Tag Archive: newslettersent

Emerging Markets: What has Changed

China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again.

Read More »

Read More »

BMW must pay multimillion-franc fine, Swiss court rules

Switzerland's highest court has confirmed a CHF157 million ($158 million) fine against German luxury carmaker BMW for blocking car shipments to Switzerland. The fine was originally levied on BMWexternal link by Switzerland’s Competition Commissionexternal link (COMCO) in May 2012 for preventing Swiss residents from buying BMW cars from the European Economic Area (EEA) and importing them to Switzerland, after the strong francexternal link made...

Read More »

Read More »

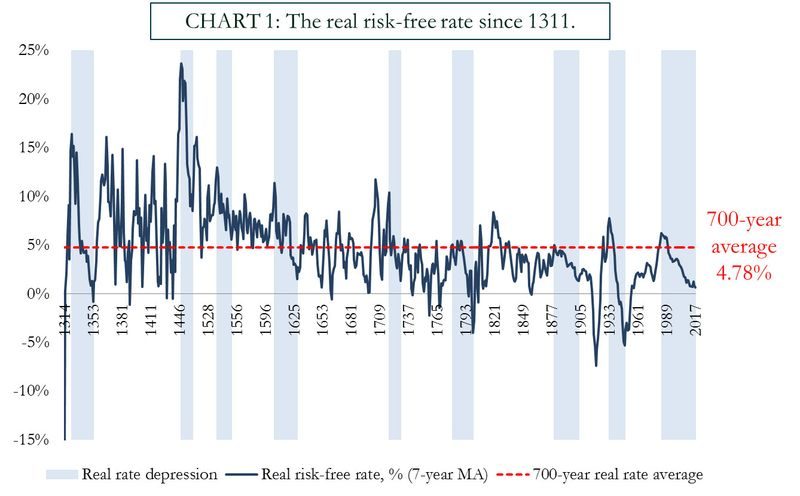

Prepare For Interest Rate Rises And Global Debt Bubble Collapse

Diversify, rebalance investments and prepare for interest rate rises. UK launches inquiry into household finances as £200bn debt pile looms. Centuries of data forewarn of rapid reversal from ultra low interest rates. 700-year average real interest rate is 4.78% (must see chart). Massive global debt bubble – over $217 trillion (see table). Global debt levels are building up to a gigantic tidal wave.

Read More »

Read More »

The Downright Sinister Rearrangement of Riches

Simple Classifications. Let’s begin with facts. Cold hard unadorned facts. Water boils at 212 degrees Fahrenheit at standard atmospheric pressure. Squaring the circle using a compass and straightedge is impossible. The sun is a star.

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »

La politique monétaire de la BNS rejaillit sur le système bancaire suisse. Le cas de la BCV.

Les « opérations de refinancement » de la BNS peuvent-elles exposer l’ensemble du système bancaire suisse aux aléas de la finance spéculative européenne ? Les too-big-to-fail sont-elles les seules concernées ? Eh bien non. Certaines déclarations du directeur de la Banque cantonale vaudoise (BCV*) nous ont incité à nous pencher sur les comptes de cet établissement de taille moyenne.

Read More »

Read More »

Switzerland moves closer to female board quotas

This week, Switzerland moved closer to requiring minimum percentages of women on company boards and management teams. A parliamentary commission came out in support of the Federal Council’s plan to require greater gender balance in the boardrooms of Switzerland’s large listed companies.

Read More »

Read More »

OECD Country Report 2017 on Swiss economic policy

On Tuesday, November 14, 2017, the OECD presents the OECD Country Report 2017 on Swiss economic policy at a media conference. This takes place at 15.00 clock in the media center Bundeshaus, Bundesgasse 8-12, 3003 Bern.

