While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump’s violating the “One China” policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office. Even Bank of America, which two months ago issued a report arguing that it is too early to base concerns of US trade barriers against China on campaign rhetoric, notes “that recent tweeter feeds from Mr. Trump suggests he disapproves the yuan depreciation, implying a higher probability of naming China as a currency manipulator country after his inauguration in January 2017.”

BofA believes that such an action could take place as soon as the spring of 2017, or around the time the the US Treasury Department meet in April to determine which country on the monitoring list will be named.

First, some background: under rules adopted by the Obama Treasury, China is not a currency manipulator. It fails to meet 2 out of the 3 conditions named below, even though it is on the watch list together with 5 other economies (Japan, Germany, South Korea, Taiwan and Switzerland). The criteria include:

|

China - BoP |

Nonetheless, despite the last bullet point suggesting the Yuan is rather over valued at this moment, with PBOC intervention serving to prop it up in order to prevent further capital flight, as BofA’s Helen Qiao admits, these criteria are far from being a fixed standard. Since they are not legally binding, it is not impossible that the future President would ask his Treasury Secretary to revise the criteria, or use his discretion to label China as a manipulator anyway.

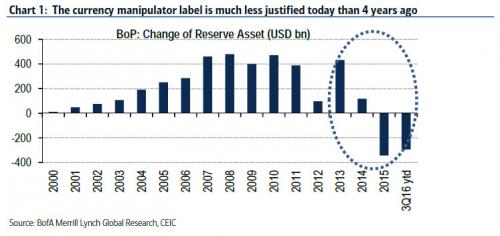

If tagged in April 2017, it will be the 2nd time the US Treasury names China as a currency manipulator. The first time was back in 1992 – 1994, after labelling Korea and Taiwan in 1988. Back then the criteria were similar to the current version. Both Korea and Taiwan were struggling to resist the pressures of currency appreciation, which appeared to be in sharp contrast of the PBoC’s efforts to prevent yuan from excessive weakening in the last 1.5 years. The point of naming China as a currency manipulator could have won more sympathy, had it been made 4 years ago (see Chart 1).

What happens when China is labelled a manipulator?

Labeling itself doesn’t lead to an immediate tariff hike. The designation itself won’t enable the President or the Congress to impose an immediate tariff on imports from China. Nor will it bring any severe penalty on China with the measures proposed. After all, the last time this clause was used dated back to 1994.

If China were named a currency manipulator, the law requires the US Treasury to kick off enhanced bilateral engagement. If the assessment of currency manipulation remains unchanged a year after the initial labeling, legislation requires the US president to take one or more of the penalties that include i) denying access to US Overseas Private Investment Corporation (OPIC) financing; ii) exclude China from US government procurement; iii) call for heightened IMF surveillance; and iv) instructing trade representative to assess whether to enter into a trade agreement/negotiations. However, most of these measures do not form any immediate restrictive or binding punishment on China.

So why bother?

The main point of naming China as a currency manipulator would be to bring China back to the negotiation table at the lowest cost. Trump has publicly stated that he supports bilateral vs. multilateral trade agreements (not just for China, but all trading partners). It is possible that the Trump administration will seek to engage China in trade agreement negotiations as soon as possible, even before a manipulation conclusion is drawn. But depending on the terms and conditions attached, China may not be in a hurry to engage.

When they finally sit down, the future US President could raise concerns about selected industries during the trade negotiations, where he sees the potential for reclaiming jobs in the US. Recall that under the International Emergency Economic Power Act of 1977 Congress has delegated “emergency” powers to the President to impose selective tariff and quotas, which are likely to materialize.

The question then becomes how would China respond, as such a risky move could potentially set the US-China trade relationship off on the wrong foot under the new presidency.

BofA thinks China will push back against threatened trade restrictions. Instead of caving in and trying to prepare voluntary export restraints (VER) like Japan did with their auto exports back in the 1980s, China will likely start by strongly protesting against the labelling with the IMF, but not to initiate more aggressive retaliation (such as selling US government bonds from their official reserves) immediately. That said, even a “war of words” could weaken investor confidence not only in the US and China, but globally.

As BofA concludes, in the 15th year after China joined the WTO, it would likely take a lot more patience and perseverance for the largest exporter in the world to maintain a smooth path for its external sector.

To this we can add, that while China may not “immediately” sell US government bonds because it wants to, it may continue selling bonds because it has to: recall that over the past year, China and “Belgium” combined have dumped nearly half a trillion in US Treasury debt which has brought their collective holdings to a decade low of $1.23 trillion. The selling has taken place just as a result of currency defense, without the intention if impairing prices. We can imagine how much more dedicated China would be if it wanted to sell with the specific intention of hurting other holders of US Treasuries.

Full story here Are you the author? Previous post See more for Next postTags: Asia,Bank of America,Belgium,Business,China,Congress,Currency,Currency intervention,economy,Germany,International Monetary Fund,International trade,Japan,newslettersent,Switzerland,Taiwan,Trade,Trade War,Trump Administration,U.S. Treasuries,US government,yuan