Tag Archive: newslettersent

FX Daily, November 29: Sterling Charges Ahead on Brexit Hopes

Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today's gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the...

Read More »

Read More »

WEF founder flags need for solidarity

In an interview with newspaper NZZamSonntag, Klaus Schwab, founder of the World Economic Forum, says that WEF is more relevant than ever. “We’re the witnesses to a transformation from a unipolar to a multipolar world. In this situation, the attempt to build bridges and work together is more important than ever,” the 80-year-old German engineer and economist told the newspaper.

Read More »

Read More »

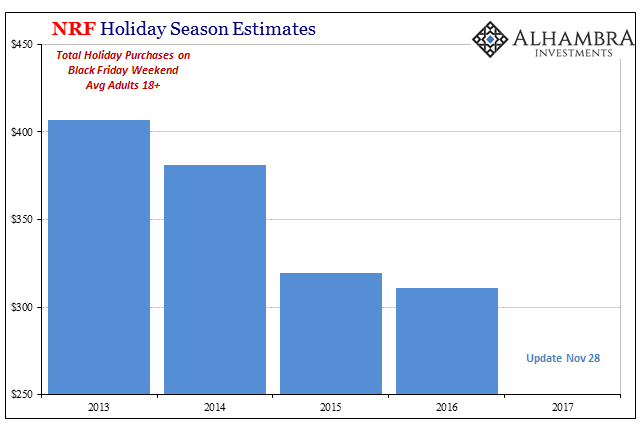

Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was.

Read More »

Read More »

Un algorithme du Credit Suisse avait pour but de gagner de l’argent au détriment de ses clients

Le grand déballage des « arrières cuisines » des marchés des changes et de leurs dérives se poursuit sur tous les continents . Les petits arrangements entre traders sur un des marchés les moins régulés, ne sont plus tolérés. Dernier exemple en date aux Etats-Unis, la banque Credit Suisse a reçu une amende de 135 millions de dollars pour la violation de certaines règles (partage d’informations des clients, manipulations de...

Read More »

Read More »

FX Daily, November 28: Greenback Ticks Up in Cautious Activity

The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed's Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year's BOE stress test saw all seven banks pass.

Read More »

Read More »

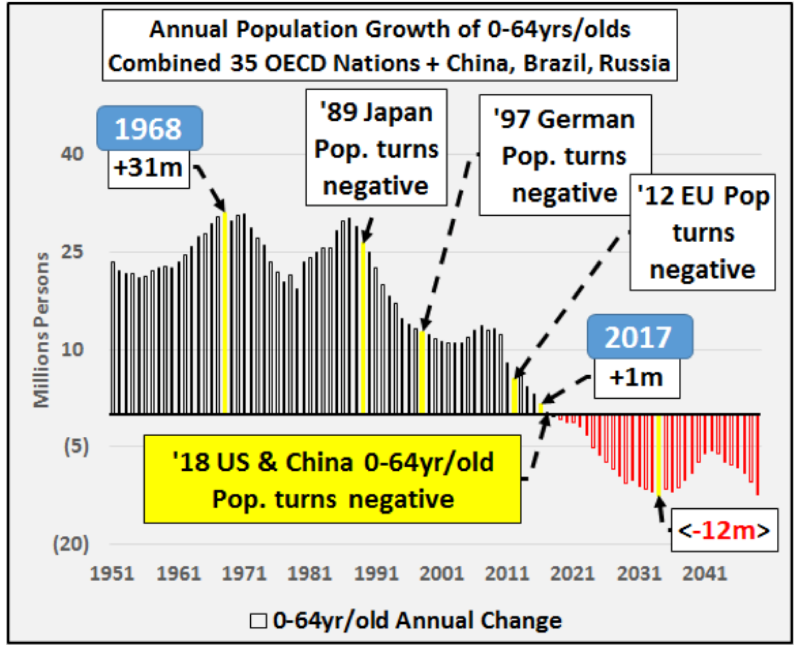

Demographic Dysphoria: Swiss Village Offers Families Over $70,000 To Live There

Across the world, demographic dysphoria is taking shape, creating numerous headaches for governments. To avoid the next economic downturn, governments are searching for creative measures to increase population growth and deliver a sustainable economy. In Europe, a near decade of excessive monetary policy coupled with a massive influx of refugees have not been able to reverse negative population growth– first spotted in 2012.

Read More »

Read More »

Bitcoin Facts

When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to address some of the objections to Bitcoin’s fitness as...

Read More »

Read More »

FX Daily, November 27: Slow Start to Busy Week

The US dollar is narrowly mixed and is largely consolidating last week's losses as the market waits for this week's numerous events that may impact the investment climate. These include the likelihood of the US Senate vote on tax reform, preliminary eurozone November CPI, a vote of confidence (or lack thereof) in the deputy PM in Ireland, Powell's confirmation hearing as Yellen's successor, the BOE financial stability report, and stress test, and...

