| Following the seemingly endless procession of short-squeeze-fueling trial balloons last week – from settlement rumors to German blue-chip bailouts to Qatari investors – Germany’s Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department. |

. |

| Having soared over 25% off the briefly single-digit price levels thanks to well-chosen rumor headlines of an “imminent settlement”, news and facts on Friday started to eat away at that confidence…

And now, as Bloomberg reports, Deutsche Bank’s Chief Executive Officer John Cryan failed to reach an agreement with the U.S. Justice Department to resolve a years-long investigation into its mortgage-bond dealings during a meeting in Washington Friday, Germany’s Bild newspaper reported.

The meeting was meant to negotiate the multi-billion-dollar settlement the bank will have to pay to resolve alleged misconduct arising from its dealings in residential-mortgage backed securities that led to the 2008 financial crisis, according to a Bild am Sonntag report.

The German lender is still considering seeking damages against Anshu Jain and Josef Ackermann, who are both former CEOs of the bank, the newspaper reported. Bild said the bank froze part of the millions in bonus payments to Jain and other former top managers.

A Deutsche Bank spokeswoman declined to comment to Bild about the outcome of Cryan’s Friday discussion or about clawing back former executives’ compensation. Mark Abueg, a Justice Department spokesman, declined to comment.

Cryan, a Briton who speaks fluent German, has sought for the last three weeks to reassure investors that Deutsche Bank can weather the formidable obstacles to its financial health. His arsenal of strawmen include: denials of bailouts, blaming speculators, rumors of informal capital raising talks with Wall Street firms, rumors of capital injections from Germany’s blue-chip corporations, rumors (denied) of Qatari sovereign wealth fund investments, and the sale of key assets and elimination of thousands of jobs. |

. |

So what happens next?

Three things:

1) The “settlement-imminent”-driven 25% short-squeeze in stocks – completely decoupled from credit market’s less optimistic perspective – is going to end badly… |

. |

2) Deutsche Bank will need to raise more capital and that just became more problematic after the bank quietly raised $3bn in a senior unsecured bond issue on Friday at a very wide concession…

Some have wondered why the need to sell new paper at such a wide concession: after all as we reported before, DB has no current liquidity constraints courtesy of substantial ECB generosity, which backstop DB’s existing liquidity reserves of just over €200 billion.

… while issuing debt does nothing for the bank’s net leverage, and in fact could lead to an erosion of certain credit metrics.

If anything, the push to obtain cash may be seen by some as an indication that management is taking advantage of the recent stock price rebound window to offload securities to investors, which alone could lead to more pressure on the bank.

After all, the question immediately emerges: “does DB know something investors don’t?.”

|

. |

3) A “bail-in” is more likely than a ‘bailout’, and as we detailed earlier, and here’s how it can be done… Jonathan Rochford, PM of Australian hedge fund Narrow Road Capital, explains that despite all the recent confidence-building rhetoric and posturing, Deutsche Bank will need a bail-in. In the following analysis he explains how it would (and should) be done.

Following the confirmation that hedge funds have started to reduce their capital and trading with Deutsche Bank its position is now perilous. It is correct to say that Deutsche Bank doesn’t have a liquidity crisis and that even if it did the Bundesbank could provide it with unlimited liquidity. But liquidity alone doesn’t guarantee a bank can continue to operate in the long term, solvency and profitability are essential as well. Deutsche Bank is at best borderline for both solvency and profitability with little prospect of either improving materially in the medium term. Deutsche Bank needs to substantially restructure its business activities and balance sheet, both of those will take time and capital neither of which Deutsche Bank has.

Insufficient Capital

Unlike other global banks Deutsche Bank has failed to adequately lift its capital levels since the collapse of Lehman Brothers eight years ago. It has been allowed to remain undercapitalised due to weak European regulators, which are fighting against global efforts to have all banks increase capital levels. Whilst German and Italian regulators are fighting for lower capital levels and avoiding dealing with their problem banks Switzerland and the US are implementing much higher capital levels, particularly for the largest banks.

On Deutsche Bank’s preferred measure, risk weighted assets, it sits behind most of its peers. That’s after it has gone through a capital optimisation exercise which reduced risk weighted assets without reducing their balance sheet by the same proportion. On the more rigorous leverage ratio shown below, Deutsche Bank is dead last at less than half of its peer group average. When Europe’s most systemically important bank is the most poorly capitalised of its peer group that is a major problem that needs to be corrected as soon as possible.

|

Source: FDIC. |

Deutsche Bank’s current equity at book value is €61.9 billion but its market capitalisation is only €15.8 billion. Its total assets are 114.3 times its market capitalisation and its price to book ratio is 25.5%. The only peers with ratios this bad are Italian banks who have dubious solvency and very high levels of non-performing loans. To get from the 2.68% tier one capital ratio shown above to the 5% leverage ratio many consider the minimum acceptable level requires €40.1 billion of new equity.

Not Profitable

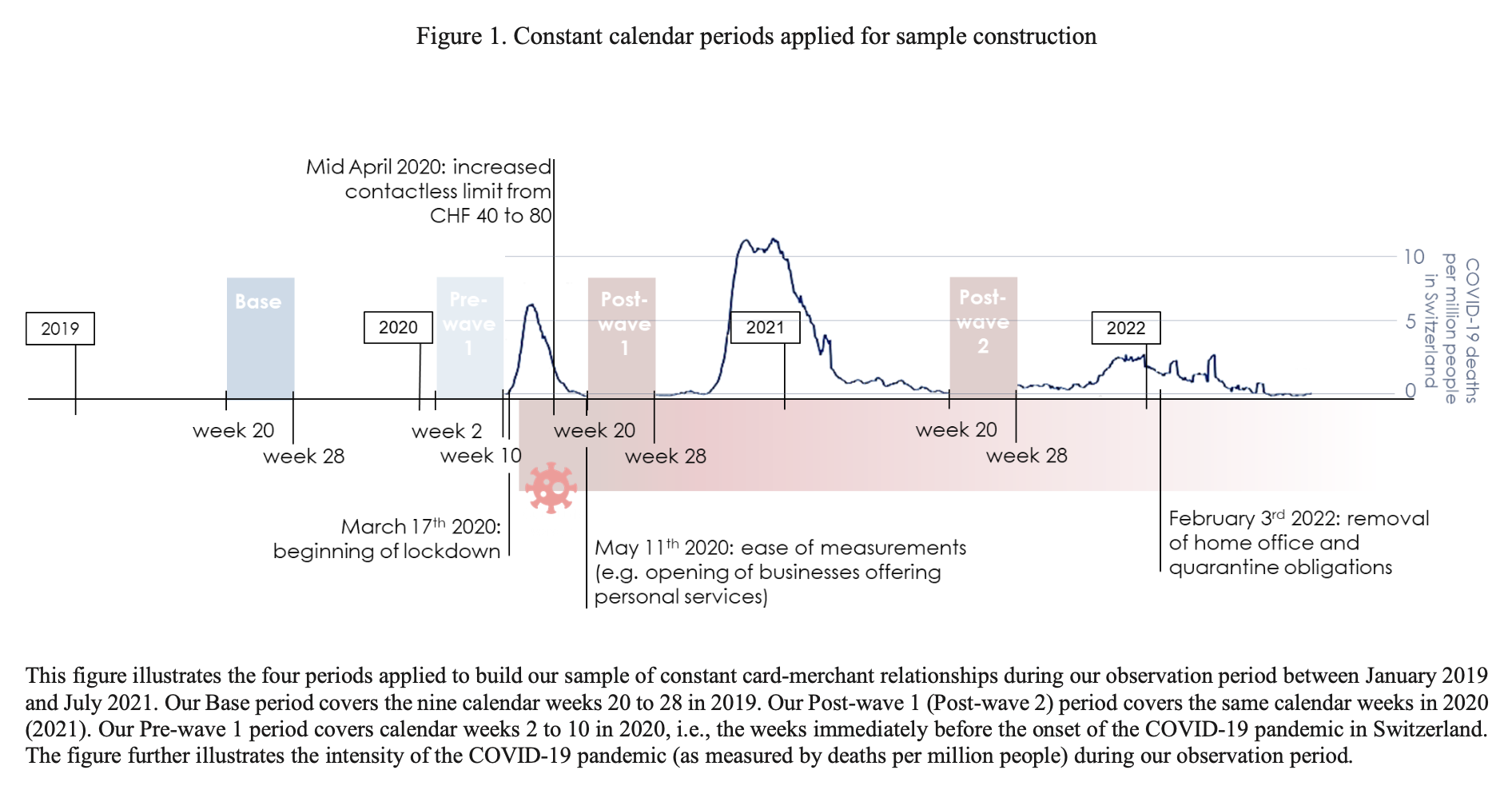

There are three primary ways for a bank to increase its capital. Firstly, profits can be retained rather than paid out as dividends. Deutsche Bank hasn’t been meaningfully profitable since 2011. The table below shows the net income after taxes for Deutsche Bank since 2009. The combined total of the last seven and half years is €7.8 billion, an average of €1.04 billion per year. That equates to a return on equity of 1.68% since 2009. Over the last four and a half years the cumulative loss is €3.8 billion with the average return on equity -1.38%.

The CEO has stated that 2016 will be a peak year for restructuring, meaning investors should expect a loss for 2016. The fine being negotiated with the US Department of Justice will have a significant impact this year. Further fines for new scandals, the difficulties of operating in a negative interest rate environment and the potential for another European or global downturn mean there is a material risk of losses continuing in future years. Given sufficient time and capital Deutsche Bank would restructure substantially, ridding itself of unprofitable and low return activities. Unfortunately, it has squandered the opportunities it had over the last eight years and now doesn’t have either the time or capital needed to facilitate the necessary cuts.

|

. |

Assets Sales Not Sufficient

The second way to raise capital is to sell assets and Deutsche Bank is making a great deal of noise about its asset sale plans. The sales of the UK and Chinese insurance businesses will together raise approximately €4.5 billion. A sale of the asset management business might raise €10 billion. Altogether that’s €14.5 billion which is helpful but not nearly enough. The flipside of asset sales is that future profits are reduced, exacerbating the profitability issues already outlined.

