| Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really important is relevant only because Jerome Powell is being asked if he can do what Paul Volcker did 4 decades ago, namely induce a recession to kill the inflation part of that equation. The stagflation scenario got a little more traction last week with the release of a negative Q1 GDP print on Thursday and hints of more inflation on Friday.

I am not in the stagflation camp because the inflation part of the 1970s economic equation is quite a lot different today than back then. |

|

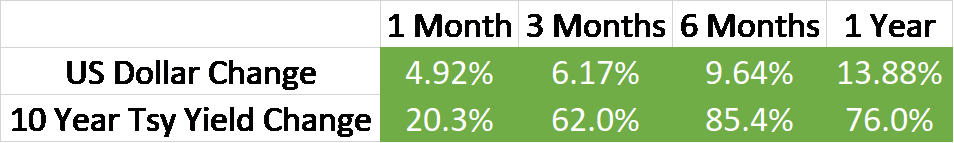

| We’re in a strong dollar environment today as opposed to the weak dollar one that prevailed back then and I think that’s quite important. A strong dollar is generally a positive when it comes to inflation and I don’t think this time is different. The inflation we’ve experienced recently is directly related to COVID, a function of reduced supply and high demand stoked by profligate fiscal policy, both of which are now normalizing. The fear of an inflationary spiral is, in my opinion, overstated. That isn’t to say that Federal Reserve policy shouldn’t be tightened up from the emergency levels that have been maintained for far too long. But when inflation comes back down, it probably won’t be because of monetary policy, even if it coincidentally seems that way. | |

