Tag Archive: newslettersent

FX Daily, February 13: Quiet Start of Busy Week

With inflation and growth reports due out this week and Federal Reserve Chair Yellen's testimony before Congress, it promises to be a busy week for investors. However, the week has begun off fairly quietly, while the recent rally in equities continues.

Read More »

Read More »

New Book: Political Economy of Tomorrow

My new book,Political Economy of Tomorrowhas just been published, and it is available onAmazon. The book is not so much of a sequel to my first book,Making Sense of the Dollar. There is very little about the foreign exchange market in the new book. However, it is not wholly new cloth either.

Read More »

Read More »

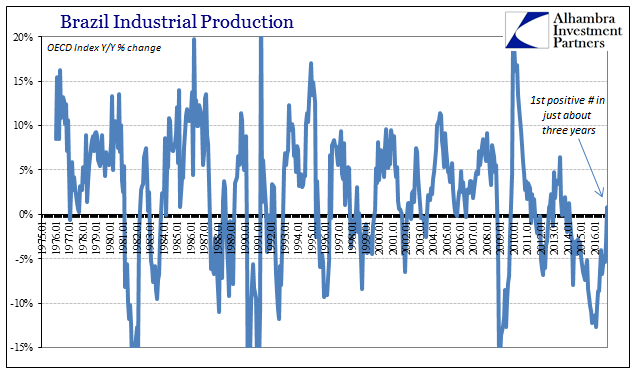

Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

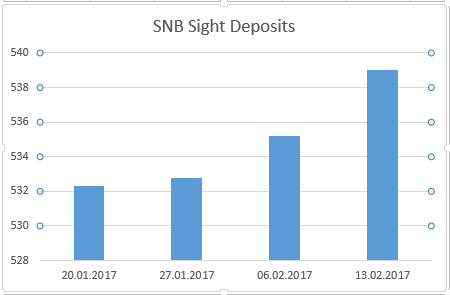

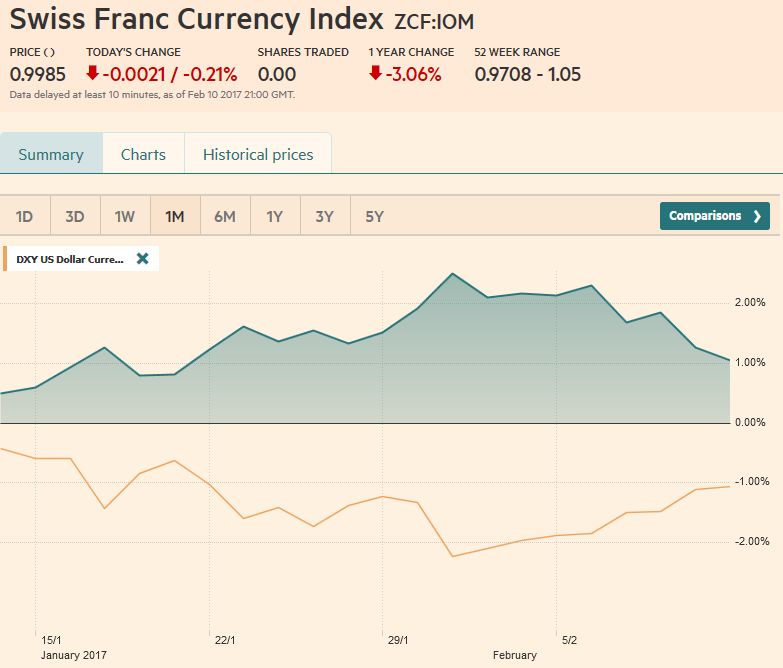

Weekly Sight Deposits and Speculative Positions: Another Post-Trump SNB Intervention Record

A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But one should realize that private investors will need to buy the EUR at 1.10, but the SNB is not willing to do so any more. Hence we must see SNB interventions of zero, before EUR/CHF goes to 1.10.

Read More »

Read More »

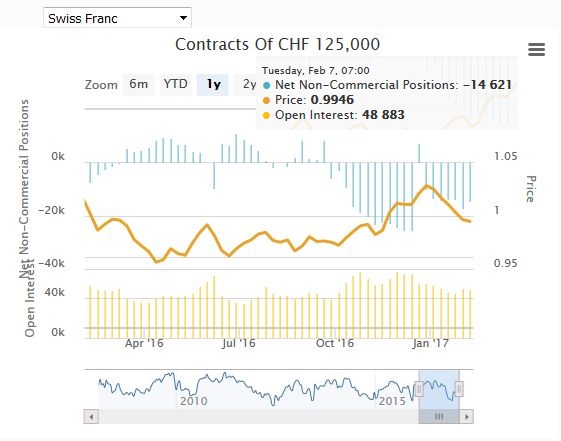

Weekly Speculative Position: Speculators are long all currencies of the dollar bloc

Speculators are net short CHF with 14.6K contracts against USD. This is less than the 17K last week.

