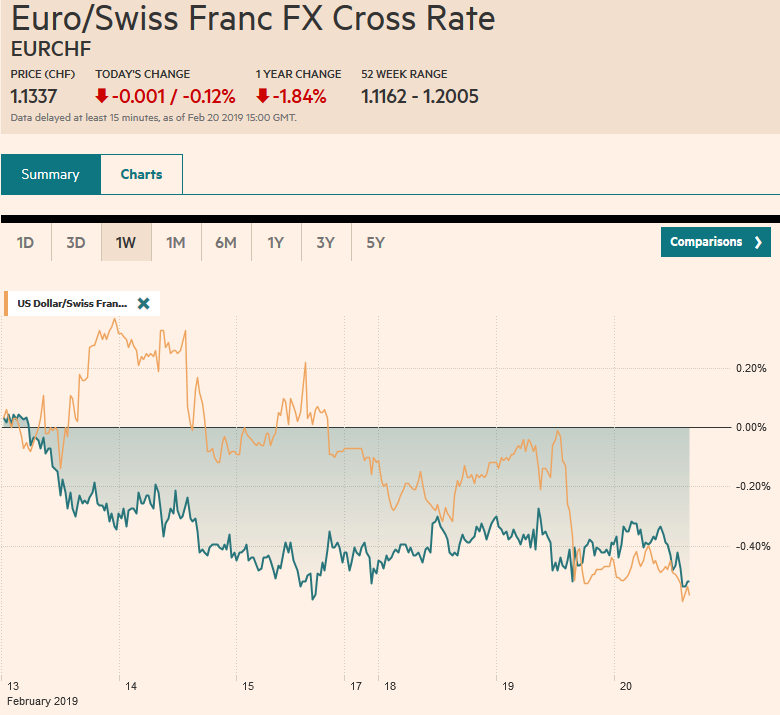

Swiss FrancThe Euro has fallen by 0.12% at 1.1337 |

EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is narrowly mixed against the major currencies, but the strongest currency today is the Chinese yuan, following reports that US wants China to keep the yuan stable and not offset US tariffs with currency depreciation. The second monthly decline in Japanese exports weighted on the yen. In the UK, another Labour MP left, while there is speculation that a few Conservatives may defect today. The focus in the US turns to the FOMC minutes from last month’s meeting that saw a meaningful change in the central bank’s rhetoric. The steep losses in the stock market and elevated volatility that spooked officials have been retraced by about 75% and the VIX is at four-month lows. The MSCI Asia Pacific Index has advanced for the third session and is at its highest level since October, still more than 1% below its 200-day moving average. The Dow Jones Stoxx 600 firm enough to reach a new high for the year and fractionally below its 200-day moving average. Benchmark bond yields are little changed. Gold is at new 10-month highs and oil is trading slightly lower. |

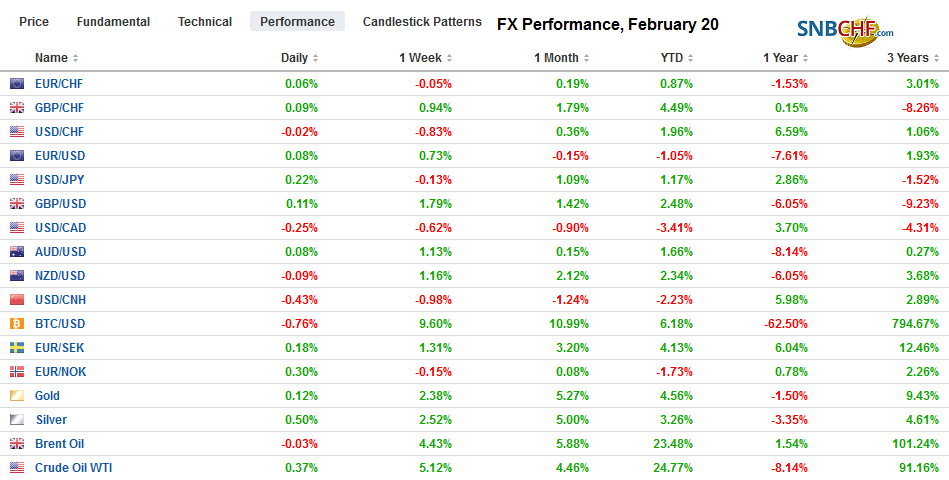

FX Performance, February 20 |

Asia Pacific

The Chinese yuan has risen by about 0.6% today, which makes it the strongest currency today. It is the third day of gains. We had previously understood Chinese officials to indicate they did not want the dollar to trade below CNY6.70. However, this area may now be challenged. The ostensible trigger comes from reports that the US seeks a commitment by China to maintain a stable currency. In the reports, the meaning of stability (real, nominal, basket, bilateral) is not clear, but the idea is that the US is trying prevent China from offsetting tariffs with a weaker currency or seeking trade advantage from the exchange rate. Chinese officials have long said they desire a stable yuan and have pledged not to use the exchange rate as a trade weapon. Both sides are conflicted. The US has encouraged China to allow markets to determine exchange rates. If the market determined the yuan’s value it would be more volatility and likely weaker. Chinese officials are engaged in various efforts to support the economy. A yuan that does not adjust creates other distortions.

