Negative for 10 YearsOvernight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and that’s precisely what happened, when as the WSJ reports, Germany sold 10-year debt at a negative yield on Wednesday, “becoming the first eurozone nation to do so and setting a further milestone in the relentless fall of government bond yields around the world.” To be fair, this was far less exciting than the media makes it out to be as primary issuance always tracks the secondary market and in the case of Bunds, these have been “sub-zero” for several weeks now. Still, it was an accomplishment for Germany to issue debt which not only does not pay a cash coupon, but which will end up reducing Germany’s total debt by the time it matures. While today’s 10Y auction was historic, Eurozone countries, including Germany, have sold shorter-dated bonds at a negative yield before, and Switzerland and Japan have issued 10-year bonds at yields below zero. But the 10-year bund is considered the benchmark issue in Europe, a region of sheer monetary insanity. These yields are “symptomatic of serious structural problems with the global economy,” said Daniel Loughney, a portfolio manager at AllianceBernstein. “Clearly this poses a serious predicament for investors, as investing in [a] negative-yielding instrument is impossible to justify from a buy and hold perspective.” |

|

| Actually, no. These yields are symptomatic of something far simpler: frontrunning of central banks, and expectations that no matter how high the price paid, the ECB will come back in a few weeks or months and offer you even more. In other words, the ECB is now the “greatest fool” ever in the history of European capital markets.

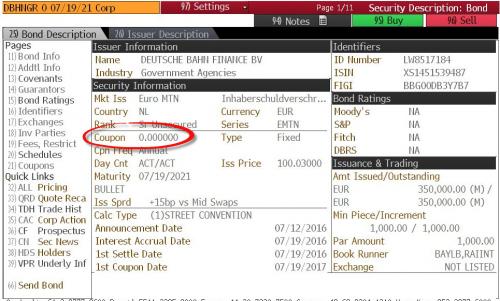

Mitul Patel, head of interest rates at Henderson Global Investors, said there are concerns the ECB will run out of eligible bonds to buy in Germany, leading to speculation that the central bank will have to alter its rules to avoid running out of road. The ECB’s rules preclude it from buying any bonds with a yield lower than its deposit rate of minus 0.4%, and the central bank can buy only up to a third of each eurozone country’s debt. Deutsche BahnBut wait there’s more, because just hours prior to Germany selling its first ever negative-yield 10Y bund, German railway operator Deutsche Bahn became the first non-financial company to sell a corporate bond with a negative yield in euros on Tuesday: it was perhaps fitting that a corporation would frontrun a government. |

|

| Deutsche Bahn began marketing an expected €250m five-year deal at mid-swaps plus 20bp area, before setting guidance for an increased 350m deal at mid-swaps plus 16bp area with a plus and minus 1bp range. Joint leads BayernLB and Raiffeisen Bank set the final spread at plus 15bp as orders reached 840m. The deal priced with a negative 0.006% yield and a 0% coupon.

The issuer was last in the market on June 30 to print a 750m 15-year deal at 26bp over mid-swaps. The deal is now bid at plus 14bp, according to Tradeweb. As with anything debt related these days, there was humor: “I’m not sure why they’re issuing so soon, probably because they can and there is demand,” one investor who placed an order for the deal said. “Compared to its last deal today’s price at plus 15bp still looks cheap on the curve and offers some value.” Yes, a financial professional just said a -0.006% YTM “offers value.” There is some speculation whether Deutsche Bahn is, in fact, a corporate: after all the company is 100% state-owned, leading some to question whether it counts as being the first ‘corporate’ issuer to sell negative-yielding debt. But, as Reuters reports, Deutsche Bahn’s debt has regularly been sold to investment-grade corporate investors, with its deals managed by the corporate banking syndicate teams. So the investment-grade corp glove fits… While other international companies such as Sanofi, Engie and Unilever – have already sold 0% coupon bond issues with barely positive yields – the German railway operator is the first one to actually do so with a negative yield at auction. |

As debt yields continue to slide ever lower and as to the monetary singularity and as fundamentals become meaningless in the global scramble for any yields, expect more companies to follow. The ECB’s aggressive approach to its corporate sector purchase program is expected to spark more sub-zero yielding debt as spreads continue to grind tighter.

Perhaps somewhat surprisingly, while the ECB said most recently that it had bought €1.676bn under the CSPP in the week to July 8, bringing purchases to €8.474bn, the heavy ECB buying has done little to spur new issuance, with just 13bn of investment-grade corporate debt printing since the ECB began buying corporate bonds – only 3bn more than in the same period of 2015, according to IFR data.

“We’re banging on the door of some issuers to encourage them to sell bond deals while the market remains stable, but not all are listening,” one banker away from Deutsche Bahn’s deal said.

“But as we’ve seen, investors are desperate to buy and the market is stable for now so it makes perfect sense to take advantage it all.”

For those confused, this means that not even with the ECB handing out European companies more than free money, they still refuse to borrow and use the proceeds for the same reason their US peers have over the past 5 years: to buy back their own stock and boost their management bonuses in the process.

Said even simpler: the ECB is giving management a raise, and management is saying no.

While we can overlook everything else, that fact that this is happening is perhaps the most troubling sign that something is truly broken in Europe…

Full story here Are you the author? Previous post See more for Next postTags: Bond yield,Capital Markets,central-banks,Eurozone,Global Economy,Japan,newslettersent,Raiffeisen,Reuters,Switzerland