Read More »

Read More »

FX Weekly Preview: Yellen’s Path Cleared by Trump’s Moderation

Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen's testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump's upcoming speech to Congress.

Read More »

Read More »

Emerging Market Preview of the Week Ahead

EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday.

Read More »

Read More »

FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

We are expecting a further strengthening of both dollar and Swiss Franc against the euro over the next 3 months. Reason is the rising Swiss demand the continued dovishness of the ECB, despite rising inflation.

Read More »

Read More »

Ist die SNB fachlich überfordert?

„Die SNB druckt Franken und kauft mit dem Geld Anleihen oder Aktien in Fremdwährungen.“ Diese Behauptung wurde in den vergangenen Tagen einmal mehr flächendeckend von den Schweizer Medien kolportiert. Vorausgegangen war ein „Montagsinterview“ von SNB-Chef Thomas Jordan in der Süddeutschen Zeitung.

Read More »

Read More »

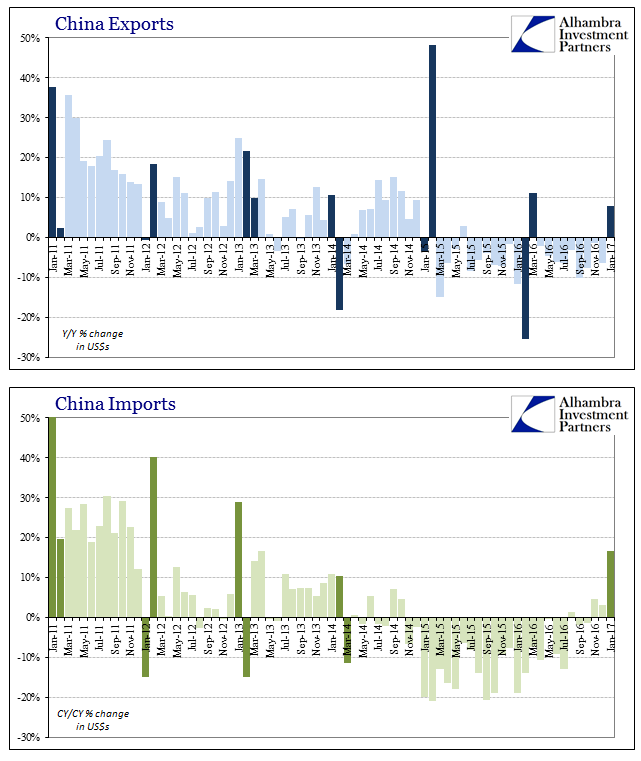

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »

Swiss Might Drop Daylight Savings

Switzerland could drop daylight savings. Currently, Switzerland’s Federal Council sees no reason to abandon it, however if Switzerland’s neighbours did it would follow, mainly for economic reasons said the Federal council. National councilor Yvette Estermann (UDC/SVP), who is fiercely opposed to daylight saving, took the opportunity to point out the negative health consequences of changing the time every six months.

Read More »

Read More »

Emerging Markets: What Has Changed

Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%.

Read More »

Read More »

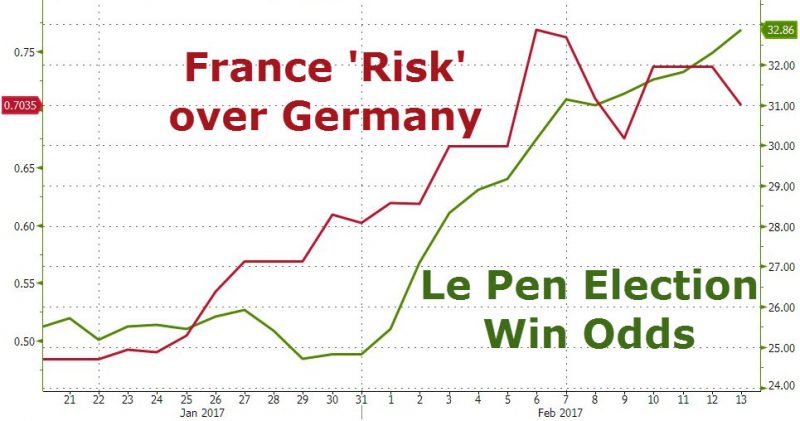

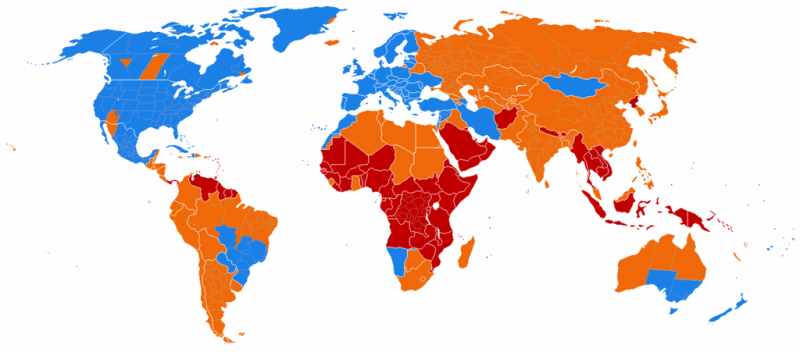

Martin Armstrong: “EU in Disintegration Mode”

Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong's piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that,

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

When Trumponomics Meets Abenomics

What will President Trump and Japanese Prime Minister Shinzo Abe talk about when they meet later today? Will they gab about what fishing holes the big belly bass are biting at? Will they share insider secrets on what watering holes are serving up the stiffest drinks? [ed. note: when we edited this article for Acting Man, the meeting was already underway]

Read More »

Read More »

FX Daily, February 10: US Dollar Holding on to Week’s Gains

The US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week's decline. The Aussie is the strongest on the day, up about 0.2% to trim the week's loss to about 0.45%.

Read More »

Read More »

Cool Video: Bearish Case for Euro and Prospect of Currency Wars

Still in London as this part of the business trip is winding down. I had the privilege of going over to the Bloomberg office today and spoke with Vonnie Quinn and Mark Burton about the euro's outlook and whether the US should have a strong or weak dollar.

Read More »

Read More »

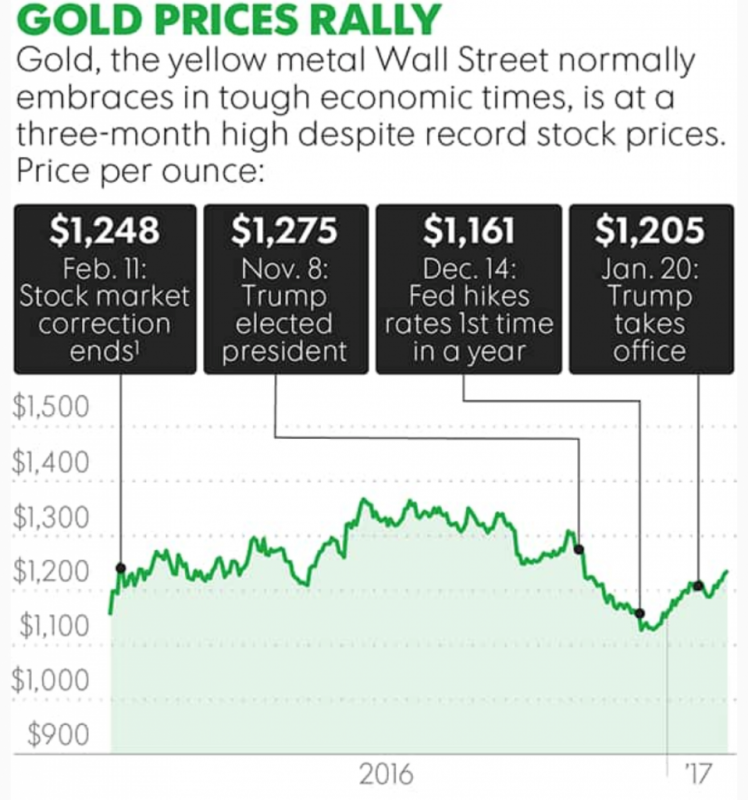

Gold Prices Up 6 percent YTD As Trump ‘Honeymoon’ Ends

Gold prices continued to shine this week reaching $1,244.70 per ounce and and has posted gains in five of the last six weeks. This week it reached a new three-month high – it’s highest since the Trump win and has climbed over 6% this year, beating the gains made in the same period in 2016.

Read More »

Read More »

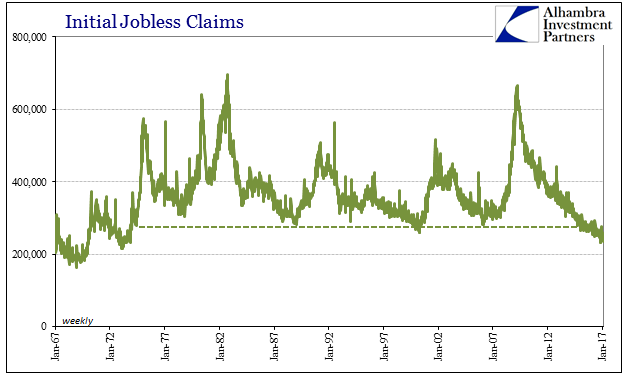

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »