Summary:

Most economists are focusing on either US monetary policy or US fiscal policy. We focus on the policy mix.

After the policy mix, politics is also a weigh on the euro.

Our long-term call is for the euro to revisit the lows from 2000.

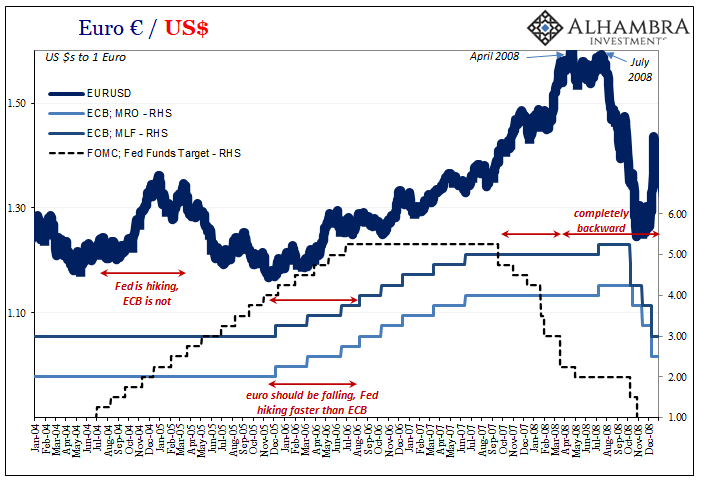

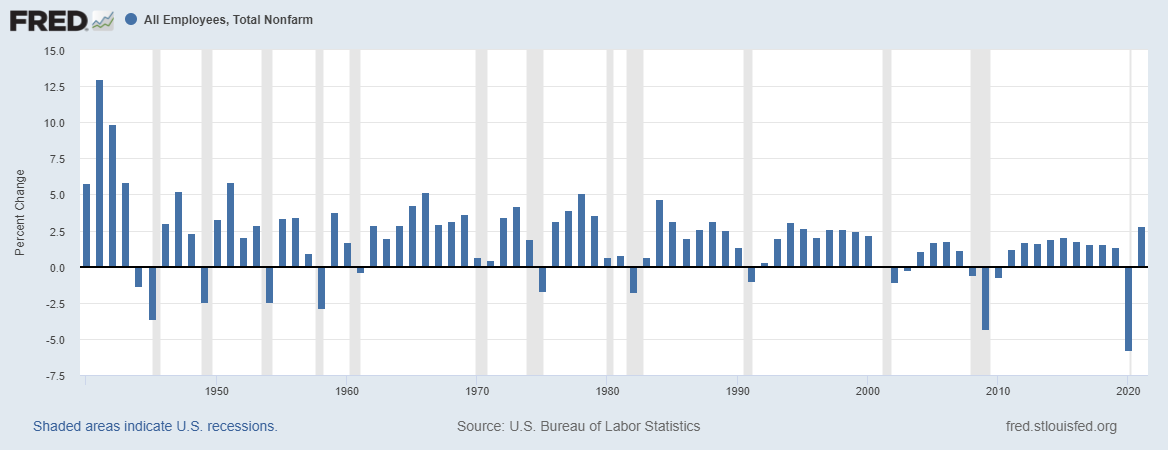

The euro has dropped almost six cents since the knee-jerk post-election bounce to $1.1300. The immediate driving force is the anticipated policy mix in the US. With the US economy already growing near the trend pace, and the Federal Reserve’s objectives of full employment and price stability (defined as 2% increase in the core PCE deflator), the central bank was already poised to lift rates.

The euro has dropped almost six cents since the knee-jerk post-election bounce to $1.1300. The immediate driving force is the anticipated policy mix in the US. With the US economy already growing near the trend pace, and the Federal Reserve’s objectives of full employment and price stability (defined as 2% increase in the core PCE deflator), the central bank was already poised to lift rates.

|

In France, the center-right Republican Party will hold the first round of its first primary this coming weekend. A second round run-off will be held the following weekend. It is important because the winner is most likely to face Le Pen in the second round of the French Presidential election in the Spring. Hollande’s Socialist Party is suffering in the polls. His support is in single digits.

Where does that leave the euro? This Great Graphic is a month bar chart of the euro, and Bloomberg uses a synthetic calculation to capture its value before EMU. The euro peaked in 2008. From 2008 through mid-20014, the euro traded in a broad range between $1.20 and $1.50. After 2011 though, it was capped near $1.40. The euro broke down in H2 14, and since early 2015 has moved in a narrow $1.05-$1.14 range with a few exceptions.

We anticipate that the consolidation will be resolved with another leg lower. On the chart, we drew a trendline of the synthetic euro low during the Reagan dollar rally (~$0.6445) and the low of the Clinton dollar rally (~$0.8230). That trendline comes in near $1.000 by the end of the year. That roughly coincides with a 61.8% retracement of the euro’s rally from the 1985 low to the 2008 high (~$1.01). A break of that area, which is also of psychological importance, would open the door to a fall toward $0.8200-$0.8700.

|

Euro currency(see more posts on Euro, ) |

Tags: $EUR,Euro,Great Graphic,newslettersent