Tag Archive: newslettersent

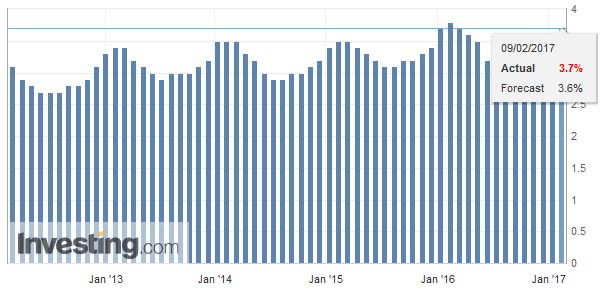

Switzerland Unemployment January 2017: Up to 3.7 percent from 3.5 percent, seasonally adjusted unchanged at 3.3 percent

According to the State Secretariat for Economic Affairs (SECO) surveys, 164,466 unemployed were registered at the Regional Employment Centers (RAV) at the end of January 2017, 5,094 more than in the previous month. The unemployment rate thus rose from 3.5% in December 2016 to 3.7% in the reporting month.

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

Is a Strong or Weak Dollar Good for the US? The $16 trillion Question

Dollar movement helps some economic interest and hurts others. From a strategic point of view, the best thing for the US is the market-generated rate. It was an important achievement that the forex market was de-weaponized. Many observers have been crying wolf about a currency war for many years, which may have de-sensitized investors to the threat of a real one.

Read More »

Read More »

Incrementum Advisory Board Meeting, Q1 2017 and Some Additional Reflections

The quarterly meeting of the Incrementum Advisory Board was held on January 11, approximately one month ago. A download link to a PDF document containing the full transcript including charts an be found at the end of this post. As always, a broad range of topics was discussed; although some time has passed since the meeting, all these issues remain relevant.

Read More »

Read More »

Cool Video: Around the World with Katie Martin of the Financial Times

I am in London as part of a larger business trip. I had the chance today to talk to Katie Martin, who runs Fast FT and is often writing about foreign exchange. They show was live on Facebook. It is about a 22 minute interview and although foreign exchange is the key issue, to get to it we end up talking about many things, including US interest rates, Trump, and even cooking frogs.

Read More »

Read More »

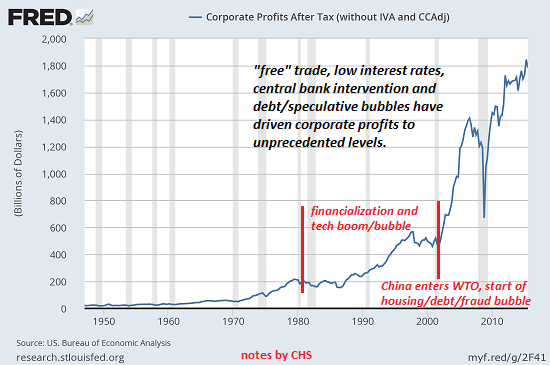

The Colonization of Local-Business Main Street by Corporate America

This is what our mode of production optimizes: ugliness, debt-serfdom, and servitude to politically dominant corporations.

Read More »

Read More »

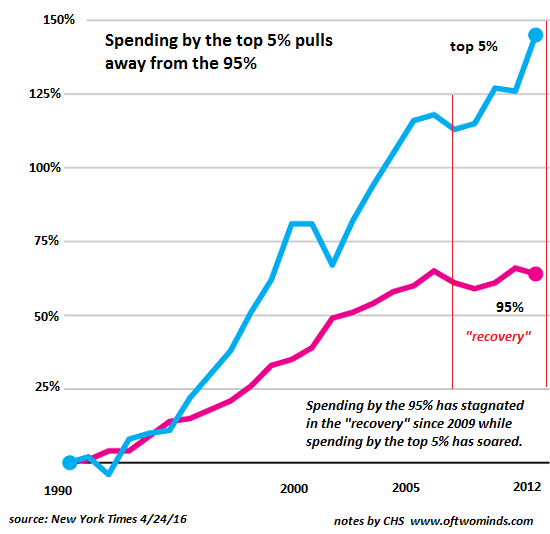

The Central Banks Pull Back: Now It’s Up to Fiscal Policy to “Save the World”

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank "save" has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy?

