Tag Archive: central-banks

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

SNBs Maechler will not hesitate to raise rates if inflation remains outside the target

The SNBs Andrea Maechler in a newspaper article has said:The SNB will not hesitate to increase interest rates if inflation remains outside of the target.

Read More »

Read More »

Central Banks…Why Bother?

Central banks…why bother? Inflation is here and it cannot be contained. US inflation is touching a 40-year high, the UK has hit the 40-year high, and the EU’s has already hit an all-time high.

Read More »

Read More »

SNB’s Jordan: Inflation will temporarily rise above target then fall quickly

We take into account the higher inflation rates abroad when deciding monetary policy. We are ready to intervene in FX when necessary. Negative rates and currency interventions necessary for SNB to meet its mandate.

Read More »

Read More »

Martin Schlegel appointed to SNB

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose.

Read More »

Read More »

Central Banks on a Preset Course Reduces Significance of High-Frequency Data

Arguably the most important data next week is the flash PMI. It is not available for all countries, but for those generally large G10 economies, the preliminary estimate is often sufficiently close to the final reading to steal its thunder.

Read More »

Read More »

SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

Vulnerabilities have increased and Swiss real estate market. Swiss apartments overvalued by 10% to 35%. SNB continues to monitor developments in real estate market. It is not roll of monetary policy to curb risk to financial system. The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304.

Read More »

Read More »

SNB introduces possibility of repo rate transactions being indexed to policy rate

This will be added to the SNB's monetary policy repertoire moving forward but not before some test operations are conducted. For the time being, the central bank implements monetary policy by setting the SNB policy rate so this just adds to the tools they can play around with. However, I still see the key policy rate as being the main weapon in the armory.

Read More »

Read More »

SNB says remains prepared to intervene in FX market if necessary

Franc is currently sought after as a refuge currency. Franc appreciation also reflects inflation differential between Switzerland and other countries. The franc continues to be highly valued SNB looks at overall currency situationIndividual currency pairs do not play a special role. Some verbal intervention there by the SNB but in typical cases for the franc, actions speak louder than words.

Read More »

Read More »

SNB Jordan: Strong Swiss Franc limits Swiss inflation

SNBs JordanStrong CHF limits swiss inflation

See no sign swiss wage price cycle

Inflation stubbornly above 2% would lead to policy tightening

Difficult to say whether global rates have turned, much still depend on economic development

CHF has remained stable in real termsAsked about real estate prices, Jordan says monetary policy aims primarily at price stabilityThe SNB is not investing in crypto currencies

The USDCHF has moved...

Read More »

Read More »

SNB says successfully tested use of digital currency to settle transactions with top investment banks

The latest trial could see the introduction of central bank digital currency move a step closer in Switzerland. The SNB says that they integrated the digital currencies into payment systems and used them in simulated transactions involving UBS, Credit Suisse, Goldman Sachs, and Citigroup.

Read More »

Read More »

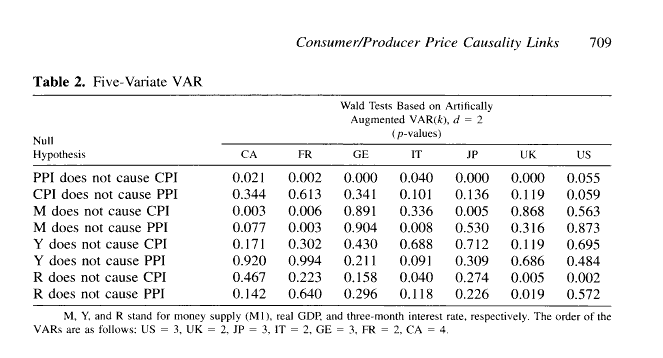

Testing The Supply Chain Inflation Hypothesis The Real Money Way

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

Why Do Central Banks Want Higher Inflation?

Why do Central Banks want higher inflation? The debt ceiling debate in U.S. Congress and related political nonsense brings even more to light the exponential growth in US federal government debt. US government debt has doubled in the 10 years since the last major debacle Congress created over raising the debt ceiling back 2011.

Read More »

Read More »

Inflation is now out of the control of central banks

2022-07-01

by Stephen Flood

2022-07-01

Read More »