Tag Archive: U.S. Core Consumer Price Index

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, June 10: Corrective Forces Still Seem in Control Ahead of the FOMC Outcome

The pullback ins US shares yesterday has not derailed the global advance. Japanese and Chinese markets were mixed, the Hang Seng slipped, and Indonesia was hit with profit-taking, but the MSCI Asia Pacific Index eked out a small gain. It has fallen once past two and a half weeks. The Dow Jones Stoxx 600 opened higher but is falling for the third consecutive session.

Read More »

Read More »

FX Daily, March 11: US Over-Promises and Under-Delivers, while BOE Steps Up with 50 bp Rate Cut

Overview: The S&P 500 and Dow Jones Industrials sold off after the higher open and briefly traded below yesterday's lows. Investors seemed disappointed that the Trump Administration was not ready with specific policies after Monday's tease that had initially helped lift Asia Pacific and European markets earlier on Tuesday. This sparked a sharp decline in Europe into the close.

Read More »

Read More »

FX Daily, January 14: China was a Currency Manipulator for a Few Months

Overview: The leaked US decision to lift the currency manipulator designation on China was the latest fodder fueling the new record highs in the S&P 500. The risk-taking appetite helped extend the rally in the MSCI Asia Pacific Index for the fourth consecutive session. Europe's Dow Jones Stoxx 600 is little changed and trying to snap a two-day decline.

Read More »

Read More »

FX Daily, December 11: Sterling Holds Firm Despite Tighter Poll

Overview: The capital markets continue to tread water as investors await this week's key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde's first ECB meeting at the helm. Global equities continue consolidating the recent gains. Asia Pacific equity markets were mostly higher.

Read More »

Read More »

FX Daily, November 13: Investors Temper Euphoria

Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is fragile and will likely follow prices.

Read More »

Read More »

FX Daily, October 10: Setback for the Greenback

Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China's indices, and HK gaining, while most of the others slipped lower. The 0.9% gain in the S&P 500 yesterday failed to lift European stocks, and the Dow Jones Stoxx 600 is near the week's lows.

Read More »

Read More »

FX Daily, September 12: Focus on the ECB, while the Dollar Slips below CNY7.09

Overview: Some gestures in the US-China trade spat have given the market the reason to do what it had been doing, and that is taking on more risk. Equities are higher in Asia Pacific and opened in Europe higher before slipping. The MSCI Asia Pacific and the Dow Jones Stoxx 600 are advancing for the fourth consecutive week.

Read More »

Read More »

FX Daily, August 13: Investors Remain on Edge

Overview: The confrontation in Hong Kong and the fallout from the Argentine primary over the weekend join concerns the conflict between the two largest economies and slower growth to force the animal spirits into hibernation. Global equities remain under pressure. Japan's Topix joined several other markets in the region to have given up its year-to-date gain.

Read More »

Read More »

FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng's nearly 1.9% decline was the largest in a month and led the region lower.

Read More »

Read More »

FX Daily, September 13: Vulnerable To Disappointment

There is an eerie calm in the markets ahead of the highlight for the day and week. The central banks of the eurozone, UK, and Turkey hold policy meetings, and the US reports August CPI. The greenback is a mostly firmer, with the Australian dollar as the notable exception. On the one hand, we would note that is it higher for the fourth consecutive sessions, after finding some support near $0.7100 earlier in the week.

Read More »

Read More »

FX Daily, May 10: Kiwi Tumbles on Dovish RBNZ, While Sterling Goes Nowhere Ahead of BOE

The US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback's consolidation is giving it a heavier bias against most of the major currencies. The recently strong upside momentum has stalled, but the losses are modest and the euro and sterling are inside yesterday's ranges.

Read More »

Read More »

FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Between Syria, trade tensions, and the US special investigator into Russia's attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%.

Read More »

Read More »

FX Daily, March 13: Non-Economic Developments Dominate Ahead of US CPI

Many see the eruption of the scandal that threatens senior government officials as yen positive because it weakens those that ostensibly want to depreciate the yen through monetary policy. The scandal involves falsifying documents to conceal a sweetheart deal. The government sold of state-owned land to a school-operator, reportedly with connections to Prime Minister Abe's wife at an incredibly low price.

