Tag Archive: newslettersent

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults. Last Wednesday Moody’s reported that mortgage arrears continue to rise across Australia, particularly in the mining states of WA & NT:

Read More »

Read More »

The Washington Post: Useful-Idiot Shills for a Failed, Frantic Status Quo That Has Lost Control of the Narrative

Don't you think it fair and reasonable that anyone accusing me of being a shill for Russian propaganda ought to read my ten books in their entirety and identify the sections that support their slanderous accusation?

Read More »

Read More »

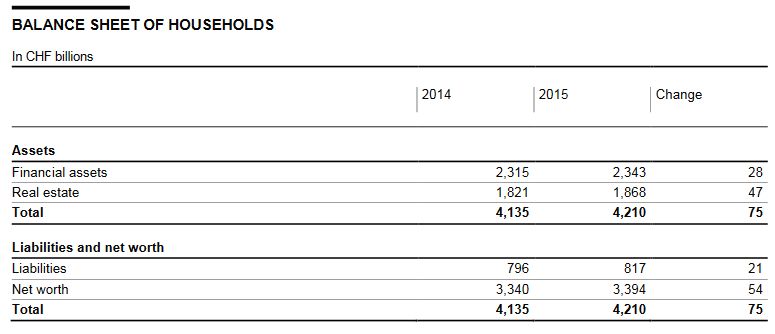

Swiss Financial Accounts, 2015 edition

This year, the Swiss financial accounts, which have been released by the Swiss National Bank since 2005, feature changes affecting both timeliness and presentation.

For the first time, data on the financial accounts are now published within eleven months of the reference date, reducing time to publication by one year. Moreover, the balance sheet of households, previously the subject of the press release on household wealth, is now included in the...

Read More »

Read More »

Emerging Markets: What has Changed

China President Xi raised the possibility of sub-6.5% growth. Fitch moved the outlook on Indonesia’s BBB- rating from stable to positive. The Philippine central bank raised its 2017 inflation forecasts for 2017 and 2018.

Read More »

Read More »

The Disaster of Inflation-For the Bottom 95 percent

Central banks are obsessed with boosting inflation, but the "why inflation is good" arguments make no sense for households being ravaged by inflation. The basic argument is that inflation makes it easier for debtors to service their debts.

Read More »

Read More »

Seven banks fined in Swiss probes of rate-rigging cartels

Switzerland handed out about $100 million in antitrust fines against seven U.S. and European banks for participating in cartels to manipulate widely used financial benchmarks.

Read More »

Read More »

Modi’s Fantastic Promises

This article continues right where Part VI left off (for earlier updates on the demonetization saga see Part-I, Part-II, Part-III, Part-IV, and Part-V). There is still huge support for Modi even among the poor. A big carrot is dangled before them, which makes many stay numb to their current suffering. During his election campaign in 2014, Modi promised to deposit more than Rs 1.5 million (~$22,000) in each poor person’s account once the...

Read More »

Read More »

