Submitted by Jeffrey Snider via Alhambra Investment Partners,

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos. At the start of April that year, the Swiss National Bank (Swiss central bank) was suddenly refusing its own banks dollar swaps in order that they would have to unwind foreign funds positions in the eurodollar market. The Bank of Italy (the Italian central bank) had ordered some Italian banks to repatriate $800 million by the end of the second quarter of 1969. It also raised the premium on forward lire at which it offered dollar swaps to 4% from 2%, discouraging Italian banks from engaging in covered eurodollar placements.

The “rising dollar” of 1969 had somehow become anathema to global banking liquidity even in local terms.

The FOMC, which had perhaps the best vantage point with which to view the unfolding events, documented the whole affair though stubbornly and maddeningly refusing to understand it all in greater context of radical paradigm banking and money alterations. In other words, the FOMC meeting MOD’s for 1968 and 1969 give you an almost exact window into what was occurring as it occurred, but then, during the discussions that followed, degenerating into confusion and mystification as these economists struggled to only frame everything in their own traditional monetary understanding – a religious-like tendency that we can also appreciate very well at this moment.

At the April 1969 FOMC meeting, Charles A. Coombs, Special Manager of the System Open Market Account, reported that the bank liquidity issue then seemingly focused on Germany was indeed replicated in far more countries.

Mr. Coombs reported that the other main recent development in the European exchange markets had been the actions taken by the various continental central banks to defend their domestic liquidity and credit situations from the strains generated by the sharp rise in U.S. bank borrowings from the Euro-dollar market.

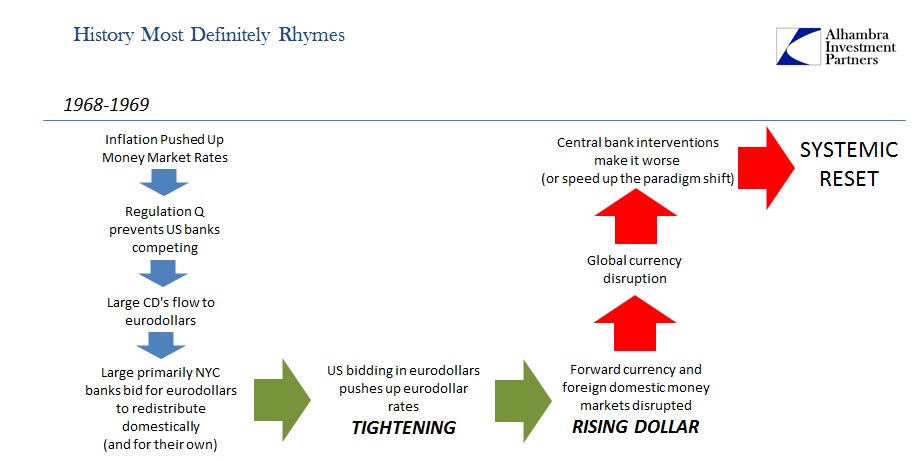

European central banks, in particular, were nearly apoplectic about US banks’ sudden and incessant presence as eurodollar borrowers. Prior to 1968, eurodollars were largely a European affair, that Merchant’s bankers market to achieve global trade finance and settlement. Rising consumer inflation starting in 1965 had the effect in domestic money markets of increasing interest rates then under the control of Regulation Q. Ostensibly a systemic protection arrangement put in place in the 1930’s to avoid another Great Depression, Regulation Q limited what banks could pay on deposits. By the middle of 1968, nearly all money market rates had hit their ceilings; eurodollar markets had no ceilings.

Large time deposits particularly of corporate, non-bank accounts started shifting in 1968 and playing a large role in provoking and amplifying the global currency crisis that year. Large banks in New York responded to the loss of primarily CD’s by simply bidding for funds in eurodollars (or exchanging them by bookkeeping alone, as Milton Friedman pointed out contemporarily) and booking those liabilities instead as borrowings from their foreign subsidiaries operating in eurodollar markets. The scale here was also massive; foreign subs booking eurodollar liabilities on behalf of their domestic head offices had added $3 billion during January and February 1969 alone.

The more US banks were “forced” to bid in eurodollars to escape the liability and deposit strangle of Regulation Q, the more illiquidity spread throughout the rest of the exchange markets, particularly eurodollars and eurocurrency. As the FOMC discussion in April 1969 pointed out then, “U.S. banks were willing to pay almost any rate for marginal additions to their resources, but that the actions of U.S. banks at their margins were tending to force upward the general levels of rates in European money markets.” There was a direct link between eurodollars and the domestic money conditions in the countries most exposed or participatory in eurodollars.

And it wasn’t just eurodollars, either. The loss of time deposit liabilities had struck smaller reserve city banks domestically. These banks, unlike the global NYC banks, however, could not bid in eurodollars to re-obtain this funding. Instead, there was a massive increase in “borrowed reserves”, both federal funds and the Discount Window. From the February 1969 FOMC MOD:

These funds were then channeled through the Euro-dollar market to the largest banks, with an actual basic reserve surplus developing in New York City banks last week and a record level of borrowing by country banks. These twin developments had the result of taking some of the pressure off the Federal funds market as the most aggressive bidders had less urgent needs and country banks made greater use of the discount window. This in turn helps explain last week’s anomaly of the highest level of net borrowed reserves in 16 years and a relatively comfortable Federal funds market.

