Tag Archive: newslettersent

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »

The Day They Killed the Dollar

LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered!

Read More »

Read More »

The World’s Central Banks Are Making A Big Mistake

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments.

Read More »

Read More »

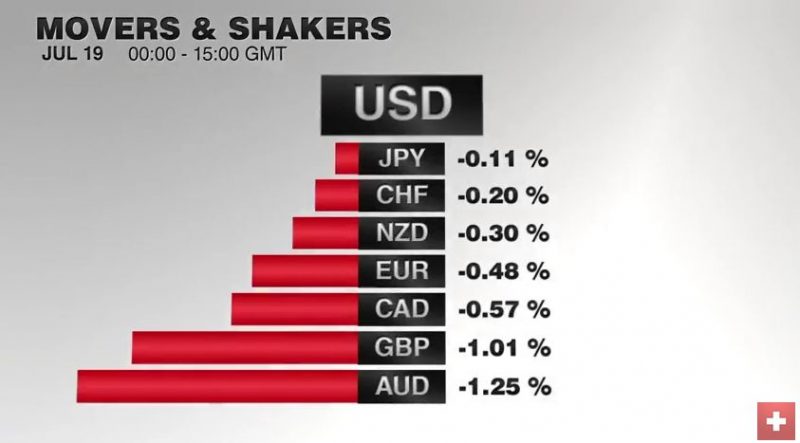

Great Graphic: Aussie Approaches Two-Month Uptrend

Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year.

Read More »

Read More »

The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. Many, maybe most, of young America's citizens were illiterate. "Liberty" may have been the first word they ever learned to read.

Read More »

Read More »

FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today.

Read More »

Read More »

Dollar Bull Case Intact: It is All About the Perspective

Our bullish dollar outlook was based on divergence and we judge it to still be intact.The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its arlier rally. The Dollar index is at it highest level since March today.

Read More »

Read More »

European Court of Justice Ruling Weighs on Italian Banks

ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event.

Read More »

Read More »

Givaudan profit beats estimates on U.S. fragrance demand

Givaudan SA, the world’s largest flavors and fragrance company, reported first-half profit that beat analyst estimates on increased demand for perfumes. Earnings before interest, taxes, depreciation and amortization rose 13 percent to 638 million francs ($649 million), the Vernier, Switzerland-based company said in a statement on Monday. Analysts had predicted 576 million francs. Sales gained 6.2 percent on a like-for-like basis to 2.33 billion...

Read More »

Read More »

Novartis says profit may drop

Novartis AG said profit may fall this year as the Swiss drugmaker increases spending on the heart medicine Entresto and faces declining sales of its best-selling cancer treatment Gleevec. Core operating income will either be about the same as 2015 or decline by a percentage in the low single digits at constant exchange rates, Novartis said Tuesday in a statement. Sales will show little change.

Read More »

Read More »

Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization”

All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing of productive people for the benefit of unproductive people. They tax people, who have earned their income and accumulated their wealth by producing goods or services purchased voluntarily by consumers (and of course...

Read More »

Read More »

FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

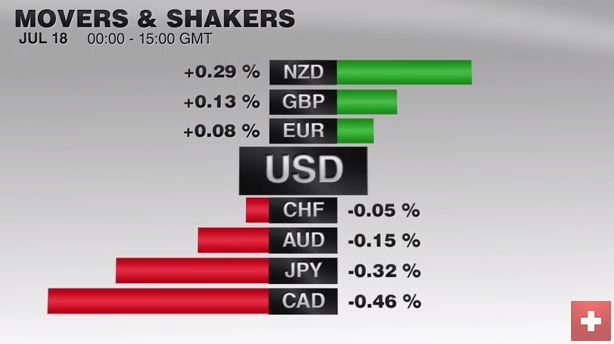

The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign direct investment and comments from a hawkish member of the MPC suggesting not everyone is onboard necessarily for a rate cut next month.

Read More »

Read More »

Bank of Japan: Destination Mars

Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical.

Read More »

Read More »

Squaring the Circle: Can Article 7 be Used to Force Article 50?

Article 7 would suspend the UK's EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what "is" means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not.

Read More »

Read More »

Some Thoughts on Turkey

INTRODUCTION After last Friday’s failed coup attempt in Turkey, a measure of calm has returned to global markets. We did not think Turkish developments have wide-reaching implications for EM assets, but we do remain very negative on Turkish assets in the wake of the coup and ongoing political uncertainty.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note, due in large part to the attempted coup in Turkey. Weakness in the lira spilled over into wider EM weakness in thin Friday afternoon market conditions. The situation in Turkey has calmed, and so EM may gain some limited traction this week. However, that calm will likely be very fragile and so we retain a defensive posture with regards to EM.

Read More »

Read More »

Three-Ring Circus

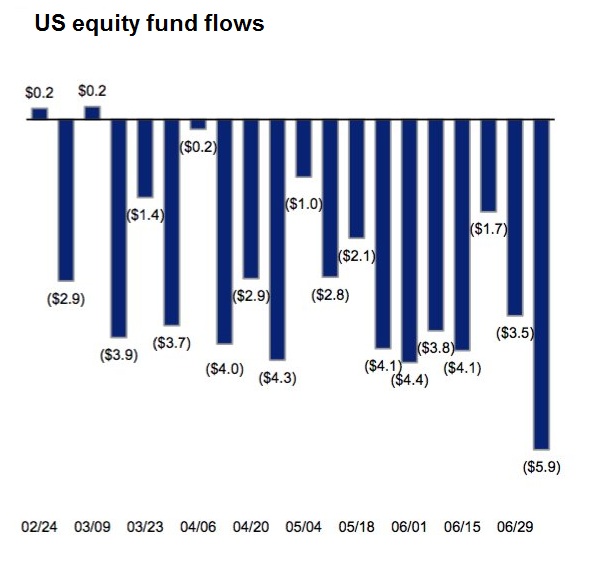

Speculator’s Market LOS ANGELES – Stocks were up again… Whoa! Hold on just a cotton-picking minute. Honest investors are getting out of the stock market. There have been net withdrawals of $80 billion from U.S. equity funds so far this year. Who’s buying?

Read More »

Read More »

FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Key event in Europe is not on many calendars--it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ's meeting at the end of the month.

Read More »

Read More »

Speculative Sentiment Shifts

The combination of a robust US jobs report, speculation of bolder action by Japan, the possibility that the ECB drops the capital key to overcome the ostensible shortage of some core bonds (e.g. German bunds), and the anticipation of easier BOE policy appears to have generated a change in sentiment among speculators in the currency futures market.

Read More »

Read More »