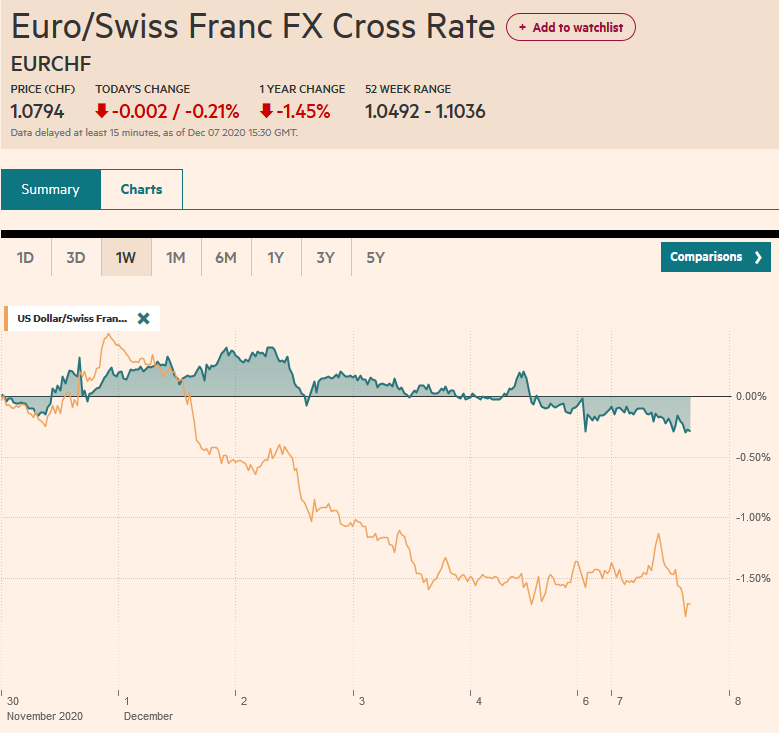

Swiss FrancThe Euro has fallen by 0.21% to 1.0794 |

EUR/CHF and USD/CHF, December 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents. This, coupled with new US sanctions on Chinese officials, is helping spur a larger risk-off moment. Japanese, Chinese, and Hong Kong markets sold-off in the Asia Pacific region while small markets were firm. A five-week advance is also at risk in Europe, where the Dow Jones Stoxx 600 is off around 0.5%, though the FTSE 100, aided by a weaker pound, is posting a modest gain (~0.3%). US shares are also under pressure, and the S&P 500 futures are about 0.5% lower. Benchmark yields are mostly lower. The US 10-year is a couple basis points lower, around 0.94%, while most European yields are 2-3 bp lower, the UK 10-year Gilt yield is off around five basis points (0.30%). The Australian benchmark played catchup with the rise in US yields before the weekend and now offers about 10 bp more than the US. It is not just sterling that is weaker today. The greenback is firmer against nearly all the other currencies too. The yen and Swiss franc are holding in best, while sterling leads on the downside. The JP Morgan Emerging Market Currency Index is about 0.25% lower, which would be its biggest drop in a couple of weeks. Gold is softer, and in late morning turnover in Europe, it is near the middle of the $1822.5-$1842.5 range. Oil has come back lower, and the January WTI contract has given up the pre-weekend gain to return to around $45.50. |