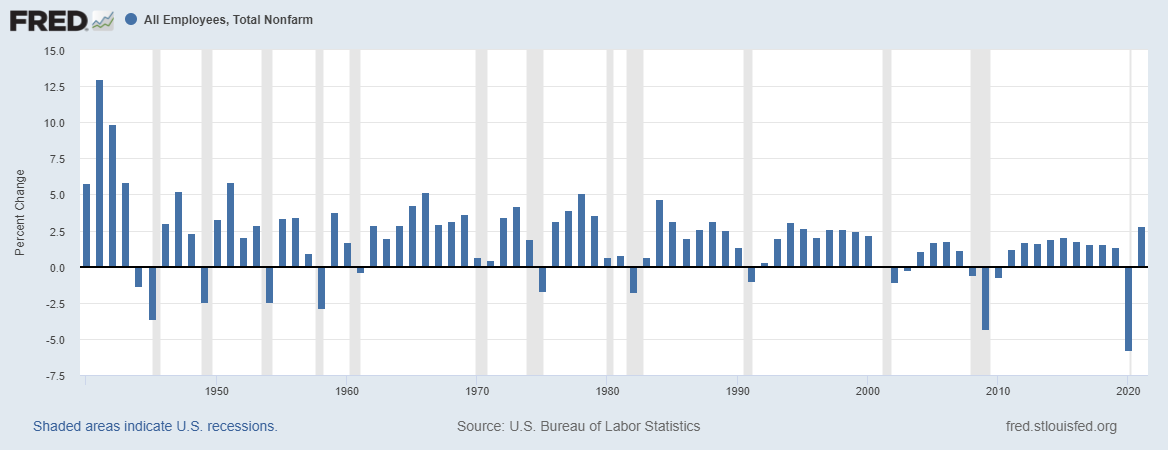

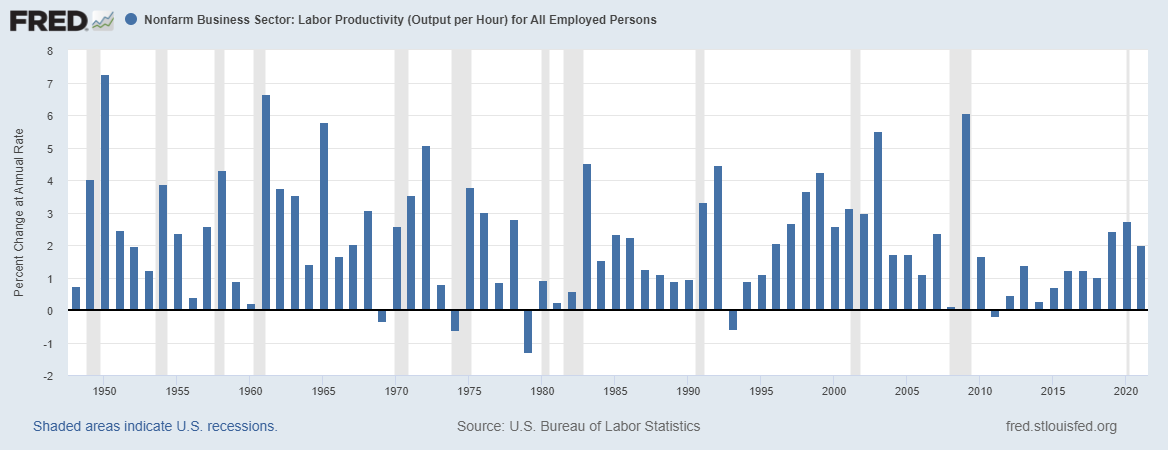

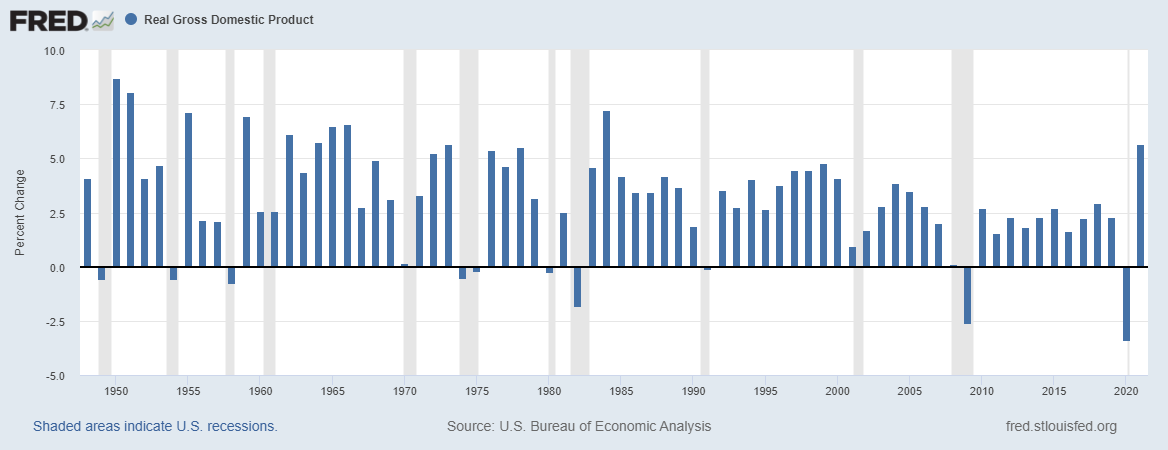

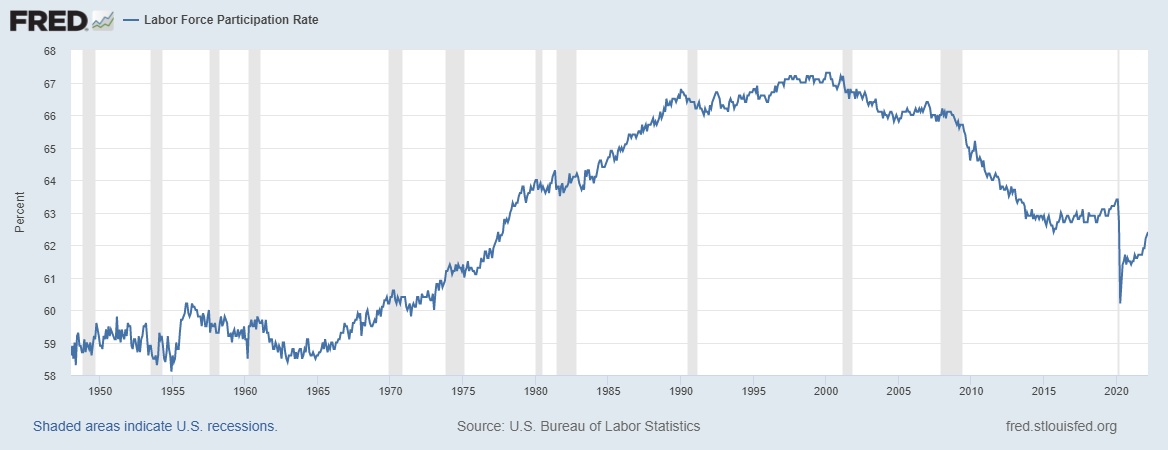

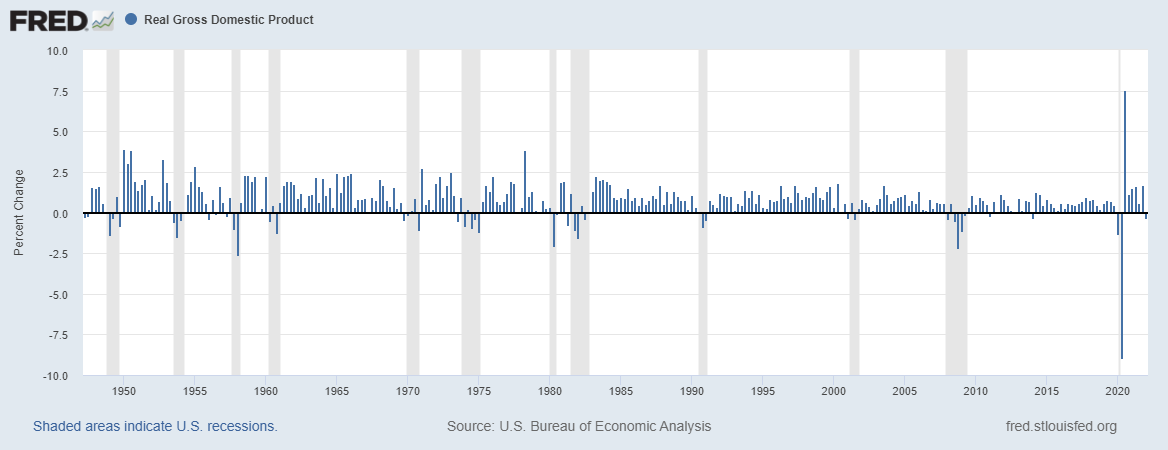

| I have said – in client meetings and in writing – since early in the COVID recovery that, once COVID and the response to it passes, growth would fall back toward its previous trend (and maybe somewhat lower given that we added more debt during COVID). The US economy had averaged growth of a little over 2% a year for the previous decade when COVID hit in the spring of 2020. There are a plethora of arguments about the causes of “secular stagnation” but I prefer to see macro in simple terms, with an emphasis on “what” rather than “why”. Economic growth is about two things – employment growth and productivity growth – both of which stagnated in the 2010s. | |

| While I am encouraged that productivity growth has improved since 2019, I am far from convinced that current economic policy sufficiently encourages investment for it to continue. As for the employment part of the growth equation, this chart is certainly not encouraging: | |

| One of the consequences of this weak growth is exactly what we got in Q1 this year. When growth is trending at 2%, it doesn’t take much of a shock to push GDP growth into the negative column. There were a litany of explanations – excuses – offered last week about why Q1 growth wasn’t as bad as the data made it seem. But the fact is that Q-Q GDP contractions outside of recession or near recession are rare. We had two negative quarters in 1947 (recession started in Q1 1949) and two in 1956 (recession started in Q4 1957). The two most recent instances though are more interesting, Q1 2011 and Q1 2014. Neither of those was near recession but show how easy it is for a slow-growing economy to oscillate between growth and contraction.

