Tag Archive: newslettersent

FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Our weekly review of currency movements, with focus on the Swiss franc. This week: The US dollar is easily the most traded currency, and despite the plethora of other currencies, it is on one side of nearly 90% of all trades. Yet the movement in the foreign exchange market presently is not so much driven by the dollar as it is by other currencies.

Read More »

Read More »

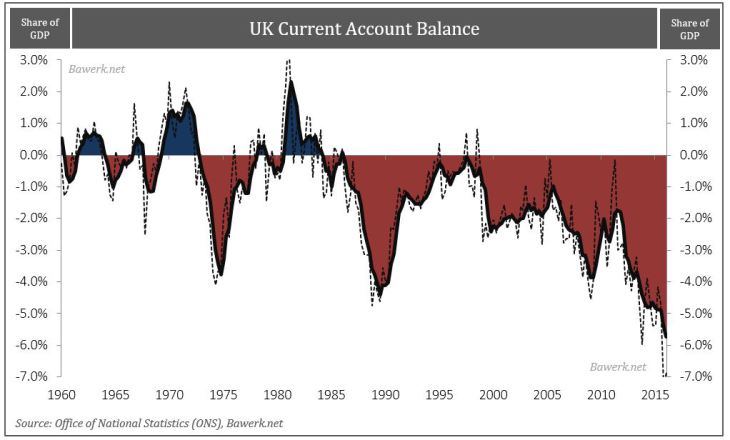

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

Helping Robots Find Jobs…

When the cost of capital goes down to zero, a company with access to that cheap – or even free – money can afford to pay almost an infinite amount of money to get rid of its employees and hire robots.

“Zero-interest-rate policy is really a full robot employment program.”

Read More »

Read More »

Great Graphic: Equities Since Brexit

Since the UK voted to leave the EU, emerging market equities have outperformed equities from the developed markets. This Great Graphic, composed on Bloomberg, shows the MSCI Emerging Market equities (yellow line) and the MSCI World Index of developed equities (white line).

Read More »

Read More »

Swatch profit plunges as demand falls across europe, asia

Swatch Group AG said first-half profit fell by more than half — the most in at least 15 years — as demand for its watches in Hong Kong, France and Switzerland collapsed.

Read More »

Read More »

FX Daily, July 15: Sterling and Yen Remain Key Drivers in FX

The US dollar is broadly mixed against the major currencies. The Swiss franc's 0.25% gain puts it at the top of the board, after sterling's earlier gains were largely unwound in late-morning turnover. The yen is the weakest major; extending its loss by 0.6%, to bring the weekly decline to more than 5%. The pre-referendum result high for the dollar was near JPY106.85. Today's high has been about JPY106.30. In emerging markets, we note that the...

Read More »

Read More »

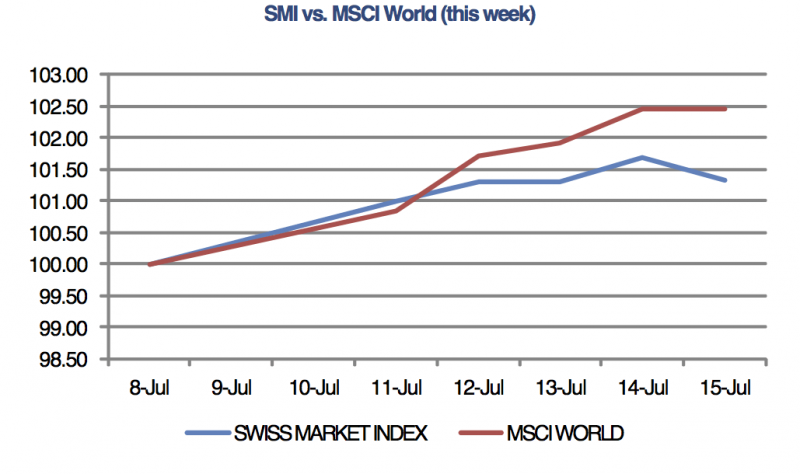

Swiss stocks higher on stimulus bet

The Swiss Market Index (SMI) is set to finish this week higher tracking equity market gains around the world as investors begin to anticipate a new wave of economic stimulus from central banks.

Read More »

Read More »

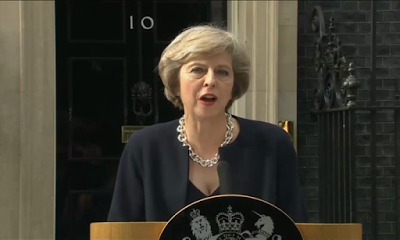

FX Daily, July 14: Will BOE Ease on May Day?

After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new government are particularly relevant. First, May demonstrates strategic prowess by putting those like Johnson and Davis, who campaigned for Brexit, to lead the negotiations with the EU, while putting Tories who favored remaining in the EU in the internal ministries.

Read More »

Read More »

Great Graphic: If You Think Sterling has Bottomed, Where may it Go?

Many think sterling has bottomed. A number of technical factors point to potential toward $1.42. Fundamental considerations do not appear as supportive as technicals.

