Tag Archive: newslettersent

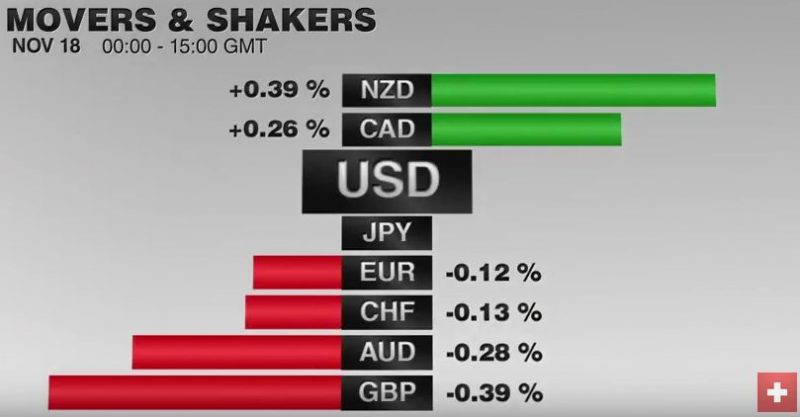

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

China fines Swiss-based packager Tetra Pak for breaking monopoly rules

According to Reuters, following an investigation, China’s State Administration for Industry and Commerce (SAIC) said, it found out that Tetra Pak violated some provisions in China’s anti-trust law and will impose a fine of 668 million yuan ($97 million) on Tetra Pak for “abuse of dominant market position”.

Read More »

Read More »

Swisscom promises to put an end to unwanted sales calls

Swisscom’s fixed line (remember those) customers will be given the option of blocking unwanted calls from 28 November. The service will be free and can be activated by checking a box online or by calling the Swisscom hotline (0800 800 800). Sunrise and UPC are expected to follow Swisscom by mid 2017, according to 24 Heures.

Read More »

Read More »

Are Emerging Markets Still “A Thing”?

Last week I jumped on a call with an old friend Thomas Hugger who I hadn't spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think about it.

Read More »

Read More »

You’ll Only Understand Trump and Brexit If You Understand the Failure of Globalization

You can only understand the victory of Donald Trump and Brexit once you understand the failure of globalization… Trump made rejection of globalization a centerpiece of his campaign. In his July 21st acceptance speech as the Republican nominee, he said: Americanism, not globalism, will be our credo.

Read More »

Read More »

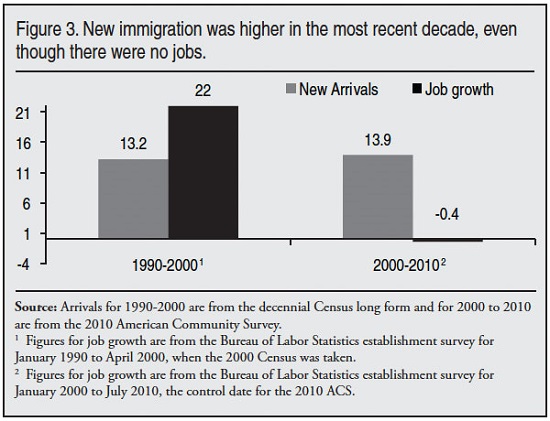

Rising Immigration but no Jobs

The list of pundits jostling for air time to add their two cents to discussions of hot-button issues such as immigration is endless. The airwaves and social media are overflowing with people wanting to comment on hot-button social issues, but when it comes to the the one truly critical dynamic that will shape the future--everyone's strangely silent.

Read More »

Read More »

Swiss National Bank won’t cut record low interest rate again, survey shows

The Swiss National Bank, which has the lowest interest rate among the world’s major central banks, may be done cutting. SNB President Thomas Jordan and his fellow policy makers will keep the deposit rate unchanged at minus 0.75 percent until at least the end of the first quarter of 2019, according to the median forecast in Bloomberg’s monthly survey of economists. That would mean ignoring the International Monetary Fund’s advice to fend off inflows...

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

Swiss Unemployment Rate (ILO-based) behind Iceland, Germany and Czech Republic on position 4: All Four Countries Are Currency Manipulators

With 4.8%, the Swiss unemployment rate based on the ILO concept is higher than the rates in Iceland (2.6%), Czech Republic (4.0%) and Germany (4.1%), but lower than the ones of the remaining 25 countries. As for youth unemployment, the Swiss are on position three with a rate of 11%, this is half the rate of the Eurozone, or a fourth of the rate in Spain or Greece.

Read More »

Read More »

Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new "fear...

Read More »

Read More »

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

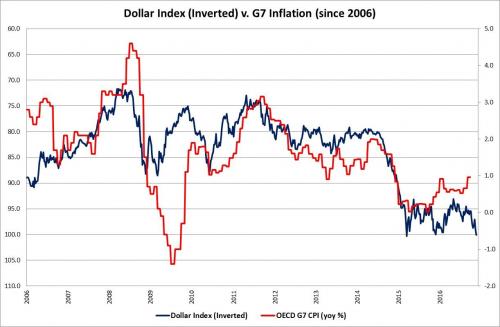

Inflation Expectations Rise Sharply

We have witnessed truly astonishing short term market conniptions following the Donald Trump’s election victory. In this post we want to focus on one aspect that seems to be exercising people quite a bit at present, namely the recent surge in inflation expectations reflected in the markets. Will we have to get those WIN buttons out again?

Read More »

Read More »

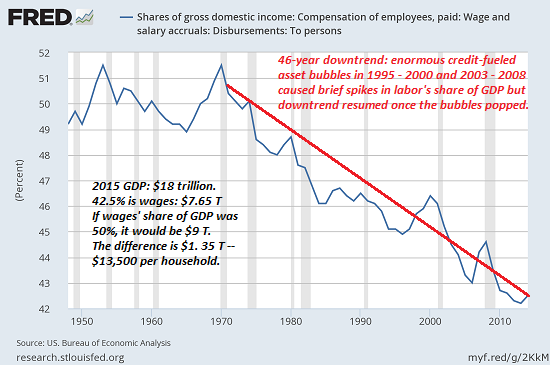

The Source of Trump’s Success: The Bigger and Bigger Wage Gap

There are many sources of rage: injustice, the destruction of truth, powerlessness. But if we had to identify the one key source of non-elite rage that cuts across all age, ethnicity, gender and regional boundaries, it is this: The Ruling Elite is protected from the destructive consequences of its predatory dominance.

Read More »

Read More »

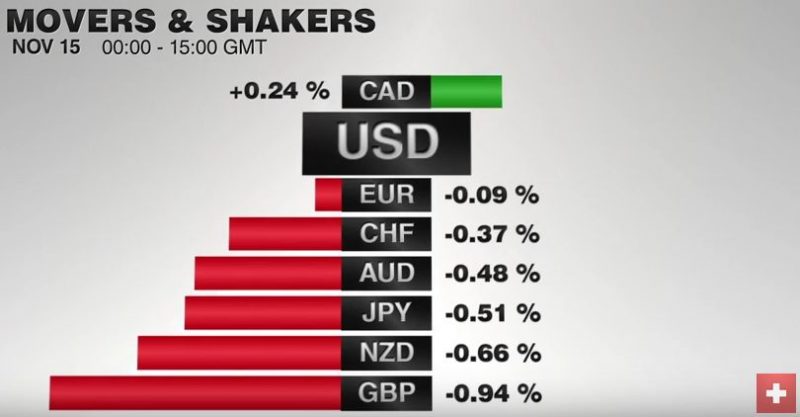

FX Daily, November 15: Investors Catch Breath, Markets Consolidate

After a dramatic run since the US election, the capital markets are consolidating today. It is a bit too restrained to such a Turn Around Tuesday is unfolding. The euro is struggling to sustain corrective upticks through $1.08, and after a pullback is, the greenback pushed back above the JPY108 level like a beach ball held under water.

Read More »

Read More »

Those with less are worth more in Schwyz than Geneva

Last Friday, the federal Swiss tax office published the latest statistics covering the wealth and earnings of the nation’s more than 5 million tax payers – Switzerland has wealth tax, so net worth is included in tax returns. The highest percentage of the very wealthiest (CHF 10 million plus) lived in Schwyz. Geneva also made the top five cantons in this category.

Read More »

Read More »

Great Graphic: Euro-the Big Picture

Most economists are focusing on either US monetary policy or US fiscal policy. We focus on the policy mix. After the policy mix, politics is also a weigh on the euro. Our long-term call is for the euro to revisit the lows from 2000.

Read More »

Read More »

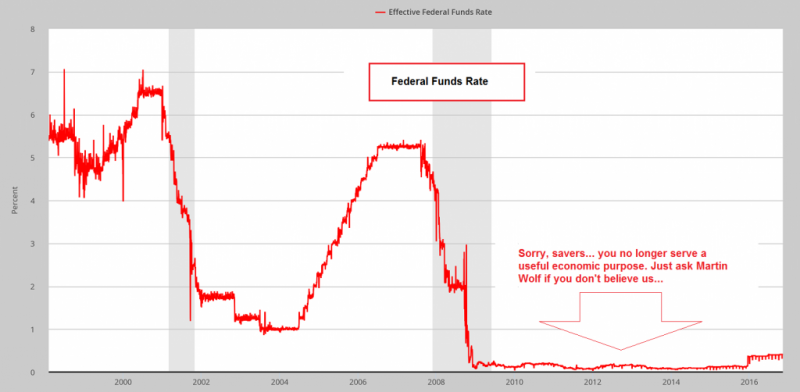

The Fed’s “Hothouse” Is in Danger

RHINEBECK, New York – It is a beautiful autumnal day here in upstate New York. The trees are red, brown, and yellow. Squirrels hop across the lawn, collecting their nuts. Unseasonably warm the last few days, rain showers are moving in from across the Hudson, driven by a chilly wind.

Read More »

Read More »