Tag Archive: newslettersent

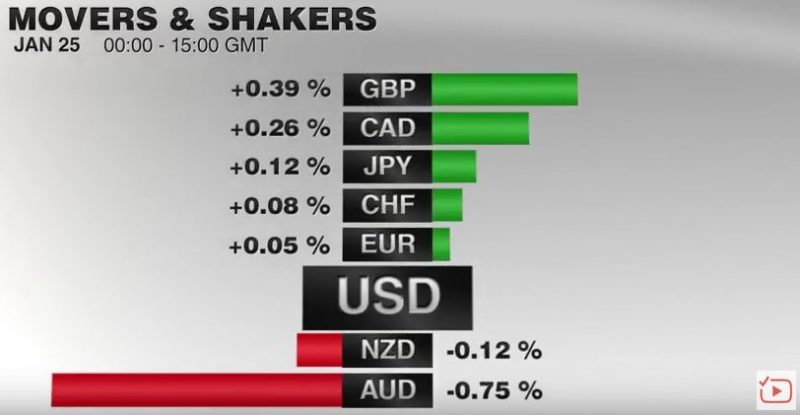

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

Ein Macher im Weißen Haus

Donald Trump sagt den alten Eliten den Kampf an. Europas Bürokraten müssen sich warm anziehen. Kürzlich stellte der Hedgefonds-Mogul Ray Dalio eine Analyse des Führungsteams von Donald Trump ins Netz („Reflections on the Trump Presidency, One Month after the Election“).

Read More »

Read More »

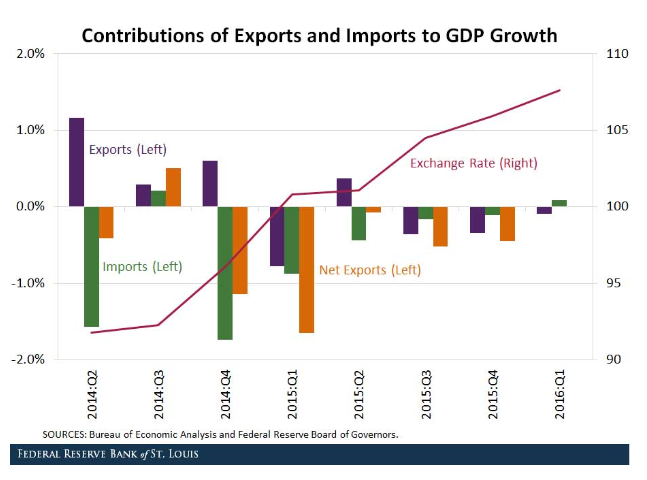

Great Graphic: How a Strong Dollar Weighs on Net Exports

Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar's appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP.

Read More »

Read More »

Policy Makers – Like Generals – Are Busy Fighting The Last War

The Maginot Line formed France's main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success...as the Germans never seriously attempted to attack it's interconnected series of underground fortresses. But the days of static warfare...

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

FX Daily, January 24: UK Supreme Court Requires May to Submit Bill on Brexit to Parliament

As widely expected, the UK Supreme Court ruled that Parliament approval is needed to trigger Article 50 start the divorce proceedings with the EU. The Court decided by an 8-3 majority that a bill needs to be submitted to both chambers, but that the approval of the regional assemblies (e.g. Scotland, Northern Ireland) is not necessary.

Read More »

Read More »

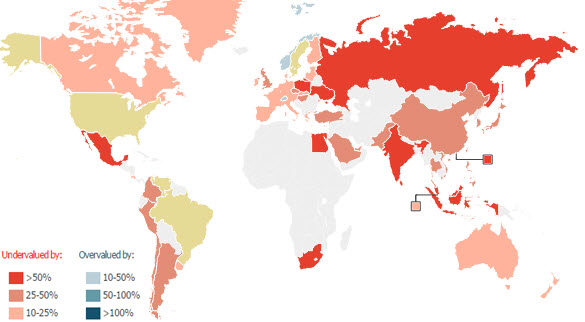

The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto.

Read More »

Read More »

UK Supreme Court Decision: Anti-Climactic?

Sterling retreats on court ruling but key supports hold and it recoups initial loss. The US dollar is recovering with the help of firming US yields. Investors are still anxious for details of new US government's tax, deregulation, and infrastructure investment plans.

Read More »

Read More »

Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities.

Read More »

Read More »

FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration's economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European morning, but broader risk appetites were not rekindled, and the Dow Jones Stoxx 600, led by financials, was sold to its lowest level this month.

Read More »

Read More »

Changes to health insurance zones could lead to steep premium rises for some

In Switzerland, how much you pay for compulsory health insurance depends on where you live. Premiums vary hugely by canton. For 2016, average monthly adult premiums in Basel City are CHF 545.60, Switzerland’s most expensive, compared to CHF 326.70, in lowest-cost Appenzell-Innerhoden. The difference between the two cantons is 40%.

Read More »

Read More »

China Says It Is Ready To Assume “World Leadership”, Slams Western Democracy As “Flawed”

Over the weekend China used the Trump inauguration to warn about the perils of democracy, touting the relative stability of the Communist system as President Xi Jinping heads toward a twice-a-decade reshuffle of senior leadership posts.