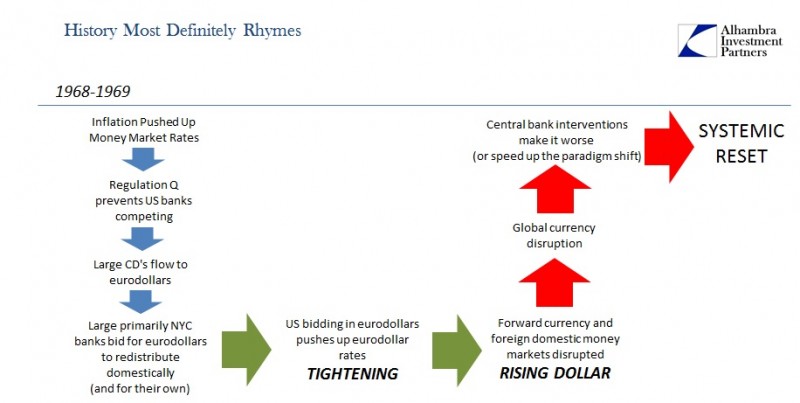

We Know How This Ends – Part 2

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

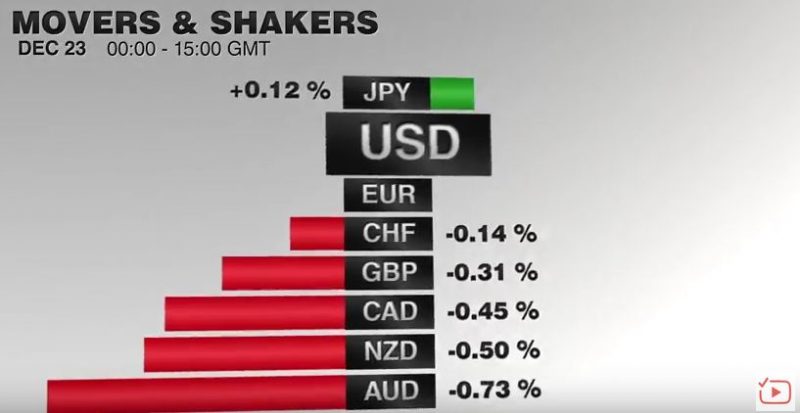

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

Sentiment appears positive as investors close their books for the year

Ahead of the Christmas break, trading volumes were thin this week amid a lack of new market catalysts. Swiss and European equities were generally unchanged through the week, tracking global stock markets. Overall, sentiment appears to be positive as investors close their books for the year.

Read More »

Read More »

ECB Assets Hit 35 percent Of Eurozone GDP; Draghi Owns 9.2 percent Of European Corporate Bond Market

As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global "helicopter money", by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks).

Read More »

Read More »

Where Do US Companies Hire Abroad?

High-wage economies of Canada, EU, Japan and Australia account for nearly half of US corporate employment abroad. And even in low-wage regions, the high-wage parts tend to draw more US employment. The new US administration may have second thoughts about pivot to Asia, but US companies may not.

Read More »

Read More »

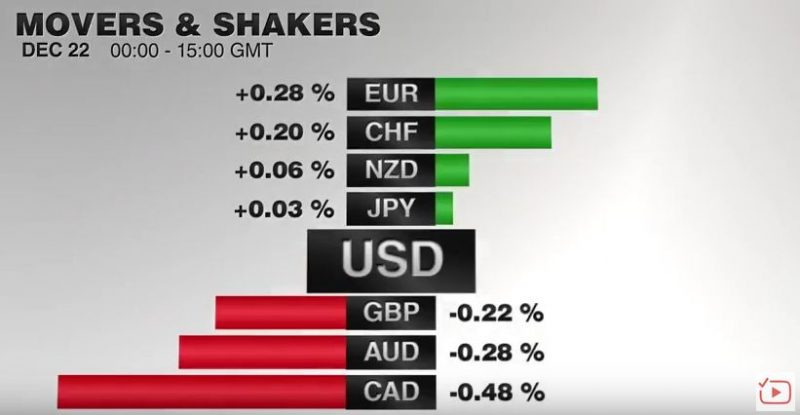

FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF.

Read More »

Read More »

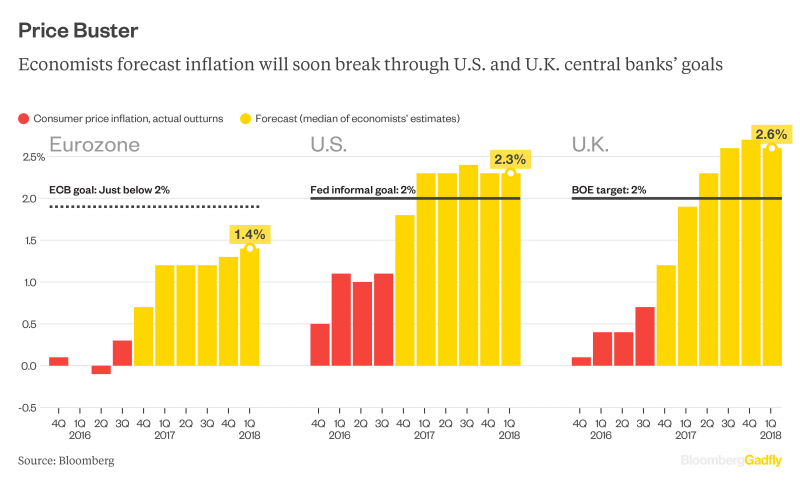

Inflation Sensation: The New Big Deal

It's finally coming. Inflation. President-Elect Donald Trump's promised a whole lot of infrastructure spending, raising the prospects for a great slug of price pressure the likes of which we haven't seen in years. Analysts' forecasts and financial markets show a dramatic shift in view on the outlook for inflation. These charts show some metrics worth watching.