Read More »

Read More »

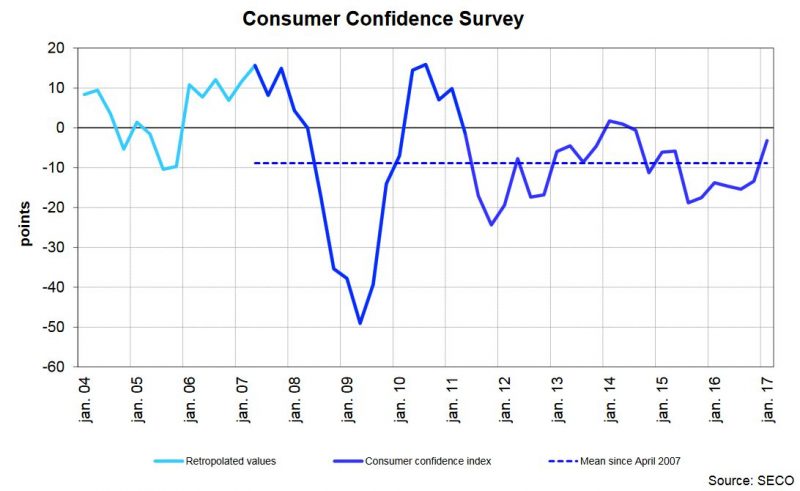

FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come.

I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015.

Read More »

Read More »

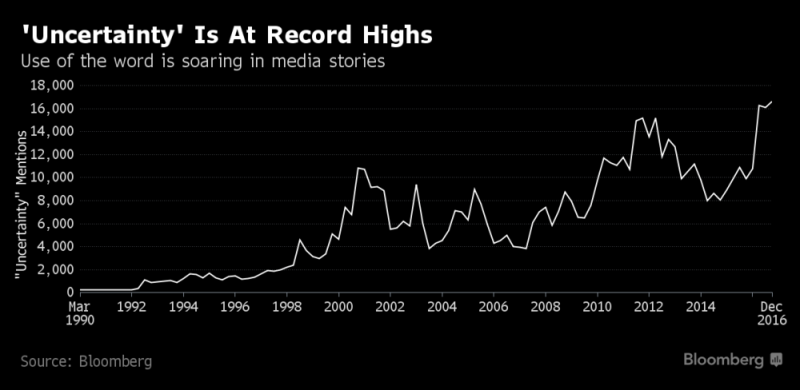

Gold Prices Rising As “World Has Never Been More Uncertain”

Gold prices rising & up 6.6% YTD. Signal “impending market volatility”. World has never been more uncertain (see chart). Fear in Wall Street versus Fear in Washington. Price of ‘plunge protection’ rising even as VIX remains low. Smart money diversifying into gold. Important to watch rising gold and rising bond yields. Gold may prove the “tell”.

Read More »

Read More »

Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the US.

Read More »

Read More »

Great Graphic: Interesting Sterling Price Action

Sterling is having an interesting day. It fell in the face of the US dollar's bounce but has recovered fully. It has not yet traded above yesterday's high (~$1.2510) but it may. It does appear to be tracing out a hammer in Japanese candle stick terms.

