Category Archive: 2) Swiss and European Macro

Swiss Consumer Price Index in January 2018: +0.7 YoY, -0.1 MoM

The consumer price index (CPI) fell by 0.1% in January 2018 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

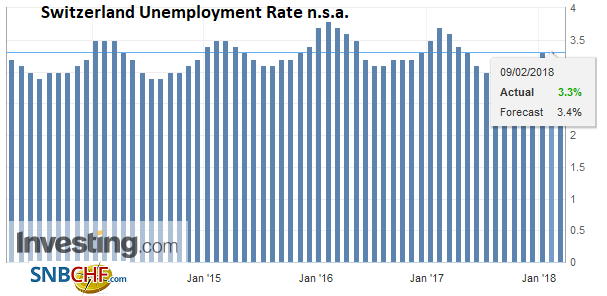

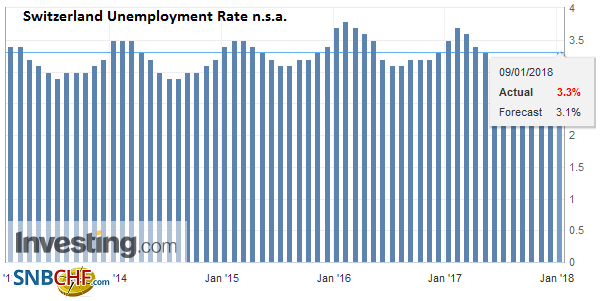

Switzerland Unemployment in January 2018: Unchanged at 3.3 percent, seasonally adjusted unchanged at 3.0 percent

Registered unemployment in January 2018 - According to SECO surveys, at the end of January 2018, 149,161 unemployed people were enrolled in the Regional Employment Centers (RAV), 2,507 more than in the previous month. The unemployment rate remained at 3.3% in the month under review. Compared with the same month last year, unemployment fell by 15,305 (-9.3%).

Read More »

Read More »

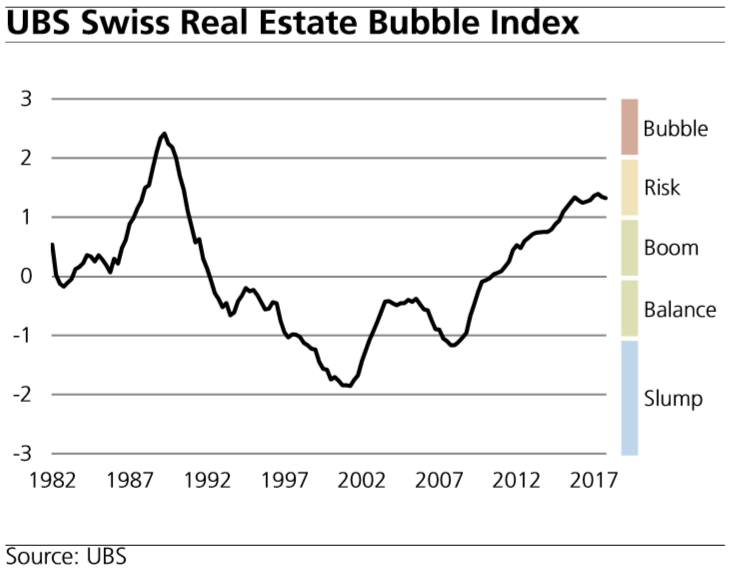

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2017

The UBS Swiss Real Estate Bubble Index declined in the fourth quarter of 2017, and is currently in the risk zone at 1.32 index points. This second fall in succession was driven by the persistently low increase of mortgage volumes. However, this may have been underestimated, as the records of mortgages granted by insurers and pension funds are inadequate. The majority of the sub-indicators remained unchanged in the last quarter.

