Tag Archive: Dollar Index

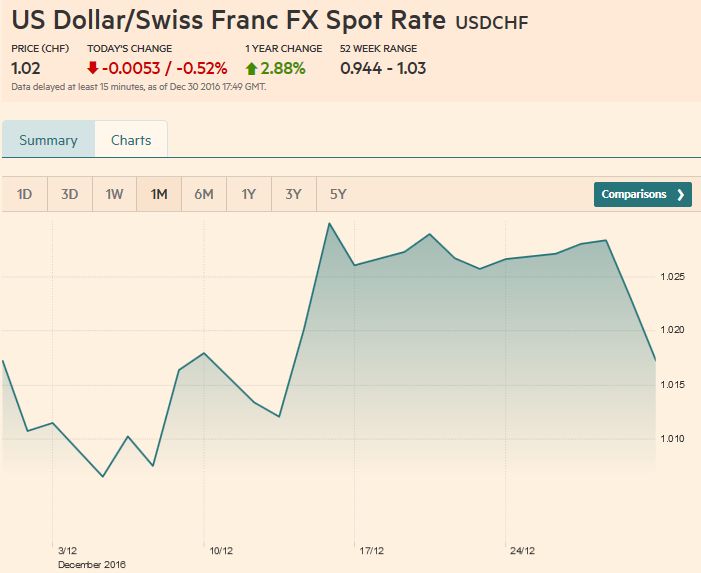

FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

The technical condition of the US dollar, which has been advancing through most of the Q4 16, has been deteriorating This led us to anticipate a consolidative or corrective phase.

Read More »

Read More »

FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

FX Weekly Review, December 12 – December 16: Fed Lifts Dollar, but Consolidation may be on Tap