Read More »

Read More »

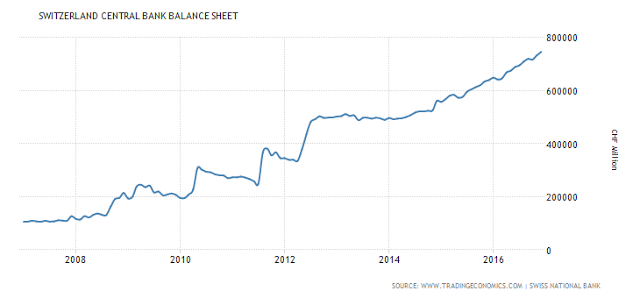

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

Swiss Consumer sentiment brightens

Consumer sentiment in Switzerland has significantly improved according to the latest survey*. The index has climbed to -3 points, rising above its long-term average. Consumers are clearly more optimistic about where they feel the economy is going as well as being less gloomy about the future development of unemployment and their own financial situation.

Read More »

Read More »

When Government Acts, “Unintended Consequences” Follow

In 1850, French economist Frédéric Bastiat published an essay that is misunderstood, or more often, unread, titled, “That Which is Seen, and That Which is Not Seen.” Bastiat brilliantly introduced the idea of opportunity cost and, through the parable of the broken window, illustrated the destructive effects of unintended consequences.

Read More »

Read More »

Expropriation and Impoverishment: “Capitalist” Greece and “Socialist” Venezuela

Yesterday I noted that not all assets will make it through the inevitable financial re-set. ( Which Assets Are Most Likely to Survive the Inevitable "System Re-Set"?) Those that are easy to expropriate will be expropriated, and those assets vulnerable to soaring taxes, inflation and currency devaluation will also be hollowed out.

Read More »

Read More »

The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations.Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan's consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the inflation-linked, or protected...

Read More »

Read More »

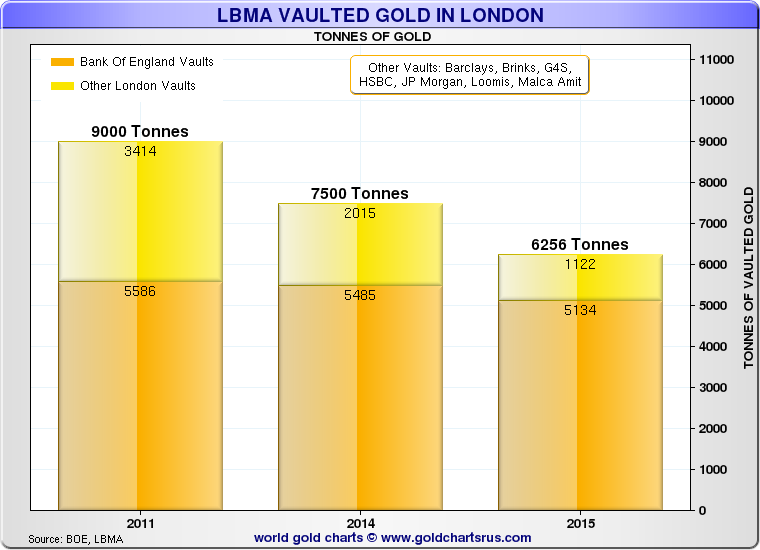

Gold Bullion Banks To “Open Vaults” In Transparency Push

London Gold Bullion Banks To “Open Vaults” In Transparency Push. London’s gold bullion market, which is centuries old, is said to be seeking transparency with plans to reveal how much gold bullion is held in vaults in and around London city according to gold bullion banks.

Read More »

Read More »

A recent purchase shows how hard it is to trust product packaging

Volkswagen shocked the world when it was revealed it was cheating on emissions tests on a grand scale. Now some television makers may be gaming the energy efficiency ratings of some of their televisions, according to the Economist.

Read More »

Read More »

Which Assets Are Most Likely to Survive the Inevitable “System Re-Set”?

Your skills, knowledge and and social capital will emerge unscathed on the other side of the re-set wormhole. Your financial assets held in centrally controlled institutions will not. Longtime correspondent C.A. recently asked a question every American household should be asking: which assets are most likely to survive the "system re-set" that is now inevitable?

Read More »

Read More »