Tag Archive: central-banks

SNB’s Jordan: I’m not sure whether if the terminal rate has been reached

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Read More »

Read More »

CHF traders take note – SNB Chair Jordan is speaking on Tuesday

High risk warning:

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks...

Read More »

Read More »

Week Ahead: Thumbnail Sketch of Central Bank Meetings

The

week ahead is dominated by central bank meetings. Six of the G10 central banks

meets. The post-Covid monetary tightening cycle is ending. The start was not

synchronized, and neither will be end. It is tempting to think that those that

began the tightening cycle early will among the first to finish. Among emerging

markets that is true for Brazil and Chile, both of whom have begun cutting

rates. And Brazil is likely to deliver the second cut in...

Read More »

Read More »

China’s Measures Begin to Find Traction, US Employment Report on Tap

Overview: Beijing's seemingly steady stream of

measures to support the economy and steady the yuan are beginning to produce

the desired effect. The yuan is snapping a four-week decline and the CSI 300

halted a three-week drop. Some economists estimate that the bevy of measures

may be worth as much as 1% for GDP. The dollar is narrowly mixed ahead of the

US employment data, which is expected to see the pace of job growth slow to

around 170k. Of...

Read More »

Read More »

While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention!

A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight:

ECB Knot: ECB can be expected to keep raising rates for quite some time after March

ECB can be expected to keep raising rates for quite some time after March

And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again

We can use interest rates but also sell foreign...

Read More »

Read More »

Your Wealth Will Save Central Banks!

Today we ask, what is wealth? As we start a new year many will be looking at their portfolios and wondering what 2023 will have in store for them. Similar to 2022, we suspect there will be a lot of unknowns.

As with anything unforeseen, it’s a good idea to have some insurance. This is why there were record levels of gold buying last year, and we expect the same in the coming months; because people want to protect their wealth with the...

Read More »

Read More »

Week Ahead: Highlights include Fed, US CPI; ECB, BoE, SNB, Norges Bank

MON: UK GDP Estimate (Oct), Chinese M2/New Yuan Loans (Nov).TUE: OPEC MOMR; BoE Financial Stability Report; German CPI Final (Nov), UK

Unemployment Rate (Oct)/Claimant Count (Nov), EZ ZEW (Dec), US CPI (Nov),

Japanese Tankan (Q4), New Zealand Current Account (Q3).WED: FOMC Policy Announcement, IEA OMR; UK CPI (Nov), Swedish CPIF (Nov), EZ

Industrial Production (Oct), US Export/Import Prices (Nov), Japanese

Exports/Imports (Nov).THU: ECB, BoE,...

Read More »

Read More »

Barclays forecasts EURCHF trading around parity for the next few quarters

Barclays Research discusses CHF outlook and targets EUR/CHF around 0.97, 0.97, 0.98, and 1.00 by end of Q1, Q2, Q3, and Q4 of next year respectively.

Read More »

Read More »

SNB’s Jordan: Monetary policy is is still expansionary

SNB's Jordan, who has been chatting more in the NY session at least of late, is no the wires saying:monetary policy is a still expansionarywe have most likely to adjust monetary policy againinflation is very thorny and there is still a risk that inflation will rise furtherinflation rate is above our target now.

Read More »

Read More »

SNBs Jordan: IN 2023, sees Swiss growth weaker than this year. USDCHF trades near lows.

SNB's Jordan is on the wires saying that:He sees weaker growth in 2023 than this year.SNB still has credibility that inflation will moderateInflation has broadenedSees limited 2nd round wage effects in SwitzerlandThere is a great probablility that SNB will need to further tighten monetary policy.

Read More »

Read More »

Federal Reserve speakers coming up on Wednesday, 9 November 2022 – Williams, Barkin

The talking heads at the US Federal Reserve have pivoted to talking about how high rates will go before they top out as against how quickly they will rise.

Read More »

Read More »

Is Central Banks’ License to Print Money About to Expire?

One of the biggest reasons for people deciding to buy gold bars or to own silver coins is because of the folly of central banks and government. It seems bizarre to most people that we are all aware that money doesn’t grow on trees and yet those responsible for financial stability have forgotten this basic life-lesson.

Read More »

Read More »

SNB’s Jordan: Central Bank Independence is crucial to fight inflation effectively

SNB Jordan is on the wires speaks in general terms:

Central bank independence is crucial to fight inflation effectively.

Read More »

Read More »

CHF traders – heads up for a SNB speaker Wednesday, 5 October 2022 – Maechler

Swiss National Bank monetary policymaker Andrea Maechler is speaking at 1130 GMT, at an event titled: After the interest rate change: high inflation, rising interest. How will it affect the Swiss economy?

Read More »

Read More »

Swiss National Bank meet this week – Goldman Sachs says “We are bullish on the CHF”

Goldman Sachs maintains a bullish bias on CHF going into this week's SNB policy meeting.

Read More »

Read More »

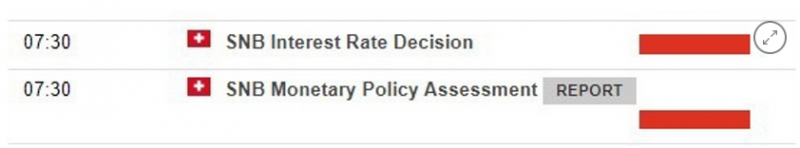

Swiss National Bank monetary policy meeting preview

The SNB announcement is due on Thursday at 0730 GMT. -This in brief via Standard Chartered:expect SNB to hike by 100bpStan Chart were at +50bp but have ramped their expectation much higher.

Read More »

Read More »

This Will Be The Biggest Theft of This Century

2023-02-10

by Stephen Flood

2023-02-10

Read More »