Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults

Last Wednesday Moody’s reported that mortgage arrears continue to rise across Australia, particularly in the mining states of WA & NT:

Moody’s report notes that mortgage performance deteriorated in all eight Australian states and territories over the year to 31 May 2016, reaching 1.50% from 1.34% at 31 May 2015. And, in Western Australia, Tasmania and the Northern Territory, the 30+ delinquency rate climbed to the highest levels since Moody’s records began in 2005, while in South Australia, the delinquency rate was just 0.1 percentage point below the state’s record-high reached in April 2013.

Western Australia fared the worst in terms of mortgage performance over the year to 31 May 2016, with the 30+ delinquency rate increasing by 0.69 percentage points to 2.33%. This measure has been on the rise in the state since 2014, following the end of the mining boom. Relatively poorer economic and housing market conditions in Western Australia contributed to the historically high level of mortgage delinquencies.

|

v |

Western Australia benefited most from the mining boom and has been suffering a bust considered to be the worst in living memory now for many months:

When Barnett came to office in 2008, net debt sat at $3.6 billion. Now it sits at $27 billion and is forecast to reach $40 billion by 2019. The state has sunk to a record $2 billion deficit… Perth’s median house price has collapsed 10.4 per cent since its December 2014 peak, according to CoreLogic. In Port Hedland – the mining towns at the epicentre of the iron boom – house prices have sunk 66 per cent in the past four years.The commercial vacancy rate in the Perth CBD is at its highest level since 1995. About 500 people a month are leaving WA for the other states and territories. Wages are falling. One in five of the city’s Uber drivers was either previously working resources or engineering, or still is but working less hours.

Those previously highly paid resources or engineering workers now need to service their McMansion mega mortgage with an Uber wage and with each month that passes their equity continues to fall:

|

v |

| Don’t expect that trend to change any time soon. The mining bust is at best only half way through so there’s still alot more pain to come for WA before there can be any hope of recovery: |

v |

So while WA has been doing it tough the rest of the country has managed to avoid the pain, predominately due to the economic benefits of an ever growing property bubble. Take for example the apartment approval pipeline since the GFC. The expression, make hay while the sun shines just doesn’t seem to come close to what’s been going on in that space:

With the long run averages you can see that Australia has experienced an apartment boom like never before. As with other aspects of the Australian bubble this risk doesn’t affect all cities equally. While Sydney has seen the greatest boom in apartments it is Brisbane and Melbourne that are at most risk. |

v |

The above chart shows the expected increase in the proportion of units in each capital city over the next 24 months if everything that is approved and expected to be built over the next 24 months is successfully built. Brisbane is set to see the biggest uplift in total unit stock followed by Melbourne and clearly in more immature unit markets this carries a risk. Importantly though, the potential uplift in unit stock in Sydney is not immaterial at 8.5% although it is lower than both Brisbane and Melbourne.

It’ is perhaps no surprise then that on October 13th the Reserve Bank of Australia issued a stark warning in their Financial Stability Review:

The foreshadowed risk of oversupply in some apartment markets is nearing as a large volume of new apartments has started to come on line, and many more completions are expected in the coming two years. Risks appear greatest in Brisbane and Melbourne’s inner-city suburbs, where the pipeline of construction is large relative to the existing dwelling stock.

|

v |

They then go on to warn of the risks to the Australian Banks:

Overall, these estimates suggest that, by value, banks are most exposed to inner-city housing markets through their mortgage lending rather than via their development lending. The data suggest that around 2–5 per cent of banks’ total outstanding mortgage lending is to inner-city Brisbane, Melbourne and Sydney, and this share is likely to grow as the apartments currently under construction are completed. At around $20–30 billion, mortgage exposures are estimated to be larger in Sydney, reflecting Sydney’s higher apartment prices and greater number of mortgaged dwellings, than in Brisbane and Melbourne where mortgage exposures are estimated at around $10–20 billion in each inner-city area.

You could argue that the banks have designed their business to be able to take strain like this and I would agree that they should have. What they aren’t prepared for though is a perfect storm of high impact risks which are likely to occur simultaneously in the next 6-24 months, such as:

- Massive job losses from the government’s decision to let the car industry close it’s doors meaning more delinquency rate increases baked in

- Huge dividends that won’t be possible to maintain

- Tightening lending standards

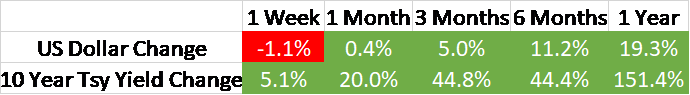

- The reliance of the Australian banks for off shore funding

- Downgrades from ratings agencies

- Possible end of business cycle shock (like the GFC)

The government, regulators, media and vested interests are all captured and will tell you all is well, but the global hedge funds and institutional investors are clear about what they expect to happen. They are placing bigger and bigger bets that the Australian Banks aren’t prepared.

In May this year Jonathan Tepper made worldwide news with his analysis of the Australian bubble, short positions on the bank shot up to $9 billion Australian dollars, a record at the time. Since then without any major news coverage, short positions have increased by %17.

The Commonwealth Bank of Australia is one of the most exposed to a housing downturn. In the last GFC it fell sharply to $AU24 before the Australian Government came to the rescue and China unleashed the mother of all stimulus packages.

|

v |

With China built out and the Australian Government out of monetary options will CBA and the other banks be so lucky a second time around. The last option to save it would be the tax payer funded $380 Billion bailout package, which itself may not be enough given that the big four’s assets are over four times the size of the economy.

No bubble is the same and the Australian bubble has many different but interrelated drivers. While one part of the market is collapsing other regions continue either sideways or even manage to grow a little. Recent data releases from both Moody’s and the Reserve Bank of Australia however show that the trend is worsening. With both threats and vulnerabilities increasing the best case the banks and community can hope for now is that it goes sideways or deflates slowly for an extended period.

If there was to be end of business cycle event though like the last GFC though it will all unravel very quickly.

Chart Captions by PT

Charts by: Moody’s, MacroBusiness, Corelogic

Full story here

Are you the author?

He is a family man with passion for the opportunity that lies at the intersection of practical macro economics and technical trading analysis.

Previous post

See more for 6b.) Debt and the Fallacies of Paper Money

Next post

Tags:

newslettersent,

Real Estate