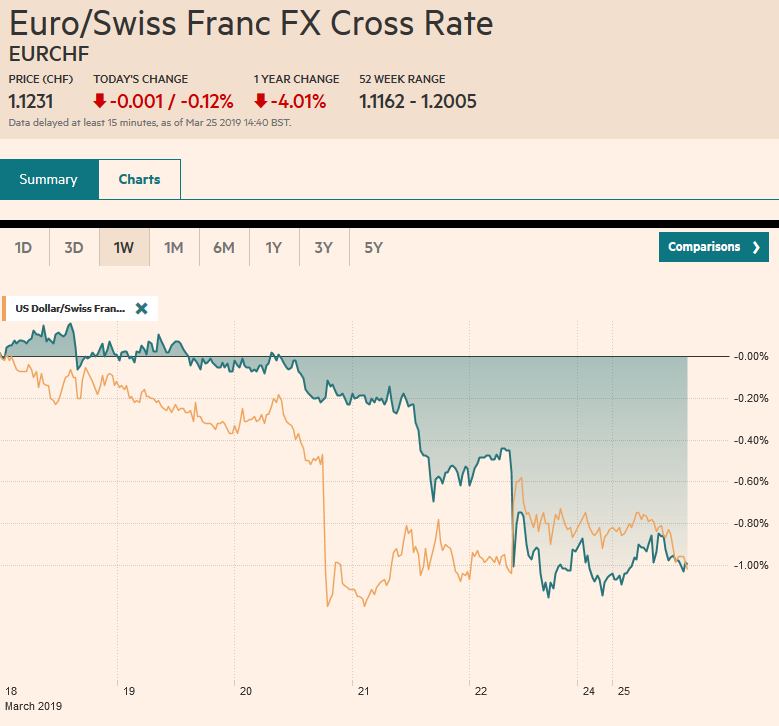

Swiss FrancThe Euro has fallen by 0.12% at 1.1231 |

EUR/CHF and USD/CHF, March 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equities have soured after the US shares dropped the most since very early in the year before the weekend. Asia’s sell-off was led by the 3% decline in Nikkei, while Malaysia fared among the best, surrendering 1%. Europe’s Dow Jones Stoxx 600 is off for a fourth session. It lost 1.2% at the end of last week and gapped lower today but stabilizing after the better than expected German IFO survey. The S&P 500 closed its week’s lows of 2800. US shares trading in Europe also pared initial loss. Bond yields in Asia were pulled lower by the pre-weekend rally in the US. Australia and New Zealand 10-year yields fell five and eight basis points respectively to new record lows (~1.78% and 1.89% respectively), while the 10-year JGB yield slipped 1 bp to yield nearly minus 10 bp. European bond yields are firmer, with Italy’s rising three basis points, as it bonds trade like risk assets. The benchmark 10-year Bund is hovering just below zero. US Treasury yields are steady to slightly firmer. The dollar is narrowly mixed. The yen and Swiss franc, which were stronger last week, are heavier today, alongside sterling, as Brexit weighs. In emerging markets, the Turkish lira has recouped about a third of the 6.25% it lost in the last two sessions (-5.4% before the weekend) as the fear over the decline in reserves were eased by officials, though the central bank did not conduct its normal fx swap auction. |

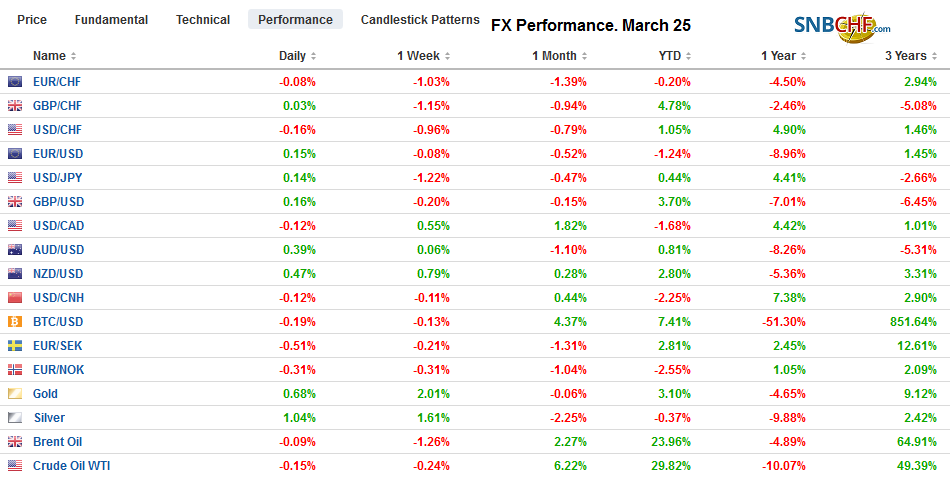

FX Performance, March 25 |

Asia Pacific

Fresh news from the region is light. The focus has been on the decline in equities and yields. The Nikkei’s 3% loss is the largest of the year. It gapped lower and finished below previous resistance near 21000. The first important retracement target of this year’s rally is found near in the 20750 area. The Nikkei recovery after the Q4 18 slide stalled in front of the 200-day moving average (~21960) twice, once at the beginning of March and again last week.

Before the weekend Markit reported that Japan’s flash manufacturing PMI for March was unchanged at 48.9, in contraction territory. Earlier today, Japan confirmed the poor start to the year with the third consecutive decline in the all-industries activity index. The 0.2% decline was a little better than expected, but the December reading was revised to -0.6% from -0.4%. The Japanese economy contracted in Q3 18 and staged a mild recovery in Q4, but looks to be contracting again. Although Finance Minister Aso recently reaffirmed plans to hike the sales tax later this year, an economic contraction would justify postponing it (again).

