Tag Archive: newslettersent

FX Weekly Preview: Politics Not Economics is Driving the Markets

The Fed is more confident this year of stable growth and rising inflation. The new US Administration's economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the week on a firm note, with markets digesting what they perceived as a dovish Fed bias. We disagree, and continue to believe that markets are underestimating the Fed’s capacity to tighten this year. EM FX could continue gaining some traction if the dollar correction continues, but we think US interest rates will ultimately move higher and put pressure on EM once again.

Read More »

Read More »

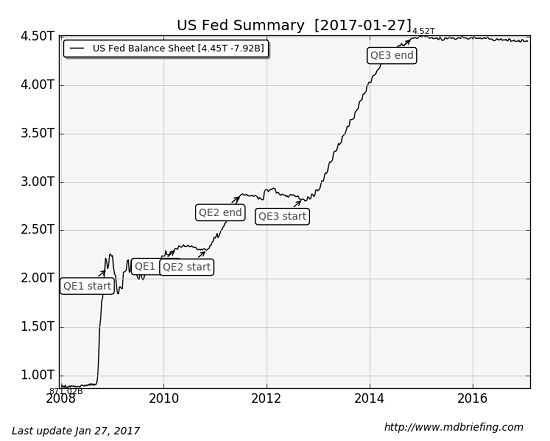

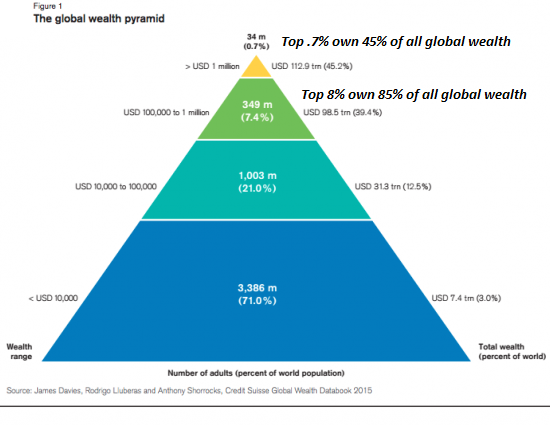

The Central Banks Face Unwelcome Realities: Their Policies Boosted Wealth Inequality, Failed to Generate “Growth”

Rather than be seen to be further enriching the rich, I think central banks will start closing the "free money for financiers" spigots. Take a quick glance at these charts of the Federal Reserve balance sheet and bank credit in the U.S.

Read More »

Read More »

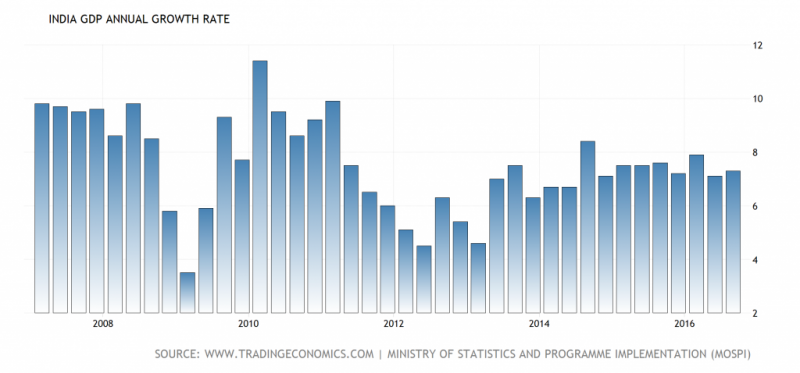

India: The World’s Fastest Growing Large Economy?

India has been the world’s favorite country for the last three years. It is believed to have superseded China as the world’s fastest growing large economy. India is expected to grow at 7.5%. Compare that to the mere 6.3% growth that China has “fallen” to.

Read More »

Read More »

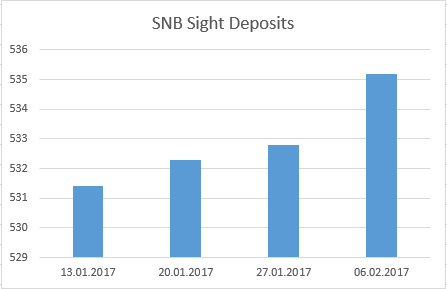

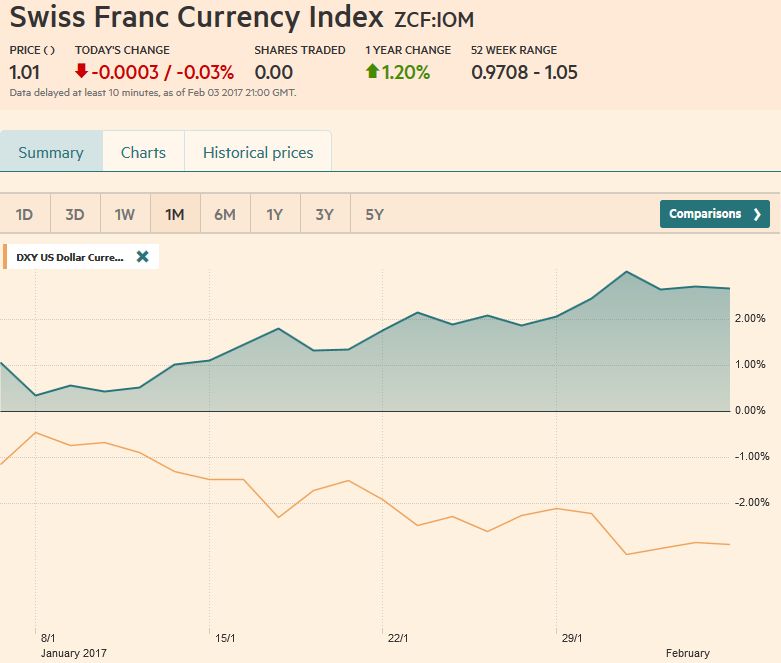

FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now - and with it the franc recovered.