Read More »

Read More »

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

FX Daily, December 13: Greenback Quiet Ahead of Five Central Bank Meetings

The Federal Reserve gets the balling rolling today with the FOMC meeting, which is most likely to deliver the third hike of the year. Tomorrow, four European central banks meet: Norway, Switzerland, the UK, and the ECB. The MSCI Asia Pacific Index rose nearly 0.3%, though Japanese and Indian shares were lower. In Europe, the Down Jones Stoxx 600 is paring yesterday's gains (-0.2%) led by utilities and telecom. Consumer discretion and financials are...

Read More »

Read More »

Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

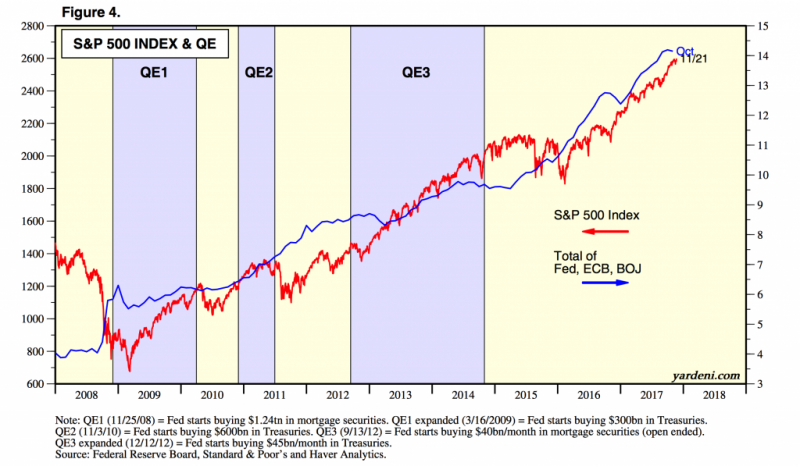

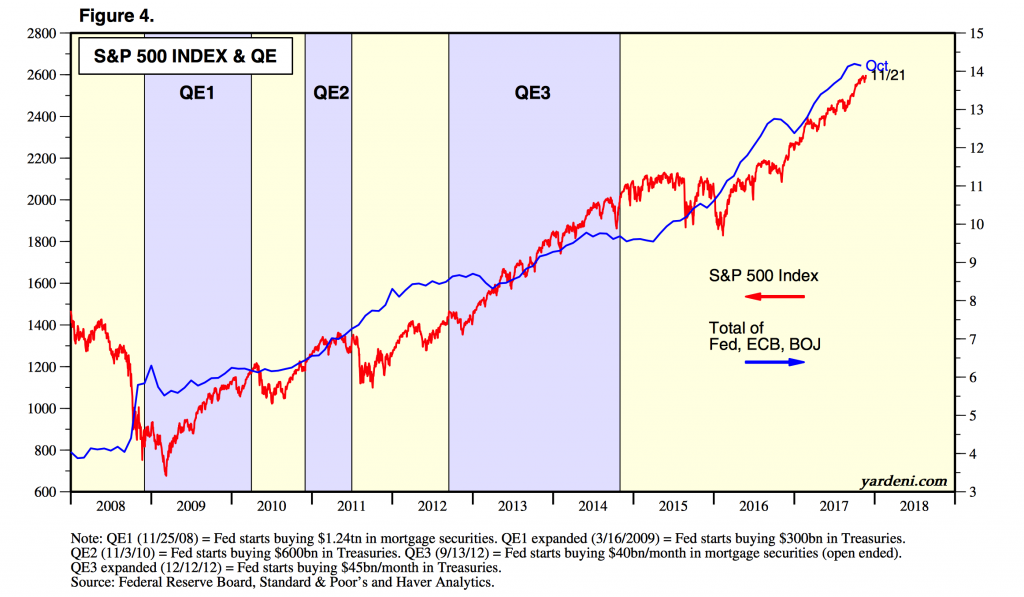

FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making. Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’. Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’. Members seem oblivious to impact of inflation on households and savings. Physical gold and silver remain the only assets for real diversification and...

Read More »

Read More »

FX Daily, November 15: Dollar Slides

The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month's highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

Dollar Dropped like Hot Potato After Core CPI Disappointed

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower.

Read More »

Read More »