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

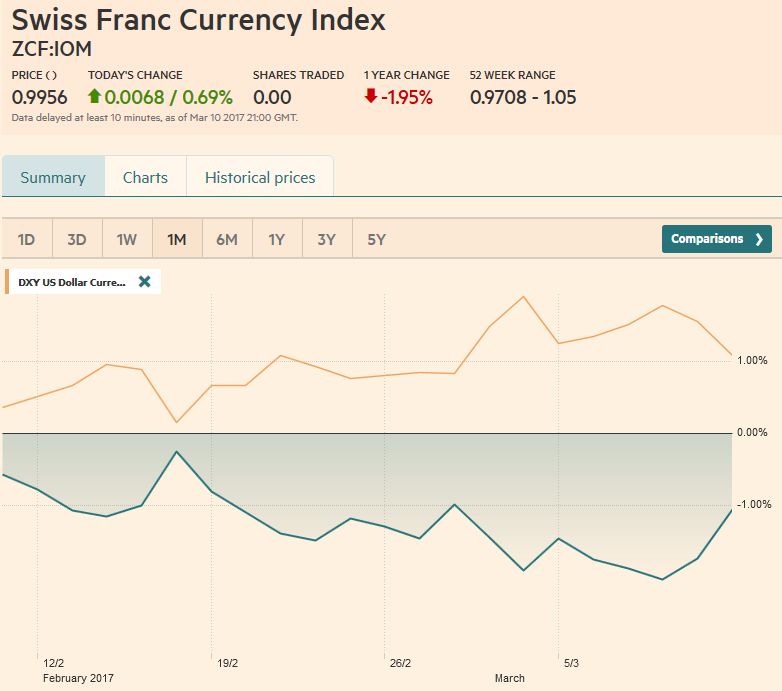

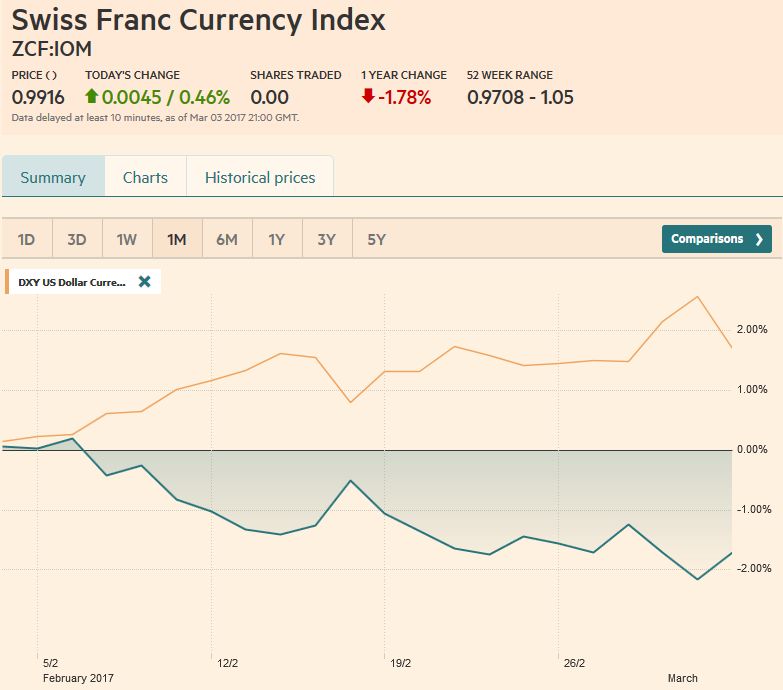

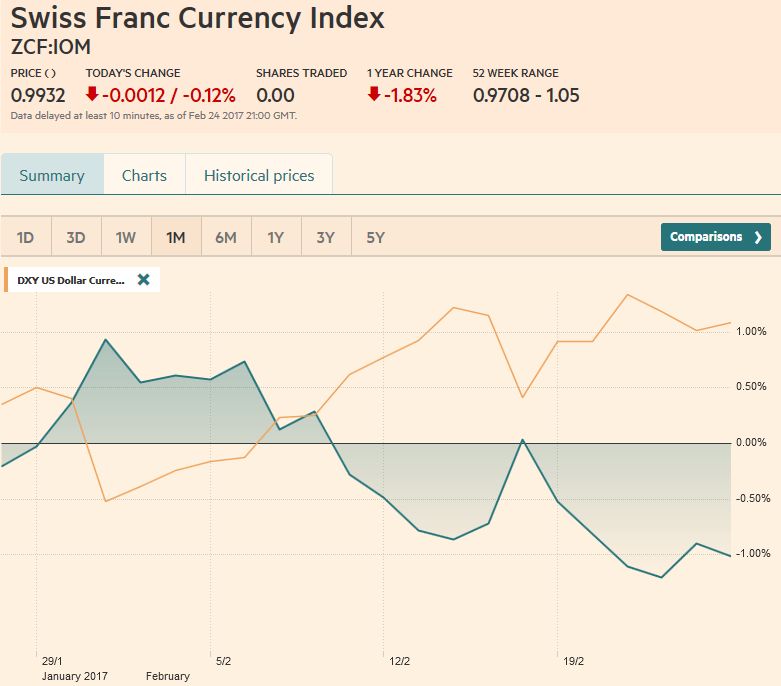

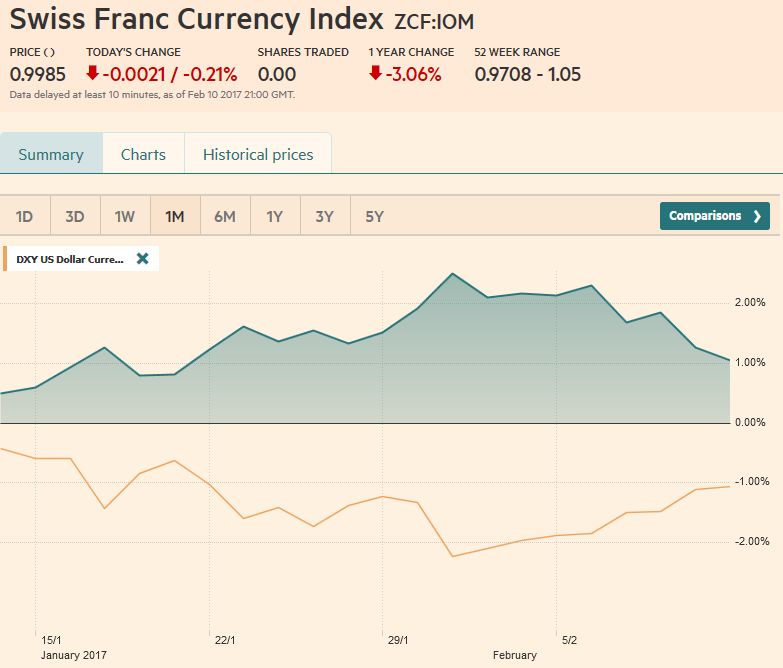

