| Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows.

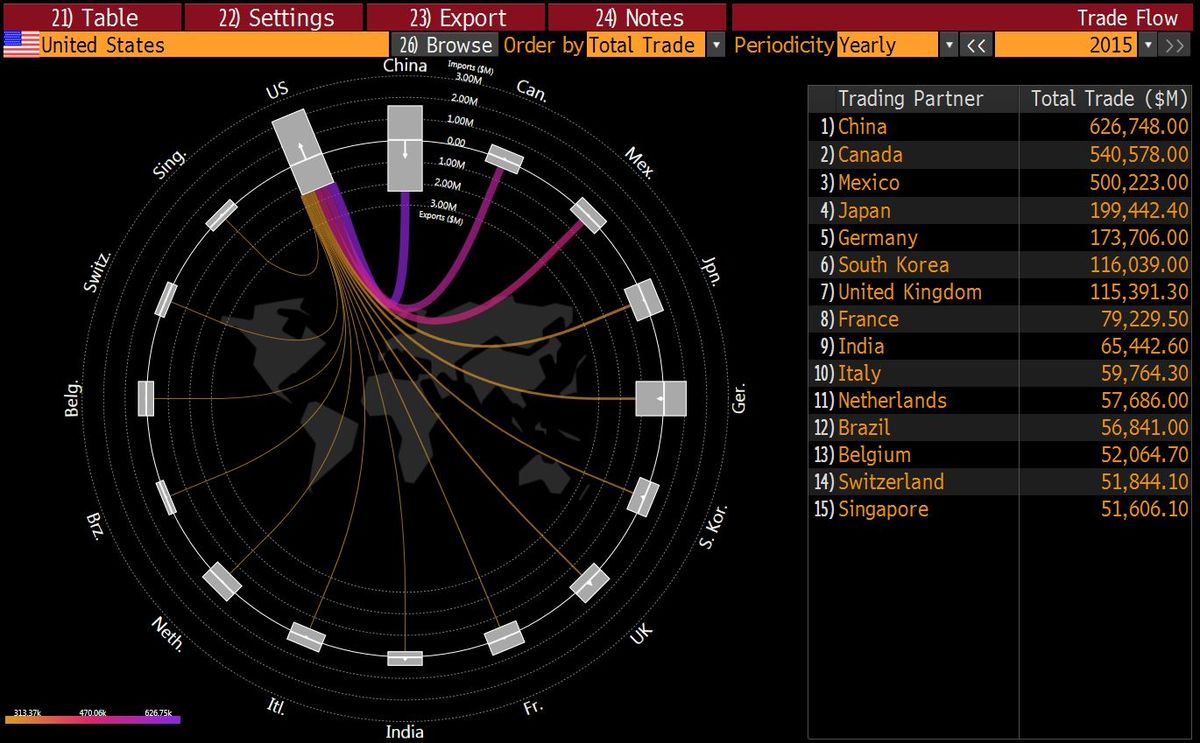

As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With protectionism, border tax, VAT and trade wars the buzzword of the day, suddenly international trade is all that seems to matter, and yet “It’s been decades since investors gave significant thought to the data amid easing trade tensions.” What’s more, traders will have to learn to think small again – the flows represent a drop in the bucket for a currency market where about $5 trillion exchanges hands every day. In a world of $4 trillion central bank balance sheets, a syplus measured in billions may seem like an anachronism, but it suddenly matters a lot. With the dollar near a 14-year high and Donald Trump accusing countries including China and Japan of keeping their currencies weak to gain trade advantages, Cignarella writes, the risk is any widening in the U.S. trade deficit may prompt a reaction from the president and spur a dollar selloff. Indicatively, on Friday, Trump was quiet after China’s monthly trade surplus with the U.S. slipped to a seven-month low of $21.4 billion. |

China Trade Balance with United States, April 2016-January 2017 |

Then again, when it comes to the second biggest economy in the world, China, all economic data should be taken with a grain of salt, whether due to outright fabrication or calendar effects, as Goldman explained today:

The above example merely underscores the difficulty traders will have in trying to keep track of one of the most important trade flows in the world. And that does not even touch on over-invoicing. In any case, “the fact that the president is planning to do so much on the trade front which could potentially alter the global trading landscape permanently, forces market participants to focus on whatever trade data they can find,” said Brad Bechtel, a currency strategist at Jefferies. “Although often a bit dated, trade data will have far more relevance going forward.” |

United States Trade Balance |

| Another example: Trump’s summit with Japanese Prime Minister Shinzo Abe on Friday drew the attention of dollar-yen traders like no such meeting since trade tensions preoccupied the nations’ leaders in the 1980s and 1990s.

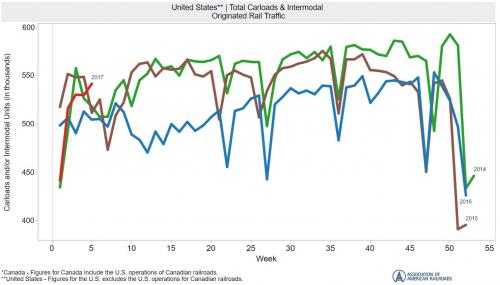

So what data should currency traders follow? Cignarella’s advice is that apart from the the U.S. Census Bureau’s monthly release (due March 7), investors should pay attention to the statistics from these seven nations: China, Japan (due Feb. 20), South Korea (due March 1), Germany (March 10),Taiwan (due March 7), and Switzerland (due Feb. 21). All were placed on the Treasury Department’s monitoring list last year when it evaluated the foreign-exchange policies of trading partners. Treasury cited instances of unusually large bilateral trade surpluses in the first four countries, and singled out Taiwan and Switzerland for engaging in interventions that only serve to weaken their currencies. Chinese policy makers are already surveying domestic companies to evaluate the potential impact should the U.S. label the nation a currency manipulator and impose punitive tariffs, according to people familiar with the issue. And for those uninspired by the mundane official releases and frustrated by their backward-looking nature, Deutsche Bank’s Sebastien Galy, has a different recommendation: freight-rail traffic. Incidentally, that’s the indicator Warren Buffett said he’d monitor if he was stuck on a desert island for a month and only had access to one statistic. The Association of American Railroads has weekly data for the U.S., Canada, and Mexico, the kind of high-frequency information that a currency trader could really sink their teeth into. |

United States Total Carloads and Intermodal |

Full story here Are you the author? Previous post See more for Next post

Tags: Business,China,Currency,Currency intervention,currency war,Donald Trump,economy,exchange rate,Foreign exchange market,Germany,International trade,Japan,Japanese yen,Mexico,newslettersent,reserve currency,Switzerland,trade deficit,Trade Wars,US Federal Reserve,Warren Buffett