Tag Archive: $CNY

FX Daily, October 30: Another Attempt to Put a Bottom in Stocks

Overview: First, reports suggested that if China refused to make any trade concessions, the Trump-Xi meeting on the sidelines of the G20 meeting next month would not take the issue up. Fair enough. Then, new reports indicated that the White was prepared to take additional trade measures if there was no agreement between Trump and Xi.

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch of Six Things to Monitor This Week

Global equities have sold off hard. The magnitude of the recent loss is similar to what happened earlier this year. The MSCI World Index of developed countries fell 10.5% in January-February carnage and are now off about 11% this month. The MSCI Emerging Markets Index has matched the 11% loss back at the start of the year, but never truly recovering in between.

Read More »

Read More »

FX Daily, October 24: Disappointing Flash PMI Weighs on Euro

The US dollar is firmer against the major currencies and most emerging market currencies. While the seemingly fragile equity markets are still the center of investors' attention, the weakness of the eurozone flash PMI is disconcerting and has sent the euro closer to $1.14. China's officials continue to unveil initiatives to minimize the disruption of the equity and debt markets while seemingly adding to moral hazard risks.

Read More »

Read More »

FX Daily, October 22: Collective Sigh of Relief?

After a slow start in Asia, the US dollar has turned better bid. The euro recovered from $1.1430 before the weekend to $1.1550 today, where an option for almost 525 mln euros expires today. There is another option (1.6 bln euros) at $1.1500 that also expires today.

Read More »

Read More »

FX Weekly Preview: What Can Bite You This Week?

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets.

Read More »

Read More »

FX Daily, October 18: China’s Angst Stays Local

Asian equities were lower, led by a nearly 3% drop in Shanghai, while European shares shrugged it off and the Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. The S&P 500 is off by about 0.25%. Global bond yields were dragged higher by US Treasuries where the 10-year yield is straddling 3.20% after rising four basis points yesterday.

Read More »

Read More »

FX Daily, October 16: Semblance of Stability Returns

Overview: Although the S&P 500 was unable to sustain early gains yesterday, the largely consolidative session was part of the stabilization of equities after last week's jump in volatility. Asia and European stocks are also cautiously steadying. Most Asia equity markets advanced with the Nikkei's 1.25% advance most bourses higher. China was a notable exception, The Shanghai Composite recorded new lows for the year and finished uninspiringly on...

Read More »

Read More »

Macro Cheat Sheet

The dollar's recovery ahead of the weekend was aided by the stabilization of the stock market, where the S&P 500 managed to close back above the psychologically important 200-day moving average.

Interpolating from prices, the market does not expect the President's criticism to alter the Fed's course.

Read More »

Read More »

FX Weekly Preview: Forces of Movement

There are three broad forces of movement in the week ahead: the equity market performance, political developments, and economic data. It was a tumultuous week for equities, and there was not clear or obvious trigger. With US bond yields and equities trending higher this year, there does not seem to a reason why it ended last week.

Read More »

Read More »

FX Daily, October 11: Equity Swoon Takes Spotlight, Pushes Dollar to Backfoot

There is one story today, and that is the sell-off in global equities. Although the narratives put the US at the center, the fact of the matter is that US equities have been among the best performers this year, despite the rise of interest rates and a President that is not above criticizing the central bank.

Read More »

Read More »

FX Daily, October 10: US Dollar Pullback may Continue in North America

The euro bottomed yesterday near $1.1430 and reached $1.1515 in Asia. Support is seen near $1.1480 and should hold if the euro's upside correction is to continue. There are options struck $1.1500-$1.1510 for nearly 1.4 bln euros that expire today. For the third consecutive session, the dollar found bids a little below JPY113.00. There is a $1 bln JPY113 option that will be cut today.

Read More »

Read More »

FX Daily, October 09: A (Short) Reprieve For China while the Dollar Stays Firm

The small gains in China's Shanghai Composite and the yuan is helping sentiment today. News that Italy's budget watchdog may reject the government's fiscal plans has helped stabilize Italian assets initially, but renewed pressure quickly materialized. Most Asian equities retreated while Europe's Dow Jones Stoxx 600 is struggling to snap a three-day slide. US shares are trading heavily in Europe.

Read More »

Read More »

Cool Video: Clip from CNBC Squawk Box

The combination of divergence and the US policy mix is underpinning the dollar and I was invited to share my views on CNBC's Squawk Box earlier today. It dovetailed nicely Matthew Diczok (from Merrill Lynch) views on Fed policy and US interest rates.

Read More »

Read More »

FX Daily, October 08: China and European Woes Weigh on Equities but Buoy the Dollar

Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and the yuan slid nearly 0.8%. It is an unusually large decline for the closely managed currency. The offshore yuan fell by a little more than 0.5%.

Read More »

Read More »

FX Weekly Preview: Has an Inflection Point been Reached for Investors?

Interest rates, led by the US, have accelerated to the upside. With price pressures generally rising and oil prices at four-year highs, it is understandable. Market participants need to see the breakout that has lifted US 10-year yields to their highest level in seven years is confirmed in subsequent price action.