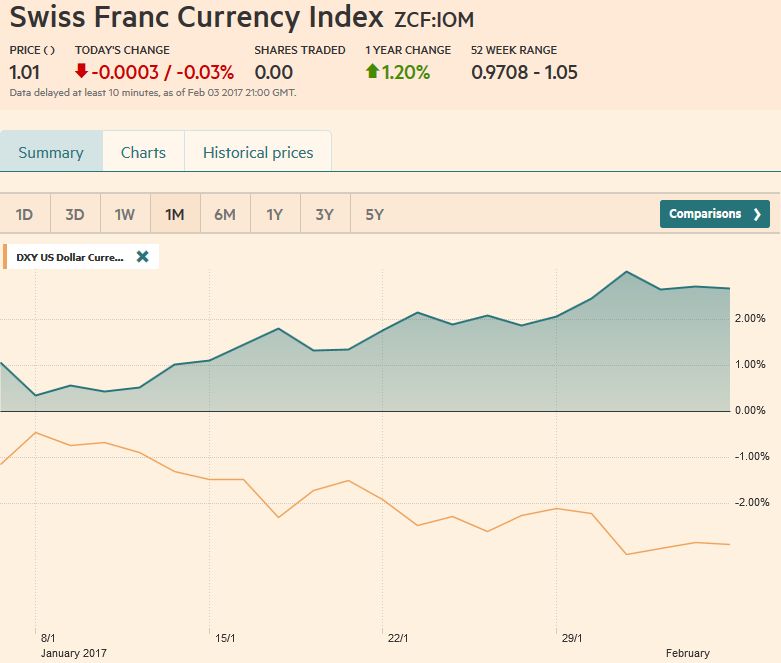

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. USD/CHF The US dollar is finishing the year on a firm note. It rose … Continue reading »

Read More »

Read More »

