Swiss FrancThe EUR/CHF improved today. The OPEC-non-OPEC agreement was the reason. Always when oil gets more expensive, the euro, gold, CHF and the whole “Asian bloc” rises against dollar and yen. Still it was astonishing that the euro improved more against USD than the inflation hedge CHF. Reason might be that investors now consider the ECB the most dovish central bank. Higher oil prices, however, may lead to more inflation and less dovishness. |

EUR/CHF - Euro Swiss Franc, December 12(see more posts on EUR/CHF, ) |

FX RatesThe dollar-bloc currencies are firm. The US dollar has slipped to near CAD1.31. It had finished November near CAD1.3440. The currency-sensitive two-year differential closed November near 36 bp, and today it is at 40 bp. A trendline drawn from early May, August and September lows comes found near CAD1.3080 today. Below there, the CAD!.3025 area corresponds with a 50% retracement of the US dollar’s advance from the early May low to the mid-November high of almost CAD1.3590. Lastly, the Australian dollar is firm and is poised to re-challenge the $0.7500 area that has stymied the upside for nearly a month. Above there, the next chart point if near $0.7550. |

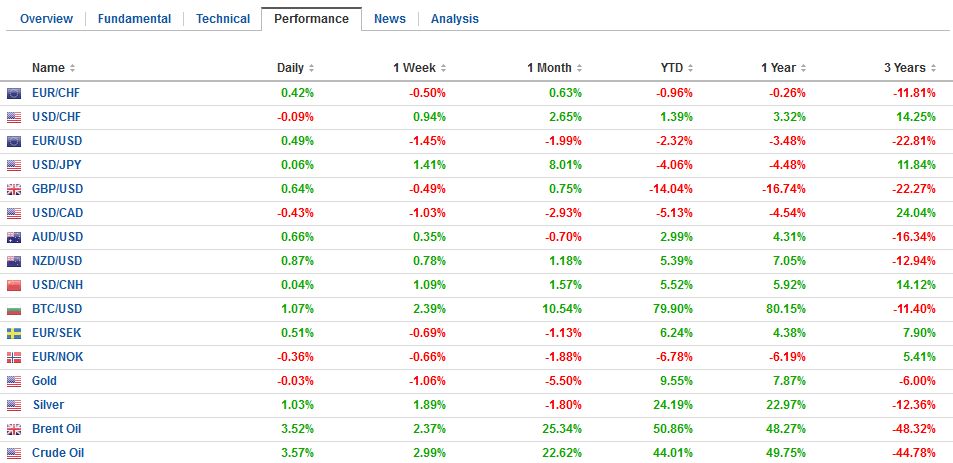

FX Performance, December 12 2016 Movers and Shakers Source: Dukascopy - Click to enlarge |

| The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers’ currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso. |

FX Daily Rates, December 12 |

| Most emerging market currencies are firmer, but the two bombings in Turkey over the weekend are seeing the lira extend the slide at the end of last week. The dollar looks poised to challenge the TRY3.5935 record high set on December 2.

Although there is much data this week, and several central bank meetings, including the FOMC, today’s calendar is nearly empty. There seems to be limited scope for additional euro gains. The bottom end of the range is seen near $1.05, and the inability to take it out appears to be the logic behind what appears to be short-covering. The pre-weekend high was near $1.0630, and around there is where new offers likely lay. The dollar has risen through the JPY115.60 area, which is 61.8% retracement of the dollar’s fall since the peak was set in June 2015 near JPY126. The dollar stalled near JPY116.10 in late Asia/early European activity. |

FX Performance, December 12 |

Japan

Bond yields broadly higher. Even Japanese bonds are not immune to the pressure. Today’s three basis point increase lifts the 10-year yield (generic) to almost nine basis points, the highest in 10 months. Recall that at the end of November the yield stood at two and a half basis points. Under its new framework, the BOJ wants to keep the 10-year yield near zero. European bonds are mostly firmer. Of the major countries, French bonds yields are up the most, with a five bp gain. Most of the core yield are up three-four basis points, while Spanish and Portuguese yields are off a little more than one basis point.

Italy

Italian bond yields are little changed and slightly lower. Despite the political and economic concerns, Italy continues to be able to borrow up to two-year money at negative rates. Italy’s Foreign Minister Gentiloni has been asked to form a government in the wake of Renzi’s resignation. Padoan is expected to remain Finance Minister. It will be the fourth un-elected government, and in its caretaking role, there are three main issues: preparing for elections, which involves a) court ruling on new reforms, b) adjusting laws as needed, and c) devise rules for upper chamber election, addressing banking challenges, and reconstruction following the recent earthquakes.

Monte Paschi will continue to try to raise capital privately, while the state works out a recourse if needed. Italy’s largest bank, Unicredit has agreed to sell Pioneer, to Amundi for 3.5 bln euros. Italian bank shares have advanced nearly 18% over the past two weeks. The All-Share Bank Index slipped 2.25% before the weekend to snap a three-day rally, but it’s up 2.2% near midday in Milan.

More broadly, Italy’s FTSE Milan bourse is the only major European equity market posting gains today. It is up nearly 1.2%. It is the strongest major market here in December, with a 9.3% rally, nearly twice the DAX and Nikkei rally. The Dow Jones Stoxx 600 is off about 0.3%. Nearly all sectors but energy are lower. While Japanese shares rallied, most of Asia equities fell. The Topix had a 12-session rally end on November 29 and has begun a new streak, and now has a five-session advance in tow. Of note, the Nikkei’s 0.8% advance today was enough to swing its year-to-date performance positive for the first time in 2016. It was off by over 20% at the midyear mark.

China

Chinese shares were particularly hard hit. The Shanghai Composite fell dropped 2.5%, the latest loss in six months. The smaller-cap Shenzhen Composite tumbled 4.9%. A warning about the potential for coming weakness in house sales hit the real estate sector, which pushed 3% lower, but its was the information technology, consumer discretionary, and industrial sectors that were hardest hit. Financials did best, slipped about a third of one percent.

United Kingdom

Sterling is sidelined. Consider that on December 8 it finished the North American session near $1.2585, and then $1.2570 before the weekend, and now it is near $1.2590. The Bank of England meets later this week. Tomorrow the UK will report November consumer and producer prices. Small gains are expected. Employment and retail sales will also be reported before the BOE meeting.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,FX Daily,newslettersent,OPEC