Tag Archive: $CNY

FX Daily, March 12: Wave of Optimism Sweeps through the Capital Markets

Last minutes statements meant to clarify what many MPs find to be the most odious part of the Withdrawal Bill, the backstop for the Irish border is goosed global equity markets even though it does not seem as if the Withdrawal Bill has changed one iota. And after the big rally in US shares yesterday, there might have been follow-through buying in any case today. Asian markets did not disappoint.

Read More »

Read More »

FX Daily, March 11: Greenback Starts New Week Decidedly Mixed, with Brexit Anxiety Weighing on Sterling

Overview: Asian shares recovered from opening losses to finish mostly higher, with the Shanghai Composite up nearly 2% and India tacking on 1% after the election was called, starting April 11. European markets, led by energy, communication, and materials sectors, is up about 0.5% through midday. The S&P 500, which closed lower every day last week is looking a little firmer.

Read More »

Read More »

FX Daily, March 07: EMU Looks to ECB

The ECB meeting is today's highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the Nikkei eased for the third consecutive session.

Read More »

Read More »

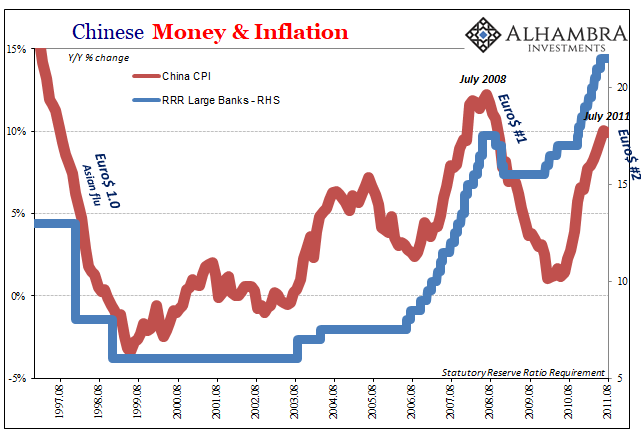

China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China.

Read More »

Read More »

FX Weekly Preview: Dovish Hold by the ECB and Uptick in US Wages will Underscore Divergence

The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won't be anything in it that lends credence to ideas that the world's largest economy is on the precipice of a recession.

Read More »

Read More »

FX Daily, March 01: Could the Worst be Behind China and Germany? Or Hope Springs Eternal

Overview: News that MSCI plans to substantially boost China's equity weighting in its indices and a better than expected Caixin manufacturing PMI and some easing of India-Pakistan tensions helped bolster the risk-taking appetite going into the weekend. This lifting equity and weighing on bonds. China's CSI 300 rose 2.2% for a 6.5% weekly gain.

Read More »

Read More »

FX Daily, February 26: Brexit Dilution Lifts Sterling, while Yesterday’s Equity Rally Fades, Powell Awaited

Overview: The increased likelihood that Brexit is delayed and the possibility of a second referendum is helping lift sterling. As has been the case for most of the time since the June 2016 referendum, the prospects of a softer and/or later Brexit is understood as sterling positive. The other key focus is US-Chinese trade.

Read More »

Read More »

FX Weekly Preview: The Week Ahead

After a dismal end of 2018, investors are faring better through the first two- thirds of the Q1 19. Equity markets have recouped a good part of the late-2018 decline. Bond yields, however, have not returned to where they previously were. The tightening of financial conditions, which was both cause and effect of heightened anxiety among investors, and spooked some central bank have eased considerably.

Read More »

Read More »

FX Daily, February 22: Markets Ending Week with A Whimper

Overview: The global capital markets are winding down what appears to be an inconclusive week quietly and on a mixed note. The MSCI Asia Pacific Index is poised to snap a four-day advance but held on to a nearly 2% gain for the week. European bourses are mostly higher, and although the weekly advance of around 0.5% may not be that impressive, Dow Jones Stoxx 600 has only fallen in one of the first eight weeks of the year for a 9.5% year-to-date...

Read More »

Read More »

FX Daily, February 20: US-China Trade and Brexit Dominate Ahead of FOMC Minutes

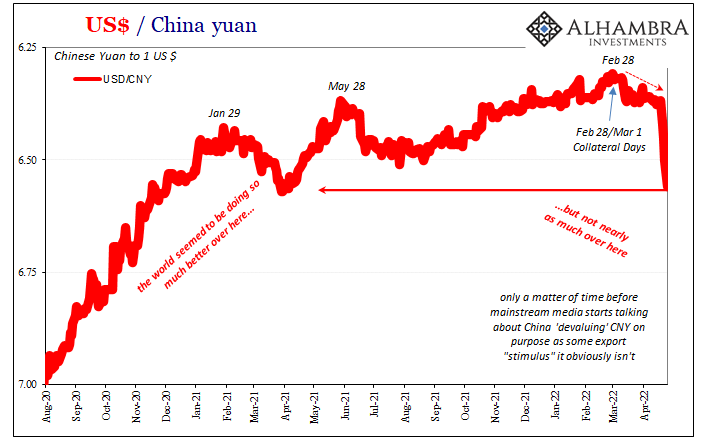

Overview: The US dollar is narrowly mixed against the major currencies, but the strongest currency today is the Chinese yuan, following reports that US wants China to keep the yuan stable and not offset US tariffs with currency depreciation. The second monthly decline in Japanese exports weighted on the yen. In the UK, another Labour MP left, while there is speculation that a few Conservatives may defect today.