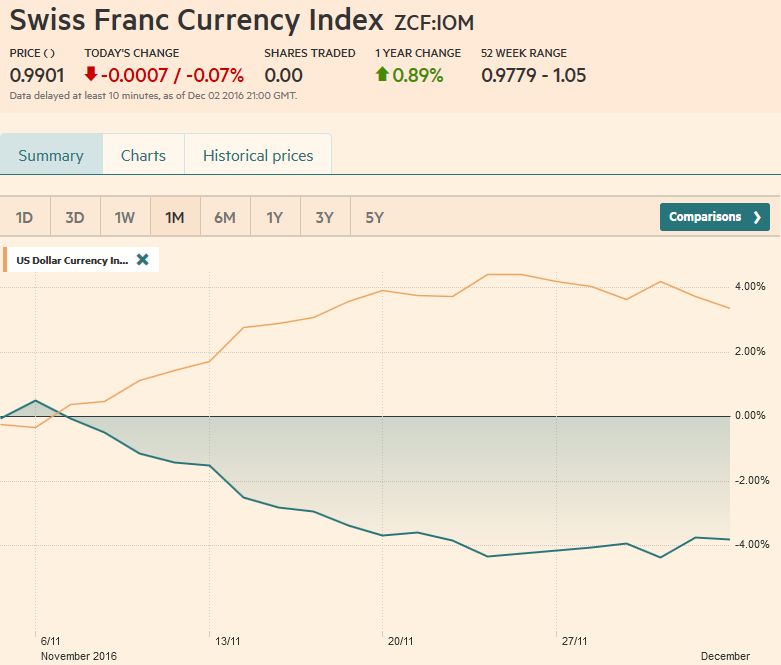

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

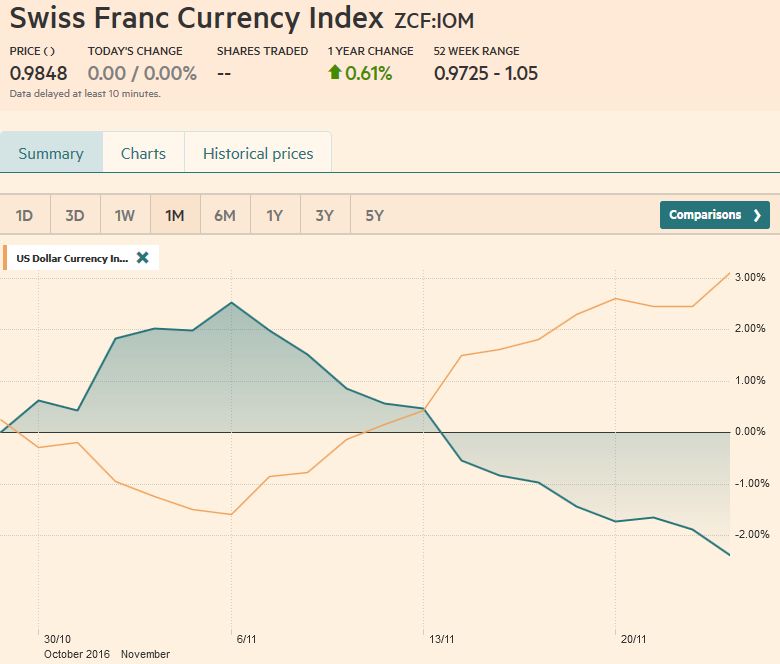

FX Weekly Review, November 21 – November 25: Dollar Strength Losing Steam

After a three-week rally, the dollar bulls finally showed signs of tiring ahead of the weekend. At least against the Swiss Franc index, the dollar index could further advance. We had observed SNB interventions in the previous week that kept the euro mostly above 1.07.

Read More »

Read More »

FX Weekly Review, November 14 – November 18: Best Dollar Weeks since Reagan

The US dollar has recorded its best two-week performance since Reagan was President. The weeks after Trump's election continue to see a weakening of the Swiss Franc, while the dollar index is on a steady rise. Still both the euro and the yen have seen worse performance than the Swiss Franc. The euro is currently under 1.07.

Read More »

Read More »