Read More »

Read More »

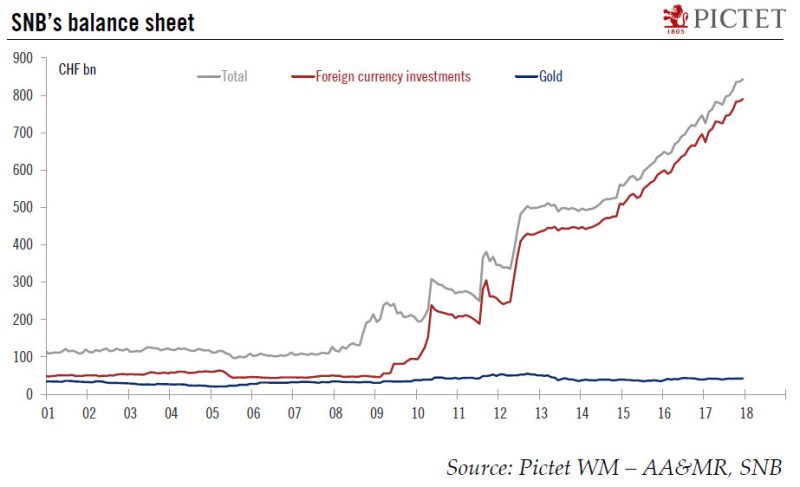

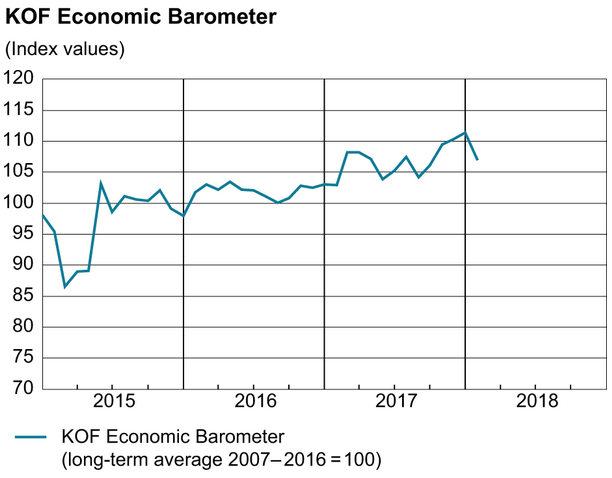

When will the SNB start the process of policy normalisation?

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of -...

Read More »

Read More »

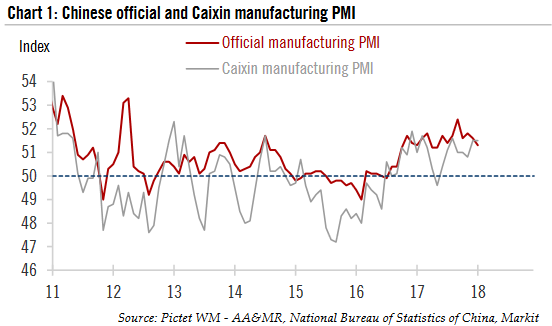

China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

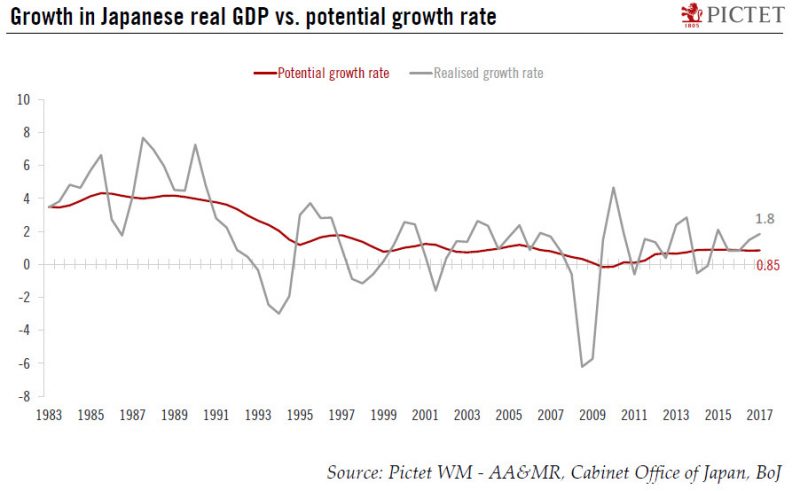

Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 - year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth, which currently stands at 0.85%, according to the Bank of Japan (BoJ, see...

