In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Tag Archive: Currency intervention

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

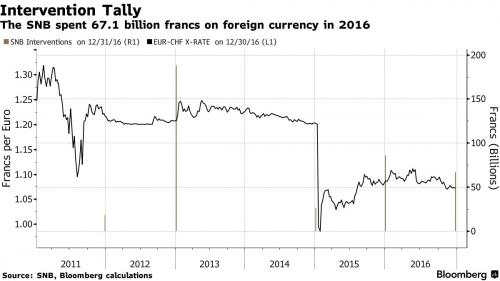

SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China.

Read More »

Read More »

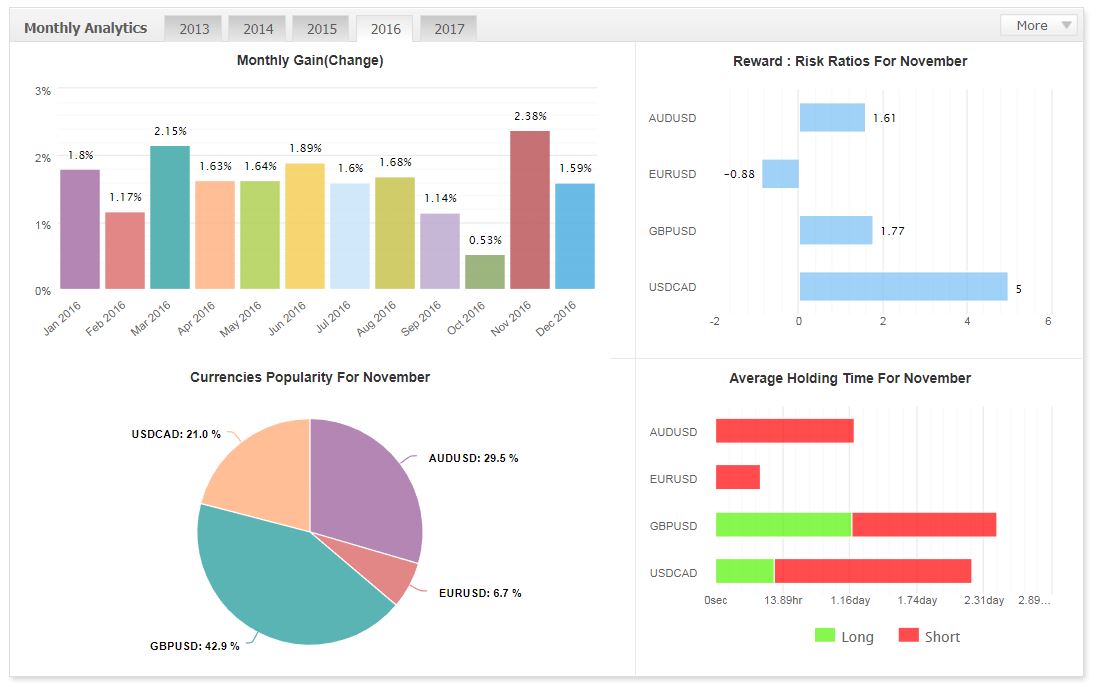

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

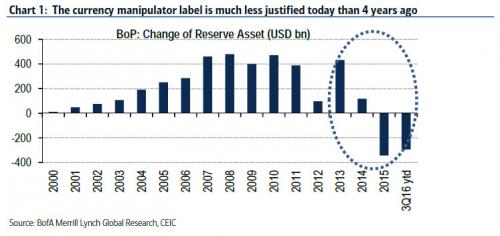

Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump's violating the "One China" policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office.

Read More »

Read More »

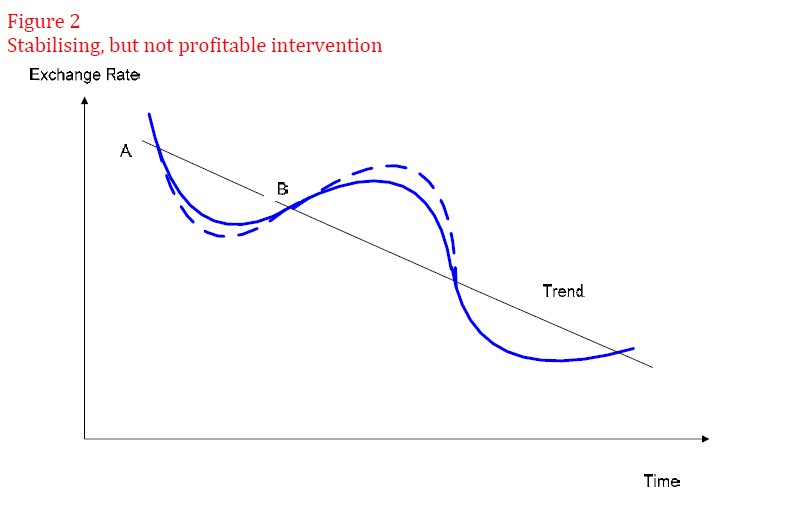

Currency intervention for Central Banks: When and at which level?

The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data.

Read More »

Read More »