With the March 1 trade deadline approaching, and both sides seemingly still far apart, we are on the lookout for some sign of a delay. The clearest indication of this came from President Trump yesterday, indicating that March 1 is not a “magical date.” However, US negotiators were using the deadline to help maintain pressure on China. When playing the “bad cop” during NATFA talks and early talks with China, Trump may have helped his negotiators, but now, playing nicer, may weaken his negotiators. From another angle, Trade Representative Lighthizer is a true believer, but the President is more opportunistic.

Japanese exports tumbled 8.4% in January, the largest year-over-year decline in two years. In December, they were off 3.9% year-over-year. Exports to China were off 17.4%. While Chinese demand has weakened, this may have been exaggerated by the distortions around the Lunar New Year. Exports to the US rose 6.8%. On a seasonally adjusted basis, Japan has been running monthly trade deficits since mid-2018.

Australia reported Q4 wages rose 0.5% instead of 0.6%. The headline seemed to weigh on the Australian dollar even though it seemed that the miss was due to a rounding adjustment. The 2.3% year-over-year pace that had been expected was in fact delivered. Australia reports the flash PMI and employment data tomorrow.

After falling in the last two days of last week, the US dollar is gaining against the yen for the third session this week. Ahead of JPY111, today there are $1.14 bln in options struck between JPY110.75 and JPY110.85 that may slow the progress, but intraday technicals suggest that the upside may be favored in North America. Last week’s high was near JPY111.15. Above there is the mid-December high around JPY111.45. The Australian dollar made a marginal two-week high just shy of $0.7180 before encountering some selling pressure that knocked it back to the $0.7150 area. Support is seen a little lower in the $0.7140 area. Note that as the Chinese yuan has strengthened, so has the offshore yuan (CNH) and the difference between the two has virtually closed.

Europe

There was an important development in Europe yesterday that may have been overshadowed by US-China trade and currency developments. Recently, the EC blocked a potential merger of rail asset between Siemens and Alstom. Germany and France both support the tie-up. Germany and France want to modify the EC rules and allow the heads of state to overrule M&A decisions. The EC seemed more interested in preserving competition within Europe, while the national leaders are interested in creating European champions that can compete with US, Japan, and Chinese combines.

Former UK Prime Minister Cameron says he sought a referendum in order to unite the Conservative Party. Instead, it appears to be facilitating new political alignments that both party leaders are resisting. An eighth Labour MP has bolted, but the new Independent Group, is hesitant, so far, about forming a new party and as many as 41 had broken from the party last week to vote in favor an amendment last week seeking a delay. Meanwhile, there is speculation that a few Tory MPs may also join. There are threats of more resignations and talk that May could bring the “meaningful vote” in Parliament next week to forestall others from leaving. Sterling rallied strongly yesterday, above $1.30, amid efforts to rule out a no-deal Brexit.

The Swedish krona is consolidating yesterday’s losses scored in the wake of a soft inflation report. Riksbank Governor Ingves played down the significance of the report, noting there were some technical issues and, in any event, one report, is not sufficient to alter the monetary course. These seem like brave words that investors are not buying. The krona is flattish on the day. The two-year yield fell four basis points yesterday to -45 bp, where it is practically unchanged on the day.

The euro reversed higher ahead of last weekend. It consolidated on Monday when the US was on holiday. Yesterday itt posted a bullish outside up day (traded on both sides of Monday’s ranges and closed above Monday’s high). It is struggling to move decisively above the resistance we pegged near $1.1340. Above there, another cap is seen at $1.1365. Investors may be reluctant to push the euro much higher ahead of tomorrow’s flash PMI report. Note that there are options struck at $1.13 for over a billion euros tomorrow and Friday. Sterling overshot the $1.3045 retracement target and rose to $1.3075 before sellers re-emerged. A break of $1.30 would embolden the bears again and could see the $1.2985 option (expiring today for GBP311 mln) in play.

America

The FOMC minutes are more important than usual. Investors want more context and color for what appears as a major shift in the Fed’s rhetoric and views. The risk is that the minutes underscore the concern the Fed had in January. The easing of financial conditions in February may have eased some of these concerns. Still, NY Fed’s Williams comments yesterday, suggesting some change, not necessarily major, in growth and/or inflation is needed to spur a change in policy. We expect the cross currents to further ease in Q2 (trade, government shutdown, Brexit, Chinese and European slowdown), allowing the Fed to consider rate hike around midyear.

The Dollar Index posted a key reversal ahead of the weekend and another outside down day yesterday. There has been no follow-through today and it is confined to a narrow 10-pip range on either side of 96.50. Technical indicators like the MACDs and Slow Stochastics warn that the downside correction may not be over. The US dollar has slipped through CAD1.3200 for the first time in a couple of weeks. A break of CAD1.3180, which it is testing in the European morning, may see a retest on the CAD1.3070 area seen at the start of the month. We are less optimistic on the Canadian dollar and anticipate another soft retail sales report ahead of the weekend and weak economic data (CPI and December GDP) next week. The Mexican peso gained for the fourth consecutive session yesterday and finished back in the previously MXN19.00-MXN19.20 range. The US dollar posted an outside down day yesterday, but follow-selling has been limited. The greenback has found a bid near the 20-day moving average (~MXN19.1450).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,MXN,newsletter,USD/CHF