Read More »

Read More »

FX Weekly Preview: Events + Market = Potential for Combustible Price action

There are a number of events and economic reports in the week ahead that will help shape the investment climate in the weeks and months ahead. In recognition of the importance of initial conditions, let's briefly summarize the performance of the dollar and main asset markets.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the holiday-shortened week on a soft note. While most were up on the entire week, notable laggards were TRY, CLP, and ZAR. All three currencies underperformed due to rising political risks, and we suspect that will continue. We believe MXN and BRL are likely to rejoin the laggards in the coming days.

Read More »

Read More »

Switzerland’s 1.3 billion franc payment to EU proves divisive

Switzerland’s deal with the EU involves a financial contribution. The sum announced by the Federal Council is CHF 1.3 billion over the next 10 years.The arrangement, announced on Thursday to coincide with a visit by european commission president Jean-Claude Juncker, extends a previous 10 year deal.

Read More »

Read More »

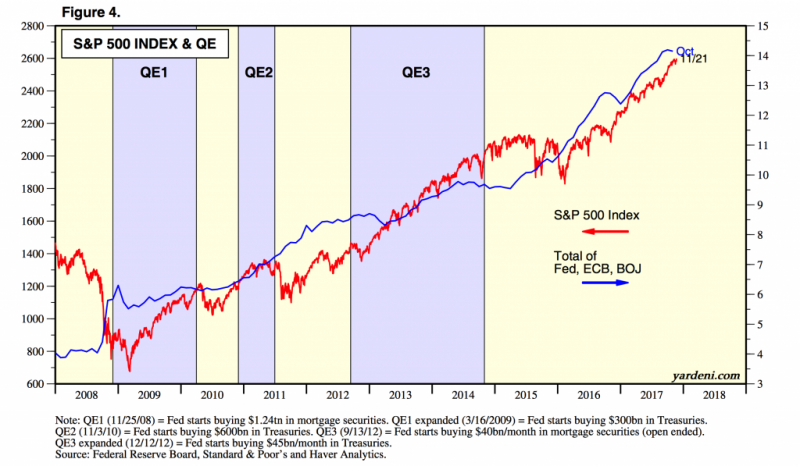

Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making. Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’. Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’. Members seem oblivious to impact of inflation on households and savings. Physical gold and silver remain the only assets for real diversification and...

Read More »

Read More »

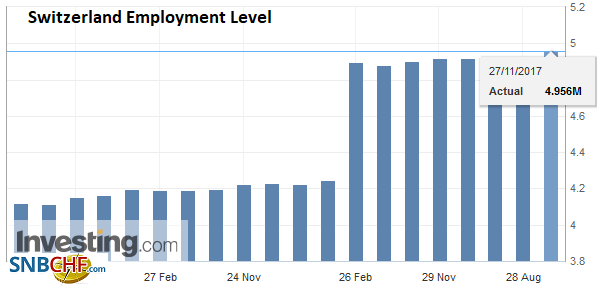

Stress rises among Swiss workers

A recent report by Travail.Suisse shows around 40% of Swiss workers report feeling often or very often stressed by their work.Stress and emotional exhaustion is a daily reality for many says Travail.Suisse. Between 2015 and 2017, the percentage suffering work related stress or emotional exhaustion has risen from 38% to 48%.

Read More »

Read More »

Richest get richer – Switzerland’s top 300

The wealthiest people in one of the world’s wealthiest nations - Switzerland, have increased their assets by CHF60 billion over the past year. According to the latest edition of the German-language business magazine, Bilanz, the 300 richest residents of the country have assets totalling CHF674 billion.

Read More »

Read More »

Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

Geopolitical risk highest “in four decades” should push gold higher – Citi. Elections, political and macroeconomic crises and war lead to gold investment. Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank. “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank. Reduce counter party risk: own safe haven allocated and...

Read More »

Read More »

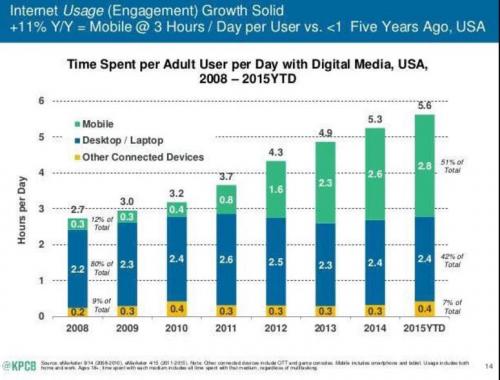

Addictions: Social Media & Mobile Phones Fall From Grace

Identifying social media and mobile phones as addictive is only the first step in a much more complex investigation. For everyone who remembers the Early Days of social media and mobile phones, it's been quite a ride from My Space and awkward texting on tiny screens to the current alarm over the addictive nature of social media and mobile telephony.

Read More »

Read More »

Lessons from Squanto

Governments across the planet will go to any length to meddle in the lives and private affairs of their citizens. This is what our experiences and observations have shown. What gives? For one, politicians have an aversion to freedom and liberty. They want to control your behavior, choices, and decisions. What’s more, they want to use your money to do so.

Read More »

Read More »