And absent some new shock, I think this most recent episode will prove to be similar. |

|

| From an economic policy standpoint, the COVID response didn’t do anything to change positively either of the two factors that affect growth. There were some positive changes in productivity from COVID but they were borne out of necessity, not deliberate policy. Business have had to find a way to survive – and thrive in many cases – with fewer workers and they have largely responded to the challenge. Employment growth has been impressive over the last year but we haven’t even recovered to the previous peak yet so we have a long way to go. Immigration would likely help to raise total GDP but the current political environment makes that unlikely. One of the positives in the GDP report was investment and core capital goods orders are still trending higher so the outlook for productivity may be improving but it will take time for those investments to pay off.

Slow growth, or even a negative quarter to quarter growth rate, is not a recession though, which seems to be the dominant worry these days. |

|

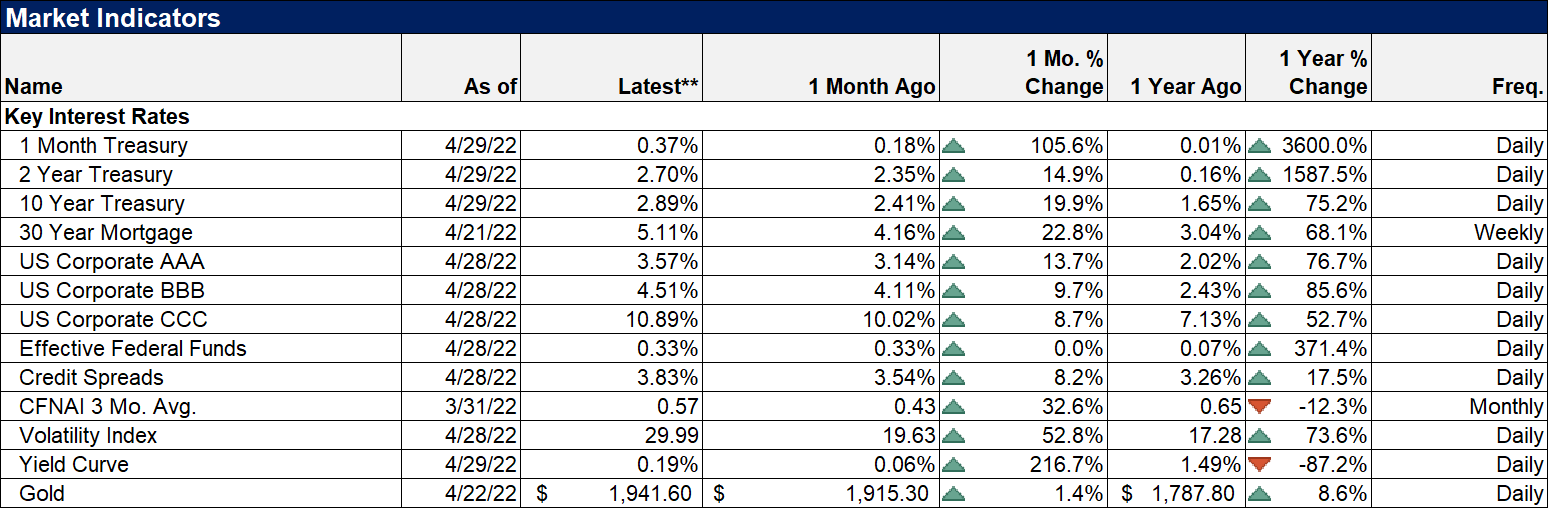

| We don’t currently see the conditions we normally see prior to recession. Credit spreads are still well behaved if off the lows. The yield curve is flattish but still fairly steep at the short end. Broad measures of growth such as the CFNAI are on or slightly above trend. Consumer sentiment is still low but actually rose a bit last month and, since Republicans are the most dour in the survey, I think that could continue to improve as we near the mid-term elections. Last week’s data did seem to require the market to price in a higher probability of recession over the next two years but the key word there is probability. My reading of futures markets is that the peak in short-term interest rates got moved back a couple of months last week, from late Q3 2023 to early or mid-Q3 2023. And that will continue to be a moving target as we get more information about the economy and monetary policy.

