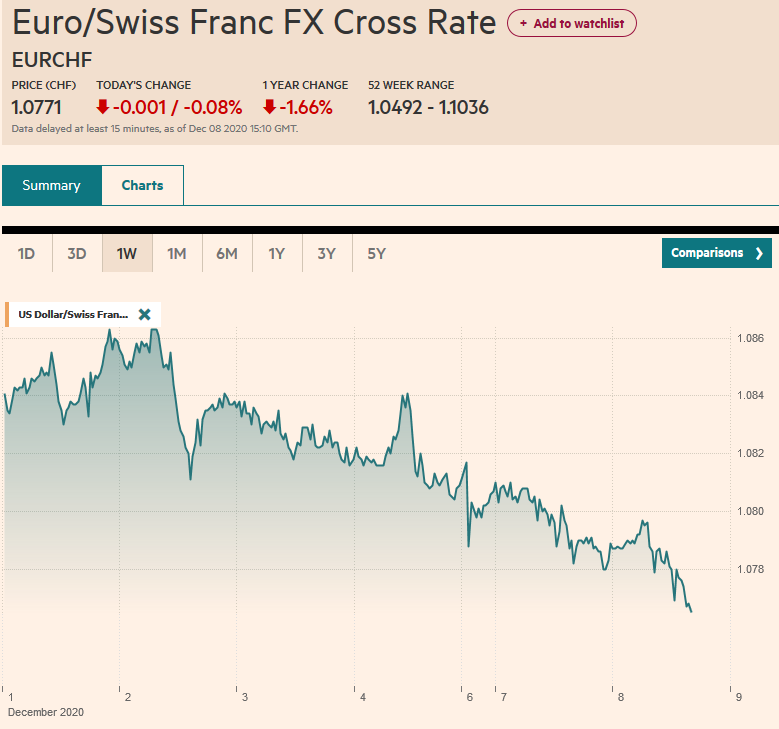

FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders' summit that begins Thursday. The US federal spending authorization is exhausted at the end of the week.

Read More »

Read More »

FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents.

Read More »

Read More »

FX Daily, December 4: The Employment Report may not Give Greenback much of a Reprieve

After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine's supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea's Kospi and Taiwan's Taiex, the MSCI Asia Pacific benchmark secured its fifth consecutive weekly gain.

Read More »

Read More »

Speculative Positioning in Selected Currency Futures

With the media playing up the US dollar's negatives, one would think speculators are short the greenback like there is no tomorrow. Yet a review of the Commitment of Traders report that covers the week through last Tuesday, August 4, shows that this is not really the case.

Read More »

Read More »

FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia, advanced. The MSCI Asia Pacific Index rose for the second week.

Read More »

Read More »

FX Daily, December 18: Markets Turn Quiet Ahead of Central Bank Meetings

Overview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased. European equities are off to a firm start, and the Dow Jones Stoxx 600 is consolidating near the record high set Monday.

Read More »

Read More »

FX Daily, September 27: Markets Limp into the Weekend with the Euro Languishing at New Lows and Sterling under Pressure

Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to snap a five-week advance.

Read More »

Read More »

FX Daily, August 8: PBOC Helps Stabilize CNY, while US Equity Recovery Lifts Sentiment

Overview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar's reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan strengthen modestly today. Meanwhile, the strong recovery in the S&P 500 has spilled over and helped lift global equities.

Read More »

Read More »

FX Daily, July 30: Sterling Pounded

Overview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing $1.32. Two weeks ago it was around $1.25. Today it traded near $1.2120 before stabilizing. On the other hand, the 10-year Gilt yield is below 65 bp, a new multiyear low, while the international-laden FTSE 100 is holding its own in the face of heavier equity prices in Europe.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

FX Daily, June 10: Collective Sigh of Relief Lifts Equities, Yields, and the Dollar

Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit.

Read More »

Read More »

FX Daily, June 04: Nervous Calm Settles Over Markets

The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between the US and China, and the threat of anti-trust action against the largest digital platforms.

Read More »

Read More »

FX Daily, May 31: US Struggles to Build Physical Wall, Tries Tariff Wall on Mexico

Overview: The US announcement to lay a 5% tariff on all goods coming from Mexico (starting June 10) until it stops the flow of "illegal migrants" spurred sharp losses in the Mexican peso and general risk-off move that strengthened the yen. The tariffs are set to rise every month until reaching 25%. This is a significant surprise and especially given that the Trump Administration is preparing to formally submit the USMCA to Congress.

Read More »

Read More »

Canada, Mexico, and the USMCA

The US dollar closed today above CAD1.3500 for the first time since January 2. Despite the setback, the Canadian dollar is the strongest of the major currencies year-to-date with a little less than a one percent gain. The yen, in second, has is up about 0.2% (~JPY109.50). Among emerging market currencies, the Mexican peso's 2.6% gain puts it in in second place behind the Russian rouble's 7.2% appreciation.

Read More »

Read More »

FX Daily, April 15: Redemption Monday

The holiday-shortened week is off to a slow, tentative start. The surge of the S&P 500 before the weekend failed to inspire today. Asia markets were mostly firmer, led by Japan, while China, Hong Kong, and Singapore moved lower.

Read More »

Read More »

April Monthly Currency Outlook

Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis.

Read More »

Read More »

FX Daily, March 28: Brexit Uncertainty Deepens as Parliament is Divided, while Turkey’s Short Squeeze Falters

The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below similar Japanese government bond yields for the first time since Q4 16, but when the JGB market opened, it the 10-year JGB yield fell a couple more basis points to minus 10, the most negative since August 2016.

Read More »

Read More »

FX Daily, March 27: Global Bond Rally Continues, Greenback Remains Firm

Overview: The US 10-year yield is trading below the Fed funds target. The two-year yield is trading below the lower end of the Fed funds target range. A warning by New Zealand that the next rate move could be a cut sent New Zealand and Australian yields to new record lows. In Japan, the 10-year yield slipped below the overnight unsecured call rate.

Read More »

Read More »