Read More »

Read More »

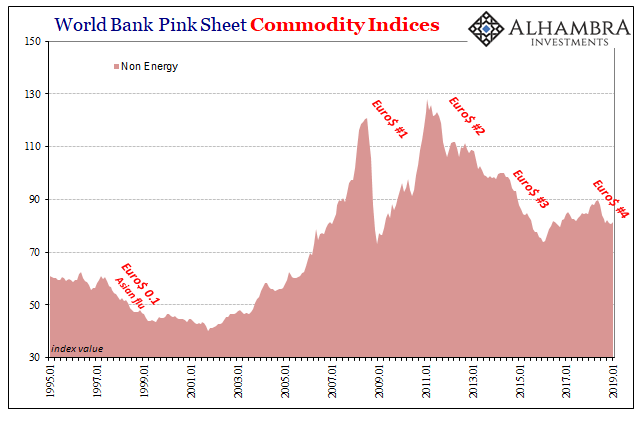

China’s Big Money Gamble

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018.

Read More »

Read More »

FX Daily, February 18: Dollar Drifts Lower

Overview: In quiet turnover, the US dollar slipped lower against most of the major currencies to start the new week. The news stream is light and the US markets are closed today. The MSCI Asia Pacific Index was up five of the past six weeks and extended its gains today. Nearly all the equity markets in the region rose but India.

Read More »

Read More »

FX Daily, February 11: Dollar Starts New Week on Firm Note

Lifted by the re-opening of Chinese markets after the week-long Lunar New Year holiday, global equities are trading firmer. Outside of Japanese markets that were closed, the large markets in Asia--China, Taiwan, South Korea, and Hong Kong advanced.

Read More »

Read More »

FX Daily, February 01: Did the Fed Steal the Jobs Data Thunder?

Overview: Weak manufacturing PMI readings are curbing risk appetites ahead of the US jobs report. Growth concerns are top and center after dovish Fed and the Bundesbank's Weidmann warning that Germany may undershoot 1.5% growth this year, though the ink is barely dry on the central bank's forecast for 1.6% growth this year and next.

Read More »

Read More »

FX Daily, January 31: Did Powell Toss in the Towel or was it a Tactical Retreat?

Overview: The Fed's dovish tone and earnings news are the main drivers of the capital markets today, helping lift stocks, bonds, and currencies. Large equity markets in Asia, including Japan, Hong Kong, China's CSI 300, India, and Indonesia, all rose more than 1%, putting the MSCI Asia Pacific Index in a good position to extend its rally for a fourth consecutive week.

Read More »

Read More »

FX Daily, January 30: She Can’t Accept No

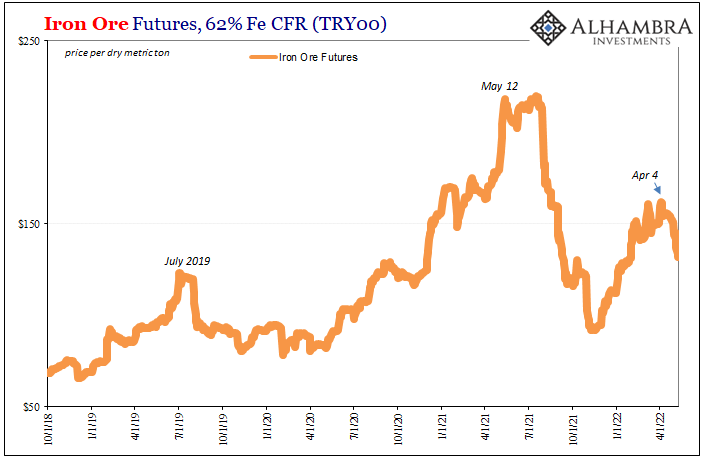

Overview: The UK Prime Minister has two weeks to strike a new deal with the EC over the Irish backstop or return to Parliament in mid-February to consider alternatives, six weeks before Brexit. Sterling has recovered about half of yesterday's drop. The Australian dollar jump back to $0.7200 was aided by the nearly 10% jump in iron ore price after Vale announced a sharp reduction in output.

Read More »

Read More »

FX Daily, January 29: Fragile Tone Persists

The positive impulse in the capital markets seen last week has faded. The gap higher opening ahead of the weekend by the S&P 500 was follow by a gap lower opening yesterday. The US threatened crackdown on Huawei disrupted equities in that sector, with as many as two dozen companies on the Shenzhen exchange that were limit down (10%).

Read More »

Read More »

FX Daily, January 28: Getting Ducks Lined Up for Later in the Week

Overview: The global capital markets are consolidating ahead of this week's big events, which include the FOMC meeting, US jobs, an important Brexit vote in the UK parliament and the first look at Q4 EMU and US GDP. The US dollar is narrowly mixed. Equities are mostly lower. European benchmark 10-year yields have edged up, though the US 10-year yield is struggling to hold above 2.75%.

Read More »

Read More »

FX Daily, January 18: Markets Finishing Week on Positive Note

Sentiment has improved since the volatility last month spooked investors and, perhaps, some policymakers. Global equities are rallying. The Shanghai Composite and the Nikkei are at their best levels in almost a month, while the Dow Jones Stoxx 600 is at its best level since early December, gapping above a downtrend in place since late last September.

Read More »

Read More »

FX Daily, January 17: Risk Assets Underperform as Investors Await Fresh Developments

The capital markets remain relatively subdued as fresh trading incentives are awaited, including US corporate earnings. Some of the enthusiasm for risk-assets has diminished. The MSCI Emerging Markets Index has stalled after trading at six-week highs yesterday, though most bourses in Asia were higher, but the Nikkei (Topix gained), China, and Singapore.

Read More »

Read More »