Read More »

Read More »

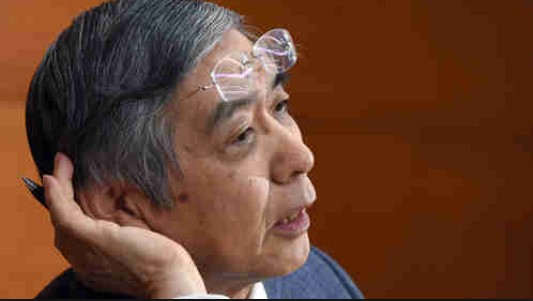

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

BOE Surprises by Doing Nothing, but Tips August Action

BOE neither cut rates not announced a new asset purchase plan. Sterling rallied hard. However, the BOE indicated an August ease and I look for sterling to pare knee-jerk gains.

Read More »

Read More »

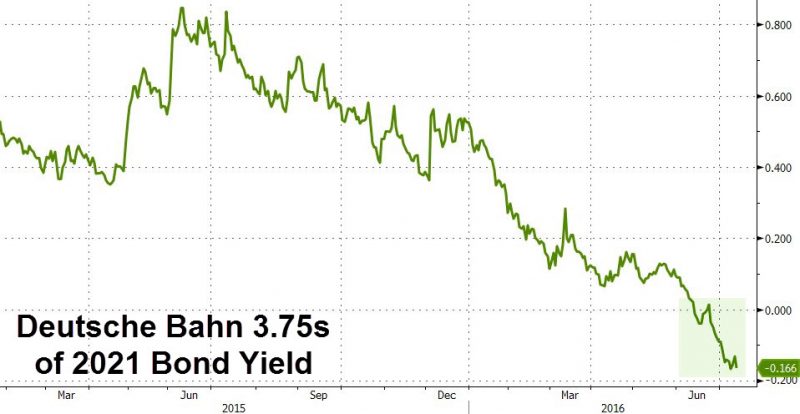

Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon.

Read More »

Read More »

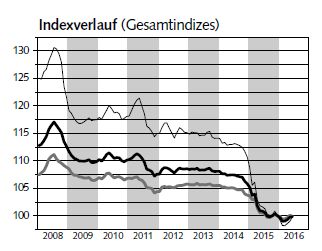

Swiss Producer and Import Price Index, June 2016: +0.1 percent MoM, -1.0 percent YoY

The Producer and Import Price Index rose in June 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.2%, the Import Price Index rose by 0.8%. The slight increase of the overall index is due in particular to higher prices for petroleum products. Compared with June 2015, the price level of the whole range of domestic and imported products fell by 1.0%.

Read More »

Read More »

FX Daily, July 13: Sterling and Yen Momentum Slows

The two main developments in the foreign exchange market this week in recent days has been the opposite of what has transpired over the past several weeks. Sterling moved higher quickly. The yen moved down just as fast. Over the past five sessions through late-morning levels, sterling has gained 2.5% while the yen has shed 2.8%.

Read More »

Read More »

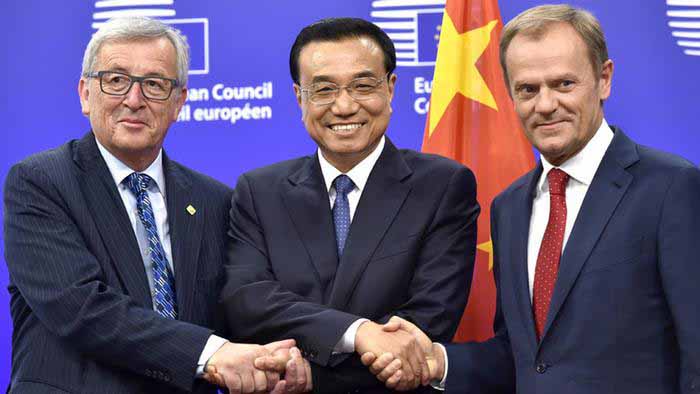

EU Sends Obsolete Industries Mission to China

The European press informs us that a delegation of EU Commission minions, including Mr. JC Juncker (who according to a euphemistically worded description by one of his critics at the Commission “seems often befuddled and tired, not really quite present”) and European Council president Donald Tusk, has made landfall in Beijing.

Read More »

Read More »

Three Developments in Spain

Favorable initial ruling for Spanish banks that overcharged on mortgages. The EC may be lenient on Spain (and Portugal) for the excessive deficits in 2015. There is a window of opportunity for Rajoy to form a minority government.

Read More »

Read More »

QE and stress tests could cause a state of emergency for some insurers

European insurers, whose profits are being eroded by Mario Draghi’s quantitative-easing program, face a stress-test headache that risks requiring them to set aside more capital, further hurting their ability to make money. The timing of the regulator’s “stress test couldn’t be worse as the results will be rather negative,” said Lutz Roehmeyer, who helps oversee about $12 billion as director of fund management at Landesbank Berlin Investment.

Read More »

Read More »

Spiritus rector des kranken Bonussystems ist Oswald Grübel

97 Franken – das war der Kurs der CS-Aktie im Mai 2007. Vergangene Woche notierte die Aktie noch bei einem Zehntel. Bei einem solch dramatischen Kurszerfall muss die CS sich nicht wundern, wenn kritische Fragen gestellt werden. Weshalb beträgt der aktuelle Wert der CS-Titel nur noch rund die Hälfte des in der Bilanz ausgewiesenen? Besteht die Gefahr eines Konkurses der CS? Wer wird dieses Too Big To Fail-Institut allenfalls retten? Die SNB, der...

Read More »

Read More »

FX Daily, July 12: Easing Political Uncertainty Encourages Animal Spirits

Further risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180.

Read More »

Read More »