Read More »

Read More »

The Futility of Predictions

Back in late 2013 I wrote a piece on human nature which was in part inspired by the bullish exuberance exhibited by a MarketWatch article predicting the DJIA at 20,000 in the near term future. Yesterday afternoon, a bit over three years later, that prediction actually became reality and I’m sure the author of that article as well as many other like minded traders popped some champagne in celebration of their awesome ability to predict the future.

Read More »

Read More »

Destroying The “Wind & Solar Will Save Us” Delusion

Submitted by Gail Tverberg via Our Finite World blog, The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short … Continue reading »

Read More »

Read More »

Switzerland: Chocolate, Watches, And Jihad

Swiss authorities are currently investigating 480 suspected jihadists in the country. "Radical imams always preached in the An-Nur Mosque... Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad." — Saïda Keller-Messahli, president of Forum for a Progressive Islam.

Read More »

Read More »

Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states?

Read More »

Read More »

Emerging Markets: What has Changed

Philippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. The Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Allies of Brazil President Michel Temer now head up both houses of congress. Press...

Read More »

Read More »

Don’t Blame Trump When the World Ends

There was, indeed, a time when clear thinking and lucid communication via the written word were held in high regard. As far as we can tell, this wonderful epoch concluded in 1936. Everything since has been tortured with varying degrees of gobbledygook.

Read More »

Read More »

What Would a Labor-Centered Economy Look Like?

How about moving the power to create money from the apex of the pyramid down to its lowest level? Let's spend a moment deconstructing the word "capitalism." Note it contains the word Capital. So far so good. Obviously the key concept here is capital. So what is "capital"? It turns out there are multiple kinds of capital. The most familiar kinds are tangible: cash, orchards, factories, water rights, tools, and so on.

Read More »

Read More »

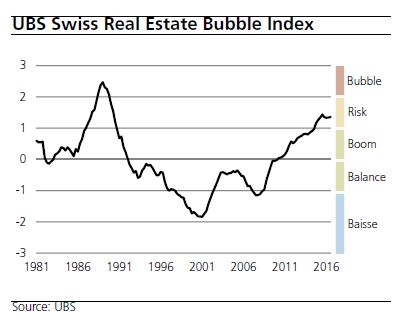

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2016

The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016. The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks. The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth.

Read More »

Read More »

Swiss fact: 96 percent of Swiss workers earn 3,000 francs or more a month

A report published by the Swiss Federal Office of statistics, shows that only 4.3% of full-time workers earn less than CHF 3,000 per month. The monthly figure is net of social security deductions, but includes one twelfth of the 13th bonus month typically paid in Switzerland.

Read More »

Read More »

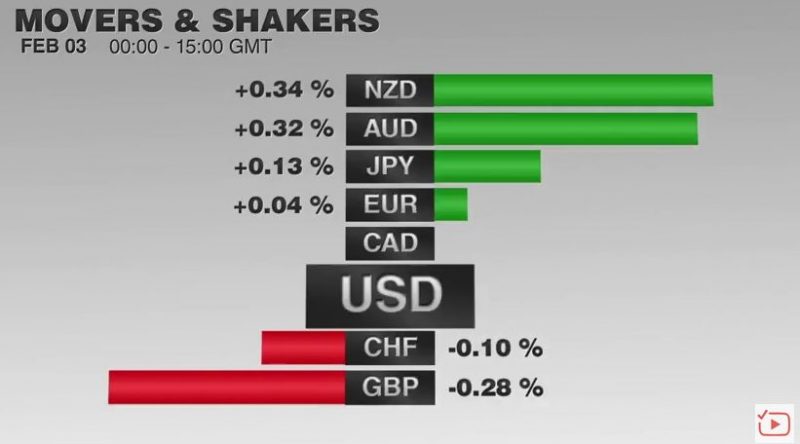

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

The Future of Globalization

antiglobalizationThe cross-border movement of goods, services, and capital increased markedly for the thirty years up to the Great Financial Crisis. Although the recovery has given way to a new economic expansion in the major economies, global trade and capital flows remain well below pre-crisis levels. It had given rise to a sense globalization is ending.

Read More »

Read More »

Ignore Sabre-Rattling Between Trump and The World, Buy Gold

Gold hits 12-week high. USD Gold price up 4.85% in last month. Sabre-rattling from Trump administration set-to benefit gold. Iran upset and Middle East tensions could drive oil and gold prices up. Financial Times foresees “not only currency wars but a fully fledged trade confrontation that could be disastrous for the world economy.” Royal Mint producing 50 % more gold bullion coins and bars compared to 2016

Read More »

Read More »

Swiss Retail Sales, December: Down 3.5 percent against last year

Turnover in the retail sector, adjusted for sales days and holidays, fell by 4.3% in nominal terms in December 2016 compared with the previous year. To put this into perspective, however, it should be noted that unadjusted turnover fell by only 0.7%. Seasonally adjusted, nominal turnover fell by 2.0% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, February 02: Dollar Remains on Back Foot After ADP and FOMC

The US dollar remains on its back foot despite the stronger than expected ADP job estimate and the FOMC that said nothing to dissuade investors that it will be gradually raising rates this year.

Read More »

Read More »