Sufficiently Large Capital Raising Near Impossible

The third way a bank can strengthen its balance sheet is by conducting a capital raising. The problem for Deutsche Bank is that the amount needed is simply too high based on the current metrics. Any investment banker will tell you raising 254% of market capitalisation is extremely optimistic. To achieve that for a business with a history of being marginally profitable is near on impossible.

A Bailout or Bail-in is Needed

Taking into account the lack of capital and the very unlikely prospects for an equity raising or asset sales to be sufficient, Deutsche Bank needs either a bailout or a bail-in. A bailout by the German government is legally possible given the gaps in the regulation that can be exploited. The key question is whether the German government would be willing to do so. In recent years Angela Merkel and her key ministers have consistently denounced the possibility of the Italian government providing a bailout to Italian banks. In recent months they have been adamant they won’t bailout Deutsche Bank.

I’m cynical enough to know that politicians can change their minds extremely quickly when the pressure is on. I acknowledge there is a decent chance that the German government will do that soon. What the rest of this article aims to show is that there is a way to recapitalise Deutsche Bank without taxpayer funds. If there’s a decent solution that doesn’t involve taxpayer funds I think that solution can win out.

Bail-in Mechanics

The recently introduced European regulations lay out a framework for how a bail-in would work. Equity, additional tier 1 securities (Coco’s or hybrids) and subordinated debt can be written off completely if the bank is declared non-viable. Senior debt, particularly that provided by large institutions can also be converted to equity in order to lift reserves. By undertaking a combination of those two processes Deutsche Bank’s undercapitalisation could be quickly rectified.

The table below lays out the liabilities and equity on Deutsche Bank’s balance sheet. Equity, additional tier 1 and subordinated debt securities are broken out. Senior debt has been broken into two categories, the portion which could be expected to be bailed-in and that where it is uncertain. For the purpose of this exercise a conservative approach has been taken, the amount that could be bailed-in is likely much larger.

|

. |

How Much More Capital is Needed?

In determining how much additional capital is needed a target capital level must be chosen. If a bail-in is executed it needs to be a one-time exercise that removes all concerns about Deutsche Bank’s solvency. Lifting the core equity tier 1 ratio just to the average level of its peers is not enough, it must go much further.

