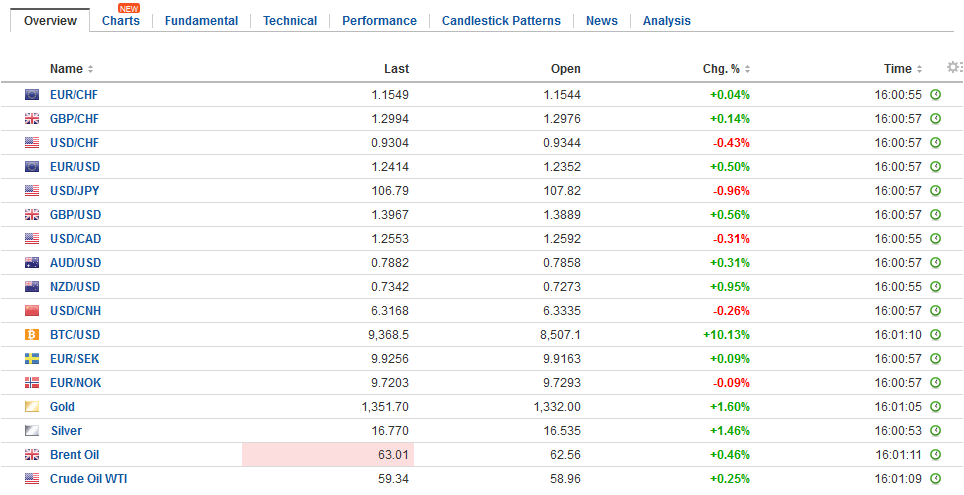

Swiss FrancThe Euro has fallen by 0.08% to 1.1533 CHF. |

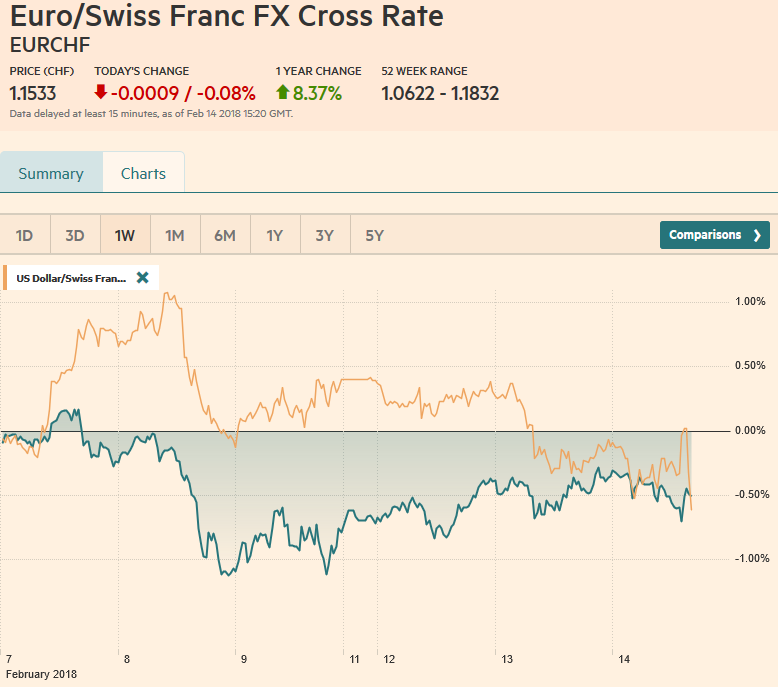

EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThere is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. First, we note that the market appears to have nearly fully discounted the likelihood of a rate hike next month, has priced in about a 60% chance of follow-up hike in June. Second, as of Feb 6, speculators in the futures market had a record short 10-year Treasury position. The yield has not been below 2.805 this week and put in the recent high on Monday near 2.89%. The technical indicators favor consolidation or higher prices (lower yields). Third, the S&P 500 closed higher yesterday for the third advancing session. It finished yesterday a hair above the 38.2% retracement of its swoon (~2662.65). The 50% retracement is a little below 2703. |

