In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new “fear indicator”.

The bitter irony is that the institution which appears to have very little understanding of what’s actually happening is the Federal Reserve. We noted Stanley Fischer’s speech yesterday when he argued that liquidity is “adequate”…. at least he didn’t say “contained.”

Yet Dollar illiquidity has been one thing that central banks can’t control…think SNB and Swiss Franc, BoJ and Yen (full report on this below) and now the PBoC as the RMB looks at 6.90. Mylchreest points out that Fischer could take a look at dollar cross currency basis swaps (chart below) and the dollar liquidity problem would be immediately obvious.

Fischer could take a look at dollar cross currency basis swaps (chart below) and the dollar liquidity problem would be immediately obvious.

While everybody is now waiting for the Fed to wake up, here at ZH we have been tracking the issue of a global dollar shortage well ahead of the mainstream, starting back in 2009 and continuing with “The Global Dollar Funding Shortage Is Back With A Vengeance And ‘This Time It’s Different” in March 2015 and “Global Dollar Shortage Intensifies To Worst Level Since 2012” in October 2015.

If the dollar continues to strengthen, it will spell trouble for the recently adopted market narrative that Trump brings higher inflation and higher rates. Another major rotation and market reversals are the last thing that active managers need, or can can afford, in the run up to year end.

From the first section of the report:

|

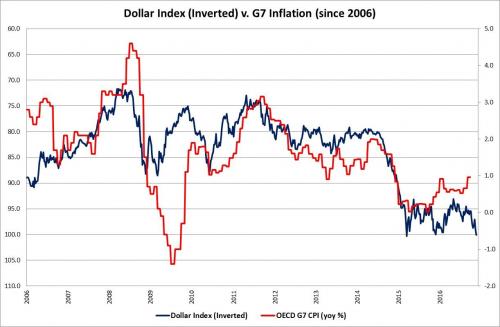

Dollar Index vs G7 Inflation(see more posts on Dollar Index, ) |

|

US 3-month Cross Currency Basis Swap |

* * *

Much more in the full report below.

Tags: Bank of international Settlements,BRICs,Business,central banks,Currency,Dollar Index,economy,EuroDollar,exchange rate,Federal Reserve,Federal Reserve System,Foreign exchange market,Harvard University,International trade,Japanese yen,newslettersent,renminbi,Swiss Franc,Swiss National Bank,US Federal Reserve,Yen