The domestic, as well as international, banking system was becoming fully functional on a wholesale level of action and activity (and, as you can appreciate, it greatly favors the biggest NYC and London banks). But while there might be some domestic redistribution through NYC bank “excess reserves” into federal funds, for foreign liquidity arrangements there was no such recycling pass-through possible. Thus, “tightening” in eurodollars was directly translatable:

And Denmark, Holland, Japan and any number of other eurodollar-connected places. While Mr. Bodner was ascribing these processes to the short-term, “tend initially”, what the events of 1969 would demonstrate conclusively was that the disruption left a lasting, scarring impact upon global finance (and then, as the recession developed, global economy). The “rising dollar” had major influence on what were thought completely separate financial systems – an assumption that persisted even though central banks had been actively participating and entangling their own banking systems (as Bundesbank belatedly admitted) within it all for years by then. |

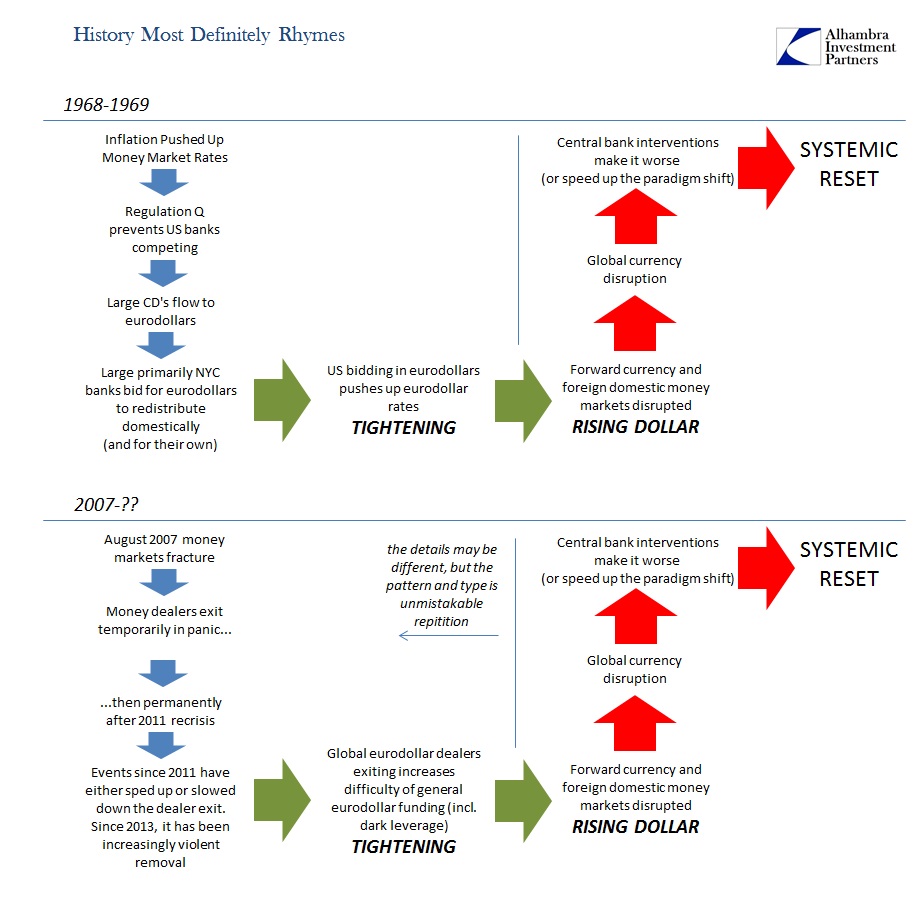

History Most Definitely Rhymes |

Throughout the whole of 1969, the FOMC remained as if this was all some minor nuisance for foreigners to settle out amongst themselves. Though the Fed had sent representatives to the conference in Bonn in November 1968, there was absolutely no urgency even though central bank after central bank succumbed to the “rising dollar.” From the April 1969 MOD:

But it wasn’t just quantity issues that were affecting almost everything in the global regime during the dying days of Bretton Woods; in fact, the innovation here in qualitative terms and repurposing was perhaps far more important. It certainly was a contributing factor toward the eventual dissolution of gold exchange, but these transformations in money and banking would rule the next forty-five years and set us up to do this all over again:

And:

