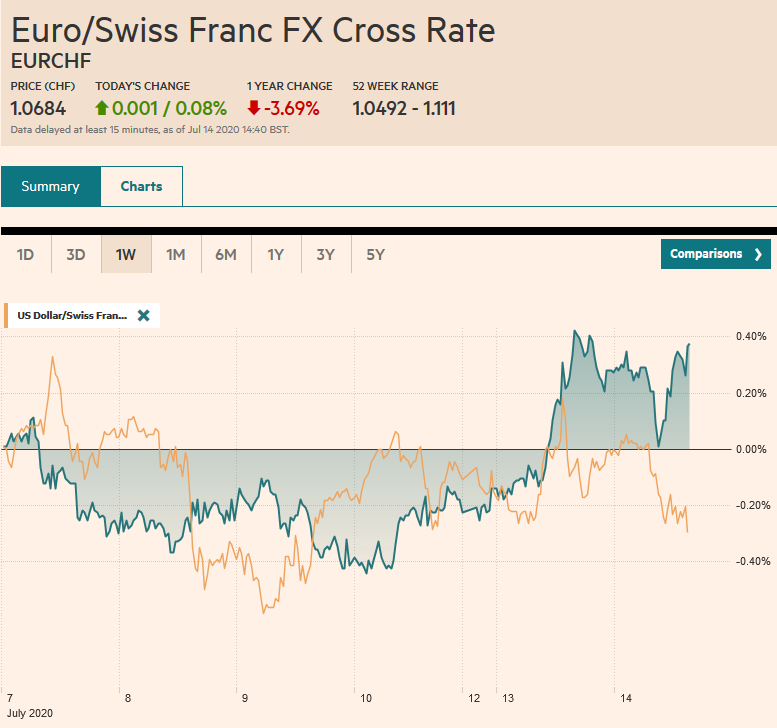

Swiss FrancThe Euro has risen by 0.08% to 1.0684 |

EUR/CHF and USD/CHF, July 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Turn around Tuesday began yesterday with a key reversal in the high-flying NASDAQ. It soared to new record highs before selling off and settling below the previous low. The S&P 500 saw new four-month highs and then sold-off and ended on its lows with a loss of nearly 1% on the session. Asia Pacific shares fell, led by declines in Hong Kong and India. The main Chinese benchmarks were off less than 1%. The Dow Jones Stoxx 600 is off about 1.3% in late morning turnover in Europe, while US shares are flat to slightly higher. Benchmark yields are mostly 1-3 bp lower. The US 10-year yield is near 62 bp. The dollar is mixed. Among the majors, the Swedish krona continues to lead. The Swiss franc, euro and Australian dollar are a little firmer. At the same time, sterling, an underperformer yesterday, is heavier after a disappointing May GDP print (1.8%, about a third of what was expected). The greenback is also mixed against emerging market currencies. Asia Pacific currencies slipped, but the liquid accessible currencies, like the Mexican peso, Hungarian forint, Polish zloty, and South African rand, are trading higher. Poland’s rate decision is awaited, but no change in the 10 bp repo rate is anticipated. Gold has lost some momentum and continues to trade in a narrow range around $1800. September WTI is slipping back below $40 but has remained above the low for the month set last week near $38.75. OPEC+ meet tomorrow to ostensibly agree to adhere to the deal that calls for a boost in output next month. |

FX Performance, July 14 |

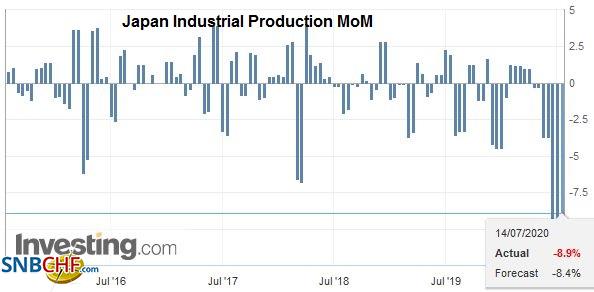

Asia PacificIndustrial output in Japan fell a revised 8.9% in May from an initial estimate of an 8.4% decline. It followed a 9.8% slump in April. While Japan’s industrial sector continues to suffer, the tertiary sector (services) appears to be on the mend. It contracted by 2.1% in May after falling a revised 7.7% in April (initially -6.0%). The median forecast in the Bloomberg survey was for a 3.8% decline. The BOJ’s two-day meeting ends tomorrow with little new likely coming from it. However, there does appear to be more talk of another stimulus effort by Tokyo in the second half of the fiscal year (October 1). |

Japan Industrial Production MoM, June 2020(see more posts on Japan Industrial Production, ) Source: investing.com - Click to enlarge |

China reported an unexpected increase in both imports and exports in June, suggesting the economy is continuing to recover. Exports rose by 0.5% after a 3.3% decline in May. The Bloomberg survey anticipated a decrease of 2%. Imports rose by 2%. The median forecast was for a 9% decline after a 16.7% fall in May. This resulted in a trade surplus of $46.4 bln, down from almost $63 bln previously. Regionally, exports rose to ASEAN (1.6%) and the US (1.4%). The two together account for around a third of PRC exports. The exports of medical goods rose by 100%, while exports to furniture and electrical lighting equipment rose by 8.4% and 9.9%, respectively. Energy imports soared (crude oil imports rose 19.2% on the month) as did soy. China appears to have stepped up its purchases of US grains in recent weeks.