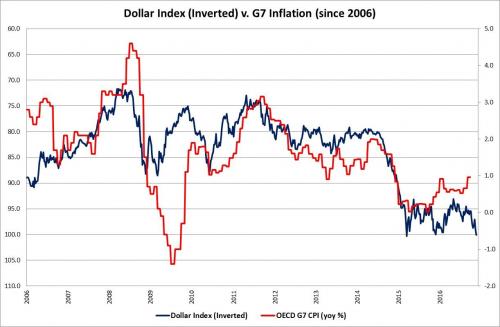

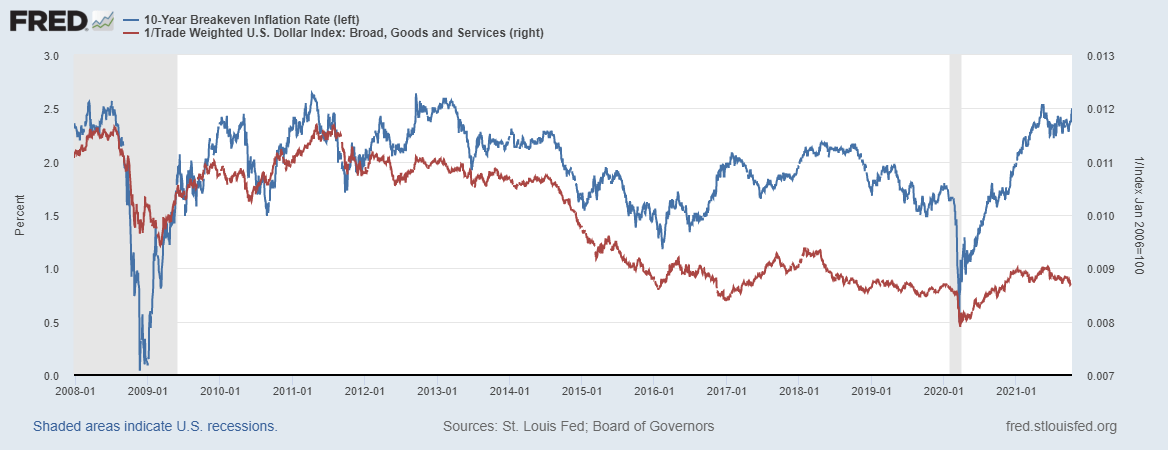

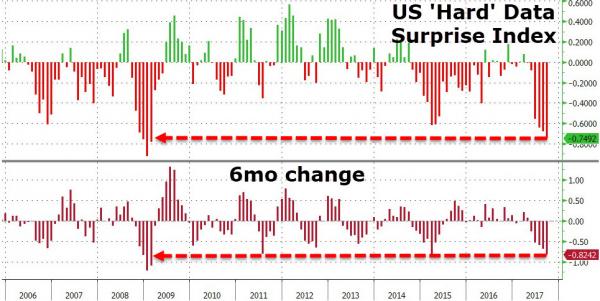

Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new "fear...

Read More »

Read More »

FX Weekly Review, November 07 – November 11: The Trump Reflation Trade

The Swiss Franc Index rose sharply, shortly after the U.S. elections. But then the Trump reflation trade came. Trump may fulfills the wet dreams of many economists. With tax cuts he might extend the U.S. fiscal deficit up to 10% per year. This resulted in:

Gains on U.S. stocks, inflows in U.S. Bonds, inflation hedges gold and Swiss Francs.

Read More »

Read More »

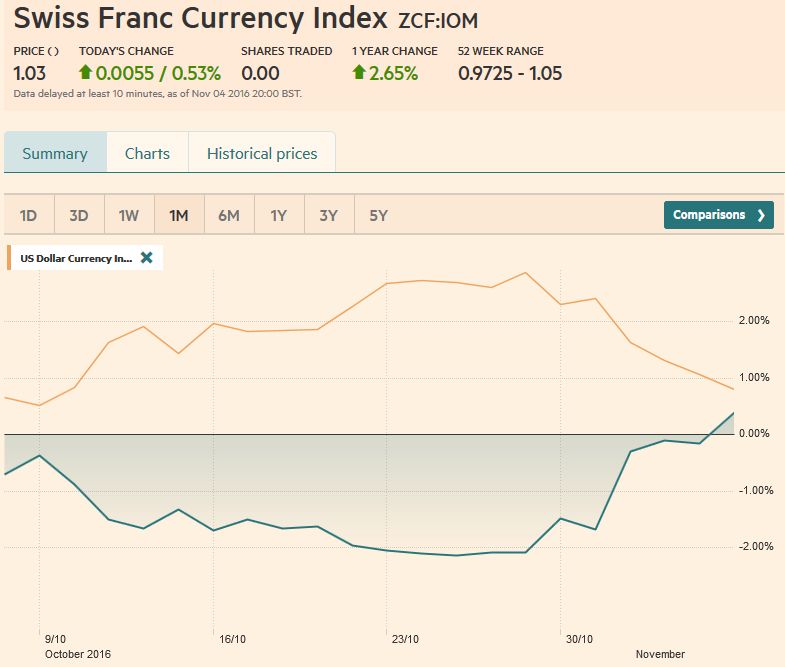

FX Weekly Review, October 31 – November 04: Dollar at Crossroads

Swiss Franc Currency Index As visible in the graph, the Swiss Franc index recovered most of its losses against the US Dollar Index for the last 30 days. In the last 30 days, both the USD currency index and the CHF currency index have had a positive performance.

