Tag Archive: newslettersent

Cool Video: Reiterate Bullish Dollar Call on Bloomberg

I was on Bloomberg TV this morning to weigh in on the dollar's rally. The US Dollar Index is flirting with the 100 area that has blocked side since last year. In my work, after a big run-up form around 80 in mid 2014, the Dollar Index has been consolidating. I have long anticipated a spring board for another leg up.

Read More »

Read More »

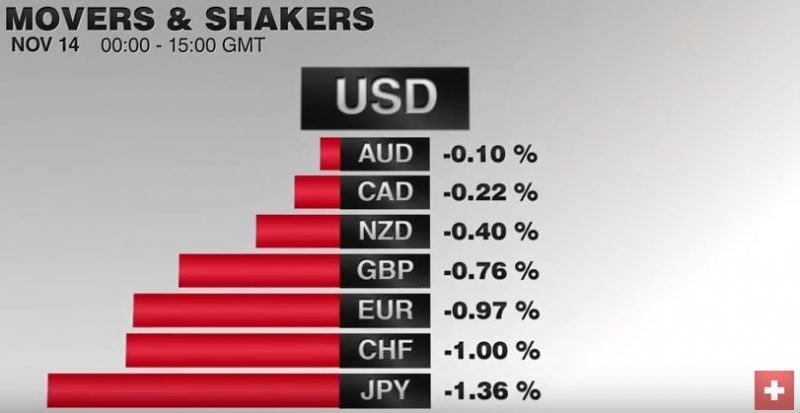

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

Swiss Producer and Import Price Index, October 2016: +0.1 percent MoM, -0.2 percent YoY

The Producer and Import Price Index rose in October 2016 by 0.1% compared with the previous month, reaching 99.8 points (base December 2015 = 100). While the Producer Price Index declined by 0.1%, the Import Price Index rose by 0.3%. The slight overall increase is due in particular to higher prices for petroleum products. Compared with October 2015, the price level of the whole range of domestic and imported products fell by 0.2%. These are the...

Read More »

Read More »

European break up now looks more likely, says Blond

If there’s one country with reason to resent the rise of populist movements, it’s Switzerland. Twenty-two months after it abandoned its 1.20-per-euro exchange-rate cap, the Swiss National Bank still finds the franc in focus every time there’s a major event that threatens to upset markets.

Read More »

Read More »

Serious Flaws in ECB’s Economic Thinking

Marc Meyer shows that the European Central Bank has big flaws in their economic thinking. Lowering the ECB Deposit Rate means depressing the economy. The ECB takes the risk when it buys Greek bonds. Should Greek bonds devalue then the ECB equity ratio falls under zero and European banks write must write-down their ECB Deposits.

Read More »

Read More »

FX Weekly Preview: Forces of Movement

US election results accelerated forces that were already present. Interest rates have appeared to bottom, fiscal stimulus in Canada and Japan already evident, and divergence between US and EMU/Japan monetary policy. US stimuli may reach when the economy is already near trend.

Read More »

Read More »

Great Graphic: Growth in Federal Spending

Federal spending growth under Obama is lower than under the previous four presidents. Subsequent to the chart, US federal spending has increased. It will likely increase more under the next President.

Read More »

Read More »

An English Breakfast Causes Less Indigestion than the British Brexit

Prime Minister May is appealing the High Court decision and preparing to present broad guidelines of her strategy. An early election; even if it could be arranged, it is not clear which wing of the Tories would win. May missed the opportunity to provide strong leadership when it was most needed.

Read More »

Read More »

Dissection of the Long-Term Asset Bubble

The Long Term Outlook for the Asset Bubble Due to strong internals, John Hussman has given the stock market rally since the February low the benefit of the doubt for a while. Lately he has returned to issuing warnings about the market’s potential to deliver a big negative surprise once it runs out of greater fools.

Read More »

Read More »

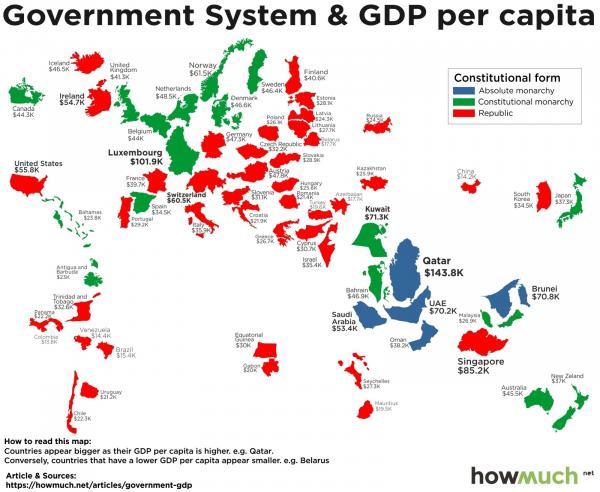

Which Government System Is The Best For People’s Wealth?