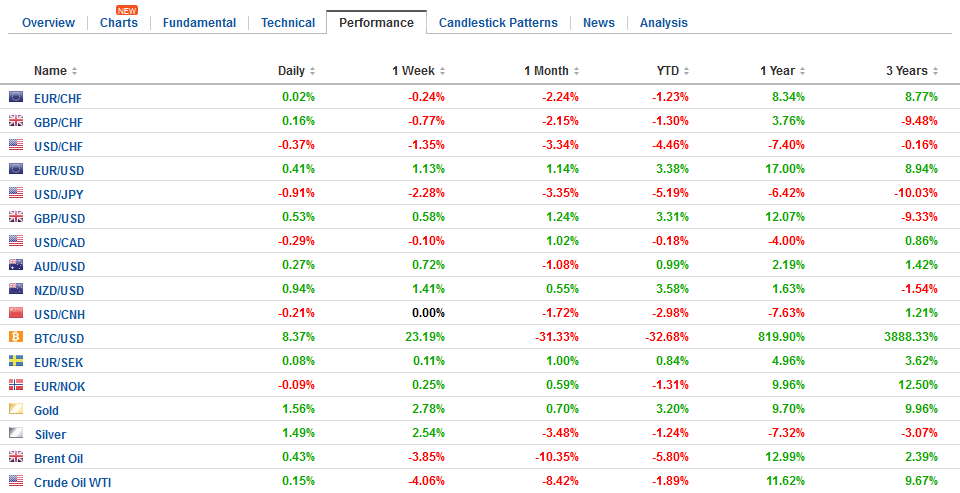

FX Daily Rates, February 14 |

| The MSCI Asia Pacific Index rose 0.3%, but it was dragged down by the heaviness of Japanese stocks. The Topix fell 0.8% and is now at a four-month low. Excluding Japan, the MSCI Asia Pacific Index was up 0.9%. We note that foreign interest has returned to South Korean equities. Foreign investors bought a modest $154 mln of Korean shares today. European markets are following the US and Asia higher. The Dow Jones Stoxx 600 is up about 0.7% in broad gains.

The yen remains very much the main focus in the foreign exchange market. The dollar fell 1.25% against the yen last week, while rising against all the other major currencies. It has fallen each day this week, and earlier today fell to a low near JPY106.85, its lowest level since November 2016. The recent yen moves appear to be led by Japanese-based investors. It could be increasing hedge ratios. It could be reducing new buying of foreign securities. Some link recent yen strength to efforts to curb retail leverage. |

FX Performance, February 14 |

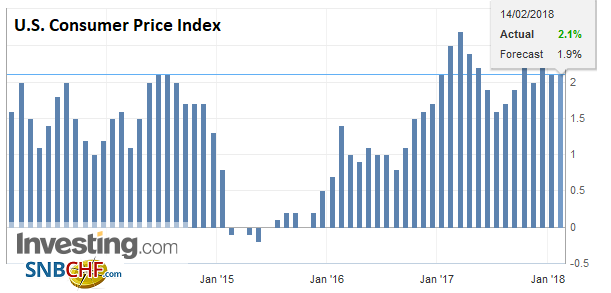

United StatesMoreover, the focus today on US CPI may prove for nought. The consensus view is that the rise in US average hourly earnings spurred inflation fears, a sell-off in US Treasuries, triggering the slide in stocks. |

U.S. Consumer Price Index (CPI) YoY, Jan 2018(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Journalists and investors have put much weight in today’s CPI report. We think it is too much, but will be looking at how the market responds to the news as an important reflection of market psychology. |

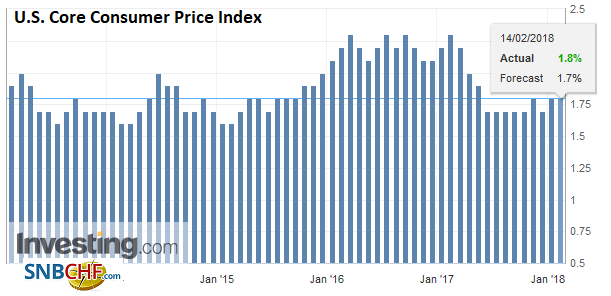

U.S. Core Consumer Price Index (CPI) YoY, Jan 2018(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Specifically, the 0.2% and 0.3% rise in the core and headline rates respectively will be unable to prevent the year-over-year rates from slipping lower, due to the larger rise in January 2017. |

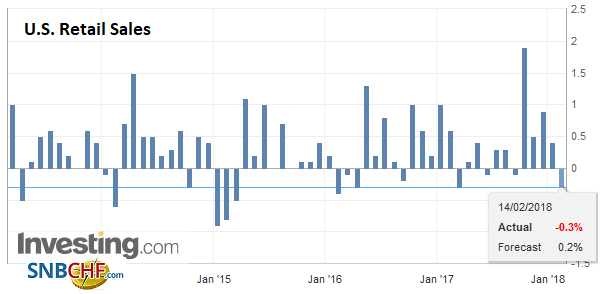

U.S. Retail Sales, Jan 2018(see more posts on U.S. Retail Sales, ) Source: Investing.com - Click to enlarge |

| We do look for US inflation to edge higher this year, but see it as beginning later in Q1 and running through early Q3. |

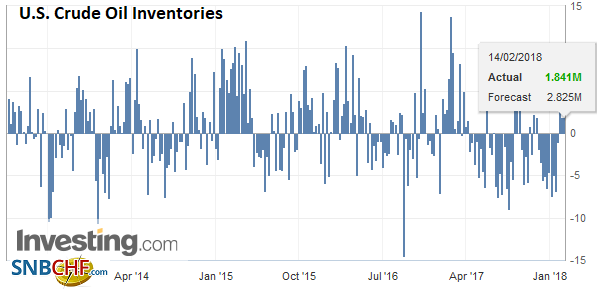

U.S. Crude Oil Inventories, Jan 2018(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

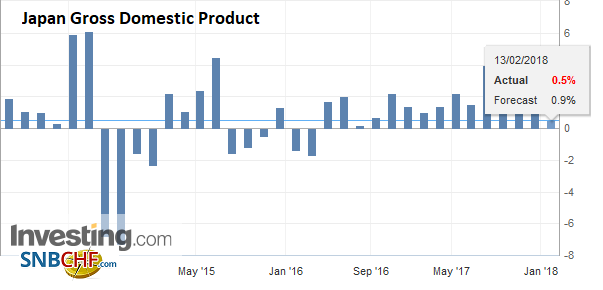

JapanSeparately, Japan’s first estimate of Q4 17 GDP was disappointing. The economy appears to have nearly stagnated, with the quarter-over-quarter pace of 0.1% in real terms and it was flat in nominal terms. The bright spot was consumption (0.5% after -0.6% in Q3), but business spending was weaker than expected (0.7% rather than 1.1%). Public investment and residential investment fell, while trade was a net wash. The GDP deflator, which some suggest may be a better measure of inflation than CPI was flat after a revised 0.2% gain in Q3 17. |

Japan Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on Japan Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

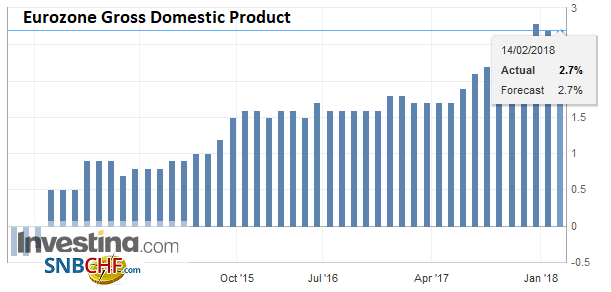

Eurozone |

Eurozone Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

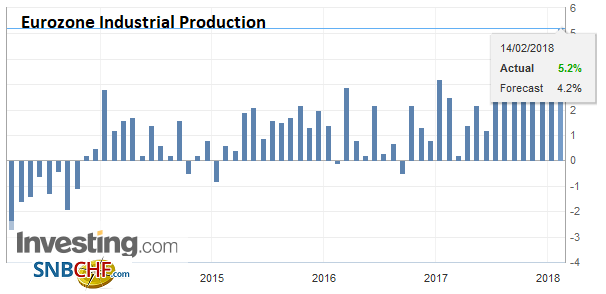

Eurozone Industrial Production YoY, Dec 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

|

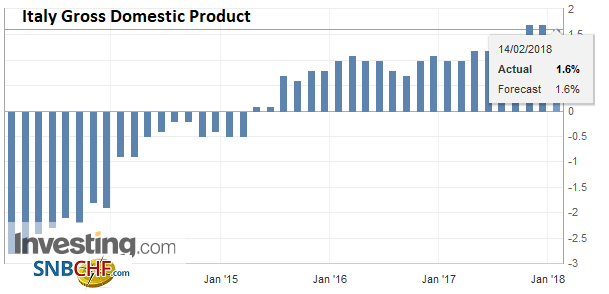

Italy |

Italy Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on Italy Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