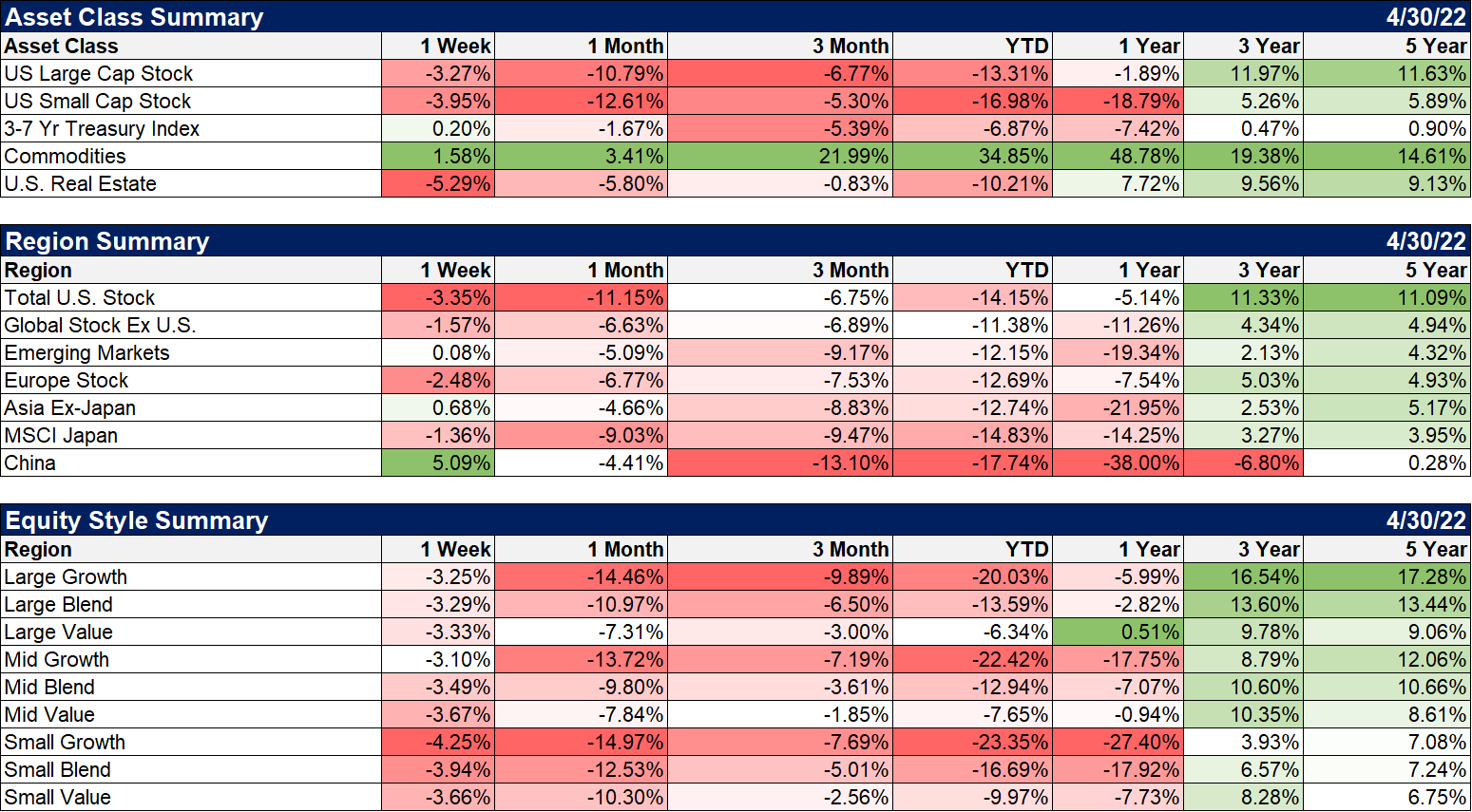

Importantly for investors, the weak growth in the decade prior to COVID was not an impediment to generating acceptable returns. And if we are indeed returning to that environment of low growth and low inflation (admittedly the former seems more likely than the latter at present), bond returns would seem likely to improve after the brutal bear market of the last year. As for stocks, the correction so far is just run of the mill for the S&P 500, the 13% loss from the peak almost exactly the average of corrections that we’ve gotten every 18 to 24 months throughout history. There are some areas of the market that have been hit harder – NASDAQ and small-cap – and maybe the S&P has more to go, but absent a near-term recession history says that most of the correction is likely behind us. Stock valuations have been reduced in this correction but the S&P 500 – which we declared persona non grata for our portfolios last year – is still not exactly cheap. The growth stocks that dominate the index have pulled back but the S&P 500 growth index still trades for 25 times earnings. I think it makes sense to maintain a defensive posture in the equity part of your portfolio. We continue to emphasize value and dividend factors which have outperformed this year (S&P 500 value -5.1% and Select Dividend +1.5%; we own IVE, DVY and SDY). Global stocks are also much cheaper than the US alone, with the ACWI trading at a P/E of about 16 (versus 20 for the S&P 500). I don’t know for sure that we will avoid recession in the near term or if the S&P 500 will ultimately fall into a full-blown bear market. But I also don’t find today’s markets or economy surprising in the least. Corrections happen, on average, every 18 months and the average fall is 14%. The economy was growing at 2.1%/year for a decade prior to COVID and we did nothing to change the long-term trajectory of the factors that affect growth. No one should be surprised that we find ourselves right back where we started. Welcome back to the Old Normal. The rising rate, rising dollar environment continues with the dollar accelerating to the upside last week. It is, from a technical perspective, overbought right now and a pullback would not be surprising at all. But a correction of the trend back to 100 would be nothing more than that – a correction. The volatility we’ve seen in markets recently is evidence that liquidity is somewhat constrained right now – volatility is the market expression of low liquidity. There is an obvious correlation between a rapidly rising dollar and prior EM crises so, of course, we’re monitoring this closely. But the dollar’s gains this year have been primarily against the Euro and Yen while EM currencies are more mixed with Latin American currencies outperforming their Asian counterparts (which makes sense given commodity prices). The commodity dollars (Aussie and Canadian) are essentially unchanged YTD. The 10-year Treasury rate is at the high of this move and only 27 basis points from the pre-COVID high of 3.25%. I am doubtful that rates will exceed that level and if that is true, the vast majority of the bond bear is probably behind us. |