We have created a map which shows the per-capita GDP based upon the type of government in a country. The larger the country appears on the map, the higher the GDP per capita.

Read More »

Read More »

Great Graphic: Shifting Trade-Weighted Exchange Rates

The dollar's trade-weighted index is firming and a couple percentage points from the year's high set in January. The yen's trade-weighted index is at several month lows, but remains dramatically higher ear-to-date. The euro's trade-weighted index has begun falling amid concerns that it is the next focus for the anti-globalization/nationalism movement. Sterling's trade-weighted index is extending its recovery as a softer Brexit is anticipated, the...

Read More »

Read More »

Swiss National Bank agrees to pay out 1 billion francs annually

Today, the Swiss National Bank (SNB) announced a new agreement with the Federal Department of Finance, to pay the Swiss confederation and cantons CHF 1 billion per year, as was previously the case. The deal will run from 2016 to 2020, according to an official press release.

Read More »

Read More »

SMI: Trump win boosts pharma and financials

A rally in pharmaceutical and banking shares helped boost the Swiss Market Index this week as investors weighed the prospect of a Trump’ presidency in the United States. Stocks in the healthcare sector jumped after Donald Trump’s victory as drug pricing reforms, proposed by Hillary Clinton, are now unlikely to materialize.

Read More »

Read More »

Toward a New World Order, Part II

One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil.

Read More »

Read More »

Seven Suggestions for President-Elect Trump

Make sure your administration is as diverse as America. No single act will give your enemies more ammo than populating your cabinet and administration with the Usual Suspects: Caucasian elites from Ivy League universities. These privileged "experts" have bankrupted the nation financially, morally and spiritually while enriching themselves and their privileged cronies.

Read More »

Read More »

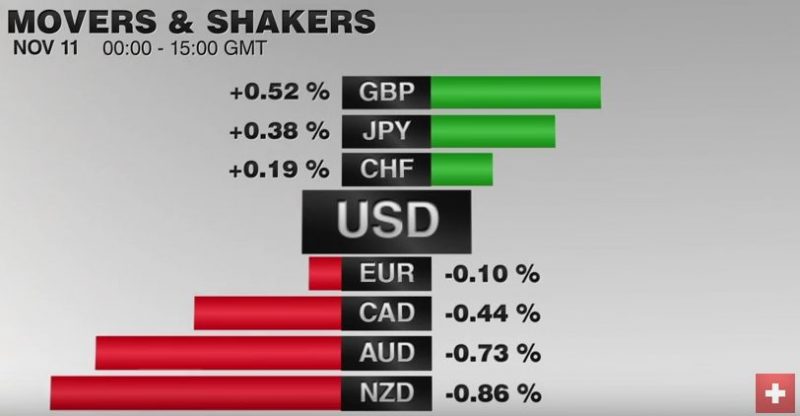

FX Daily, November 11: Ramifications of Trump’s Election Continue to Drive Markets

The forces unleashed by the US election results continue to drive the capitals markets. The combination of nationalism, reflation and deregulation are seen as good for US equities and the US dollar. It has not been so kind to US Treasuries, where the 10- and 30-year yield has risen about 32 bp this week coming into today's federal holiday that closes the bond market, while the stock market is open.

Read More »

Read More »

How Switzerland came top of the 2016 young worker’s index

Where you are born makes a big difference to the chances of getting a job when you leave school. In 2015, youth unemployment rates in some OECD countries such as Greece (49.8%), Spain (48.3%) and Italy (40.3%) were all close to 50%. In others such as Germany (7.2%), Austria (10.6%) and Switzerland (8.6%), youth unemployment was far lower. Why? The Young Workers Index 2016, an annual report by PWC, offers some insights.

Read More »

Read More »

Rising US Premium Lifts Dollar-Yen

US 10-year rate premium is the largest in 2.5 years. US 2-year premium is the most since Q4 2008. Japanese investors likely will be buying foreign bonds, while foreigners may see opportunities in Japanese stocks after being large sellers in the first 9 months of the year.

Read More »

Read More »

Toward a New World Order?

A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future.

Read More »

Read More »