Tag Archive: $CNY

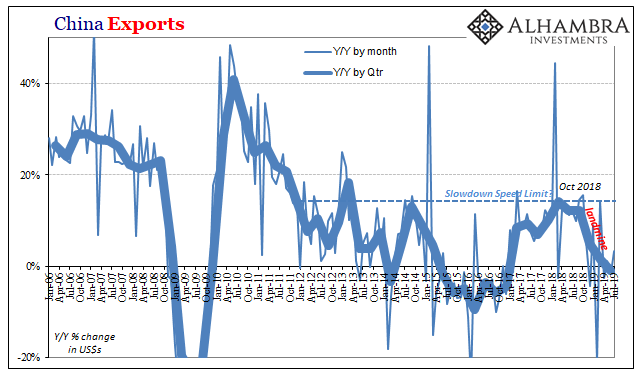

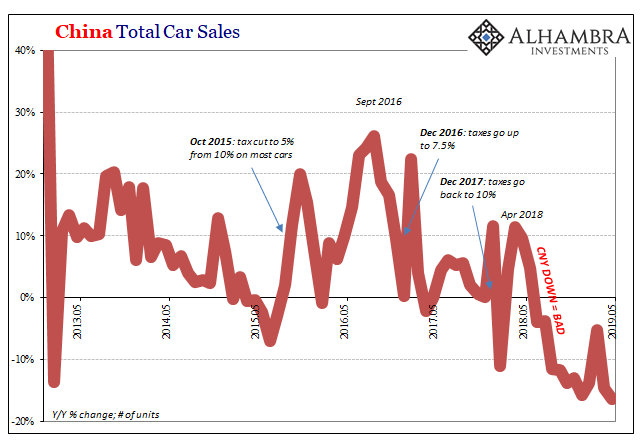

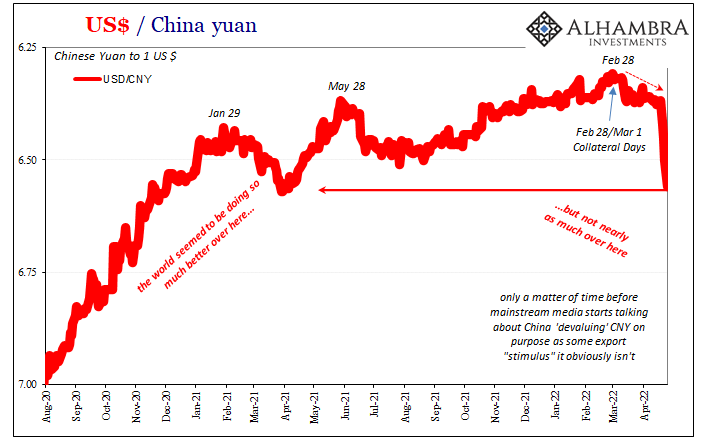

The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out.

Read More »

Read More »

FX Daily, August 8: PBOC Helps Stabilize CNY, while US Equity Recovery Lifts Sentiment

Overview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar's reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan strengthen modestly today. Meanwhile, the strong recovery in the S&P 500 has spilled over and helped lift global equities.

Read More »

Read More »

Yes, the Dollar is Above CNY7.0, but No, the Sky is Not Falling

The world's two great powers are at loggerheads. Chinese nationalism meet your sister, US nationalism. Import substitution strategy of Made in China 2025 meet your cousin Make America Great Again. Paradoxically, or dialectically, the similarities are producing divergent interests that extend well beyond economics and trade policy.

Read More »

Read More »

FX Daily, August 7: Three Asian Central Banks Surprise Investors

While investors keep a watchful eye on the dollar fix in China (a little firmer than projected) and tensions with the US, two other developments compete for attention. The Reserve Bank of New Zealand and the central banks of India and Thailand surprised the market with lower rates. The RBNZ cut by 50 bp, India by 35 bp, and the fact that Thailand cut at all was unexpected.

Read More »

Read More »

FX Daily, August 6: Markets Stabilize with Help of CNY Fix in Muted Turnaround Tuesday

Overview: The escalation of the economic conflict between the world's two largest economies is dominating the capital markets. The US cited China as a currency manipulator after the North American markets closed, ensuring the troubled start to Asian trading after the US equities and yields plummeted on Monday. The VIX surged to 25%, doubling in the past week.

Read More »

Read More »

Cool Video: The implication of CNY7.0+

President Trump's tweets last week announcing the end of the tariff truce signaled a new phase in the US-Chinese tensions. China responded as did investors. I was fortunate to have been invited to the Bloomberg set to discuss the issues of the day.

Read More »

Read More »

FX Daily, August 5: China Strikes Back

Overview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the mainland session a little above CNY7.03 and CNH7.07 for the offshore yuan.

Read More »

Read More »

FX Daily, August 2: End of Tariff Truce Trumps Jobs

Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell's attempt to give insight into the Fed's thinking. Trump's tweet than signaled an end to the tariff truce with a 10% levy on the $300 bln of imports from China that have not been subject to action previously.

Read More »

Read More »

China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter.

Read More »

Read More »

FX Daily, July 18: Dollar on Back Foot as Equities Slide

Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

FX Daily, July 8: Macro Monday

Overview: The capital markets have begun the week in a mixed note. Asia Pacific equities tumbled, led by 2%+ losses in China and South Korea, but European shares are edging higher, and a positive close would be the seventh in the past eight sessions. The S&P is little changed. Asia Pacific bond yields moved higher, as anticipated after the jump in US yields after the jobs data.

Read More »

Read More »

FX Daily, July 01: Trade Optimism Meet Reality of Disappointing PMI

Overview: A new tariff truce between the US and China, coupled with the North Korean diplomacy and Russia-Saudi tentative agreement boosted investor confidence and sharp equity rallies. Japanese and Chinese equities rallied 2-3%. Most markets rallied in Asia-Pacific except for South Korea's Kospi and Hong Kong markets were closed as the handover was commemorated.

Read More »

Read More »

FX Daily, June 20: Doves Rules the Roost Except in Oslo

Overview: The prospect of "lower for longer" continues to fuel the bond and stock rally. The initial US equity response to the Fed was positive but not strong and closed about 0.3% higher. Asia Pacific equities followed suit with mostly modest gains, except for China and Hong Kong, where gains of more than 1% were recorded.

Read More »

Read More »

Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each.

Read More »

Read More »

FX Daily, June 13: Financial Statecraft or Whack-a-Mole

Overview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing tariffs to the remaining goods the US buys from China that have not already been penalized.

Read More »

Read More »

FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng's nearly 1.9% decline was the largest in a month and led the region lower.

Read More »

Read More »

FX Daily, June 11: Markets Take Another Small Step Away from the Edge

Overview: The recovery in equities continues today in light news day. Nearly all the bourses in the Asia Pacific region rose, led by a 2.6% gain of the Shanghai Composite. The MSCI Asia Pacific Index rose for a third session. European equity benchmarks are rising for the sixth time in the past seven sessions.

Read More »

Read More »

FX Daily, June 10: Collective Sigh of Relief Lifts Equities, Yields, and the Dollar

Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit.

Read More »

Read More »

FX Weekly Preview: US Policy Mix Flips and Will Take the Dollar with It

There is a new game, afoot. For the last couple of years, it has been about normalizing policy. Even the Bank of Japan, which has never declared it was tapering, has gradually reduced the amount of government bonds it purchases. Countries like the US, or Canada in 2017, who could raise interest rates were rewarded with stronger currencies.

Read More »

Read More »