Tag Archive: Switzerland

Interview with Executive Global: “The Return of Marxism in the West”

Our special interview on Swiss Wealth Advisor with CLAUDIO GRASS, CEO and Independent Precious Metals Consultant, explores the manner in which astute investors may preserve wealth against the backdrop of debilitating central economic planning and monetary inflation.

Read More »

Read More »

Dollar Recovers from Yesterday’s Slide, but Slumps Against the Yen

Overview: The dollar's losses scored after yesterday's disappointing ISM manufacturing report were extended initially in Asia Pacific turnover earlier today before it recovered. The recovery has stretched the intraday momentum indicators, warning against expected strong follow-through dollar buying in North America, without fresh impetus.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Private property rights under siege

People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings.

Read More »

Read More »

Dollar Jumps

Overview: A less hawkish Reserve Bank of New Zealand and a slightly softer than expected January CPI from Australia appears to have sparked a broad US dollar rally.

Read More »

Read More »

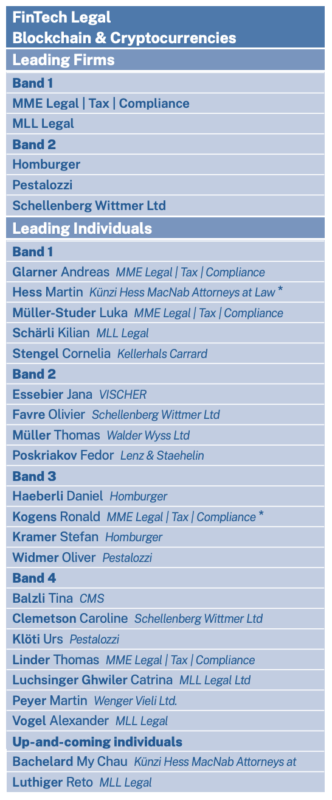

The Top Swiss Law Firms for Fintech and Blockchain Practice

Chambers and Partners, a legal research company, has released its Chambers Fintech 2024 guide, an annual report which recognizes the top fintech advisors and litigators worldwide.

In this year’s Swiss edition, Chambers and Partners ranked MME Legal | Tax | Compliance, MLL Legal, Baer and Karrer, and Lenz and Staehelin as the top Swiss law firms in the fintech legal category, recognizing them for their expertise, diligence and customer service.

MME...

Read More »

Read More »

Quiet End to a Busy Week

Overview: The US dollar is winding down this week on

a quiet note. Most of the G10 currencies are trading within yesterday's ranges.

On the week, only the Scandis are set to close with gains, though with a little

effort, the Australian dollar could too. The Japanese yen and Swiss franc are

the laggards off 0.65%-0.75% this week. Most emerging market currencies outside of

central Europe are firmer. The South African rand is the strongest this...

Read More »

Read More »

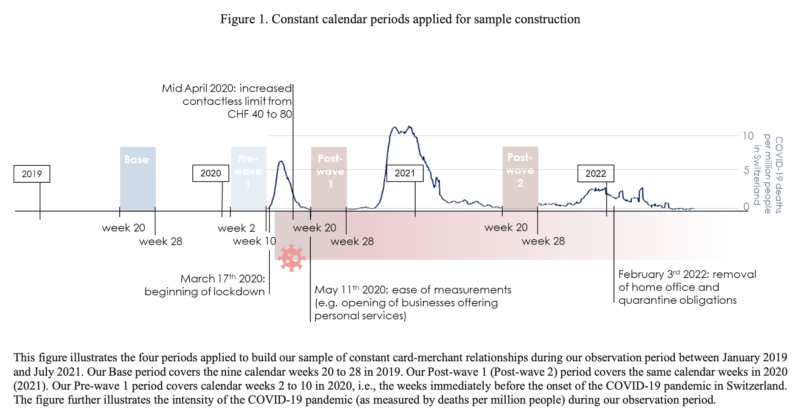

New SNB Study Reveals Critical Role of Card Schemes and Banks in the Contactless Payment Usage

Financial intermediaries, including card schemes and issuing banks, are playing a critical role in the use and promotion of new payment methods in Switzerland. A 2023 research by the Swiss National Bank (SNB) revealed that the rules and standards set by these intermediaries are impacting usage and frequency of contactless payments.

The findings, shared in a new report titled “Consumer adoption and use of financial technology: “tap and go”...

Read More »

Read More »

Holiday Moves Continue to be Unwound

Overview: The dollar is firm. Rates are mostly

higher and equities lower. The moves scored in the holiday-thin markets are at

end of last year are being unwound. This does not appear complete yet. Geopolitical tensions remain high but do

not seem to be having a direct market influence as both gold and oil are

trading lower. Among the G10 currencies, sterling has been the most resilient

today but nearly flat. Within the emerging market complex, the...

Read More »

Read More »

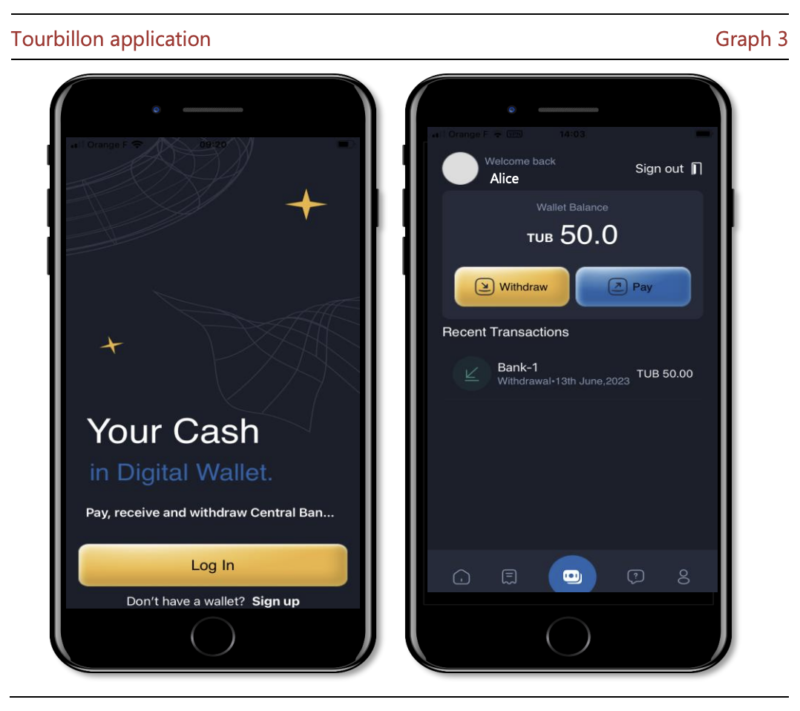

Swiss-Backed CBDC Project Explored Feasibility of Cash-Like, Anonymous Digital Currency

Project Tourbillon, an initiative led by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre and supported by the Swiss National Bank (SNB), explored the feasibility of a retail central bank digital currency (CBDC), finding that it is possible to implement a CBDC design that provides anonymity to the payer and which is scalable and secure.

In a new report released in November 2023, BIS shares details of the project, outlining...

Read More »

Read More »

Markets Catch Collective Breath

Overview: The US dollar is mixed today. The dollar-bloc currencies are firmer, while the euro and yen are softer. We had anticipated a recovery of the dollar on ideas that the market has too aggressively pushed down US rates, and pricing in more Fed easing with higher confidence than seems to be warranted by the recent data. However, US rates have not recovered, but the dollar has. Partly, this reflects that rates have fallen as faster if not...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

“Sound money must be anchored to and backed by real, tangible assets”

Dani Stüssi interview with Claudio Grass

Over the last few years, the financial woes and daily pressures that have been unleashed upon the average citizen, saver and taxpayer have put the spotlight on money itself. Countless ordinary people who have otherwise never seriously pondered these questions, began to question basic principles like: what makes their paycheck shrink from month to month, what or who actually responsible of it and what,...

Read More »

Read More »

Food Prices Drive China’s CPI Lower while the Greenback is Mostly Firmer in Narrow Ranges

Overview: The dollar is mostly firmer against the

G10 currencies and has been confined to tight ranges through the European

morning. Outside of the China's deflation and Japan's monthly portfolio flow

data that showed Japanese investors bought the most amount of US Treasuries

(~$22 bln) in six months in September, the news stream is light. Most emerging

market currencies are trading with a softer bias today. The Philippine peso is

the strongest...

Read More »

Read More »

Swiss Banks Unlikely to Migrate to Blockchain, DLT Systems, Says SNB Advisor

While some banks have started experimenting with blockchain and distributed ledger technology (DLT), widespread migration to these systems are unlikely to occur due to a number of roadblocks, including regulatory and compliance challenges, the high costs of the endeavor, as well as uncertainties about the long-term benefits and potential disruption of the technology on existing business models, Benjamin Müller, an advisor on banking operations for...

Read More »

Read More »

Consolidative Session Marked by Weak Chinese Imports and White House Debt Ceiling Talks

Overview: The market sentiment remains fragile.

Equities are mostly lower. Japan was a notable exception, and concerns about

China's economy after a sharp decline in imports took mainland and Hong Kong

listed companies sharply lower. Europe's Stoxx 600 is giving back yesterday's

0.35% gain plus more. Bank shares are off 0.65% after rallying 4.20% over the

past two sessions. US equity futures are heavier. Benchmark 10-year yields are

mostly a couple...

Read More »

Read More »

Bank Stress Hobbles the Dollar, while Dissents Make the 50 bp Hike by Sweden less than Hawkish

Overview: The re-emergence of bank stress

reverberated through the US markets yesterday, downgrading the perceived

chances of a Fed hike next week and sending the US 2-year yield sharply lower. The

yield settled 13 bp lower, the largest drop in three weeks. The risk-off sent

the US dollar higher against most of the major and emerging market currencies. Follow-through

US dollar gains today has been mostly limited to the Australian dollar, where...

Read More »

Read More »

Swiss Central Bank Payment Vision Outlining Focus on DLT, Tokenization and Instant Payments

The Swiss National Bank (SNB) has shared how it intends to “future-proof” the domestic payment ecosystem, outlining its ambition to leverage technologies and processes including tokenization and distributed ledger technology (DLT) to establish an “efficient, reliable and secure ecosystem” that’s geared towards “the future of cashless payments in Switzerland,” SNB governing board member, Andréa Maechler, said during an event on March 30, 2023.

The...

Read More »

Read More »

Credit Suisse and the War Against Swiss Culture

I hope you will enjoy my latest interview with Maneco64.

[embedded content]

Claudio Grass, Hünenberg See, Switzerland

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »

Read More »

Firmer Rates and Higher Bank Stocks Give the Greenback Little Help

Overview: Financial strains eased yesterday, and

short-term yields jumped. The two-year US yield jumped 25 bp to pierce 4%. Yet,

the dollar fell against most of the major currencies yesterday and is mostly

softer today. Banking stress is ebbing. The Topix bank index snapped a

three-day decline and jumped nearly 2% today to recoup the lion's share of its

three-day decline. The Stoxx 600 index of EMU banks is extending yesterday's

1,7% advance. The...

Read More »

Read More »