Tag Archive: newslettersent

Canadian Bank Starts Charging Negative 0.75percent Rate On Most Foreign Cash Balances

Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada's most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most currencies, to match the deposit rate of Switzerland.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

Weekly Sight Deposits: Investors hedge against Trump’s inflationary policy with Swiss Franc.

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts - i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump would push for a more jobs and a dovish Fed, same as his fellow...

Read More »

Read More »

FX Daily, November 21: Flattish Consolidation Hides Dollar Strength

The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most...

Read More »

Read More »

FX Weekly Preview: Shifting Paradigms and the Market Adjustment

Perceptions of two trends shape the investment climate: reflation and nationalism. Fed rate hike set for next month, barring significant surprise. Japan's trade surplus is growing even as imports and exports continue to contract.

Read More »

Read More »

The Age of Disintegration: Political Disunity and Elites At War

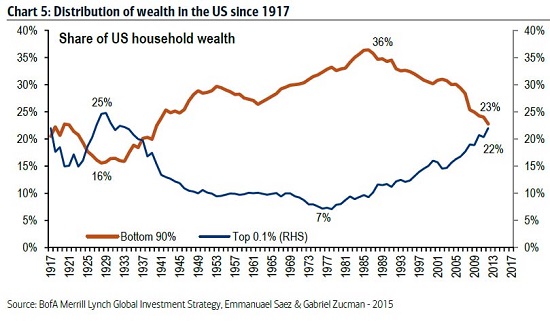

Historian Michael Grant identified profound political disunity in the ruling elite as a key cause of the dissolution of the Roman Empire. Grant described this dynamic in his excellent account The Fall of the Roman Empire. The chapter titles of the book illuminate the complex causes of profound political disunity in the ruling elite: The Gulfs Between the Classes: a.k.a. soaring income/wealth inequality: check.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a soft note, as higher US rates continue to take a toll. EM policymakers are getting more concerned about currency weakness, with Brazil, Malaysia, Korea, India, and Indonesia all taking action to help support their currencies. If the EM sell-off continues as we expect, more EM central banks are likely to act to slow the moves.

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

FX Weekly Review, November 14 – November 18: Best Dollar Weeks since Reagan

The US dollar has recorded its best two-week performance since Reagan was President. The weeks after Trump's election continue to see a weakening of the Swiss Franc, while the dollar index is on a steady rise. Still both the euro and the yen have seen worse performance than the Swiss Franc. The euro is currently under 1.07.

Read More »

Read More »

The Italian Job

Italy is the epicenter of the next potential populist "shock." A defeat of the referendum is seen as intensifying the political risk. Renzi has wavered again regarding his political future if the referendum loses.

Read More »

Read More »

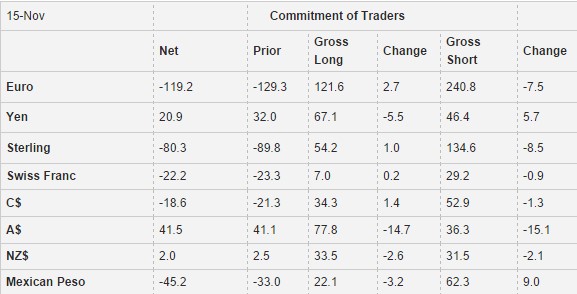

Weekly Speculative Positions: Dramatic Spot Currency Moves not Reflected

What is most noticeable about the CFTC Commitment of Traders report for the reporting week ending November 15 is what is not there: Activity. With the Australian dollar being the sole exception, we are struck by the apparent fact that dramatic spot price action and a what seemed like an impulsive trend move seemed not to be reflected in the futures position adjustments by speculators.

Given the strength of the US dollar after the election,...

Read More »

Read More »

If TPP is Dead…

TPP may be dead, but China is spearheading an alternative regional free trade deal. It is not as ambitious as the US-led TPP. China and Russia are eager to re-establish spheres of influence.

Read More »

Read More »

SNB sollte Bund bis 60 Milliarden ausschütten – nur so ist der Steuerzahler sicher

Letzte Woche gab die Schweizerische Nationalbank (SNB) bekannt, dass sie für dieses Geschäftsjahr eine Milliarde Franken an Bund und Kantone ausschütten wird. Von der Presse wird dies unterschiedlich interpretiert. Einerseits nimmt man mit Genugtuung zur Kenntnis, dass die SNB überhaupt eine Milliarde ausschütten kann. Andererseits wird mit Blick auf drohendes negatives Eigenkapital der SNB gewarnt, diese müsse dringend Reserven bilden.

Read More »

Read More »

Emerging Markets: What has Changed

Malaysia appears to have enacted a subtle change in FX policy. Turkey cut foreign currency reserve requirements in an effort to increase the supply of foreign exchange. Brazil’s central bank suspended the sale of reverse currency swaps and started selling new regular swaps (equivalent to selling USD). Colombia reached a new peace agreement with FARC rebels. Mexico's central bank hiked cash rates by 50 bp.

Read More »

Read More »

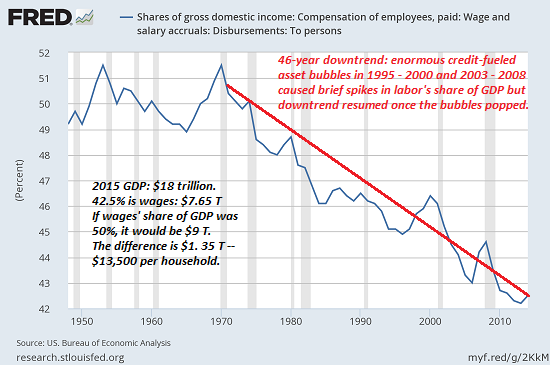

The Great Con: Political Correctness Has Marginalized the Working Class

So when the protected class of well-paid institutional "progressives" speak darkly of "reversing 40 years of social progress," what they're really saying is we're terrified that the bottom 95% might be waking up to our Great Con of identity politics and political correctness. To understand the Great Con of political correctness, we must first grasp the decline of the working class (self-described as "the middle class"), i.e. those who must sell...

Read More »

Read More »

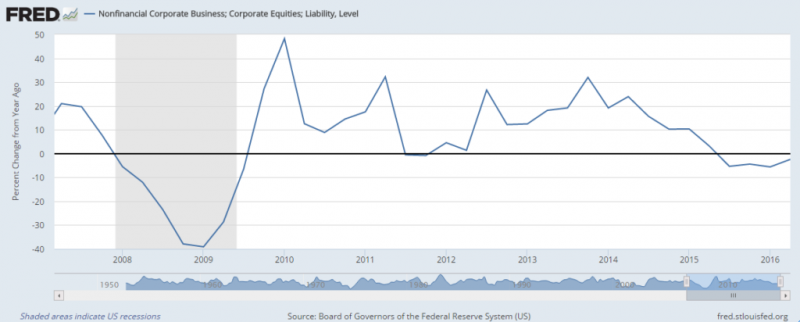

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

About that Economic Inequality

I address this essay to two groups. One group is those among the liberty movement, who believe that there’s nothing wrong with inequality. These are often Objectivists, who unknowingly defend a regime that artificially suppresses working people.

Read More »

Read More »

Geneva unveils big tax changes

After nearly ten years of European Union opposition to preferential company tax deals, Switzerland’s government agreed in 2014 to do away with such arrangements. Under current rules Swiss cantons can offer preferential tax rates to certain companies, mostly multinationals with most of their activity abroad. In Geneva, these special rates mean certain companies pay tax at a rate of 11.7%, while all others must pay 24.2%.

Read More »

Read More »

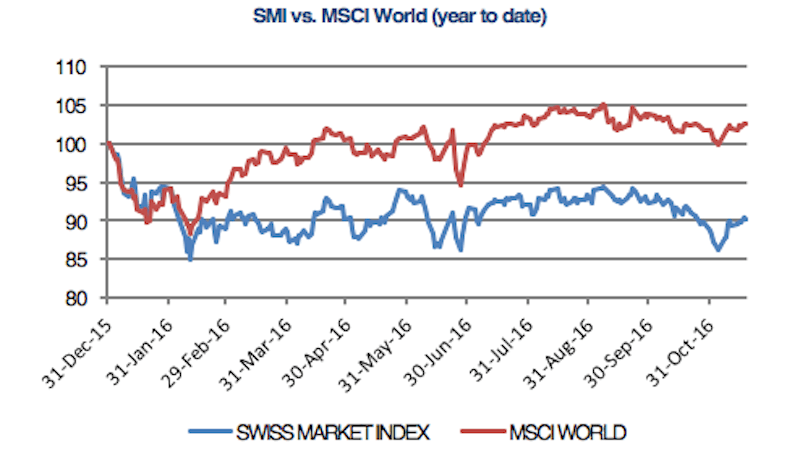

SMI up on post Trump rally

Swiss stocks continued to rise this week, in line with other global stocks thanks to a strong performance from financials which gained as investors weighted the prospects of higher interest rates in the US.

Read More »

Read More »