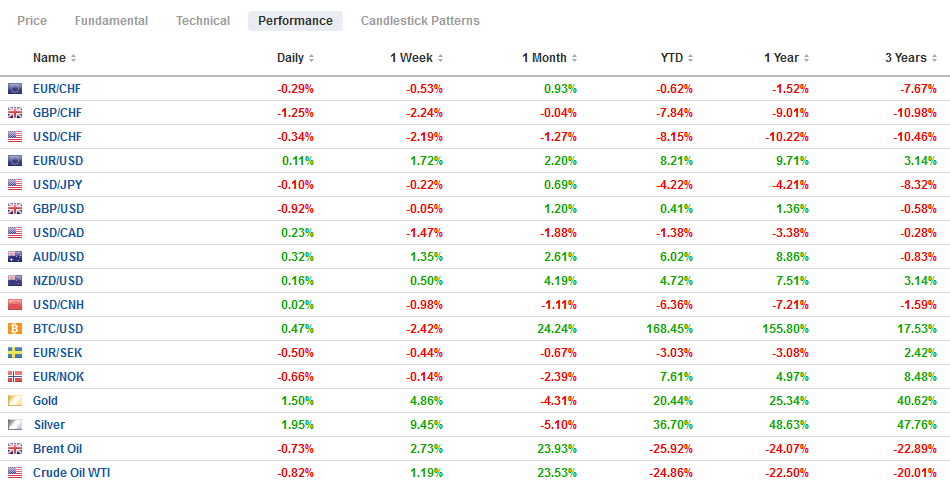

FX Performance, December 7 |

Asia Pacific

China reported November trade figures and reserves. Both were stronger than expected. Fueled by a surge in exports, China recorded a $75.4 bln trade surplus, which appears to be the highest ever. Through November, China has recorded a $460 bln trade surplus. The US accounted for about half of China’s November trade surplus, and it is more than 50% above November 2019 levels. China shipped almost $52 bln of goods to the US, while its imports from the US rose by a third to $14.6 bln. China’s trade surplus with the EU rose by 20% to $11.3 bln, as exports rose 8.6% from a year ago ($37.5 bln), and imports rose 4.5% ($11.3 bln).

Overall, China’s exports rose 21% year-over-year in dollar terms to $268 bln. Medical supplies’ shipments rose 42% in the January-November period, while electronic exports are up a quarter. Imports rose 4.5% year-over-year, a little less than October (4.5%) and well below expectations (7.0%). China imported a little more than 11 mln barrels of oil a day in November, around 6% more than in October, but practically flat on a year-over-year basis. Iron order imports fell below 100 mln tons for the first time in six months. Coal imports slipped for the second month. Copper imports also fell. Soy imports climbed.

Separately, but not completely unrelated, China reported a $50.5 bln rise in reserves to $3.178 trillion. In dollar terms, it is the largest increase since November 2013. In percentage terms, the 1.6% increase is also the largest in seven years. Changes in foreign exchange valuation played an important role. Consider this thought experiment. Assume that China has 20% of its reserves in euro-denominated instruments. The euro appreciated by 2.4% in November and could have accounted for around a third of China’s reserves increase.

The US has sanctioned another dozen Chinese officials for playing a role in disqualifying Hong Kong legislators recently. Meanwhile, TikTok/ByteDance is still in negotiations. US sanctions of Chinese companies is spurring action by FTSE Russell to exclude the companies from its benchmarks.

The dollar briefly traded below JPY104 but recovered to around JPY104.30 in Europe. We like it lower in North America today. An option for $465 mln at JPY104 expires today, as does a $700 mln option at JPY104.50. The Australian dollar failed to make new highs after the disappointing US employment data before the weekend and is offered today. It has been sold below $0.7400, which should now provide a near-term cap. Initial support was found near $0.7375, but the downside risk may extend toward $0.7330-$0.7340. The PBOC set the dollar’s reference rate at CNY6.5362, which was in line with expectations. The central bank drained liquidity from the banking system for the fifth session, and money market rates (overnight repo and seven-day repo) rose. The dollar is firmer against the yuan to snap a four-day slide.

Europe

UK Prime Minister Johnson and EC President von der Leyen will talk later today. Some report a compromise over fisheries that may break the stalemated talks in the 11trh hour. Not to carp on it, but it seemed clear that the fisheries issues had taken more than its pure economic issue and had become a proxy for sovereignty itself. Ostensibly, the so-called “ratchet clause” that gives the EU the sole power to judge what constitutes uncompetitive behavior and enforce alignment could be more troublesome limits on the perceptions of sovereignty. At the same time, even though the Recovery Fund is being blocked along with the EU budget, European officials do not want to allow the UK to protest it as a state-subsidy.

Meanwhile, in the House of Commons today, the UK government will reinstate the parts of the controversial Internal Markets Bill that allows ministers to override the Withdrawal Agreement. Some reports suggest that the government could drop the clauses that the House of Lords neutered if there were an agreement, but confirmation of an agreement would only come late in the day after Johnson and von der Leyen speak. Tomorrow the government is expected to present a separate bill that supersedes the Withdrawal Agreement by unilaterally determining which good from the UK to Northern Ireland should be subject to a tariff.

Before the weekend, Germany reported a 2.9% jump in October factory orders, roughly twice what economists forecast. Today, it followed up with a 3.2% jump in industrial output, which was also about twice expectations. September factory orders were revised higher to 1.1% from 0.5%, and industrial production was revised to 2.3% from 1.6%. While the data is undeniably good, the problem is it may not last. The November manufacturing PMI warned that activity slowed as new social restrictions came into place. Recall the manufacturing PMI slipped to 57.8 from 58.2 in October.

The euro peaked before the weekend, just shy of $1.2180. It retreated a cent by early Europe today before finding a strong bid. That area holds the (38.2%) retracement objective of last week’s gains. The next retracement (50%) is near $1.2050. Although there are no large options expiring today, tomorrow is a different matter. There is an option for 1.7 bln euros at $1.21 and options for 1.5 bln euros at $1.20 that will be cut. Sterling also set a two-year high at the end of last week, near $1.3540. On the risk that a deal will not be struck, was sold back to $1.3225 today in early European turnover. The $1.3200 area corresponds to a (50%) retracement of the rally that began early last month from around $1.2855. Initial resistance is seen now near $1.3300 and then $1.3350. Meanwhile, the euro has risen to about GBP0.9135, its best level since October 20. This area holds the (61.8%) retracement of the euro’s decline since peaking a little below GBP:0.9300 on September 11.

America

The US reports October CPI and PPI this week. Although there is increased talk of coming price pressures, which are reflected in some market measures, such as the breakeven rates (spread between conventional and inflation-linked securities), the reports are overshadowed. The federal government’s spending authorization is exhausted at the end of the week. If Congress does not do something, a partial government shutdown may be required. At the same time, with several measures of support set to expire, there is another type of fiscal cliff at hand as well. The extended jobless benefits that 12 million Americans draw expires the day after Christmas. The Federal ban on evictions expires at the end of the year.

Canada’s November IVEY survey is out today, but the focus is on the mid-week Bank of Canada meeting. It is not expecting to change policy, but the Bank of Canada is thought to be among the short-list of major central banks that will be the first to exit its emergency measures, including bond-buying. While the US November jobs growth disappointed, Canada’s exceeded expectations. The 62k increase was three-times greater than the median forecast in the Bloomberg survey. Moreover, this included 99.4k full-time positions (part-time positions fell by 37.4k), almost a 50% increase from October.

The week begins off slow for Mexico, but the highlight of the week includes November CPI and October industrial production. At mid-week, the CPI is expected to ease as seasonal sales were brought forward. The headline rate is forecast to fall back into the 2-4% central bank range but remains above the 3% target. Industrial output may have risen for the first time since June. A 0.5% gain is expected. The central bank meets next week and is expected to stand pat. Brazil’s central bank meets on Wednesday, and the Selic rate is expected to remain at 2%, which is below inflation.

The US dollar fell a little below CAD1.2775 ahead of the weekend, a new 2020-low. It is firmer today and is threatening to snap a four-day slide. It has been up to nearly CAD1.2835 today, and if a corrective move, rather than a consolidation phase, has begun, initial potential may extend toward CAD1.2865 and possibly CAD1.2900. The greenback is better bid against the Mexican peso. It recorded a nine-month low before the weekend near MXN19.74 and has bounced to almost MXN19.98 early European hours. The US dollar has pulled back a little, and initial support is now seen around MXN19.85 and then MXN19.80.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author?

Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,Featured,MXN,newsletter