Read More »

Read More »

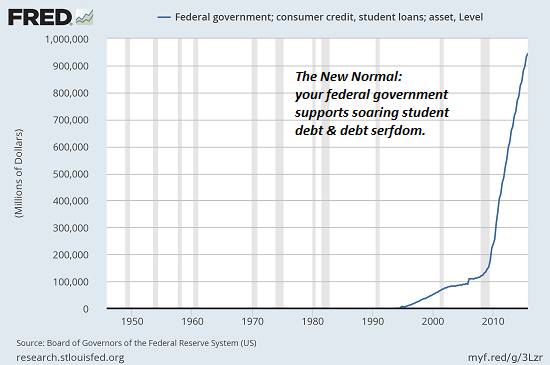

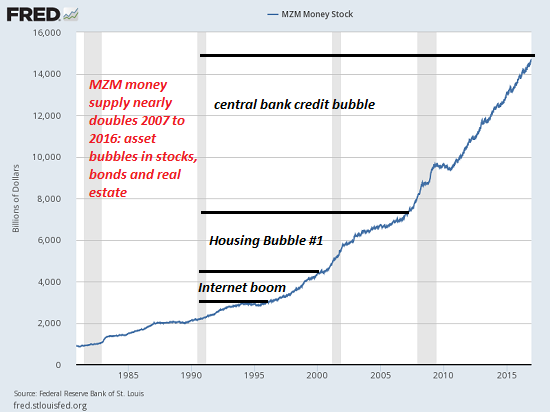

Why the Massive Expansion of “Money” Hasn’t Trickled Down to “The Rest of Us”

There are numerous debates about money: what it is, how we measure it, and so on. In recognition of these debates, I'm referring to "money" in quotes to designate that I'm using the Federal Reserve's measure of money stock (MZM). Nowadays, "money" is often credit. We buy stuff not with currency/ cash, but with credit extended by lenders.

Read More »

Read More »

The hidden cost of Christmas gifts

If you haven’t had a chance to go Christmas shopping don’t despair, gifts destroy value. For example, someone on a diet is unlikely to place much value on a box of chocolates. The difference between what was paid for the chocolates and what the recipient would have paid represents destroyed value. They could have been left on the shelf for someone who would have fully valued them. Economists call this deadweight loss.

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

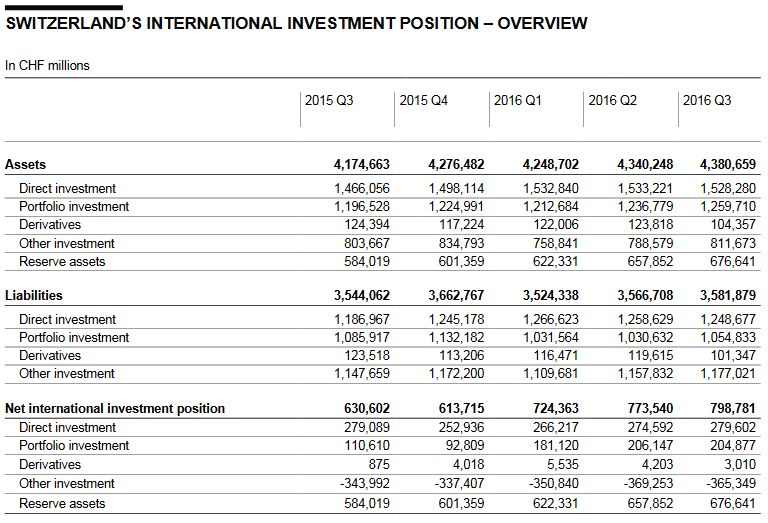

Swiss balance of payments and international investment position: Q3 2016

In the third quarter of 2016, the current account surplus amounted to CHF 21 billion. This was CHF 2 billion less than in the year -back quarter. As a result of lower receipts from direct investment, the receipts surplus in primary income (labour and investment income) declined by CHF 4 billion to CHF 1 billion. The surplus of receipts from trade in goods increased by CHF 2 billion to CHF 17 billion, while the surplus of receipts for trade in...

Read More »

Read More »

Swiss watch exports poised for worst year since 1984: chart

The number of watches Switzerland exports is on track to reach the lowest level since 1984, when digital timepieces were in vogue and Swatch Group AG had just been formed in reaction to low-cost competition.

Read More »

Read More »