The EU is preparing to respond to the new security law in Hong Kong. It seems clear, it is not hill upon which it will put at risk its entire relationship. However, still stronger action would be likely if it were not for the unanimity required, which gives those like Hungary and Greece, the ability to temper the response. The measures that seem to win broad support include limiting the sale of goods that can be used by law enforcement officials to control crowds, review of the extradition agreement, and perhaps stepping up scholarships for Hong Kong students.

China appears to have escalated tensions with numerous countries, well beyond the US. It is losing the UK and Italy for Huawei. Its tensions with India, Taiwan, and Australia are well known. At the UN Human Rights Council 53 countries supported its national security law. They account for about 4% of the world’s GDP and are linked with China through the Belt-Road Initiative. Many have authoritarian governments. Only one G20 member supported China, Saudi Arabia. Ironically, the vote on the Council succeed in achieving what has rarely been done: Iran and Saudi Arabia were on the same side.

The dollar is firm against the yen, but it is in a narrow quarter-yen range above JPY107.10 and appears capped in the JPY107.40-JPY107.50 area. There is little sign that a breakout of the JPY106-JPY108 range is imminent. The Australian dollar was turned back from $0.7000 yesterday and found support near the lower end of the range seen in the past week or so near $0.6920. Initial resistance is now pegged near $0.6960-$0.6970. Today is the first day in four that the greenback has held above CNY7.0. The PBOC set the dollar’s reference rate a little below CNY7.0, while models were biased toward a little firmer than that. Separately, the PBOC’s liquidity injections have succeeded in driving down key money market rates (e.g., overnight money and seven-day repo rates). Lastly, the US acknowledged what we suspected: it is not going to try to sabotage the Hong Kong Dollar’s peg to the US dollar.

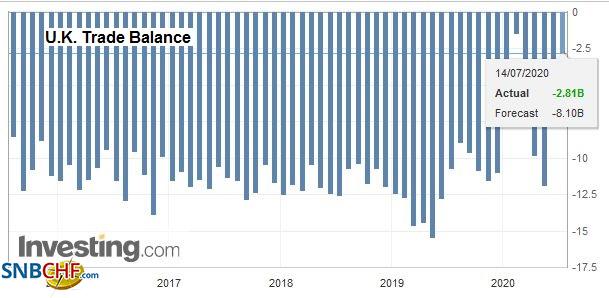

EuropeThe UK’s economic recovery is off to a disappointing start. May GDP rose by a mere 1.8%. The median forecast in the Bloomberg survey was for a 5.5% expansion. The economy contracted by 20.3% in April. The economy contracted nearly 20% over the past three months (-19.1%). Almost all the sectors (industrial output, services, and construction) missed forecasts. That said, bright spots included manufacturing and trade). The UK’s two-year yield fell to a record low of minus 12.5 bp today. It could soon eclipse Japan, where the two-year yield trades near minus 15 bp. The Bank of England has not ruled out adopting a negative policy rate. The 10-year yield is near a record low of 15 bp. |

U.K. Trade Balance, May 2020(see more posts on u-k-trade-balance, ) Source: investing.com - Click to enlarge |

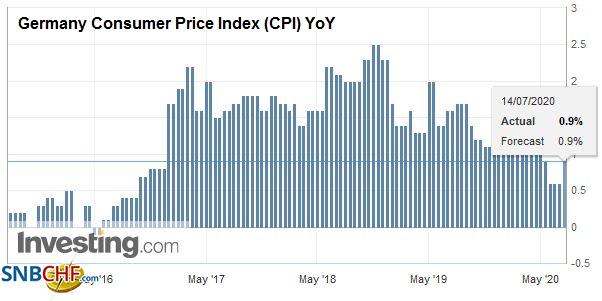

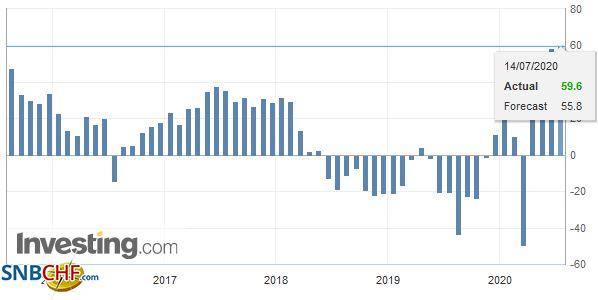

| Germany’s investor sentiment survey, ZEW, disappointed, as well. The expectations component fell to 59.3 in July from 63.4. The assessment of current conditions ticked up to -80.9 from -83.1. |