Read More »

Read More »

FX Weekly Review, October 24-28: October Surprise Pushes Open Door

The Swiss Franc Index could recover some of the losses as compared to the US dollar index. Still the USD/CHF remains above 0.99. The US dollar rose against most of the major currencies last week, but the upside momentum appeared to be dissipating, even before the FBI's announcement about new Clinton emails. There are a few exceptions like the greenback's performance against the Japanese yen, Canadian dollar, and Swedish krona. The dollar made new...

Read More »

Read More »

FX Weekly Review, October 17-21: Golden Cross in Dollar Index and Deadman’s Cross in the Euro

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

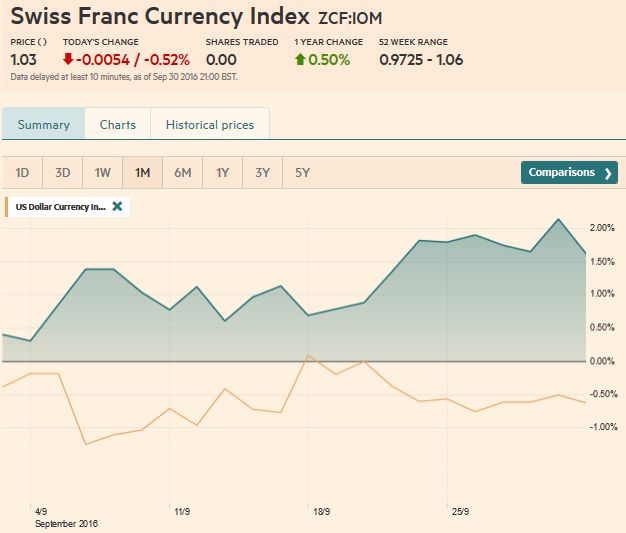

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

Great Graphic: Nearly Five-Month Uptrend in the Dollar Index Set to be Tested

DXY has been holding an uptrend since early May. It looks set to be tested near-term and technical indicators suggest it may not hold. Here are the two scenarios of penetration.

Read More »

Read More »

FX Weekly Review, September 12 – 16: U.S. Dollar Resilience Despite Hawkish ECB and bad ISM

The dollar was surprisingly strong this week. This despite a more hawkish ECB, bad U.S. economic data in the ISM surveys.

Read More »

Read More »

FX Weekly Review, September 05 – September 09: Dollar Proves Resilient as Market Rates Rise

It took the market a few days to overcome the shockingly poor non-manufacturing ISM (51.4 vs. 55.5). However, by the end of the week, the US dollar bulls had regained the upper end.

Read More »

Read More »

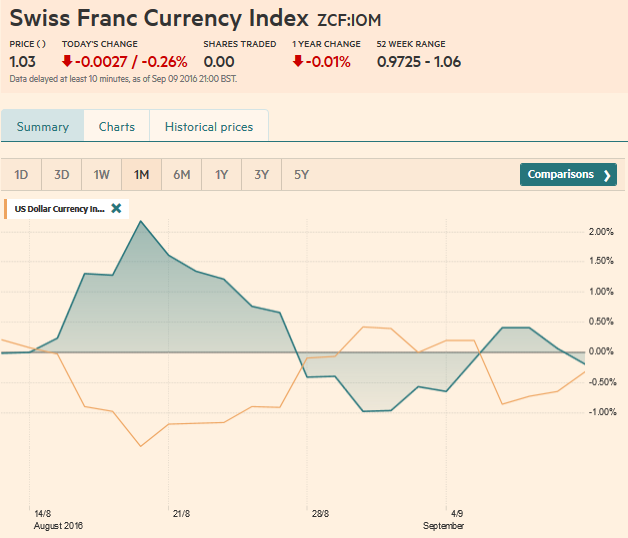

FX Weekly Review, August 29 – September 2: Disappointing Jobs Data Doesn’t Break the Buck

During this week the Swiss Franc index lost against both dollar and euro. The CHF index ended one percent down. Despite not convincing US jobs, the dollar index ended in positive territory.

Read More »

Read More »