A core equity tier one leverage ratio of 9% would lift Deutsche Bank to the top of the list amongst its global peers. This would provide strong reassurance that another bail-in won’t be needed. It would also provide breathing room to undertake the overdue restructuring of unprofitable and marginal businesses. At a 9% level, another €111.5 billion of tangible equity is required. This would come from the write-off of additional tier 1, subordinated debt and €98.5 billion of senior debt being converted to equity. This implies that 63.1% of the senior debt able to be bailed-in needs to be converted to equity.

For every €100 they are currently owed bailed-in senior debt holders would receive €36.90 in new senior debt as well as material value in new equity. To assist the transition, the regulators and Deutsche Bank should work together to see that those who receive new equity can be offered a transparent and orderly means to sell down those shares. Whilst Deutsche Bank could theoretically just restart trading after the new shares were issued, relisting without an opportunity for new shareholders to sell down to more natural equity owners could be substantially disorderly and may result in much greater losses in value and confidence in banks than would otherwise be the case.

Potential Capital Sell-Down Process

There’s two types of approach that could help facilitate the sale of shares by those who are seeking to exit; a rights issue model and an IPO model. The table below summarises some of the different features of each that could apply in the case of a Deutsche Bank bail-in.

The rights issue model is the most efficient, but it doesn’t allow for Deutsche Bank management to prepare a solid pitch to potential new investors. Management would have only a few days to develop their strategy for making the bank profitable again and limited time to explain that to the many large global investors that may want to buy shares. The IPO model takes longer, but would allow management to put forward a clear plan on what businesses it will exit, what that will cost and the additional profitability that could be generated over time. The downside of the additional time is that it increases the potential for contagion to other banks as investors remain unsure of what recovery they will receive on their new shares for a longer period. Allowing over the counter trading to continue on senior debt would allay some of these concerns.

As a guide to the possible recovery for bailed-in senior debt, other European banks were generally trading at 0.5 to 1.0 times book value in early September. This implies the new equity is worth €89.2 – €178.4 billion. When combined with the new senior debt of €57.5 billion this a total recovery of 94.0% – 151.1% on the old senior debt. If an IPO process was used this would open up the opportunity for the old subordinated debt, additional tier 1 and equity owners to receive some value. If a bookbuild ended up realising more than a 100% recovery for senior debt holders, which is reached if the price to book is 0.55 or above, the additional value could be allocated to the subordinated capital owners via the natural order of priority. This process would largely eliminate arguments that value wasn’t maximised, neutering the possibility of ongoing litigation as has been the case with Fannie Mae and Freddie Mac.

|

. |

Conclusion

Deutsche Bank’s position is currently marginal as it is woefully undercapitalised and has no clear prospect of becoming meaningfully profitable. As the world’s largest derivative trader and Europe’s most systemically important bank this is untenable. Deutsche Bank is three times larger than Lehman Brothers, making the possibility of an unexpected and uncoordinated failure completely unacceptable. Deutsche Bank needs substantial time and capital to execute a turnaround, neither of which it now has. It does not have the profitability to grow its capital base quickly or to support a capital raising of the size it needs. Deutsche Bank needs either a bail-in or a bailout.

An orderly bail-in process would deliver Deutsche Bank the additional time and capital it needs. In the first instance, the bank should be declared non-viable with all equity, additional tier 1 and subordinated debt written off. By converting 63.1% of long term senior debt to new equity the leverage ratio would increase to an unquestionably strong 9%. Based on recent peer comparisons, bailed-in senior debt holders would receive a recovery of at least 94% of their current position. Using an IPO model, where management develops and presents a new strategy to potential investors over a 2-3 month period, would allow the recipients of newly issued equity an orderly process to sell-down their equity. It also creates the possibility of a substantial recovery for subordinated debt, additional tier 1 and equity investors.

* * *

If the Lehman playbook continues to play out as it has done – denials of any problems… blame speculators… unleash short-squeeze on heels of rumors of foreign sovereign wealth fund investments… and finally acceptance – this will not end well…

Perhaps it’s time once again to listen to DoubleLine’s Jeff Gundlach, whose advice was simple: don’t touch it. “I would just stay away. It’s un-analyzable,” Gundlach said about Deutsche Bank shares and debt. “It’s too binary.”

|

. |