Read More »

Read More »

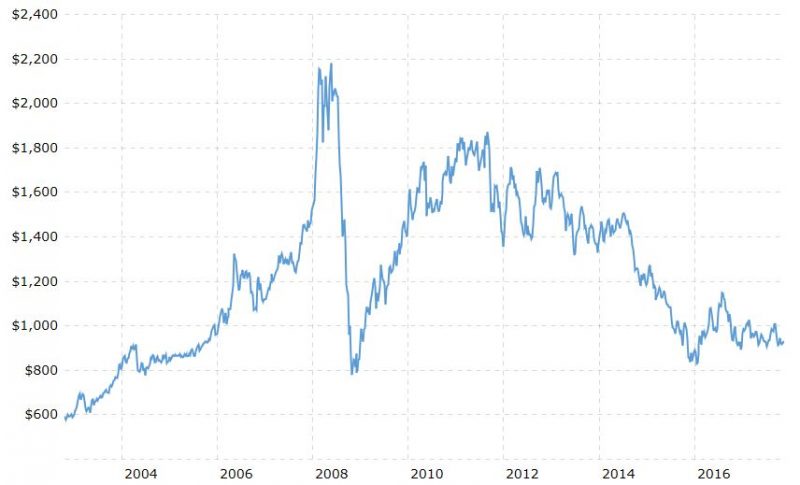

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week.

Read More »

Read More »

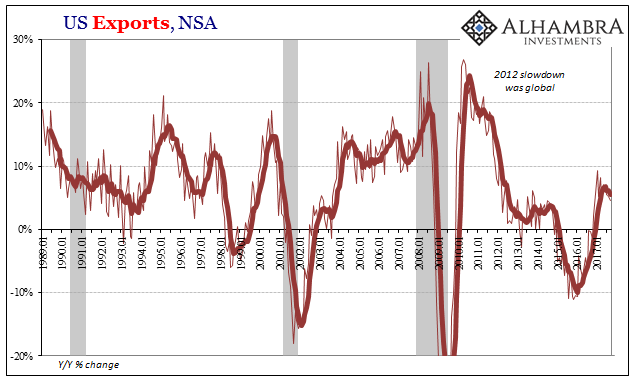

Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »

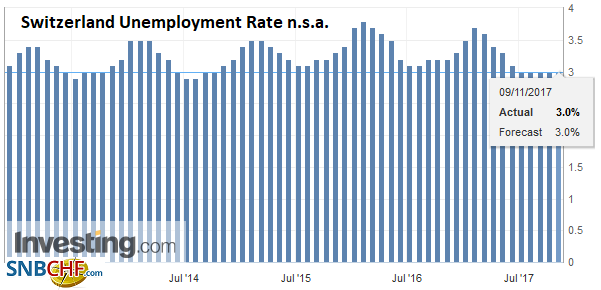

Switzerland Unemployment in October 2017: Remained unchanged at 3.0 percent, seasonally adjusted unchanged at 3.1 percent

Registered unemployment in October 2017 - According to surveys by the State Secretariat for Economic Affairs (SECO), 134,800 unemployed people were registered at the Regional Employment Centers (RAV) at the end of October 2017, 1,631 more than in the previous month. The unemployment rate remained at 3.0% in the month under review. Compared with the same month last year, unemployment fell by 9,731 (-6.7%).

Read More »

Read More »

Trust in online content takes a big hit

Internet users in Switzerland rate their computer skills as good, but trust in online news content has dropped significantly, according to a survey by the University of Zurich. An overwhelming majority (83%) of users stated they can easily distinguish between important and unimportant online activities.

Read More »

Read More »

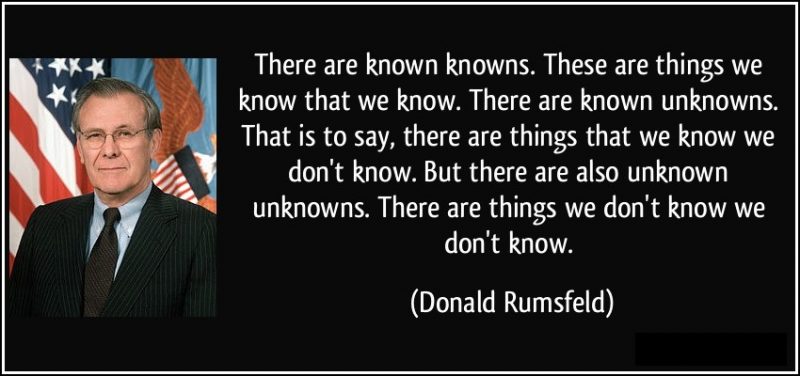

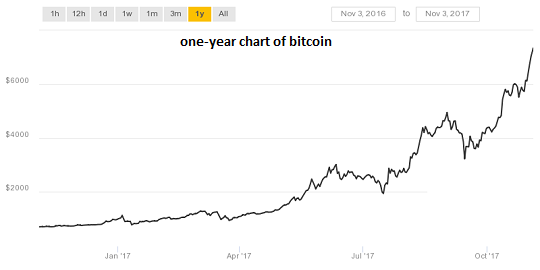

How Will Bitcoin React in a Financial Crisis Like 2008?

Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other cryptocurrencies are in a tulip-bulb type bubble, while the other camp is equally confident that we ain't seen nuthin' yet in terms of bitcoin's future valuation.

Read More »

Read More »

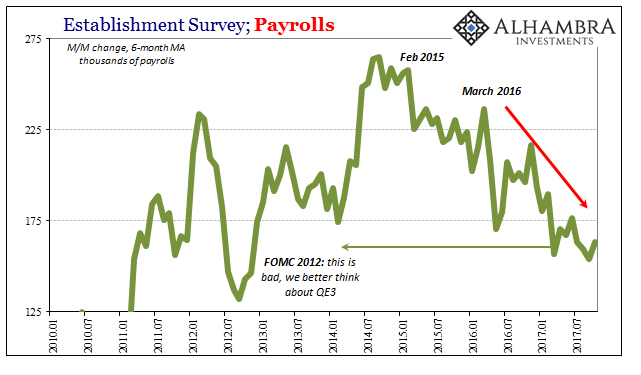

Four Point One

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »

Let’s Clear Up One Confusion About Bitcoin

If bitcoin can be converted into fiat currencies at a lower transaction cost than the fiat-to-fiat conversions made by banks and credit card companies, it's a superior means of exchange. One of the most common comments I hear from bitcoin skeptics goes something like this: Bitcoin isn't real money until I can buy a cup of coffee with it. In other words, bitcoin fails the first of the two core tests of "money": that it is a means of exchange and a...

Read More »

Read More »

Credit Spreads: The Coming Resurrection of Polly

Suspicion isn’t Merely Asleep – It is in a Coma (or Dead). There is an old Monty Python skit about a parrot whose lack of movement and refusal to respond to prodding leads to an intense debate over what state it is in. Is it just sleeping, as the proprietor of the shop that sold it insists? A very tired parrot taking a really deep rest?

Read More »

Read More »

Health insurance rise in 2018 even higher, according to new calculation

At the end of September the Swiss government announced an average nationwide health premium rise of 4% in 2018. This government calculation is rather narrow. It only looks at the price of standard compulsory insurance, including accident cover, for an adult with a CHF 300 deductible. Price comparison site bonus.ch calculates that this policy configuration only applies to 18.3% of residents.

Read More »

Read More »

Stumbling UK Economy Shows Importance of Gold

UK economy outlook bleak amid Brexit, debt woes and rising inflation. Confidence in UK housing market at five-year low. UK high street sales crash at fastest rate since 2009. Number registering as insolvent in England and Wales hit a five-year high in Q3. UK public finance hole of almost £20bn in the public finances set to grow to £36bn by 2021-22. Protect your savings with gold in the face of increased financial woes in UK.

Read More »

Read More »