Read More »

Read More »

Great Graphic: The Dollar’s Role

This Great Graphic comes from Peter Coy and team's article in Business Week. It succinctly shows three metrics for the internationalization of domestic currencies: global payments, international bonds, and foreign exchange reserves. It does not strike me as surprising, and the role of the euro as a payments currency reflects its role in intra-European trade.

Read More »

Read More »

A Few Questions From Today’s BOND ROUT!!!!

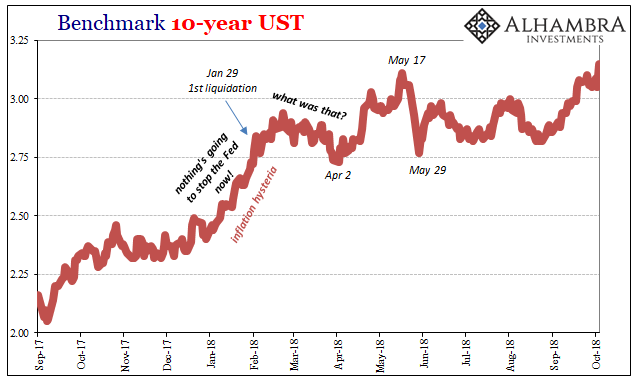

On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates.

Read More »

Read More »

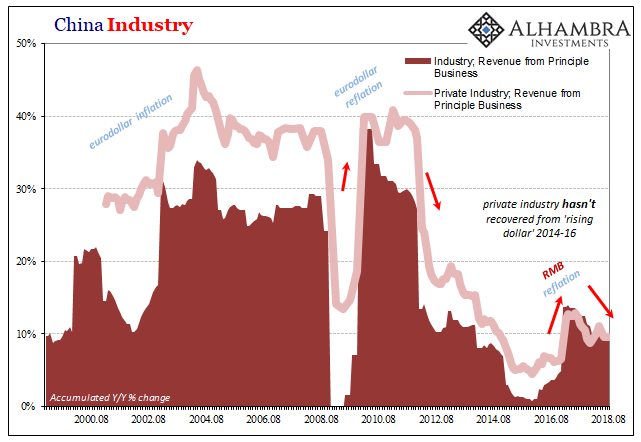

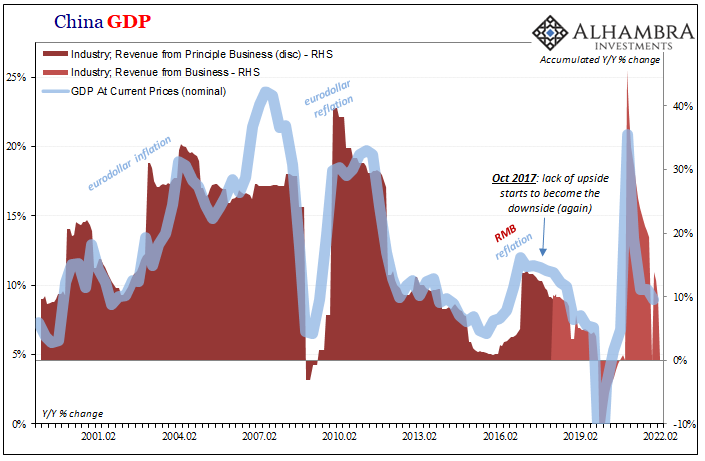

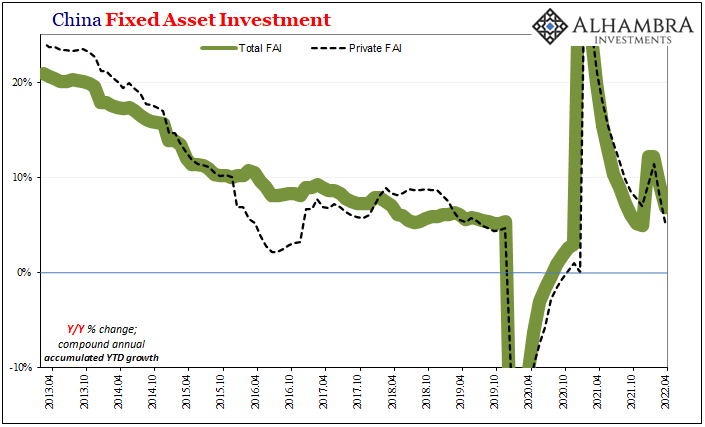

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

A Word About the Q2 COFER Report

The IMF reports the most authoritative currency allocation of global reserves at the end of every quarter with a quarter delay. Invariably, an economist, strategist, or journalist is inspired to write why some data nugget confirms the demise of the dollar as the dominant currency.

Read More »

Read More »

FX Daily, September 28: Dollar Remains Firm While Italy is Punished

The US dollar's post-Fed gains have been extended, though the upside momentum appears to be stalling. Japan's Nikkei advanced 1.35% on the back of the yen's declines and reached its highest level since 1991. Chinese shares (A and H) rallied amid reports that MSCI and FTSE-Russell are boosting Chinese shares in their benchmarks.

Read More »

Read More »