Summary:

The UK reports inflation, employment and retail sales this week.

The BOE meets but will keep rates steady.

The US 2-year premium over the UK is the highest since at least 1992 today.

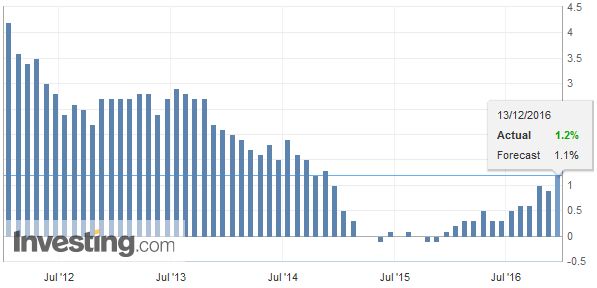

United KingdomWhile the Federal Reserve meeting is the highlight this week, the UK has a number economic reports and the Bank of England’s Monetary Policy Committee meets. The UK reports inflation tomorrow, followed employment, and then retail sales a few hours before the central bank decision. UK price pressures are rising. The past decline in sterling the rise in commodity prices are evident. Headline CPI is expected to rise 0.2% in November. In November 2015, prices were flat. This means that the due to the base effect, the year-over-year rate is expected to rise to 1.1% from 0.9%. If that pans out, UK headline CPI will be at its highest level since late October 2014. Recall that in September-October 2015; the readings were still negative. The base effect will likely be evident in the December report (December 2015 CPI rose 0.1%), and especially in January (January 2016 CPI fell 0.8%). The core rate pulled back to 1.2% in October from 1.5% in September. It is expected to tick up to 1.3% in November, which is what it has averaged this year. However, to the extent that producer prices reflect pipeline pressures, UK consumer inflation is likely to rise further in the coming months. Input prices which reflect the increase in raw material prices and fuel, as well as the depreciation of sterling. October input prices were 12.2% above a year ago levels, and they are expected to have accelerated to a 13.5% pace. Output prices, which are manufactured goods prices have been slower to rise. The base effect will turn a 0.2% increase in November into a 2.5% year-over-year increase, up from 2.1% in October.

|

U.K. Consumer Price Index (CPI) YoY, November 2016(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The UK labor market growth is not as robust as it has been. Since 2012, the monthly claimant count has mostly fallen. However, February seemed to mark the turning point. Since then, only one month (July) saw a decline in the monthly claimant count. It has risen in the August through October period and is expected to rise again when the data is reported in the middle of the week. However, deterioration has yet to be seen in the unemployment rate, which made a new cyclical low in of 4.8% in the three-month period through September and is expected to remain there in October.

Earnings growth, which is also reported with an extra month lag, are expected to have ticked up in the three months year-over-year through October, excluding bonuses are expected to have risen 2.6% from a 2.4% pace. In May through August 2015, weekly earnings rose a 2.8% clip but may have been a bit of a statistical fluke, as it finished the end of the year at 2.0% pace. Including bonuses, the average weekly earnings are expected to be stable for the third month at 2.3%.

Retail sales jumped an outsized 1.9% in October, and will lucky to simply be flat in November. Cooler weather in October spurred early winter clothing purchases, and past decline in sterling may have enticed tourists (foreign consumers), including Chinese shopper during their national holiday in early October. The 7.4% year-over-year pace reported from October was the strongest since 2002. Flat sales on the month will push the year-over-year rate to a still respectable 5.9% pace.

The Bank of England meeting concludes the day after the Fed’s meeting. While the Fed is widely expected to hike rates, the BOE will leave rates on hold. There is a 16 bp spread between the implied yield of the Dec 2016 short-sterling futures contract and the Dec 2017 contract (53 bp and 38 bp respectively). This is consistent with no change in policy next year.

The US premium over the UK on two-year money is at its widest since at least 1992 today at 1.02%. As recently as the end of October the premium was 57 bp. Over the past three months, the US two-year yield has risen 37 bp, while the UK yield is off five bp. The 10-year differential has widened from 55 bp on November 1 to over 100 bp now. In August the spread briefly traded through 105 bp, which was the most extreme since almost 123 bp in 2000.

Sterling saw $1.50 just before the referendum results were announced in late June. It recorded a low near $1.1840 on the so-called flash crash on October 7. Since then it has gradually climbed higher. The best level since October 7 was recorded on December 6 at $1.2775. Today’s low near $1.2545 is the low for December (thus far). There appears to be scope for additional near-term gains. While the $1.2775 is the next target, there may be scope before the end of they year toward $1.2830. Even though the Fed will most likely hike rates, we are concerned that many will be disappointed if it does not upgrade its forecasts. We do not think this is particularly realistic, given the official comments and the lack of concrete details from the new Administration.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,Bank of England,newslettersent,U.K.