Tag Archive: central-banks

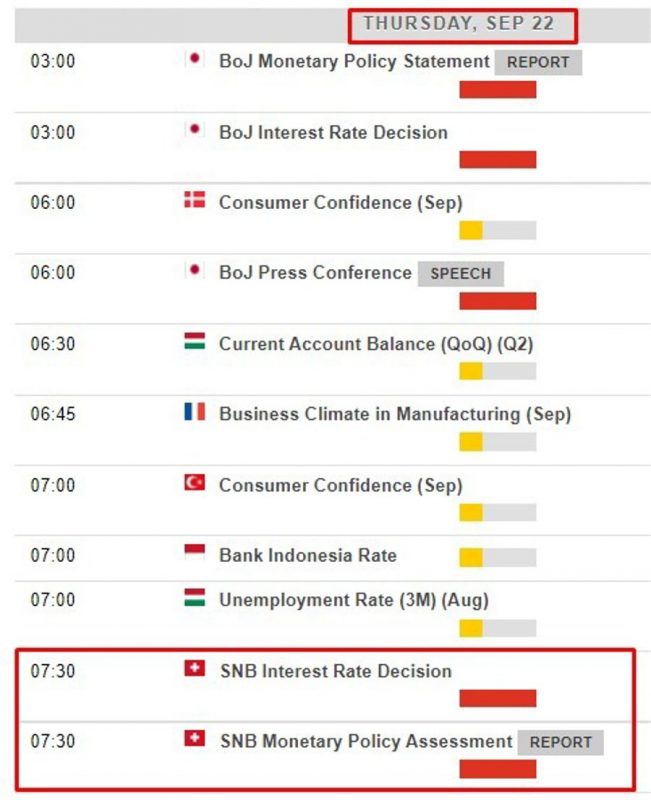

Swiss National Bank meet this week, a 100bp rate hike on the table – CHF impact

The SNB policy decision is due on Thursday. Via MUFG Bank:CHF has been the top performing G10 currency so far this month as it has strengthened sharply against both the EUR (+2.2%) and USD (+1.5%). It has regained upward momentum against our equally-weighted basket of other G10 currencies after a period of consolidation at higher levels between July and August.

Read More »

Read More »

Week Ahead Preview: FOMC is the highlight

MON: Japanese Respect for the Aged Day; EZ Construction Prices (Jul), Canadian Producer Prices (Aug), German Producer Prices (Aug). TUE: Chinese LPR, Riksbank Policy Announcement, RBA Minutes (Sep); Japanese CPI (Aug), EZ Current Account (Jul), US Building Permits/Housing Starts (Aug), Canadian CPI (Aug).

Read More »

Read More »

BOC’s Rogers: We are not where we were in July, but a long way from where we need to be

Bank of Canada's Senior Deputy Gov. Carolyn Rogers: We are not where we were in July, but we are a long way from where we need to be.

Read More »

Read More »

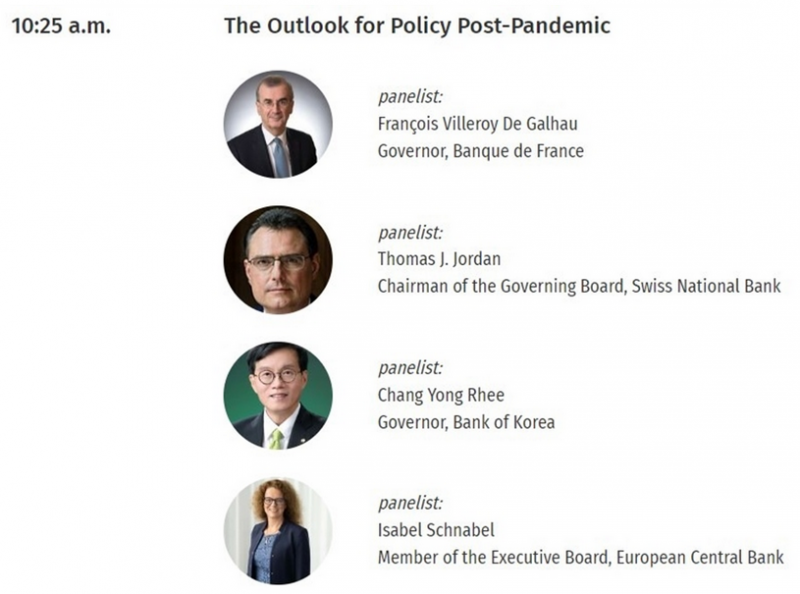

More from SNB’s Jordan: No comment on currency invention. We don’t rule anything out

Looks at series of models to gauge Swiss francs value; market has to live with some volatility, no comment on currency intervention.

Read More »

Read More »

SNB’s Jordan: We must ensure price stability over medium-term

SNB's Jordan is on the wires after the ECB hike rates by 75 basis points today:

ECB 75 basis point rate hike not fully surprising.

Read More »

Read More »

FX intervention watch – Swiss National Bank edition – too early for the CHF

This via the folks at eFX.

Credit Agricole CIB Research argues that it would be premature for the SNB to resume its intervention against CHF strength around current levels.

Read More »

Read More »

Swiss National Bank President Jordan warned of persistently higher inflationary pressure

Swiss National Bank President Thomas Jordan spoke at the Federal Reserve’s annual Jackson Hole symposium on Saturday.“Structural factors such as the transition to a greener economy, rising sovereign debt worldwide, the demographic transition and ultimately also the fact that globalization appears to have peaked -- at least temporarily -- could lead to persistently higher inflationary pressure in the coming years”

Read More »

Read More »

Newsquawk Week Ahead – Highlights: US jobs report, ISM; China PMIs; EZ inflation

The US jobs report and ISM data will be key in shaping expectations for the September 21st FOMC meeting. MON: EU Defence Ministers Meeting (1/2), UK Summer Bank Holiday; Australian Retail Sales (Jul), Swedish Trade Balance (Jul).

Read More »

Read More »

Heads up for ECB, SNB, BoK speakers over the weekend

On Saturday at the Jackson Hole symposium there will be speakers from the European Central Bank, Swiss National Bank and Bank of Korea.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

SNBs Maechler will not hesitate to raise rates if inflation remains outside the target

The SNBs Andrea Maechler in a newspaper article has said:The SNB will not hesitate to increase interest rates if inflation remains outside of the target.

Read More »

Read More »

Central Banks…Why Bother?

Central banks…why bother? Inflation is here and it cannot be contained. US inflation is touching a 40-year high, the UK has hit the 40-year high, and the EU’s has already hit an all-time high.

Read More »

Read More »

SNB’s Jordan: Inflation will temporarily rise above target then fall quickly

We take into account the higher inflation rates abroad when deciding monetary policy. We are ready to intervene in FX when necessary. Negative rates and currency interventions necessary for SNB to meet its mandate.

Read More »

Read More »

Martin Schlegel appointed to SNB

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose.

Read More »

Read More »

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

2022-09-10

by Stephen Flood

2022-09-10

Read More »