|

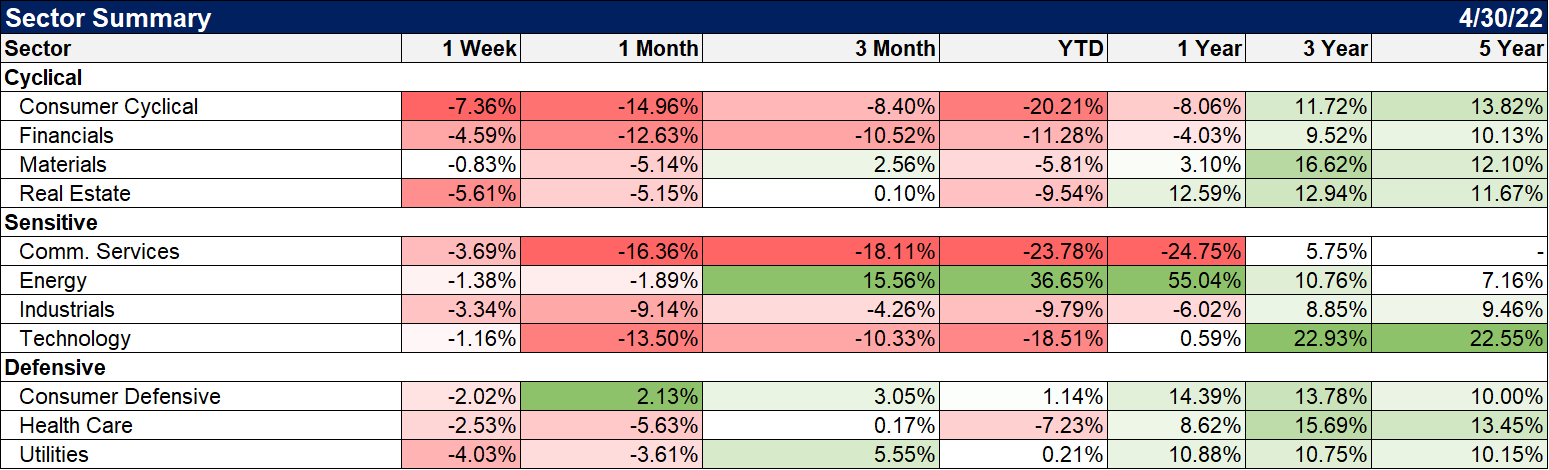

MarketsApril was a really rotten month with everything down but the general commodity indexes. Even gold (-0.33%) couldn’t rally with real rates rising. Over the last year, real assets (commodities, real estate & gold) are the only major assets in the plus column. China and EM more generally were higher last week but stocks around the world are all down over the last year. Ex-US returns over the last 5 years are mostly in the mid single digit area while China is basically flat. US outperformance seems unlikely to change as long as the dollar is rising. |

|

| There really wasn’t any difference between value and growth last week but value is drastically outperforming YTD and over the last year.

All sectors were negative for the week but materials, energy, and technology managed to outperform significantly. |

|

Investing is mostly an exercise in self-control. If you have a strategy with a history of success – and we do – you just need to stick to it. That can be really hard when things aren’t going well. But the really awful outcomes everyone fears are actually fairly rare. Since 1947 there have been 43 quarters where GDP contracted quarter to quarter. That’s less than 14% of the time in the last 75 years. Of those 43 contractions, only 20 of them exceeded 0.5%; most contractions are quite mild. A lot has happened in that time so I find it hard to say that this period is that much different than the past. Recession is a low probability event. Timing it exactly, getting out before the recession/bear market and back in when it hits bottom is almost entirely dependent on luck. An even keel and a lot of humility are a lot more important than interpreting the latest economic data. And it is important to remember that the economy and markets – stocks specifically – are inversely correlated. When things look their worst you need to be optimistic and when everyone tells you how wonderful things are you need to be skeptical. That is a very easy thing to write and a very hard thing to pull off.

Our portfolios this year are down low to mid-single digits. We have avoided the S&P 500, the glamour growth stocks, and the meme stocks. Our equity exposure is in value and dividend factor ETFs. Our fixed income was invested in short and intermediate-duration bonds until we recently moved to almost all intermediate. We have owned commodities and gold although one never has enough of the things that go up. But we’ve had our missteps too. We have a small position in Japan that is not performing well with the Yen falling. We have a smaller position in biotech stocks that is also underperforming the market. Our cash position in most accounts is a double-digit percentage. It isn’t perfect but I think it’s about as good as we could do. A client called me Friday and after talking about the market for a while, she said: “Don’t you get worked up about anything?”. After 40 years of investing? Not really. I care deeply about our clients and would like nothing more than to protect them from any and all negative market events. But that just isn’t realistic and trying to do so is an exercise in futility.

Full story here Are you the author? Previous post See more for Next postIt is better to be roughly right than precisely wrong. – John Maynard Keynes

Tags: Alhambra Portfolios,Alhambra Research,Bonds,China,commodities,credit spreads,currencies,economic growth,economy,Euro,Featured,Federal Reserve/Monetary Policy,Gold,growth stocks,John Maynard Keynes,Markets,newsletter,Real Estate,recession,stock market,stocks,US dollar,value stocks,Yen,Yield Curve,yuan