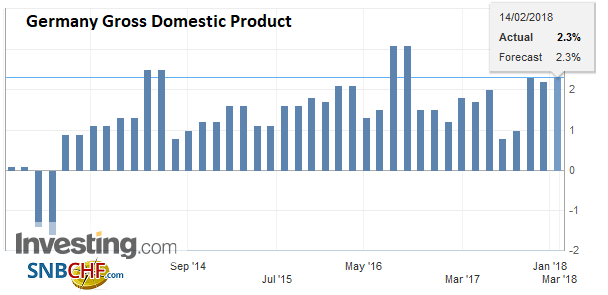

Germany |

Germany Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

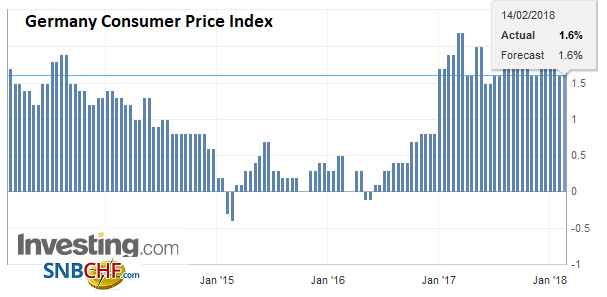

Germany Consumer Price Index (CPI) YoY, Feb 2018(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Thus far the reaction from Japanese officials has been quite modest. It jives with our understanding that at least some officials can accept a rise in the yen, provided it is gradual and part of a broader move in the foreign exchange market. The yen’s strength is not simply against the dollar. It is appreciating on a trade-weighted basis. In fact, with today’s gains (~0.7%), it has appreciated for the seventh consecutive session on a trade-weighted basis. Over this period, it has appreciated by more than 3%. The pace and breadth of the yen’s appreciation would seem to challenge Japanese official resolve.

However, given the attitude of the US Administration, Japanese officials will tread carefully. The OECD, for example, considers the yen the most undervalued currencies on a PPP-basis (~9.75% undervalued at JPY107.50). Also, Japan has a current account surplus of around 4% of GDP last year, up from less than 1% in 2013-2014.

Stops apparently were triggered on the break of JPY107. The reactionary bounce that also began in Tokyo is running out of steam in the European morning near JPY107.50. If the JPY106.80 is taken out, the next chart level is in the JPY106.40-JPY106.60 area, but many will set their sights on JPY105.

Investors have been unable to get excited about much else today. A slightly higher two-year inflation expectation in New Zealand has the local dollar leading the majors; eclipsing the yen, with a 0.6% advance. It is the fourth consecutive advancing session. The Swedish krona is dramatically unchanged following the Riksbank meeting, that shifted the first rate hike to H2 this year from mid-year, and tweaked lower its inflation forecasts.

The euro initially extended its three-day advance into today’s session, and poked briefly above $1.2390 to see its best level since last Wednesday, where it met good offers, and returned to where NY left it yesterday (~$1.2350). Still support is seen near $1.2340, and if risk appetites return following the US CPI, the euro can resurface above $1.2400. That said, there are more than 2 bln euros of options struck between $1.2340 and $1.2350 and another 1.5 bln euros struck at $1.2400, all of which expire today.

The euro is straddling resistance near GBP0.8900. On an intra-day basis, it reached nearly GBP0.8930, it is has struggled to close above it since late last November. Against the dollar, sterling is trading within yesterday’s ranges, but is still within last Friday’s range (~$1.3765-$1.3985).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Gross Domestic Product,Eurozone Industrial Production,Germany Consumer Price Index,Germany Gross Domestic Product,Italy Gross Domestic Product,Japan Gross Domestic Product,newslettersent,NZD,SPY,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Crude Oil Inventories,U.S. Retail Sales,USD/CHF