Read More »

Read More »

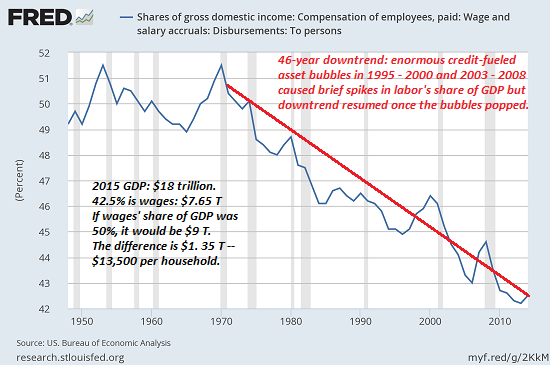

The Collapse of the Left

The Left is not just in disarray--it is in complete collapse because the working class has awakened to the Left's betrayal and abandonment of the working class in favor of building personal wealth and power. The source of the angry angst rippling through the Democratic Party's progressive camp is not President Trump--it's the complete collapse of the Left globally. To understand this collapse, we turn (once again) to Marx's profound understanding...

Read More »

Read More »

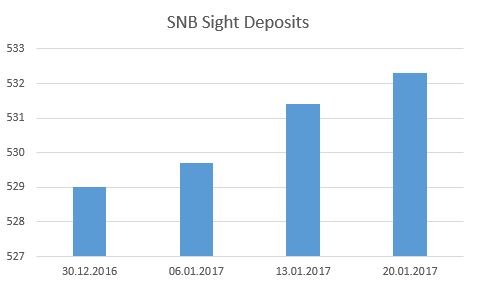

Weekly Sight Deposits and Speculative Positions: Weaker dollar let SNB accumulates losses

EUR/CHF is slightly above the “in-official minimum band”. The weaker dollar leads to bigger SNB losses in January. SNB intervenes for 0.9 bn at higher EUR/CHF rate. Speculators are net short CHF with 13.7K contracts against USD.

Read More »

Read More »

Weekly Speculative Position: CHF getting stronger, net shorts stable

Speculators are net short CHF with 13.7K contracts against USD. This is nearly unchanged. On the other side, the USD/CHF is falling.

Read More »

Read More »

FX Weekly Preview: The Challenging Week Ahead

Investors will finally be able to focus on what the new US President does rather than what he says. The UK Supreme Court decision is expected, but it may not be the driver than it may have previously seemed likely. The dollar-yen rate does not appear to be driven by domestic variable as much as US yields and equities. Prices not real sector data may be the key for the euro.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended last week on a firm not, led by a huge MXN rally on Inauguration Day. We believe that the peso rally was largely driven by positioning and technicals, and so we view Friday’s gains as a correction since the fundamental outlook remains unchanged. Indeed, we think the broader EM rally will be short-lived too, as US interest rates remain elevated. The 10-year yield flirted with the 2.5% level, and we believe it will eventually head even...

Read More »

Read More »

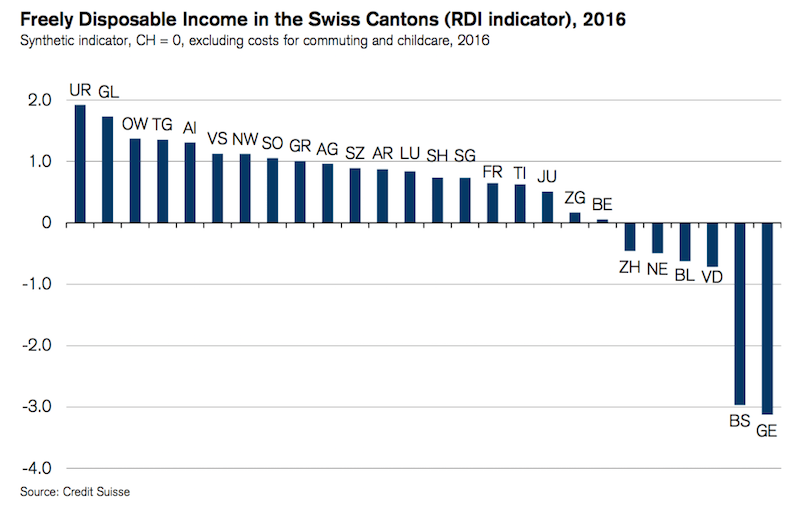

Switzerland’s costliest cantons for tax, housing, health, commuting, and childcare

This week the bank Credit Suisse published its cantonal cost of living report. Its ranking considers a typical household’s biggest expenses: tax, housing, commuting, basic health insurance and childcare. It takes income and deducts all of these costs to arrive at a measure of disposable income.

Read More »

Read More »

Swiss fact: Switzerland has one of the world’s lowest home ownership rates

In Romania, 96.1% of the population owns the home they live in. In Switzerland the percentage is 37.4%. Home ownership rates vary significantly across the country. The lowest rates are found in the canton of Basel-City (16.0%) and Geneva (18.3%). Relative to these two cities, home ownership abounds in Valais (57.2%), the highest. Vaud (31.4%), Zurich (28.5%), Bern (39.9%), and Luzern (34.8%) are all in between.

Read More »

Read More »