Tag Archive: Japan Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

FX Daily, July 8: Consolidation is the Flavor of the Day

The S&P 500's longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong and China. Europe's Dow Jones Stoxx 600 is posting its first back-to-back decline in nearly a month.

Read More »

Read More »

FX Daily, June 8: Monday Blues: Consolidation Threatened

Overview: The MSCI Asia Pacific Index rose for a sixth consecutive session. Japan, Taiwan, Singapore, and Indonesian markets advanced more than 1%. European bourses are mixed, with the peripheral shares doing better than the core, leaving the Dow Jones Stoxx 600 about 0.5% lower near midday after surging 2.5% ahead the weekend. US shares are firm, as is the 10-year yields, hovering near 92 bp.

Read More »

Read More »

FX Daily, May 18: Yuan Slumps as US-Chinese Tensions Rise

Overview: Despite somber warnings that the US economic recovery can stretch to the end of next year, investors have begun the new week by taking on new risks. Most equity markets in the Asia Pacific region rose, with Australia leading the large bourses with a 1% gain. India was an outlier, suffering a 2.4% loss, and Taiwan's semiconductor sector was hit, and the Taiex fell 0.6%.

Read More »

Read More »

FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five sessions. Germany reported a surprise 0.1% expansion in Q3, but it has done little for the DAX or the euro.

Read More »

Read More »

FX Daily, September 9: Market Sentiment Still Constructive

Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam's promise to formally withdraw the controversial extradition bill failed to deter protests.

Read More »

Read More »

Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

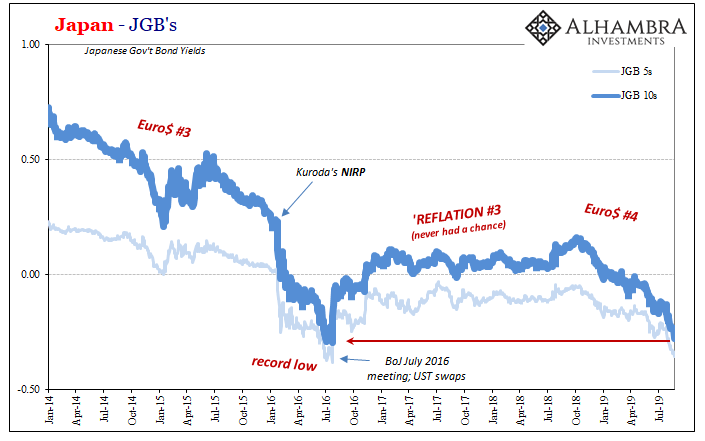

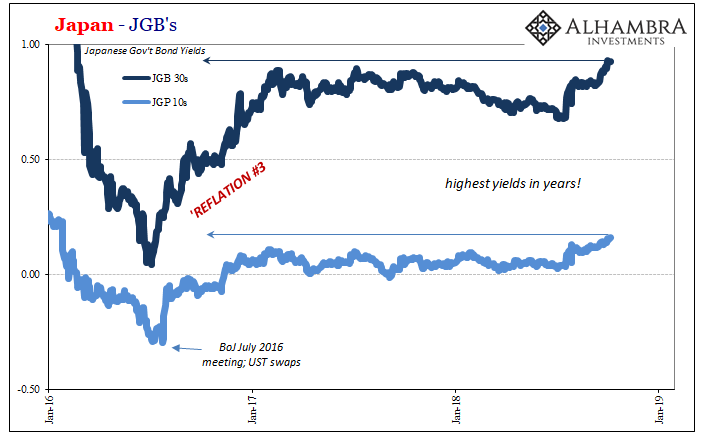

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned.

Read More »

Read More »

FX Daily, June 10: Collective Sigh of Relief Lifts Equities, Yields, and the Dollar

Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit.

Read More »

Read More »

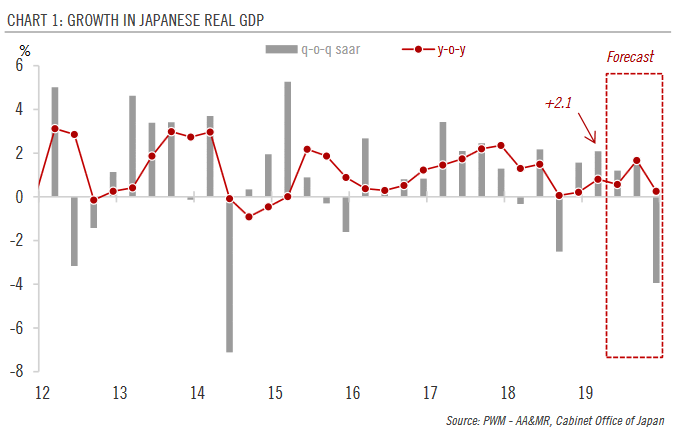

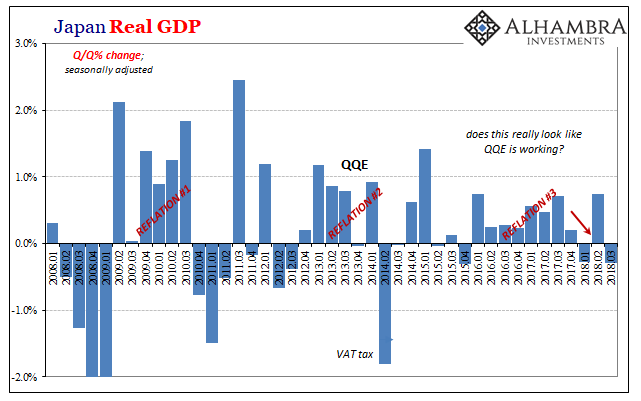

Weakening Japanese momentum behind strong GDP figures

Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures.The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%.However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum.Declining corporate capex and sluggish household consumption both drag on domestic...

Read More »

Read More »

Japan’s Surprise Positive Is A Huge Minus

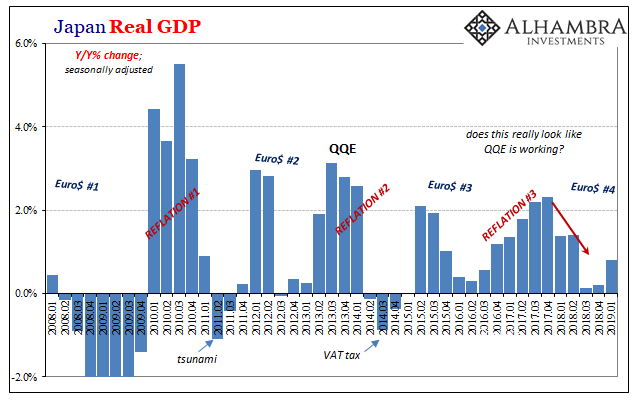

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five.

Read More »

Read More »

Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish.

Read More »

Read More »

Insight Japan

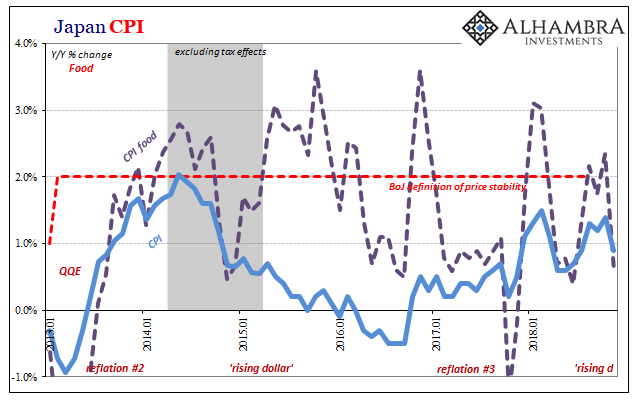

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

Read More »

Read More »

Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results.

Read More »

Read More »

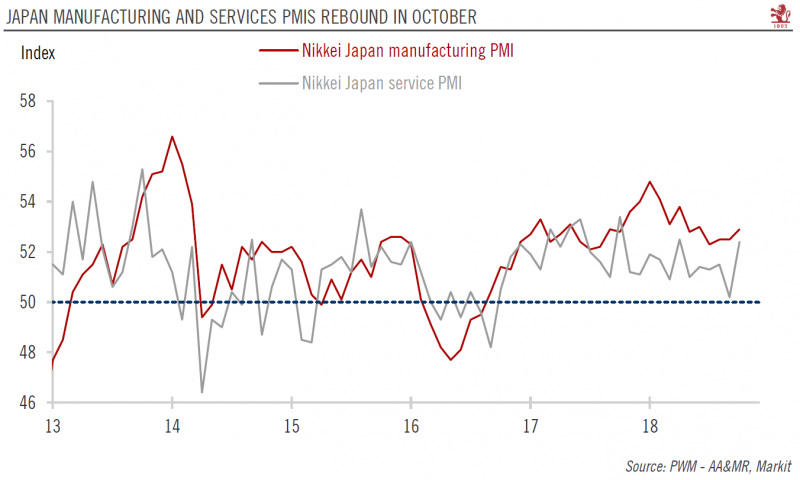

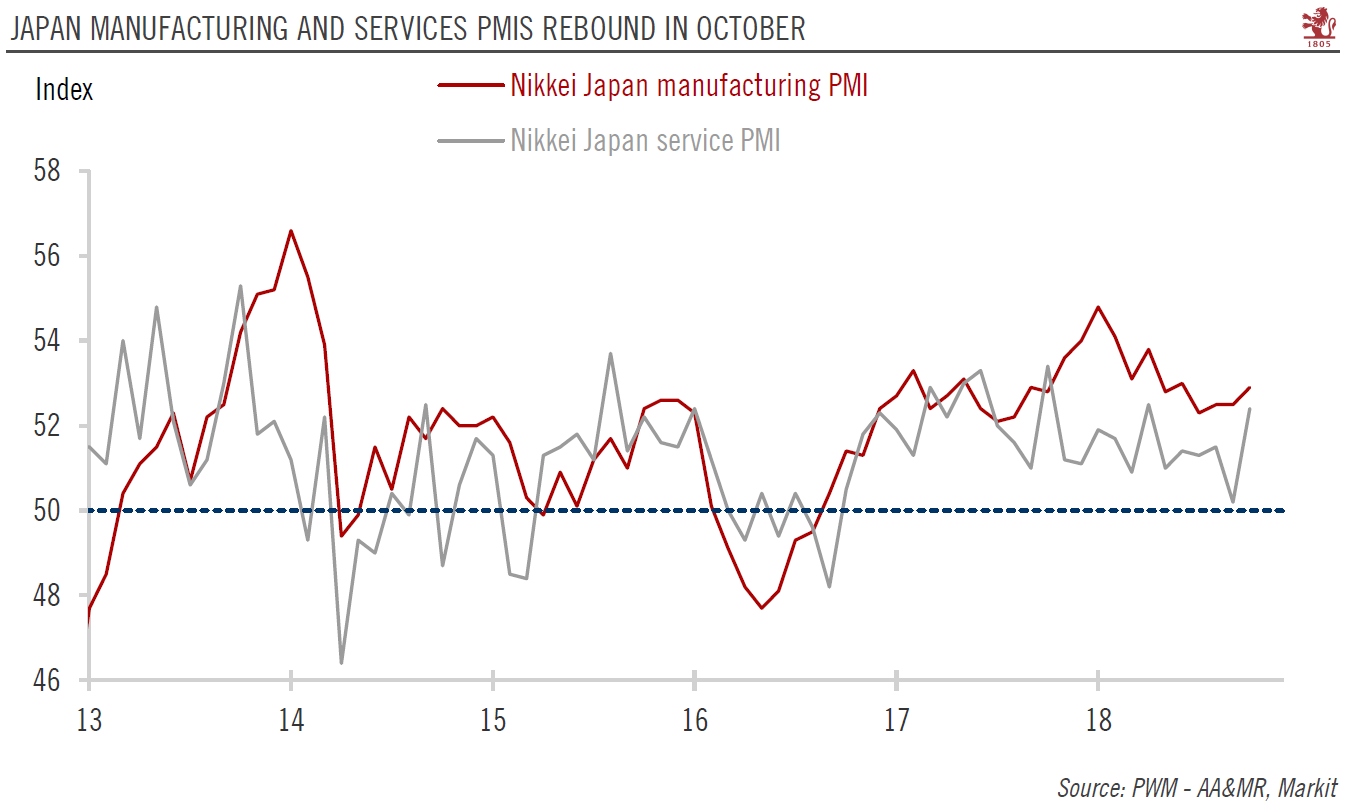

Japan services PMI rebounds strongly in October

The domestic economy is retaining its momentum, but external headwinds are building.The Japanese services purchasing managers index (PMI) rose sharply in October, surging by 2.2 points to 52.4, after a notable drop in September. The manufacturing PMI rose as well, but more moderately, reaching 52.9 in October from 52.4 in September.

Read More »

Read More »

And Now For Something Completely Different

Back in February, Japan’s Cabinet Office reported that Real GDP in Japan had grown in Q4 2017 for the eighth consecutive quarter. It was the longest streak of non-negative GDP since the 1980’s. Predictably, this was hailed as some significant achievement, a true masterstroke of courage and perseverance. It was taken as a sign that Abenomics and QQE was finally working (never mind the four years).

Read More »

Read More »

FX Daily, March 08: Euro Slips Ahead of the ECB Meeting

Expectations that the European Central Bank would change its forward guidance in a substantive way had been one of the factors behind the euro's appreciation. However, more recently, the anticipation has slackened. The last meeting took place around the same time that many perceived US Treasury Secretary Mnuchin as having abandoned the strong dollar policy.

Read More »

Read More »

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week's EU summit. To be sure, "sufficient progress," which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals.

Read More »

Read More »

Japan: It isn’t What the Media Tell You

For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. For almost three decades, Japan’s GDP growth has mostly been less than 2%, has been negative for several of these years, and has often hovered close to zero. The net result is that its GDP is almost at the same level as 25 years ago.

Read More »

Read More »

FX Daily, November 15: Dollar Slides

The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month's highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver.

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »