Tag Archive: newslettersent

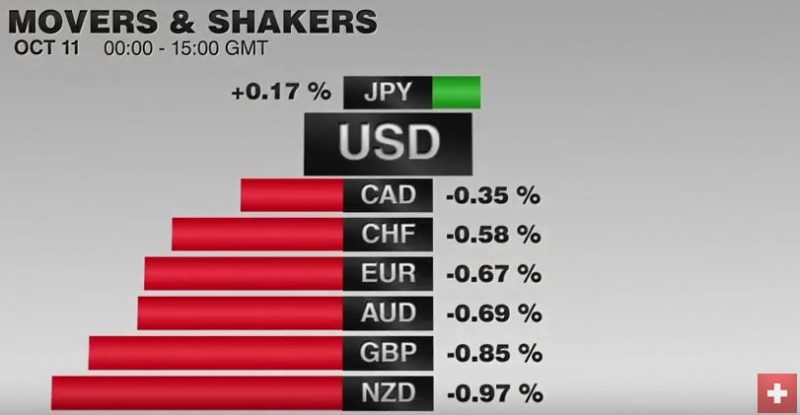

FX Daily, October 11: The Dollar Remains Bid

The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger today at 1.77%, which is the highest in four months.

Read More »

Read More »

Swiss central bank can cut rates further if needed, says bank president Jordan

The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted that the bank has already pushed rates quite far.

Read More »

Read More »

Australian property bubble on a scale like no other

Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: The record run up in commodity prices and subsequent correction. The associated boom in mining investment and current reversal. Record low bond yields. The boom in housing construction. Specifically apartments, that was spurred...

Read More »

Read More »

Great Graphic: Euro is Approaching Year-Long Uptrend

The year-long euro uptrend comes in near $1.1035, just below the August lows. The technical are fragile, but the euro is below its lower Bollinger Band. The fundamental driver seems to be the backing up of US rates, and widening premium over Germany.

Read More »

Read More »

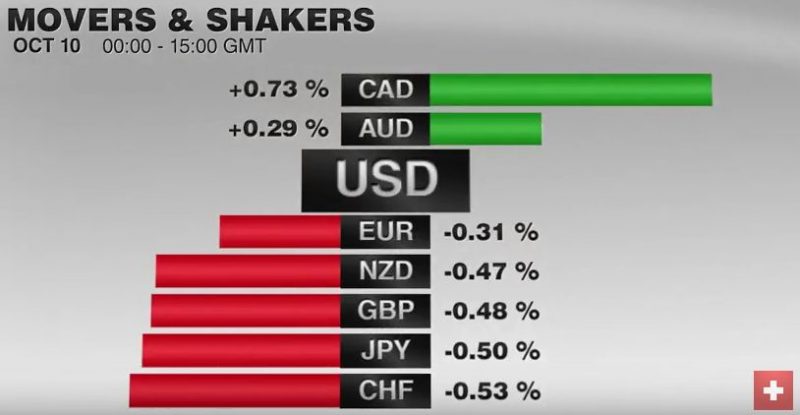

FX Daily, October 10: Dollar after the Second Debate

The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar's gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US political developments, the main feature of which is the implosion of the Trump campaign.

Read More »

Read More »

USA 2017-2020: An Ungovernable Nation?

The U.S. needs to overthrow a corrupt, self-serving elite. Regardless of who wins the presidency, a much larger question looms: will the U.S. be ungovernable 2017-2020? There are multiple sources of the question.

Read More »

Read More »

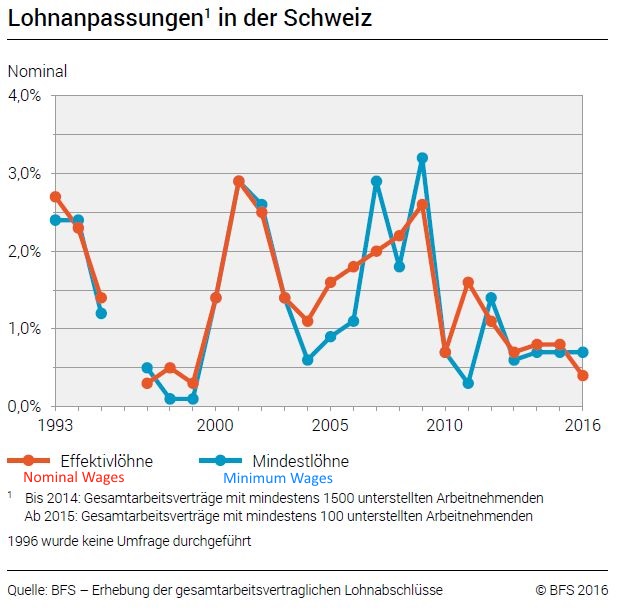

Swiss nominal and minimum wages increase by 0.4% and 0.7% respectively

The social partners signing the collective labour agreements (CLA) have agreed a nominal rise in real wages estimated at 0.4% for 2016, of which 0.2% is to be awarded collectively and 0.2% at individual level. Minimum wages were increased by 0.7%. The graph shows nominal wages since 1993.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

Despite the weaker than expected US jobs report, the dollar remains firm and EM is ending the week on a soft note. The main culprit was higher US rates, with the 2-year yield moving up to 0.85% and is the highest since early June. Concerns about Brexit impact and as well the health of European banks remain ongoing and could weigh on risk sentiment this coming week. Lastly, oil may come under more pressure after Russia said it sees no deal with...

Read More »

Read More »

FX Weekly Preview: The Week Ahead: It’s Not about the Data

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead.The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations.

Read More »

Read More »

Great Graphic: US-German 2-Yr Differential and the Euro

The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction.

Read More »

Read More »

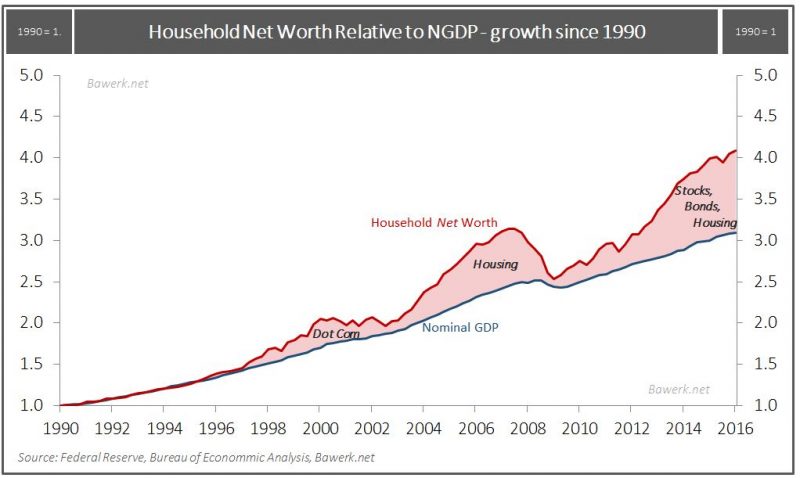

Do our money managers really believe this will end well?

An economic bubble is essentially an economic activity that cannot sustain itself without a continuous influx of new money and credit to bid away real resources from self-funding endeavors. Financial bubbles are obviously closely related as financial...

Read More »

Read More »

Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week - from settlement rumors to German blue-chip bailouts to Qatari investors - Germany's Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department.

Read More »

Read More »

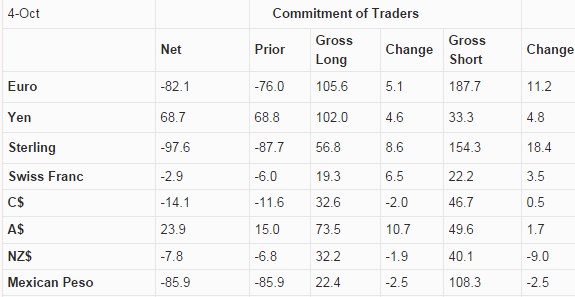

Swiss Franc Net Shorts Getting Reduced

Last week SNB Q3 window cleaning that led to a big CHF net short position. This week this changed again. Both longs and shorts on CHF increased, but the net short position fell.

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, Brazil (+5.3%), Czech Republic (+4.4%), and Hungary (+3.0%) have outperformed this week, while Peru (-3.3%), UAE (-2.2%), and South Africa (-1.4%) have underperformed. To put this in better context, MSCI E...

Read More »

Read More »

British Pounding

Flash-Crashed. Earlier this morning the British Pound suddenly found itself on the receiving end of a 6% flash crash during Asian trading hours. Some of the losses have been recouped since then, but that will be of little consolation to anyone who may have been long the GBP overnight.

Read More »

Read More »

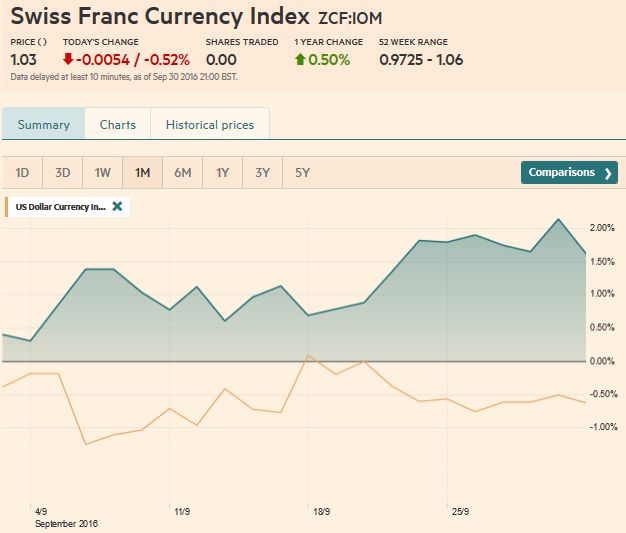

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480.

Read More »

Read More »