Tag Archive: newslettersent

Bi-Weekly Economic Review: A Whirlwind of Data

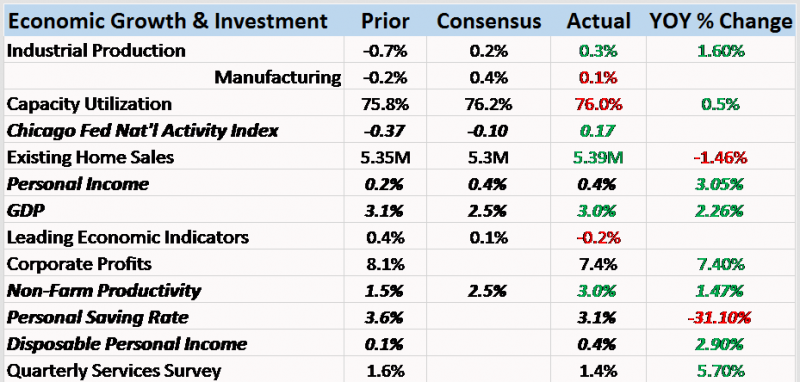

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle.

Read More »

Read More »

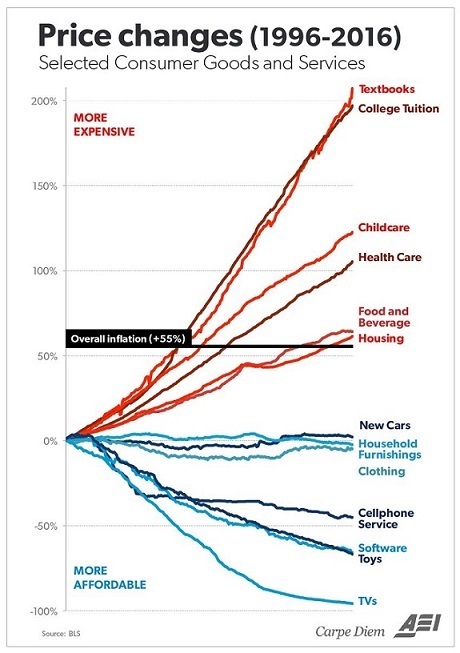

Want Widespread Prosperity? Radically Lower Costs

As long as this is business as usual, it's impossible to slash costs and boost widespread prosperity. It's easy to go down the wormhole of complexity when it comes to figuring out why our economy is stagnating for the bottom 80% of households. But it's actually not that complicated: the primary driver of stagnation, decline of small business start-ups, etc. is costs are skyrocketing to the point of unaffordability.

Read More »

Read More »

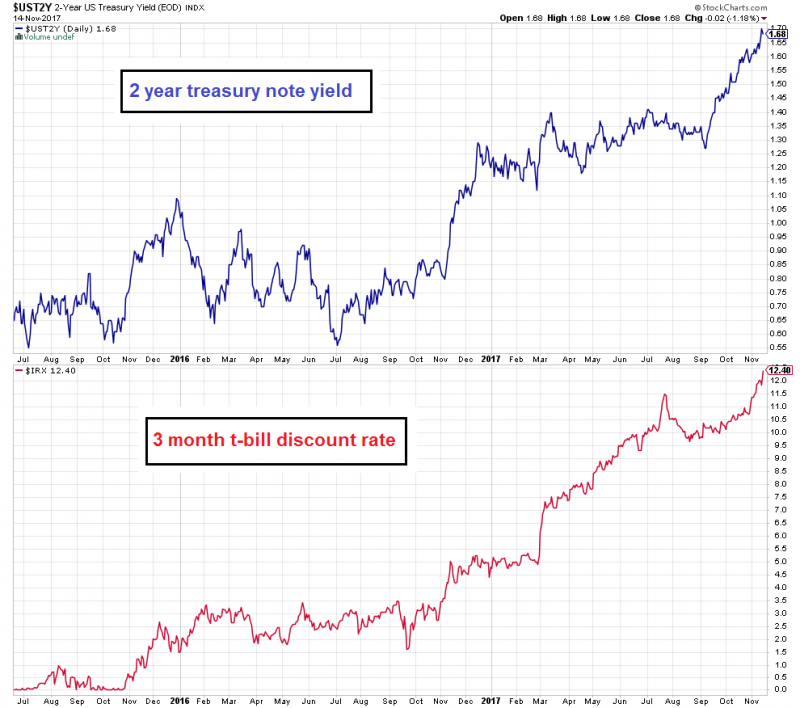

Business Cycles and Inflation, Part II

We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18 – 24 months were quite large, even if their absolute levels remain historically low.

Read More »

Read More »

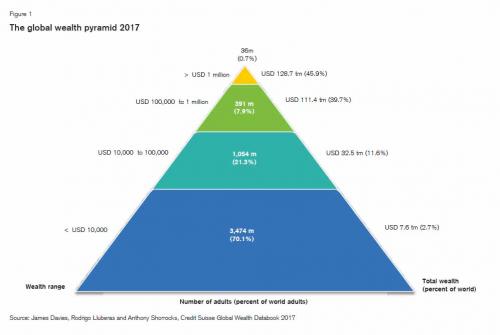

For The First Time Ever, The “1 percent” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank's infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past year, suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

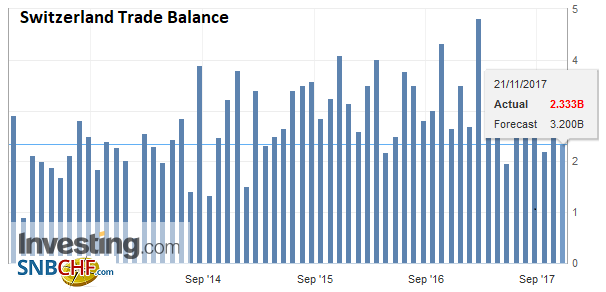

Swiss Trade Balance October 2017: A Slowdown at a High Level

In October 2017, Swiss foreign trade continued its advance. Adjusted for working days, exports grew by 5% against 7% for imports. Growth, however, weakened slightly compared to previous months. The trade balance is closing with a surplus of 2.4 billion francs.

Read More »

Read More »

FX Daily, November 21: Dollar Marks Time

The US dollar has largely been confined to yesterday's trading ranges against the major currencies amid light news. The North American session does not hold much hope for fresh impetus. The US reports October existing home sales, which are not typically market moving in the best of times. Yellen does not speak until after the markets close, and even then is unlikely to sway expectations, which have priced in a rate hike next month.

Read More »

Read More »

Oil Trader Slams “defamatory” NGO Teport

Commodities trading company Vitol has taken legal action against “inaccurate and defamatory” allegations made by the Swiss NGO Public Eye in the wake of the Paradise Papers revelations. Public Eye issued a press release and report on November 10 accusing four Swiss-based commodities traders, including Vitol, of doing business “with dodgy individuals or politically exposed partners” and colluding with the Appleby law firm to conceal “business...

Read More »

Read More »

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »

FX Daily, November 20: German Political Impasse Roils Euro…Briefly

News that the attempt to forge a four-party coalition in Germany collapsed Sunday saw the euro marked down in early Asian activity. The euro fell to nearly $1.1720 in the immediate response to the news, stabilized before turning higher in early European turnover. It quickly recovered and poked through $1.1800. The pre-weekend high was seen near $1.1820.

Read More »

Read More »

FX Weekly Preview: Another Week that is Not about the Data

The contours of the investment climate are unlikely to change based on next week's economic data from the US, Japan, or Europe. The state of the major economies continues to be well understood by investors. Growth in the US, EU, and Japan remains solid, and if anything above trend, as the year winds down.

Read More »

Read More »

Stories making the Swiss Sunday papers

Good news from the Swiss watchmaking industry, plans to ban under-18s from solariums because of health risks and a warning that the Swiss railway system could face chaos in December. The Swiss watchmaking industry has made a turnaround following a three-year dip. Nick Hayek, CEO of the Swatch Group, told the NZZ am Sonntag newspaper that his company recorded a massive increase in turnover over the past two months, resulting even in production...

Read More »

Read More »

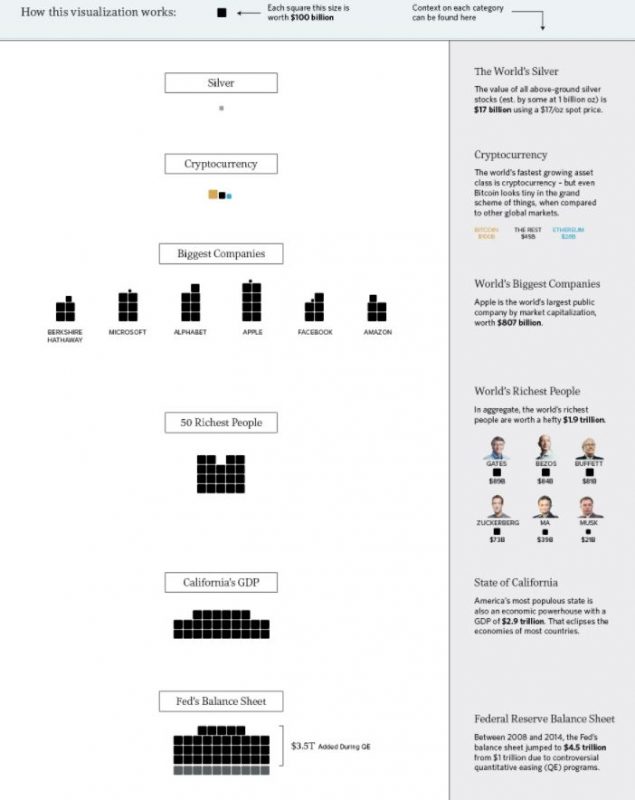

Money and Markets Infographic Shows Silver Most Undervalued Asset

Money and Markets Infographic Shows Silver Most Undervalued Asset. Silver remains severely under owned and under valued asset. Entire silver market worth tiny $100 billion shown in one tiny square. “All of the World’s Money and Markets in One Visualization”. Must see ‘Money and Markets’ infographic shows relative size of key markets: silver bullion, gold bullion, cryptocurrencies/ bitcoin, largest companies, 50 richest people, Fed balance sheet,...

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the week firm, and capped off a good week overall. Best performers last week for ZAR and KRW, while the worst were TRY and IDR. Until we get higher US rates, the dollar may remain under modest pressure. This would help EM maintain some traction, though we remain cautious.

Read More »

Read More »

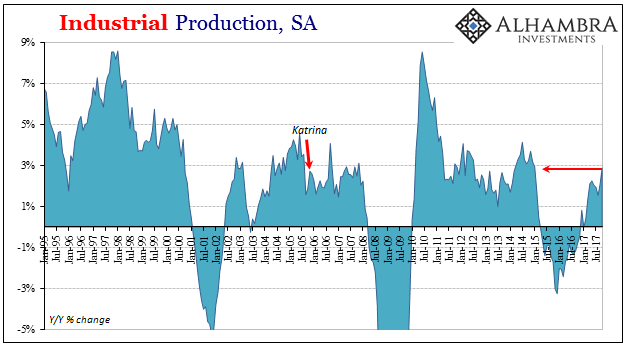

Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will experience. Production overall was still contracting all the way to November 2016, providing the index favorable base comparisons that won’t last past...

Read More »

Read More »

Great Graphic: Euro Approaching Key Test

Euro is testing trendline and retracement objective and 100-day moving average. Technical indicators on daily bar charts warn of upside risk. Two-year rate differentials make it expensive to be long euros vs. US. Beware of small samples that may exaggerate seasonality.

Read More »

Read More »

Swiss still richest, according to Credit Suisse

The Credit Suisse 2017 Global Wealth Report, shows total global wealth rose 6.4% to USD 280 trillion in 2016, taking it to the its highest level since 2007, before the financial meltdown in 2008. Globally, average wealth per adult was USD 56,540. In Switzerland, the same figure was USD 537,600 (CHF 533,000), close to ten times the global average, placing Switzerland in the lead, if Iceland – with unreliable data – is ignored.

Read More »

Read More »

Swiss Government stays mum on EU Negotiations Strategy

The seven-member Federal Council has refused to reveal its position on future negotiations with the European Union over CHF1 billion (little over $1 billion) in voluntary ‘cohesion’ payments destined for central and eastern European countries.

Read More »

Read More »

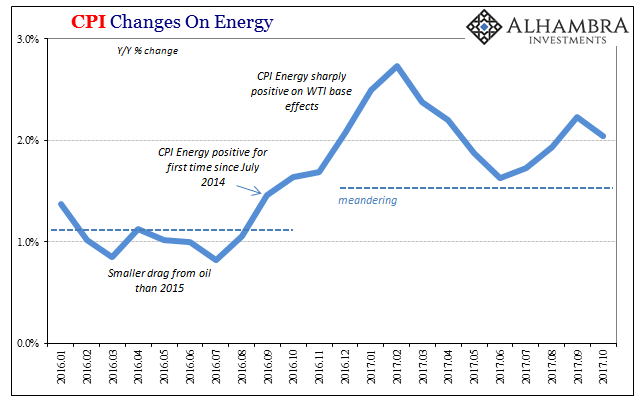

Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found.

Read More »

Read More »

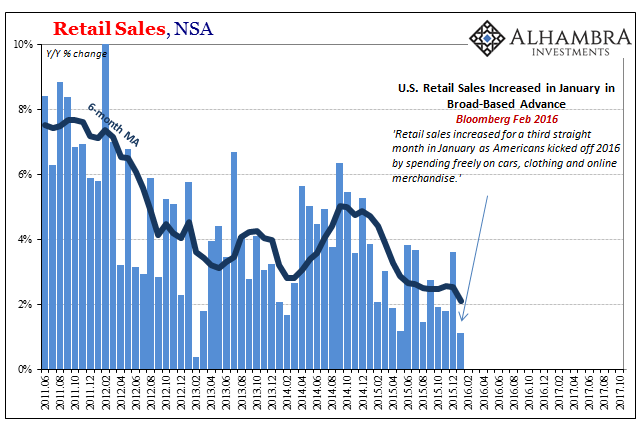

Retail Sales (US) Are Exhibit #1

In January 2016, everything came to a head. The oil price crash (2nd time), currency chaos, global turmoil, and even a second stock market liquidation were all being absorbed by the global economy. The disruptions were far worse overseas, thus the global part of global turmoil, but the US economy, too, was showing clear signs of distress.

Read More »

Read More »