Thailand initially delayed releasing the results of the weekend election, the first since the 2014 coup. While the opposition party (Pheu Thai) looks to have picked up seats in the lower chamber of parliament, the political arm of the military (Palang Pracharath) appears to have won. The Thai baht is the best performing currency in Asia today (+0.3%) and this year (3.1%). For the record, the Chinese yuan is the second strongest in the region this year with a 2.5% gain. Through the end of last week, foreign investors have sold about $350 mln of Thai equities and about $365 mln in Thai bonds this year.

The dollar made a marginal new low against the yen and the rebound back above JPY110. It is testing the resistance encountered before the weekend in North America and again in Asia near JPY110.20. However, the intraday technicals are getting stretched before the US open, and there are two large maturing options today. The first set is for $1.9 bln at JPY110. There is another roughly $805 mln at JPY110.25. The Australian dollar approached last week’s lows (~$0.7065) before stabilizing. Resistance is seen in the $0.7100-$0.7120 area.

Europe

The German IFO surprised on the upside. The March survey was not only better than expected, but the February results were revised higher. The business climate improved to 99.6 from a revised 98.7 (initially 98.5). The expectations component rose to 95.6 from a revised 94.0 (from 93.8). The overall current conditions measure was 103.8 after 103.6 (from 103.4). The euro traded at session highs (a little above $1.1320) on the news. It is not enough to offset the poor flash PMI but may dull it a bit.

The Turkish lira slumped 5.4% ahead of the weekend. It was the fourth consecutive week that the lira managed to post a single session of gains. A large drawdown in reserves prompted concern that the politically-compromised central bank was supporting the currency ostensibly ahead of local elections. Officials played down the significance of the decline in reserves largely commercially-based (making foreign exchange available to state-owned business). The government also indicated it has opened an investigation into a bank’s report with a bearish view of the lira. The lira is recovering today and is up about 2%. The TRY5.52 area is about the middle of this year’s range. It is currently about TRY5.64.

The Brexit drama continues. Reports over the weekend that a group of cabinet ministers was going to try to oust Prime Minister May appears to have been blocked. Changing governments does not make up for the lack of a majority in Parliament. It is not clear at this juncture, whether the Withdrawal Bill will indeed be voted on the third time. There will be a series of indicative votes to see the sense of the House of Commons, but it only makes sense if it is a free vote that the party whips don’t control. One of the few definite things in this very fluid situation is that the UK will not be leaving the EU at the end of the week as initially intended. A petition to revoke Article 50 has garnered more than 5 mln votes, but this does not appear to be the most likely course. In the 2016 referendum those that voted to leave numbered around 17 mln. There is also much talk about a second referendum. This was resoundingly defeated in the House of Commons and does not yet look particularly likely.

The euro reached almost $1.1450 on the back of the dovish Fed in the middle of last week. It briefly dipped below $1.1275 ahead of the weekend in response to the dismal flash PMI. Helped by the IFO survey, the euro has stabilized to start the new week. The intraday technical indicators are stretched before the US open. Initial resistance is in the $1.1320 area, and a firmer hurdle is seen in the $1.1340-$1.1360 area. Support now is seen a little below $1.1300. Sterling poked above the pre-weekend high (~$1.3225) in early Asia and tried again in the European morning. There is an unusually large sterling option (GBP1.6 bln ) struck at $1.3200 expires today and another one (GBP1.3 bln) at $1.3250 that will also be cut. Support is pegged near $1.3160. It remains vulnerable to headline risk.

America

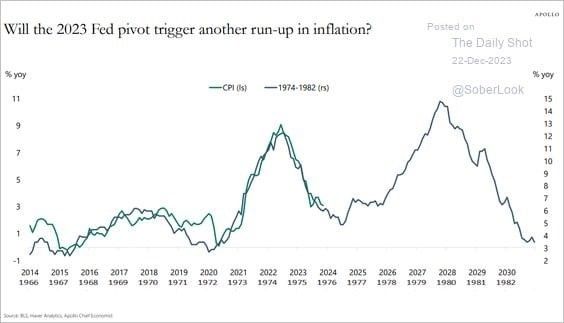

The inversion of the US yield curve (3-month to 10-year) has been a fairly good indicator of a recession but there are two caveats. First, the curve must stay inverted. A drive-by does not count. Second, the lead time can be more than a year. While it is always dangerous to assume things are different this time, the context does matter. There two aspects that make it usual. First, the drop in US yields took place after the poor eurozone PMI. The German Bund yield went negative for the first time in three years. The increase in negative yielding instruments makes US Treasuries more attractive nearly regardless of one’s macroeconomic views. Second, there are unusual supply considerations. US government debt managers are issuing more debt at the shorter end of the curve. Consider this week’s supply. The US government will raise $350 bln this week. There will be about $208 bln of bills hitting the market and $142 bln of coupons.

The economic calendar is light today. The Chicago Fed reports its national activity index for February and the Richmond Fed reports its March manufacturing index. Neither are market-movers, even in the best of times. With the FOMC meeting over, the quiet period has ended, and Fed officials will hit the news wires. Evans has already spoken and noted that it downside risks materialize the Fed will cut rates. Harker and Rosengren are later today. Eleven officials speak over the course of the week. Canada reports January trade figures in the middle of the week and January monthly GDP at the end of the week.

The US dollar tested CAD1.3440, the high from March 11 in Asia and has trended lower toward CAD1.3400 in the European morning. We look for it to find support near there. Risk-off ahead of the weekend saw the Mexican peso fall almost 1.25%, its largest loss of the year. President AMLO indicated that his government will not act to address bank fees and that banks ought to regulate themselves. The peso is recouping some of its pre-weekend losses, but the dollar may find support near MXN19.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,FX Daily,MXN,newsletter,SPX,USD/CHF