Read More »

Read More »

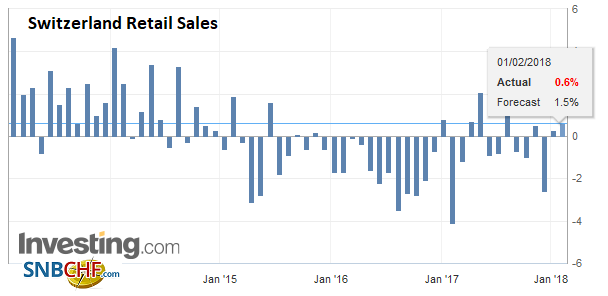

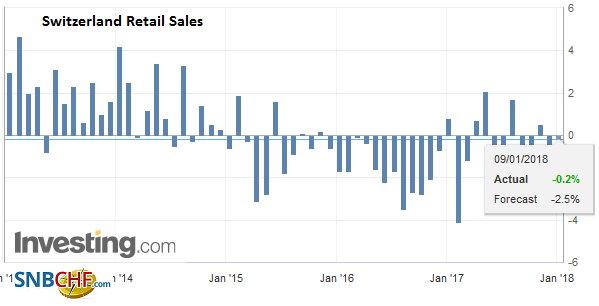

Swiss Retail Sales, December: +1.5 Percent Nominal and -0.8 Percent Real

Turnover in the retail sector rose by 1.5% in nominal terms in December 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.8% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

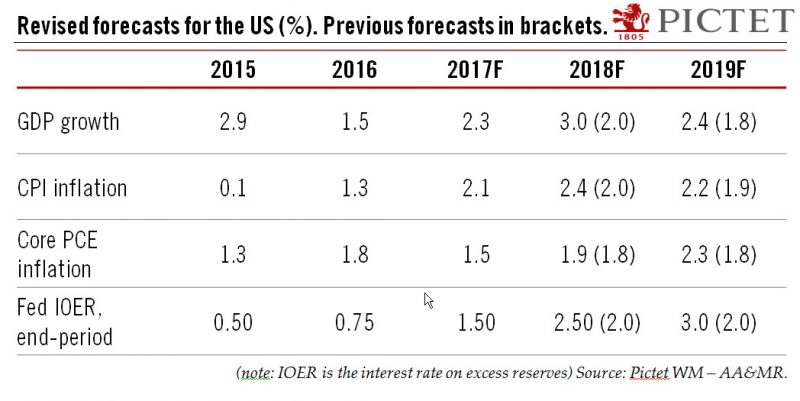

Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an estimated 4.6% in 2017. We...

Read More »

Read More »

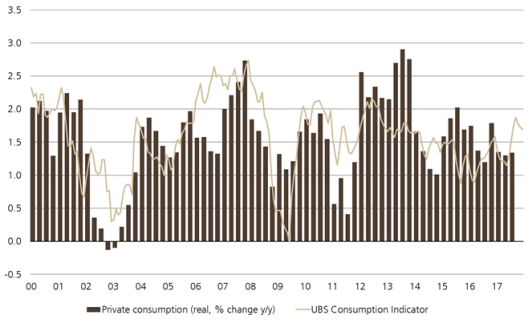

Switzerland UBS consumption indicator December: pleasing end to the year

At 1.69 points, the consumption indicator lay well above the long-term average in December 2017, conveying an optimistic snapshot of Swiss private consumption. Weaker figures for new car registrations prevented an even higher value. The consumption indicator fell slightly in December 2017 to 1.69 points from 1.73. However, values had been revised upward in the past few months.

Read More »

Read More »

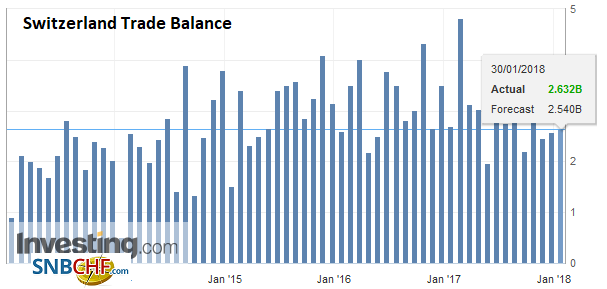

Swiss Trade 2017: Exports at all-time high

Last year, Swiss foreign trade accelerated yet again relative to 2016: exports rose by 4.7% to reach a new record high. Imports grew by 6.9%, posting their strongest growth rate since 2010. Aside from the improved economic situation worldwide, the weakening of the Swiss franc and price trends played a decisive role in both directions of trade. With a surplus of CHF 34.8 billion, the balance of trade closed the year 6% (or CHF 2.1bn) lower than the...

