Tag Archive: newslettersent

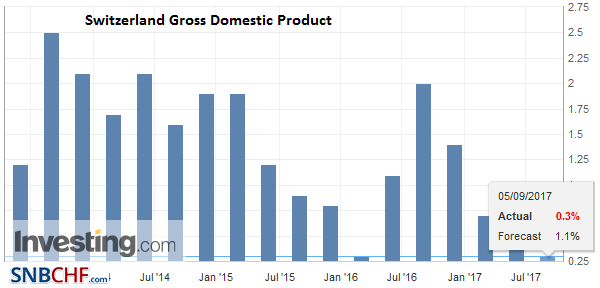

Switzerland GDP Q2 2017: +0.3 percent QoQ, +0.3 percent YoY

Switzerland's real gross domestic product (GDP) grew by 0.3 % in the 2nd quarter of 2017. Manufacturing, the financial sector and the hotel and catering in-dustry significantly boosted growth, while developments in trade, public administration and the healthcare sector were sluggish. On the expenditure side, growth was driven by domestic demand, with positive momentum coming from both consumption and investment.

Read More »

Read More »

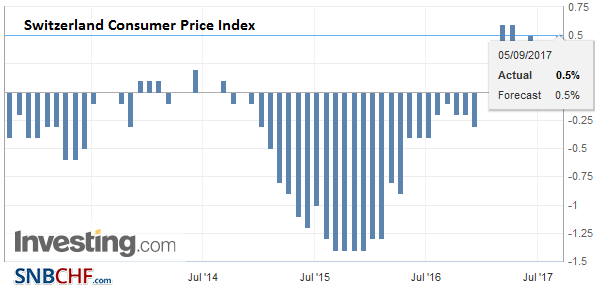

Swiss Consumer Price Index in August 2017: Up +0.5 percent against 2016, remained unchanged since last month

The consumer price index (CPI) remained unchanged in August 2017 compared with the previous month, reaching 100.6 points (December 2015=100). Inflation was 0.5% compared with the same month of the previous year.

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

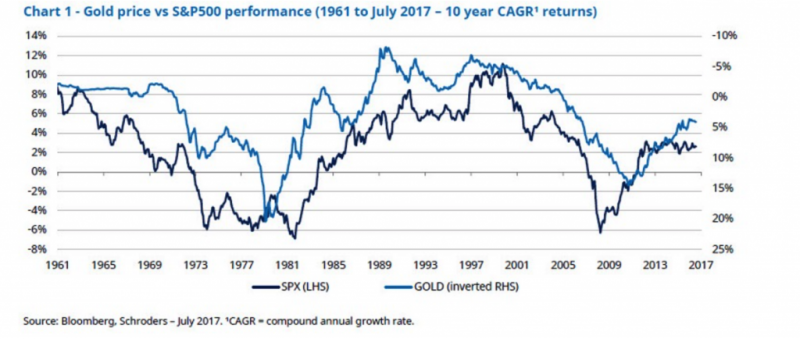

4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

4 reasons why “gold has entered a new bull market” – Schroders. Market complacency is key to gold bull market say Schroders. Investors are currently pricing in the most benign risk environment in history as seen in the VIX. History shows gold has the potential to perform very well in periods of stock market weakness (see chart). You should buy insurance when insurers don’t believe that the “risk event” will happen. Very high Chinese gold demand,...

Read More »

Read More »

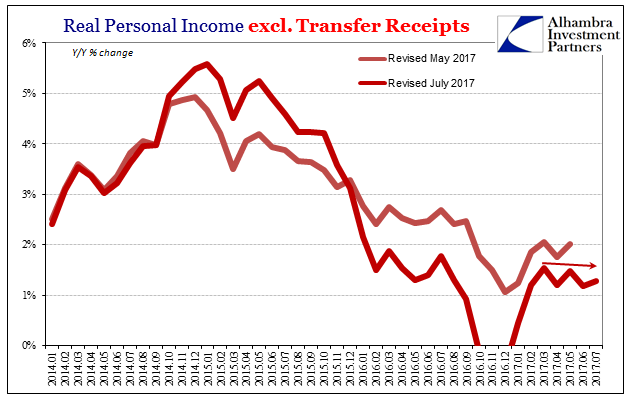

Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income.

Read More »

Read More »

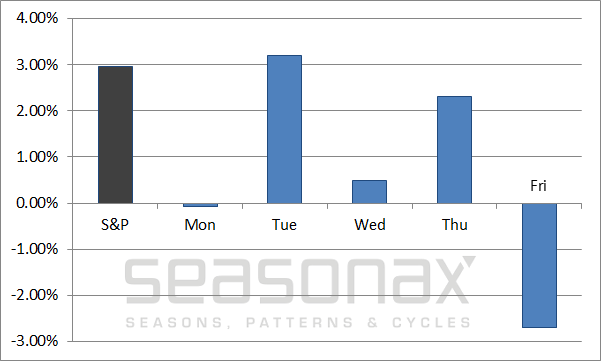

S&P 500 Index: A Single Day Beats the Entire Week!

Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods.

Read More »

Read More »

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »

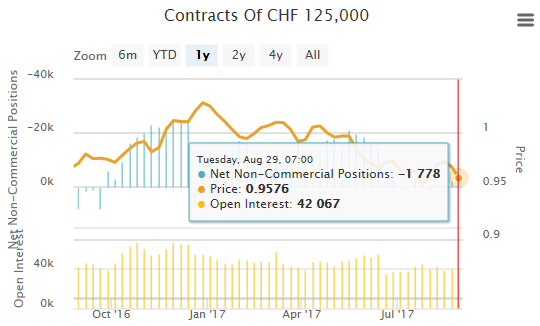

Weekly Speculative Positions (as of August 29): Speculators Make Minor Position Adjustments, but Like that Aussie

The net speculative CHF position has fallen from 2K short to 1.8K contracts short (against USD). Speculators did not make any significant adjustment to gross positions, which we define as 10k or more contracts in the currency futures, during the CFTC reporting week ending August 29.

Read More »

Read More »

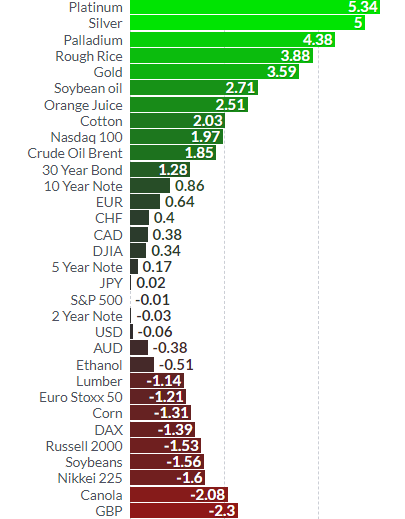

Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August. Gold posts best month since January, up nearly 4%. Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand. S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month. Platinum is best performing metal climbing over 5%. Palladium climbs over 4% thanks to seven year supply squeeze.

Read More »

Read More »

Swiss employee associations not opposed to a 60 hour week

Swiss employee associations are not opposed to a 60 hour week. Several parliamentary initiatives aim to loosen Swiss labour rules. The first aims to allow staff and employers more flexibility regarding hours worked and time off. The second aims to loosen rules on recording hours of work by managers and specialists. Another initiative aims to extend this to include employees with shareholdings in start-ups.

Read More »

Read More »

Finding a place to rent getting easier in Switzerland

A recent Credit Suisse report, entitled: Tenants Wanted, says capital continues to flow into Swiss real estate, boosting the supply of rental properties. Against a backdrop of negative interest rates at Switzerland’s central bank, investors continue to plough money into constructing new residential properties. At the same time, declining immigration has hit the demand for rental apartments.

Read More »

Read More »

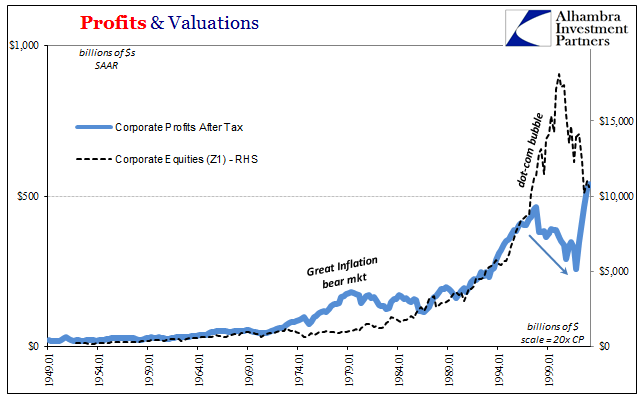

The Two Parts of Bubbles

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really going on.

Read More »

Read More »

FX Weekly Review, August 28 – September 02: The end of big euro rise?

For us, the sudden euro rise from 1.08 to 1.14 is an illusion, the euro will fall sooner or later again. Macron will not help the French economy and low core inflation will prevent that the ECB ends her bond buying program.

Read More »

Read More »

Prévoyance 2020: comment la Confédération a prévu la baisse illimitée de vos rentes LPP

La baisse du taux de conversion à 6% ne serait-elle qu’un début? Avec Prévoyance 2020, vos rentes LPP pourraient bien subir un jour ou l’autre quelques réajustements supplémentaires. Il suffirait d’une nouvelle crise financière…Alors que des milliers de foyers helvétiques comptent sur les revenus de leurs capitaux LPP pour maintenir leur niveau de vie à la retraite, de telles espérances pourraient très bientôt devenir parfaitement...

Read More »

Read More »

Nestlé Skin Health to shed almost 200 jobs

Nestlé Skin Health will cease operations at its Egerkingen factory in canton Solothurn and move manufacturing activities abroad, threatening 190 positions. “Production volumes in Egerkingen are and have been very low, resulting in underutilisation of assets and hence additional pressure on manufacturing cost,” the company, which creates skin, hair and nail products, said in a statement on Thursday.

Read More »

Read More »

Cool Video: CNBC Clip Tactical and Strategic Dollar Outlook

I appeared on CNBC earlier today to talk about the dollar. I was given the time to briefly sketch out my view of the dollar. Near-term, I am concerned about the political and economic events in September, but I am looking for a better Q4 for the greenback.

Read More »

Read More »

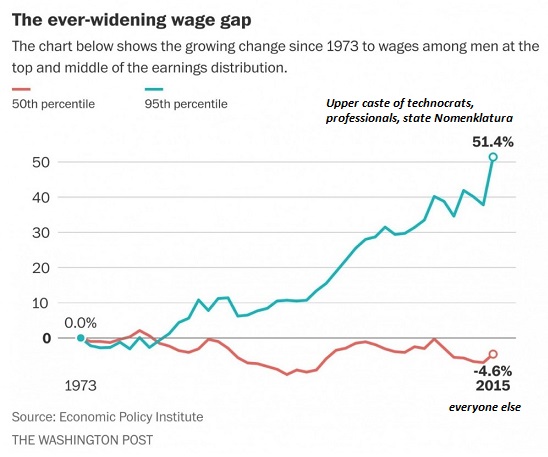

Why Wages Have Lost Ground in the 21st Century

One of the enduring mysteries for conventional economists is why wages aren't rising for the bottom 95% even as unemployment is low and hiring remains robust. According to classical economics, the limited supply of available workers combined with strong demand for workers should push wages higher.

Read More »

Read More »

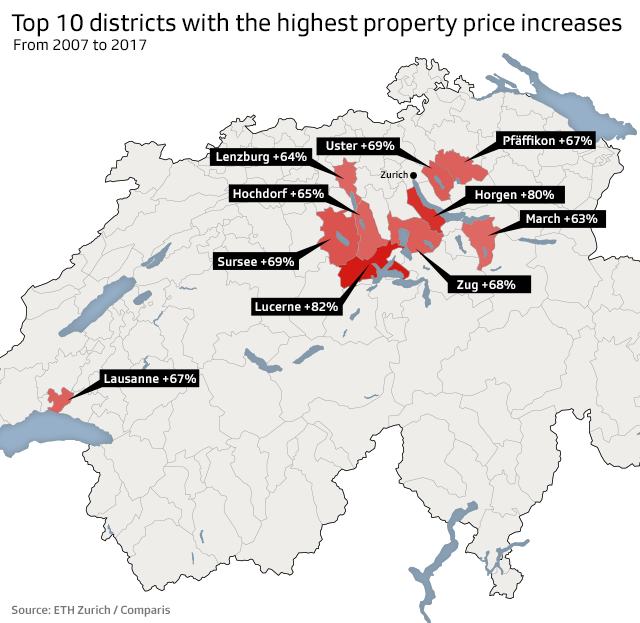

Highest Swiss Property Prices Recorded in Zurich

Zurich remains the dearest location for Swiss property at CHF12,250 ($13,000) per square metre. However, houses in Lucerne have gained the most in value over the past decade, with one square metre costing CHF8,500, up 82% on 2007.

Read More »

Read More »