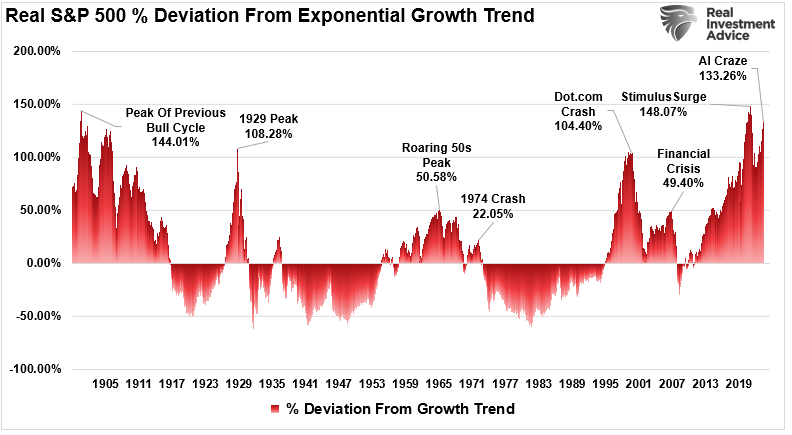

“Escaping constraints” was not a feature of hard money, as that was entirely the point of hard money. Not only were repurchase agreements becoming more common as a domestic workaround of Regulations Q and D, they were also becoming more prevalent upon eurodollars where more swaps and forwards than “covered” participation of global banks existed. In other words, not only would there be, as there increasingly had been, no hard money there wouldn’t even be money. The dollar was becoming the full “dollar” and that meant a systemic shift due to massive imbalance that was unanswerable under the paradigm in operation at that time – not just Bretton Woods but in many ways the economic and monetary theories that then prevailed. Rather than restore a hard money anchor economists instead simply continued the progression because they saw themselves now free and “flexible” to control it all more closely. It was, obviously, a disaster right from the start as we have been made to live their errors in repetition. By 1980, Keynesianism in general was being totally repudiated but rather than fade into history it just merged with the technocratic principles that had been adopted by central banks thinking they could more easily wield their own influence under this “floating” monstrosity; monetarism and Keynesianism became all one big mess. Thus, the precursor to the degradation of the serial asset bubbles of the 21st century was refashioned as some kind of monetarist, central planning Golden Age – the Great “Moderation.” But this new floating and intangible eurodollar system was itself inherently unstable once it surpassed some threshold of intrusiveness. That seems to have been in 1995 when eurodollars were shifted from payment system accounting for largely global trade to encompass an entirely parallel offshore banking system. There were continuous indications that this was a terribly inefficient and just plain bad idea (starting almost right away with the Asian flu/LTCM) but it would continue on anyway until August 2007. Since then, just like 1961, the world has been infected with almost continuous instability attaining more and more the properties and desperation that looks to be a symmetrical bookend of 1968-69. |

History Most Definitely Rhymes |

The only difference relevant in this overriding conception is that the eurodollar in 1969 was ready to break free of the shackles of hard money. Its very existence owed to the fact that central banks were repeating the same processes that they had experimented with in the 1920’s and thus felt that they had learned from those mistakes (they didn’t; blaming gold the whole time when economists, deep down, care little for gold so much as power and control). The eurodollar imbalance of 1969, which led to the great interruption of the 1970’s, was a faction, the majority faction, of banking following along the lines of monetary flexibility; in short, economists thought they would be replacing gold with themselves when even in 1969 it should have been readily apparent that banks were replacing gold with their own designs.

One final note, a haunting warning that was echoed in 1979 (itself an echo of 1964) and seemingly destined to be unheeded and thus the source of our great repetition. If we are doomed to repeat history, it is because the self-selected “best and brightest” are more enamored with their own credentials than their abilities as critical thinkers in a truly enlightened, scientific discipline. Mr. Coombs’ words from April 1969 would find application in August 2007, again in August 2011 and in increasing regularity since June 2014 and this renewed “rising dollar.”

European central banks remained apprehensive, however, that a serious crunch in the Euro-dollar market might suddenly develop if intensified U.S. and European competition for Euro-dollars suddenly revealed some vulnerable positions. The situation could be particularly serious because the Euro-dollar market had become an increasingly important source of financing for industrial and commercial enterprises not only in Europe but in the whole world. One bankruptcy could attract a lot of attention, and if it led the European commercial banks that had been supplying funds to the market to reassess the credit risks they faced, the result might be a sudden scramble for liquidity. The chances of such a development were enhanced by the fact that no central bank had formal responsibility for the behavior of the Euro-dollar market; what had been accomplished in that connection had been done through informal central bank cooperation.

As noted through this whole discussion, that “informal central bank cooperation” doesn’t really amount to anything. That lesson could be applied to the Bundesbank “selling dollars” in 1969, the PBOC “selling UST’s” in 2015 or the worthless, useless Federal Reserve RRP in 2016. They really don’t know what they are doing, they never have and it truly doesn’t matter fixed or floating. Adjust accordingly because we know how this ends; we’ve already seen it.

Full story here Are you the author? Previous post See more for Next postTags: central-banks,Commercial Paper,EuroDollar,excess reserves,Federal Reserve,fixed,Global Economy,Great Depression,Italy,Japan,Milton Friedman,Netherlands,newslettersent,recession,Swiss National Bank