Tag Archive: central-banks

Central Banks on a Preset Course Reduces Significance of High-Frequency Data

Arguably the most important data next week is the flash PMI. It is not available for all countries, but for those generally large G10 economies, the preliminary estimate is often sufficiently close to the final reading to steal its thunder.

Read More »

Read More »

SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

Vulnerabilities have increased and Swiss real estate market. Swiss apartments overvalued by 10% to 35%. SNB continues to monitor developments in real estate market. It is not roll of monetary policy to curb risk to financial system. The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304.

Read More »

Read More »

SNB introduces possibility of repo rate transactions being indexed to policy rate

This will be added to the SNB's monetary policy repertoire moving forward but not before some test operations are conducted. For the time being, the central bank implements monetary policy by setting the SNB policy rate so this just adds to the tools they can play around with. However, I still see the key policy rate as being the main weapon in the armory.

Read More »

Read More »

SNB says remains prepared to intervene in FX market if necessary

Franc is currently sought after as a refuge currency. Franc appreciation also reflects inflation differential between Switzerland and other countries. The franc continues to be highly valued SNB looks at overall currency situationIndividual currency pairs do not play a special role. Some verbal intervention there by the SNB but in typical cases for the franc, actions speak louder than words.

Read More »

Read More »

SNB Jordan: Strong Swiss Franc limits Swiss inflation

SNBs JordanStrong CHF limits swiss inflation

See no sign swiss wage price cycle

Inflation stubbornly above 2% would lead to policy tightening

Difficult to say whether global rates have turned, much still depend on economic development

CHF has remained stable in real termsAsked about real estate prices, Jordan says monetary policy aims primarily at price stabilityThe SNB is not investing in crypto currencies

The USDCHF has moved...

Read More »

Read More »

SNB says successfully tested use of digital currency to settle transactions with top investment banks

The latest trial could see the introduction of central bank digital currency move a step closer in Switzerland. The SNB says that they integrated the digital currencies into payment systems and used them in simulated transactions involving UBS, Credit Suisse, Goldman Sachs, and Citigroup.

Read More »

Read More »

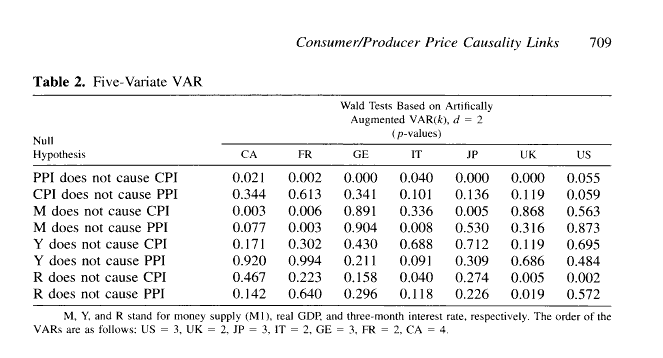

Testing The Supply Chain Inflation Hypothesis The Real Money Way

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

Why Do Central Banks Want Higher Inflation?

Why do Central Banks want higher inflation? The debt ceiling debate in U.S. Congress and related political nonsense brings even more to light the exponential growth in US federal government debt. US government debt has doubled in the 10 years since the last major debacle Congress created over raising the debt ceiling back 2011.

Read More »

Read More »

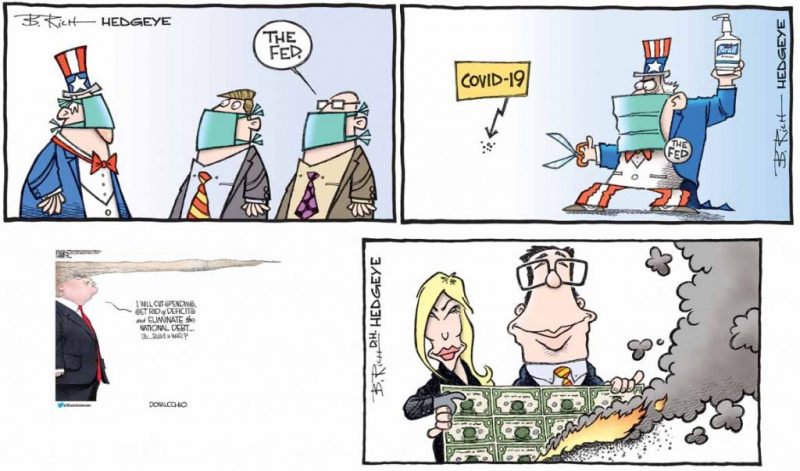

Quantitative Easing: A Boon or Curse?

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis.

However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic.

As economies recovered after the...

Read More »

Read More »

FX Daily, January 21: It is the ECB’s Turn but Little New to be Said or Done

Overview: The S&P 500 and NASDAQ gapped higher yesterday to record-levels, and the reflation theme lifted Asia Pacific shares for the third session today. South Korea, Taiwan, and China led the advance.

Read More »

Read More »

October Monthly

After falling in July and August, the US dollar strengthened against most of the major currencies in September. The dramatic pullback in equities seemed to have undergirded the yen's resilience, which gained a net 0.25% against the dollar.

Read More »

Read More »

Game Over Spending

Coming and Going Like a Wildfire. Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace.

Read More »

Read More »

US Money Supply – The Pandemic Moonshot

Printing Until the Cows Come Home… It started out with Jay Powell planting a happy little money tree in 2019 to keep the repo market from suffering a terminal seizure. This essentially led to a restoration of the status quo ante “QT” (the mythical beast known as “quantitative tightening” that was briefly glimpsed in 2018/19). Thus the roach motel theory of QE was confirmed: once a central bank resorts to QE, a return to “standard monetary policy”...

Read More »

Read More »

FX Daily, March 2: Central Banks’ Words of Assurance have Short Life

Overview: Comments beginning with Powell before the weekend, and BOJ and BOE earlier today promising support have saw equity markets briefly stabilize after last week's dramatic moves. The G7 will hold a teleconference this week, but speculation of a coordinated rate move does not seem particularly likely. Most of the large stock markets in the Asia Pacific region rallied, led by a 3%+ advance in China.

Read More »

Read More »

Why Governments Hate Gold

2021-11-27

by Stephen Flood

2021-11-27

Read More »