Germany Consumer Price Index (CPI) YoY, June 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The ZEW survey often appears to track the DAX, but the DAX has risen by over 20% in the past three months. With today’s roughly 1.5% decline, the DAX is off about 4.7% year-to-date, making it one of the better performing major markets this year. |

Eurozone ZEW Economic Sentiment, July 2020(see more posts on Eurozone ZEW Economic Sentiment, ) Source: investing.com - Click to enlarge |

| The euro remains firm. It does not appear as sensitive to the vagaries of the day-to-day shifts in risk appetites as it has recently. There are a couple of chunky option expirations today. There are near two billion euros in $1.1320-$1.325 options that expire today and 1.1 bln euros at $1.1350. Upticks have been stymied near $1.1375. Note that the upper Bollinger Band (two standard deviations above the 20-day moving average) is found near $1.1360 today. The euro has not traded above $1.14 since June 11 and has not closed above it since March 9. Sterling appears to be rolling over after rising from around $1.2260 at the end of June to about $1.2670 in recent days. The upside momentum has eased, and sterling is testing the $1.25 area today, where a roughly GBP260 mln option expires. Support is seen in the $1.2460-$1.2480 area. |

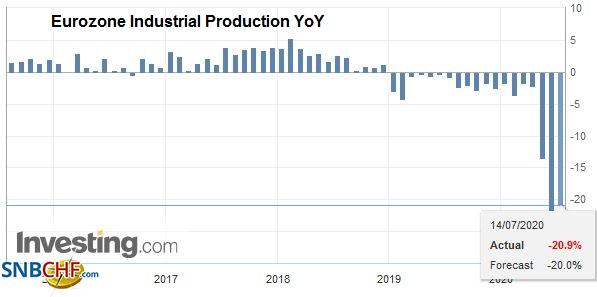

Eurozone Industrial Production YoY, May 2020(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

AmericaThe US reported a June budget deficit of $864 bln, a record. Around half the $1.1 trillion of spending was accounted for by the Payroll Protection Plan (~$495 bln) and state unemployment insurance (~$35 bln). The June figures complete the 3/4 mark of the fiscal year. The government spent about $5 trillion so far, and a little more than half ($2.7 trillion) was uncovered by insufficient revenues, i.e., the deficit. Say what you want about MMT, but the fact is that in the face of such borrowing (supply of bonds), US yields are sharply lower. The 10-year yield is more than 125 bp lower. |

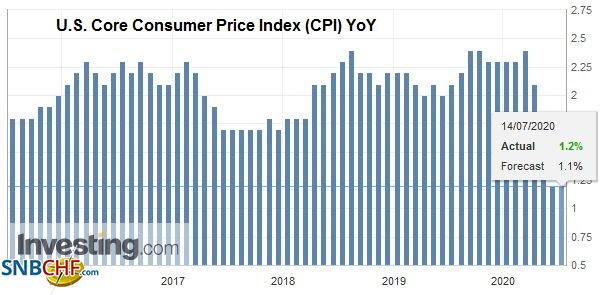

U.S. Consumer Price Index (CPI) YoY, June 2020(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

| And despite the cries of financial repression, inflation has not risen either. The June CPI will be released today. In June 2019, it had increased by 1.6% year-over-year. Economists expect it to have risen only by 0.6% last month. Despite the spending, inflation is worrisomely low. It does not line up too poorly. Using this admittedly simple approach, the real interest rate (deflating the 10-year yield by CPI) is little changed to slightly lower than prior to the US huge deficit and the large supply of notes and bonds. At least four Fed officials speak today (Brainard, Bostic, Bullard, and Harker). Several large US banks report earnings before the equity market opens. Canada, Mexico, and Brazil have light calendars. |

U.S. Core Consumer Price Index (CPI) YoY, June 2020(see more posts on U.S. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

Even if the euro is a little less sensitive to risk appetites, the Canadian dollar still seems closely linked. Its sell-off yesterday coincided with the reversal in US equities. Follow-through selling today has seen the Loonie fall new lows for the month (the US dollar rose to above CAD1.3650). The highs from late June in the CAD1.3700-CAD1.3715 are the next objectives. In the larger picture, the broad sideways movement is seeing the greenback violate the downtrend line drawn off the March, mid-May, an late June highs that comes in today just below CAD1.36. The Mexican peso also still seems sensitive to risk-appetites, and it did weaken on the equity reversal yesterday. However, the high real and nominal yields still cushion it, and the greenback has remained below last week’s highs (~MXN22.87-MXN22.90). A move above here would target the late June highs near MXN23.23. The US dollar advanced around 1.5% against the Brazilian real yesterday, the most in about two weeks. The highs in late June around BRL5.50 is the next key area. A break of it would target the BRL5.70 area. The peak in mid-May was near BRL5.97.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Brazil,China,Currency Movement,EUR/CHF,Featured,FX Daily,newsletter,U.K.,USD/CHF