Tag Archive: newslettersent

Emerging Markets: What has Changed

Moody's raised India's sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever. The head of South Africa’s budget office resigned.

Read More »

Read More »

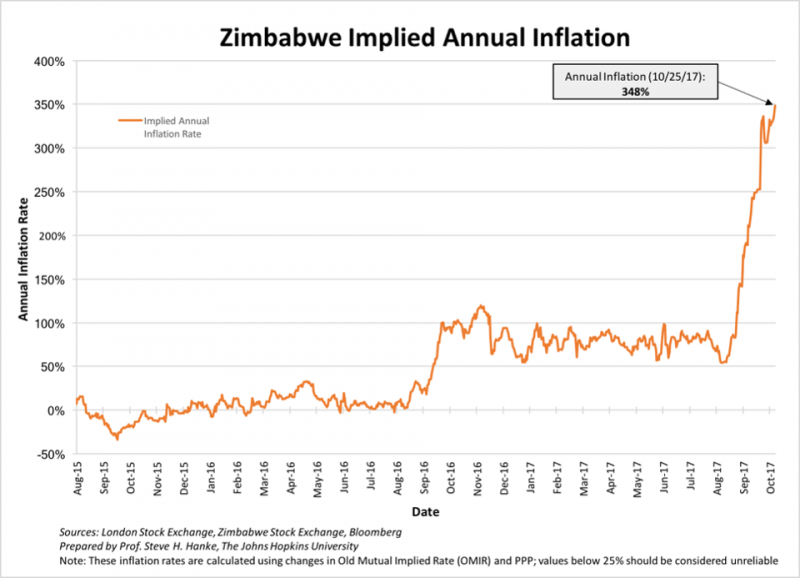

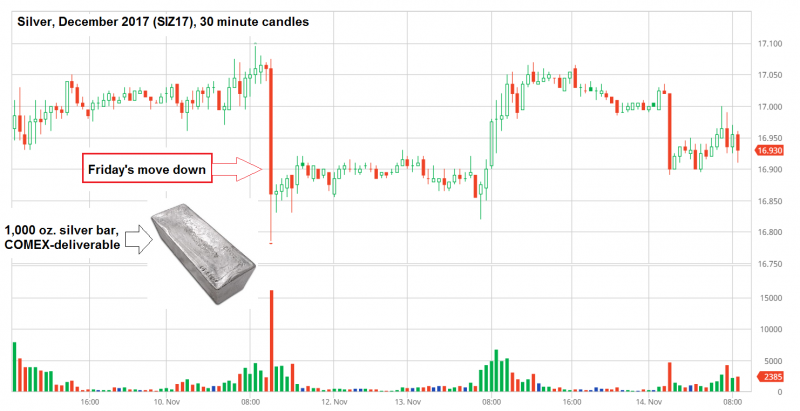

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

Swiss HSBC settles French tax fraud dispute

With a payment of €300 million (CHF350 million), the Swiss subsidiary of British bank HSBC has settled its tax fraud dispute with the French authorities. Investigations by the French government revealed that many French taxpayers had hidden their assets with help from HSBC’s private bank.

Read More »

Read More »

What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery.

Read More »

Read More »

Business Cycles and Inflation – Part I

Incrementum Advisory Board Meeting Q4 2017 – Special Guest Ben Hunt, Author and Editor of Epsilon Theory. The quarterly meeting of the Incrementum Fund’s Advisory Board took place on October 10 and we had the great pleasure to be joined by special guest Ben Hunt this time, who is probably known to many of our readers as the main author and editor of Epsilon Theory.

Read More »

Read More »

FX Daily, November 17: Euro, Yen and Sterling Regain Footing

The US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the week. The US 2-10 yr yield curve is flattening further today with the two-year pushing above 1.70% for the first time since the financial crisis. The 10-year yield is slipping toward the middle of this week's...

Read More »

Read More »

Switzerland asked to aid Mauritian inquiry into Basel-based Dufry

Switzerland’s federal prosecutor’s office is handling a request for mutual assistance in an investigation involving the Basel-based duty-free group Dufry. The request was sent by the government of Mauritius, which according to reports in two Swiss newspapers is looking into the details of an exclusive agreement reached between Dufry and two Mauritian airports.

Read More »

Read More »

Swiss Top Global Wealth Ranking

The average fortune of a Swiss adult is $537,600 (CHF528,000), according to the 2017 Credit Suisse Global Wealth Report. Switzerland continues to top the Credit Suisse global list for wealth per adult, followed by Australia ($402,600), the United States ($388,600) and New Zealand ($337,400).

Read More »

Read More »

UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off. Personal debt crisis coming to fore – litigation cases go beyond 2008 levels. October consumer spending fell by 2% in October, the fastest year-on-year decline in four years. Britons ‘face expensive Christmas dinner’ as food price inflation soars. Gold investors buying physical gold due to precarious UK and US outlook

Read More »

Read More »

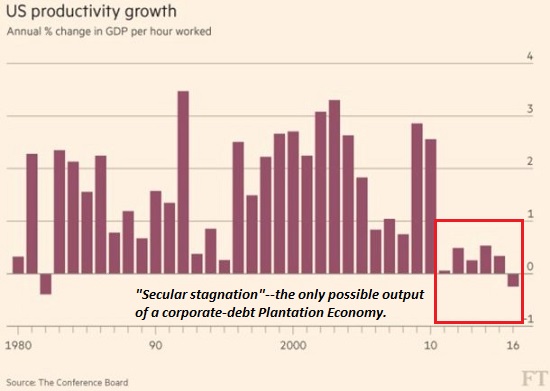

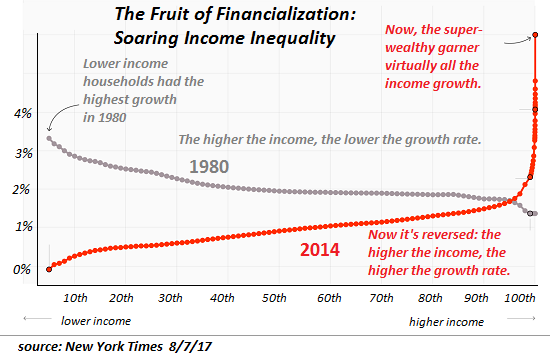

Is This Why Productivity Has Tanked and Wealth Inequality Has Soared?

Needless but highly profitable forced-upgrades are the bread and butter of the tech industry. One of the enduring mysteries in conventional economics (along with why wages for the bottom 95% have stagnated) is the recent decline in productivity gains (see chart).

Read More »

Read More »

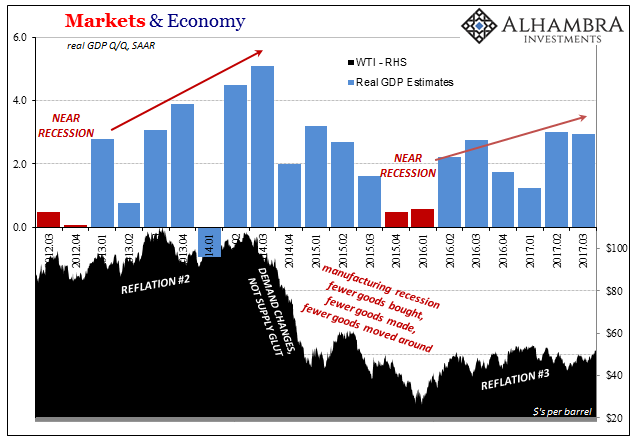

Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy...

Read More »

Read More »

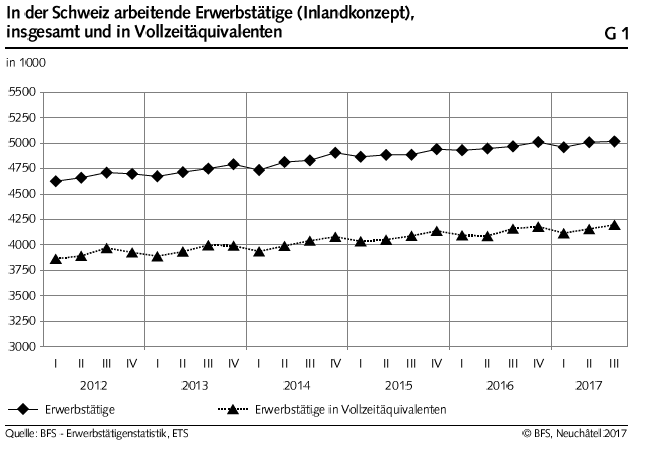

Swiss Labour Force Survey in 3rd quarter 2017: labour supply: 1.0 percent increase in number of employed persons; unemployment rate based on ILO definition at 5.0 percent

The number of employed persons in Switzerland rose by 1.0% between the 3rd quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 5.1% to 5.0%. The EU's unemployment rate decreased from 8.2% to 7.3%. These are some of the results of the Swiss Labour Force Survey (SLFS) conducted by the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, November 16: Euro Extends Pullback

After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands.

Read More »

Read More »

Saudi Billionaires Scramble To Move Cash Offshore, Escape Asset Freeze

Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter.

Read More »

Read More »

Protect Your Savings With Gold: ECB Propose End To Deposit Protection

Protect Your Savings With Gold: ECB Propose End To Deposit Protection. New ECB paper proposes ‘covered deposits’ should be replaced to allow for more flexibility. Fear covered deposits may lead to a run on the banks. Savers should be reminded that a bank’s word is never its bond and to reduce counterparty exposure. Physical gold enable savers to stay out of banking system and reduce exposure to bail-ins

Read More »

Read More »

Forget the Bogus Republican “Reform”: Here’s What Real Tax Reform Would Look Like

The point is to end the current system in which billionaires get all the privileges and financial benefits of owning assets in the U.S. but don't pay taxes that are proportional to the benefits they extract. As has been widely noted, the Republicans' proposed "tax reform" is not only just more BAU (business as usual, i.e. cut taxes for the wealthy), it's also not real reform. At best, it's just another iteration of D.C. policy tweaks packaged for...

Read More »

Read More »

What President Trump and the West Can Learn from China

Expensive Politics. Instead of a demonstration of its overwhelming military might intended to intimidate tiny North Korea and pressure China to lean on its defiant communist neighbor, President Trump and the West should try to learn a few things from China.

Read More »

Read More »

FX Daily, November 15: Dollar Slides

The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month's highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver.

Read More »

Read More »