Read More »

Read More »

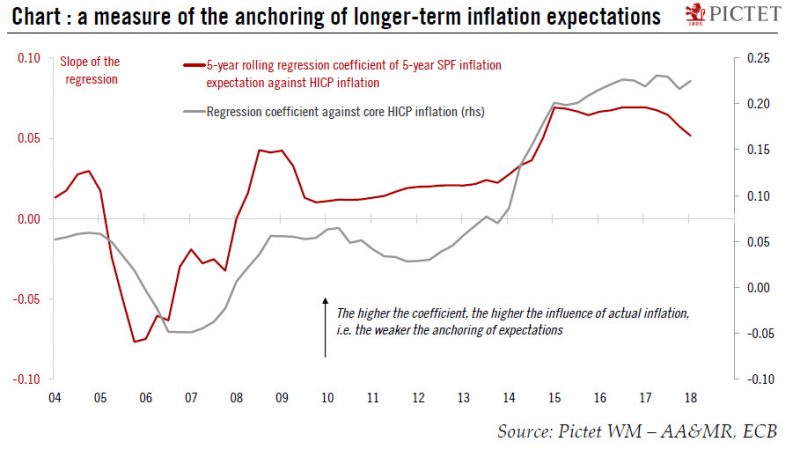

Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment.The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years, sometimes substantially.

Read More »

Read More »

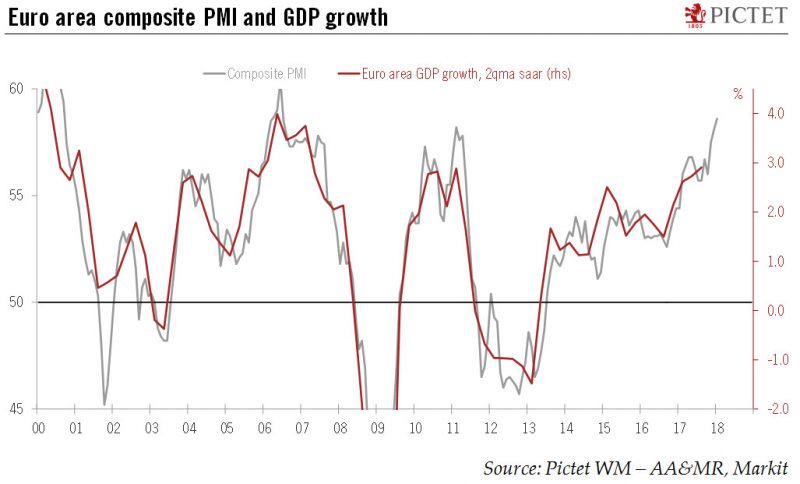

Euro area: Business activity expanding at its fastest pace in nearly 12 years

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.

Read More »

Read More »

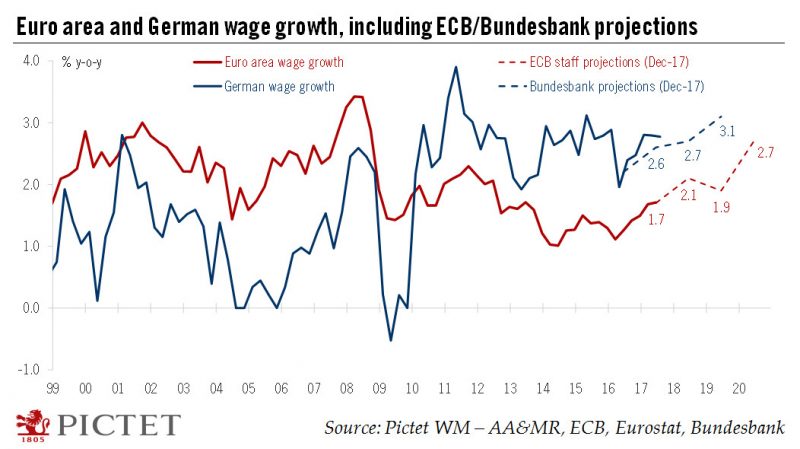

Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year.

