Tag Archive: newslettersent

Cool Video: Short Take on Bitcoins

I stopped by Bloomberg near midday to talk with Vonnie Quinn and Shery Ahn. We talked about many macro issues, but this clip that Bloomberg provided covers is the one topic that has overshadowed the big rally in US equities, tax reform and Matt Lauer: Bitcoins. In this two minute clip, I mention that despite Bitcoins capturing the headlines, most Americans are not and cannot be involved.

Read More »

Read More »

Bitcoin $10,000 – Huge Volatility of Cryptocurrencies and Risky Fiat Making Gold Attractive

Bitcoin tops $10,000, soaring more than 850% since beginning of 2017. Irrational exuberance arguably main driver of price performance. Google Trends shows search for ‘Bitcoin Bubble’ hit highest level this morning. Buyers need to be aware of hacking and security risks. Other primary risks to widespread adoption is volatility and liquidity risk. World’s largest online trading platform IG Markets suspends BTC trading

– Volatility of...

Read More »

Read More »

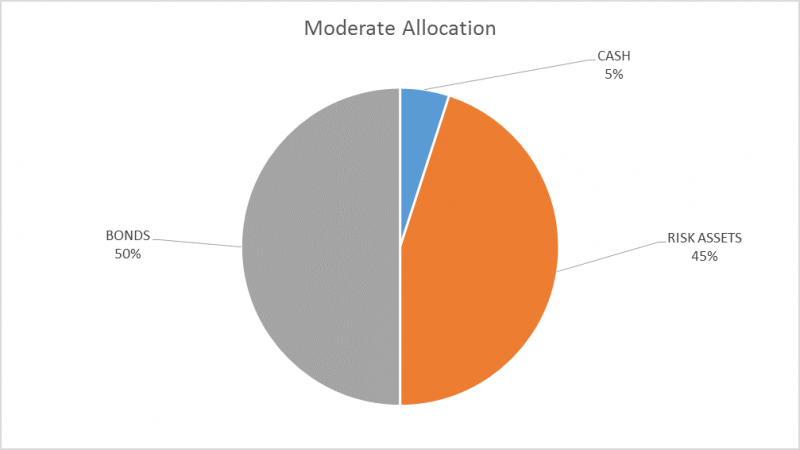

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

Darwin Airline planes grounded

Switzerland’s Darwin Airline, the Lugano-based regional carrier, was forced to halt all its flights on Tuesday after its licence was revoked by the Federal Office of Civil Aviation (FOCA) over financial problems.

Read More »

Read More »

Emerging Markets: What Changed

Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook.

Read More »

Read More »

FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher.

Read More »

Read More »

Great Graphic: US 2-year Yield Rises Above Australia for First Time since 2000

The US and Australian two-year interest rates have diverged. There is scope for a further widening of the spread. Directionally the correlation between the exchange rate and the rate differentials is strong, but not stable. Near-term technicals are supportive but the move above trendline resistance is needed to confirm.

Read More »

Read More »

Amazon coming to Switzerland

According to the newspaper Bilanz, Amazon has signed an agreement with Swiss post to provide rapid customs clearance. The head of postal customs, Felix Stierli, confirmed discussions with the company.A maximum customs clearance time of 3 hours will allow 24-hour delivery, one element of Amazon’s Prime offer.

Read More »

Read More »

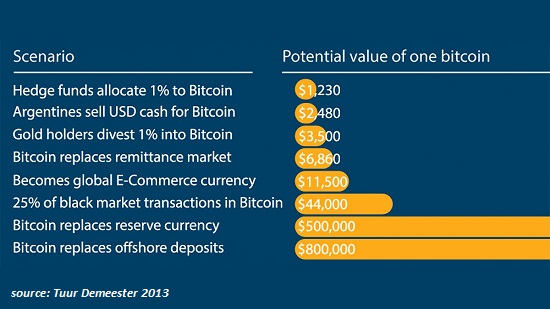

My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy

The basis of this admittedly crazy forecast was simple: capital flows. I think we can all agree that bitcoin (BTC) is "interesting." One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward. Unknowns and big swings up and down are characteristics of open markets.It's impossible to forecast bitcoin's future price because virtually all the future inputs are unknown.

Read More »

Read More »

The Asymmetry of Bubbles: the Status Quo and Bitcoin

Regardless of one's own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the electrical consumption of bitcoin is "shocking," "ridiculous," etc.

Read More »

Read More »

Japan: It isn’t What the Media Tell You

For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. For almost three decades, Japan’s GDP growth has mostly been less than 2%, has been negative for several of these years, and has often hovered close to zero. The net result is that its GDP is almost at the same level as 25 years ago.

Read More »

Read More »

Hochriskante SNB-Verschuldung: von Herrn Jordan selbst bestätigt!

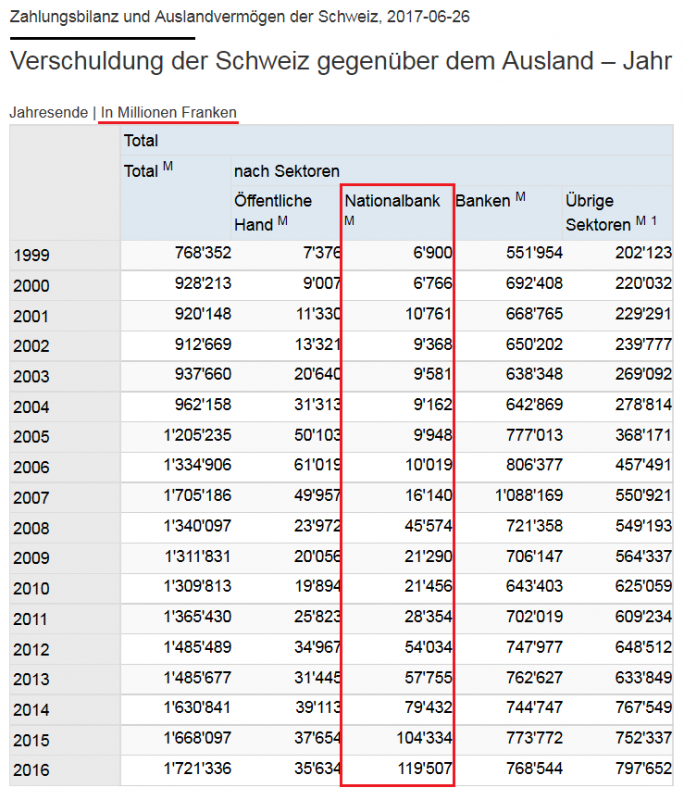

Wer ist sich in unserem Land bewusst, dass Ende 2016, die Gesamtverschuldung der Schweiz gegenüber dem Ausland den imposanten Betrag von 1‘721 Milliarden (!) Franken erreichte? Diese, auf dem Datenportal der SNB für alle zugängliche Info, darf mit einer weiteren bemerkenswerten Beobachtung vervollständigt werden.

Read More »

Read More »

Swiss Retail Sales, October: -2.7 Percent Nominal and -1.6 Percent Real

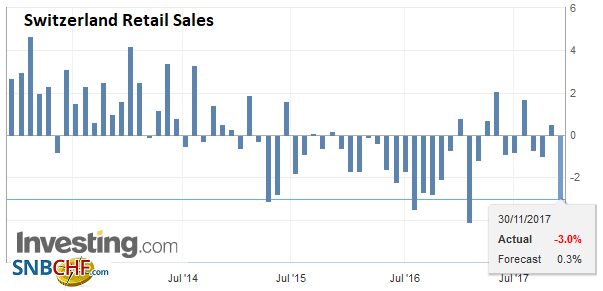

Turnover in the retail sector fell by 2.7% in nominal terms in October 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Switzerland GDP Q3 2017: +1.2 percent QoQ, +1.2 percent YoY

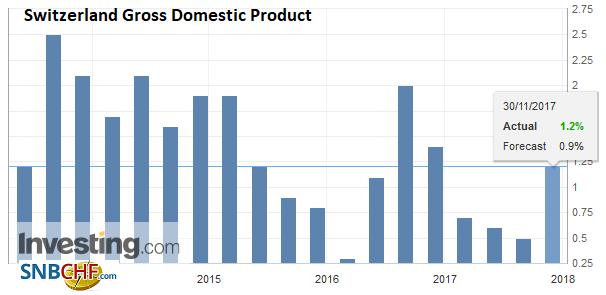

Switzerland’s real gross domestic product (GDP) grew by 0.6 % in the 3rd quarter of 2017,* boosted by manufacturing in particular. Many service sectors also contributed to growth, including trade, business services and healthcare. By contrast, value added fell slightly in construction and the financial sector.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

Health insurance premium index 2017: Premium increases from 2016 to 2017 curb growth in disposable income by 0.3 percentage points

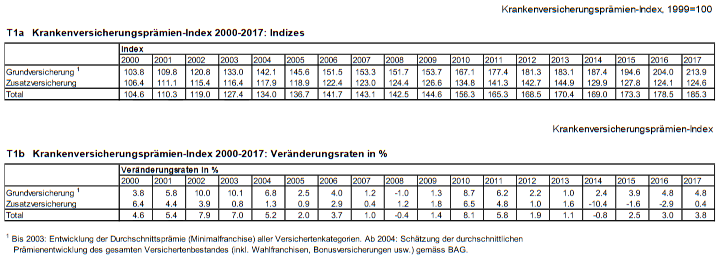

The health insurance premiums index (CIPI) recorded a growth of 3.8 percent over the previous year for the 2017 premium year. The KVPI thus achieved an index level of 185.3 points (base 1999 = 100). The impact of premium development on the growth of disposable income can be estimated using the CIPI. According to the KVPI model calculation by the Federal Statistical Office (FSO), the increase in premiums reduces the growth in average disposable...

Read More »

Read More »

Swiss Financial Accounts, 2016 edition

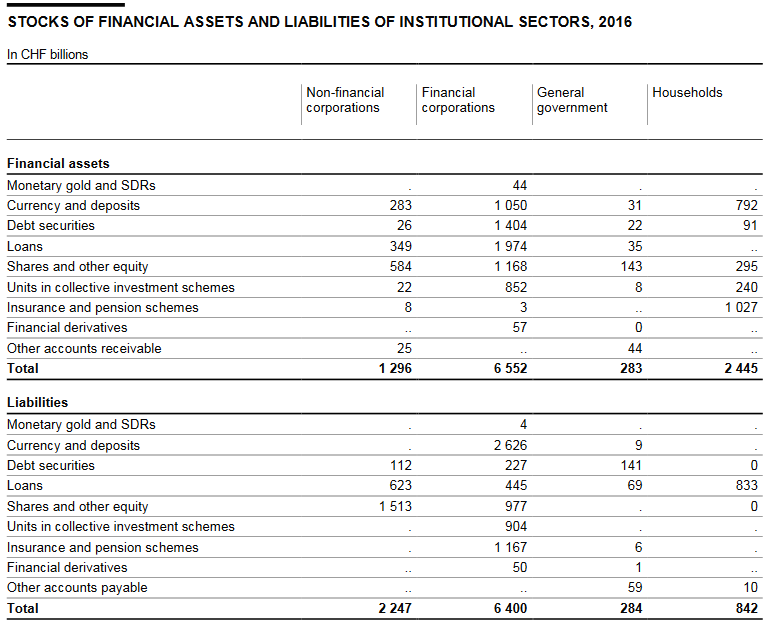

Financial assets and liabilities of the institutional sectors The financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors, which are non-financial and financial corporations, general government and households. The major developments in the financial accounts are outlined below.

Read More »

Read More »

Bitcoin – Die Tulpenknolle des Computerzeitalters

Von 10 auf 100 auf 1’000 auf 10’000 Dollar. Das ist die Kursentwicklung von Bitcoins in den wenigen Jahren seit ihrem Bestehen bis gestern früh. Der Vergleich mit der Tulpenmanie in der Hochblüte Hollands ist nicht mehr fern. Der Preis einer kostbaren Tulpenzwiebel stieg im 17. Jahrhundert in Holland auf das über 60-fache eines durchschnittlichen damaligen Jahressalärs.

Read More »

Read More »

Switzerland UBS Consumption Indicator October: UBS consumption indicator trends sideways

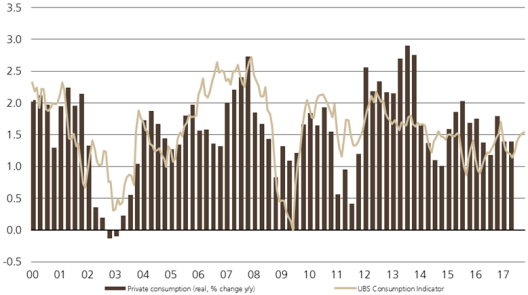

The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it.

Read More »

Read More »