Read More »

Read More »

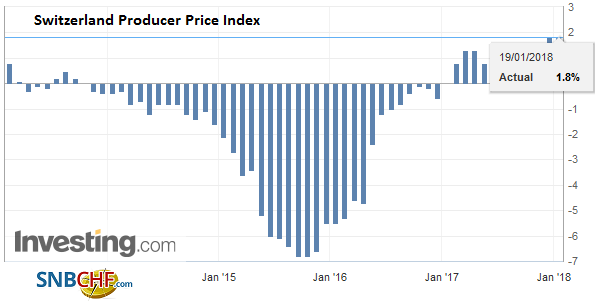

Swiss Producer and Import Price Index in December 2017: +1.8 YoY, +0.2 MoM

The Producer and Import Price Index rose in December 2017 by 0.2% compared with the previous month, reaching 101.9 points (December 2015=100). Compared with December 2016, the price level of the whole range of domestic and imported products rose by 1.8%. The average annualised inflation rate in 2017 was 0.9%. These are some of the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

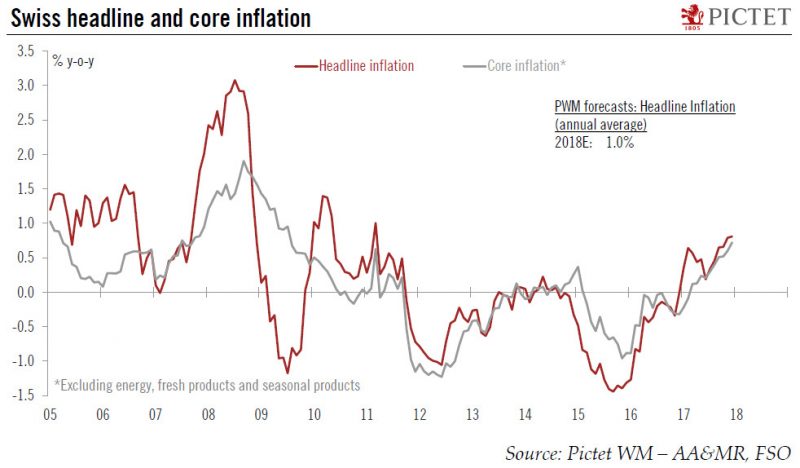

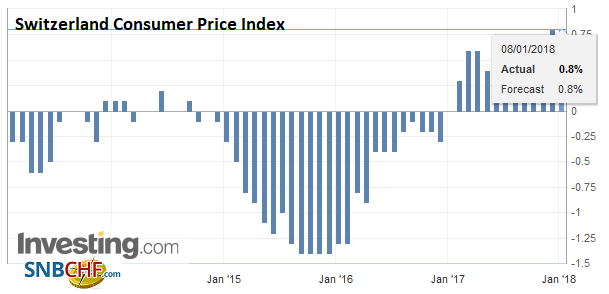

Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017.

Read More »

Read More »

Switzerland Unemployment in December 2017: Up to 3.3 percent due to winter, seasonally adjusted unchanged at 3.0 percent

Registered unemployment in December 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, 146,654 unemployed people were enrolled at the Regional Employment Centers (RAV) at the end of December 2017, 9,337 more than in the previous month. The unemployment rate rose from 3.1% in November 2017 to 3.3% in the month under review. Compared to the same month of the previous year, unemployment fell by 12,718 (-8.0%).

Read More »

Read More »

Swiss Retail Sales, November: +0.2 Percent Nominal and -0.2 Percent Real

Turnover in the retail sector rose by 0.2% in nominal terms in November 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are the provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss Consumer Price Index in December 2017: +0.8 YoY, unchanged MoM

The consumer price index (CPI) remained unchanged in December 2017 compared with the previous month, reaching 100.8 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year. Average annual inflation reached 0.5% in 2017. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »